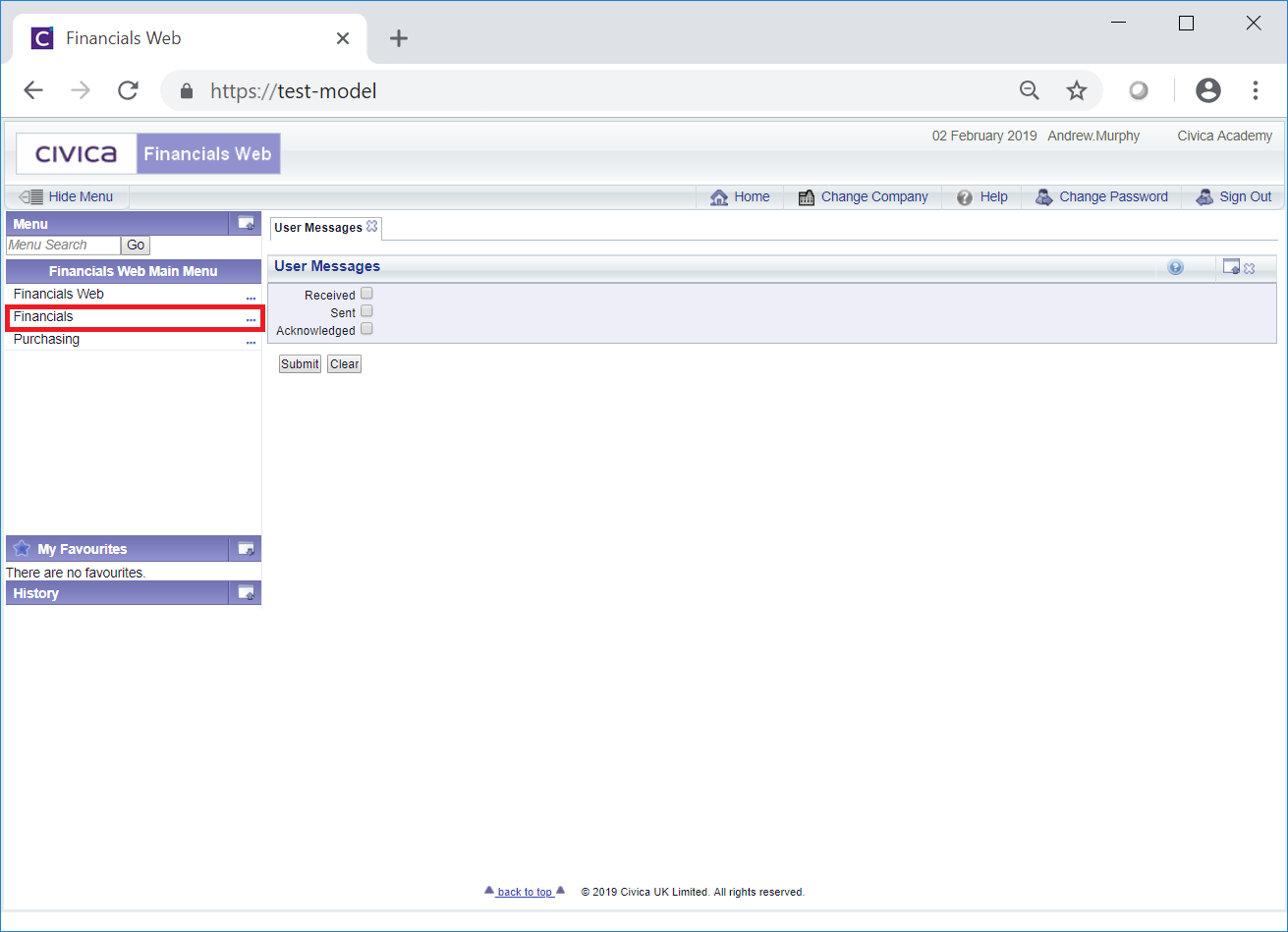

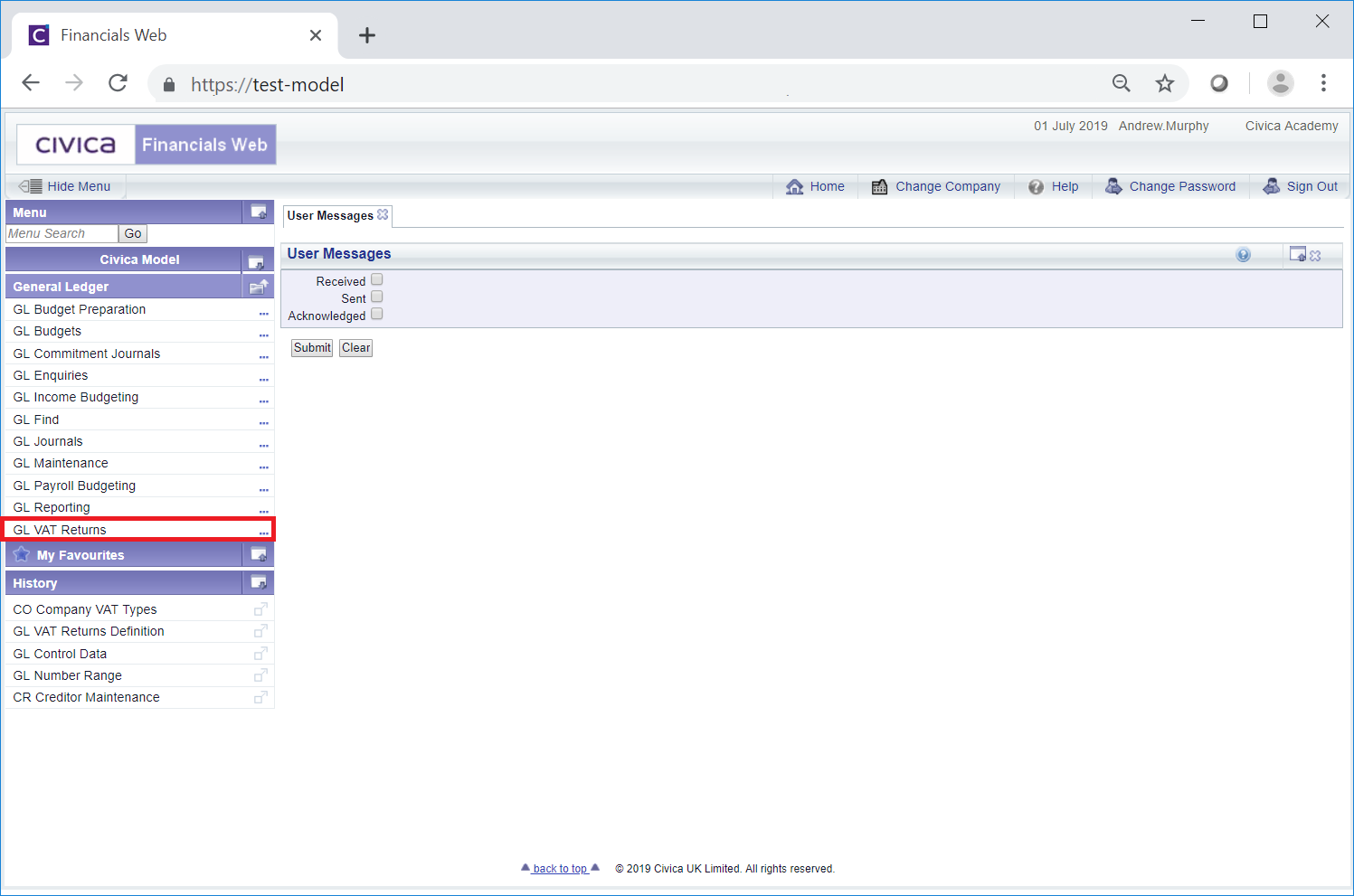

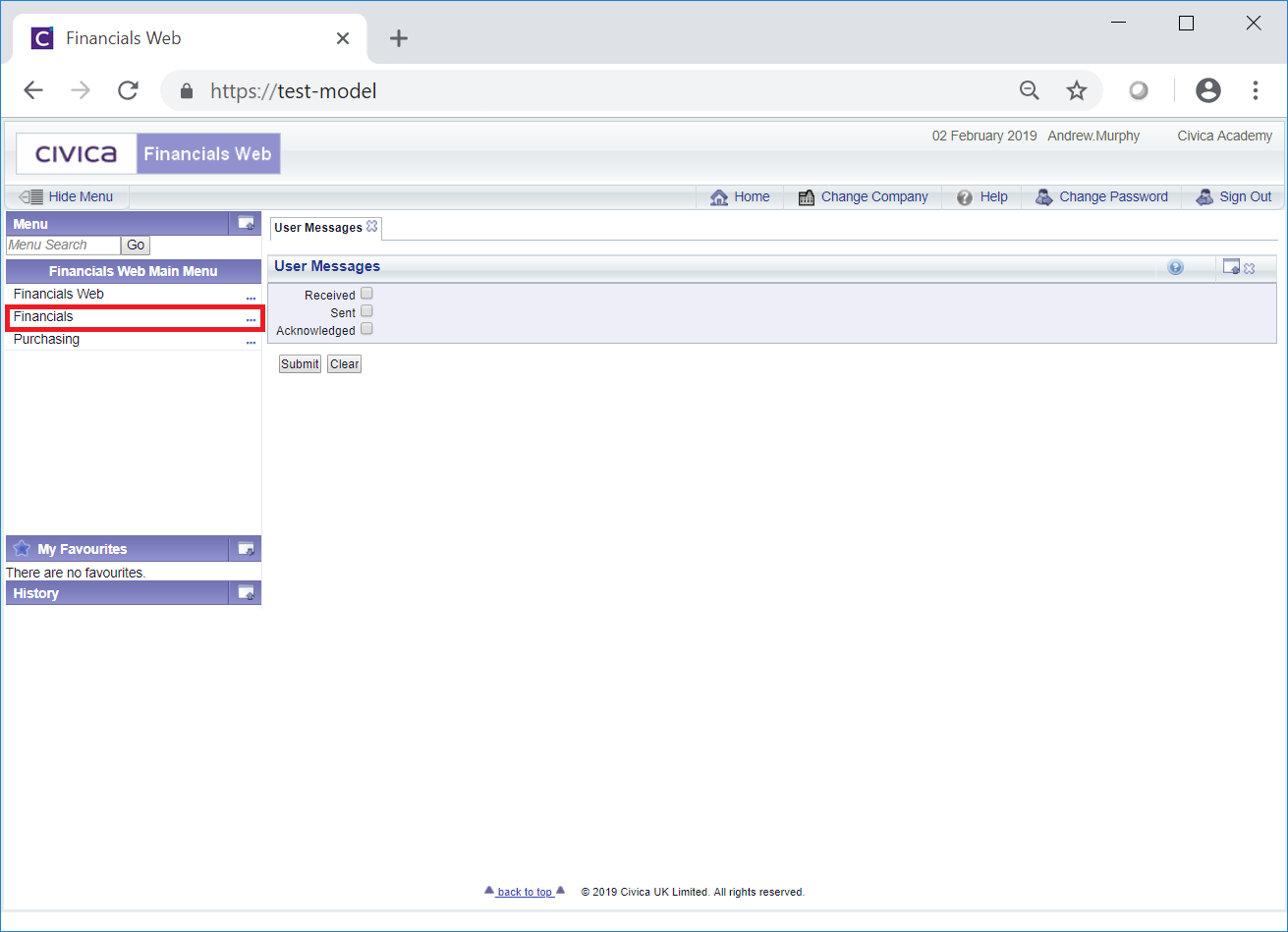

VAT Returns can be viewed and/or amended on the GL VAT Return Header form, which can be accessed by selecting the Financials option on the Financials Web Main Menu:

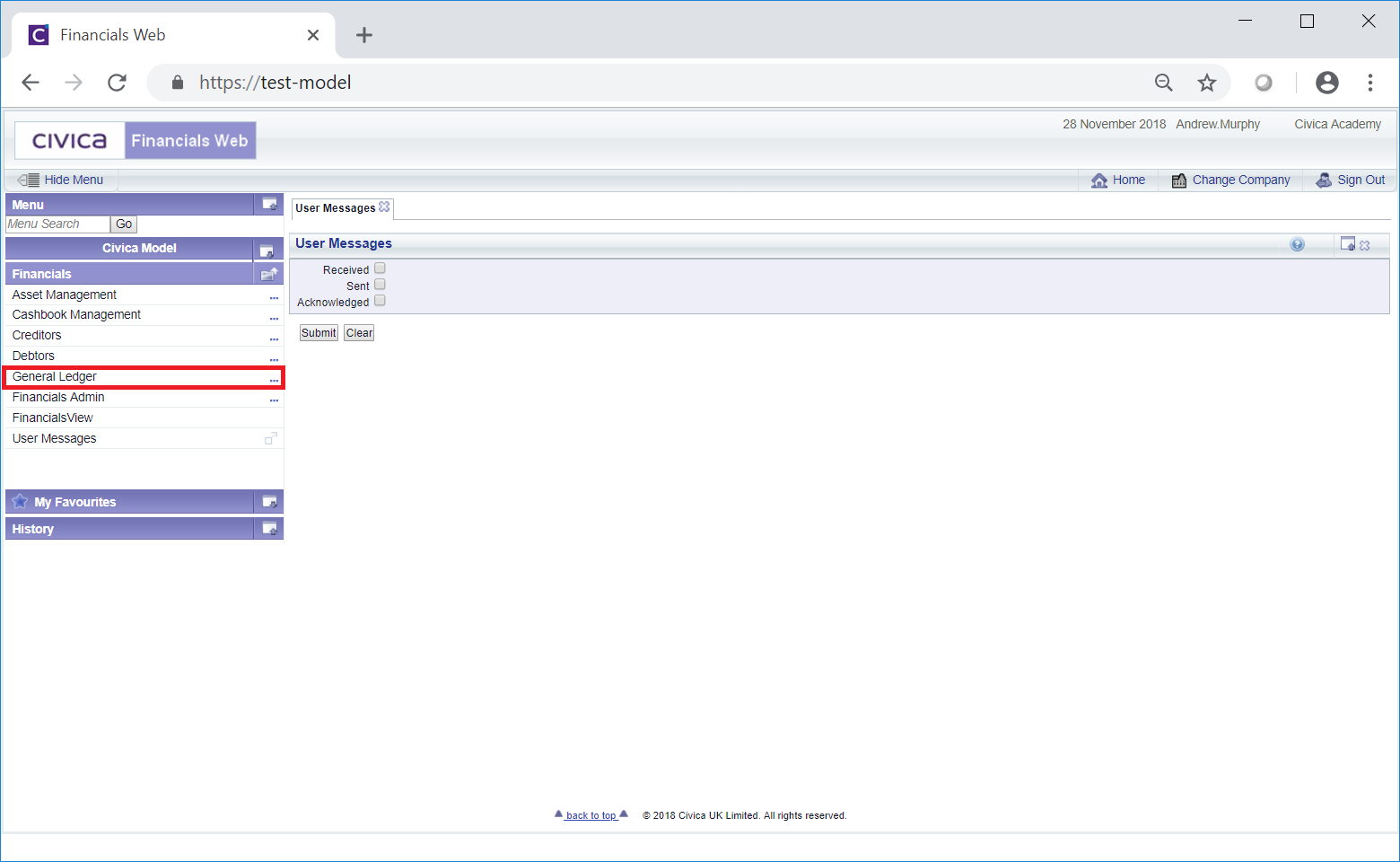

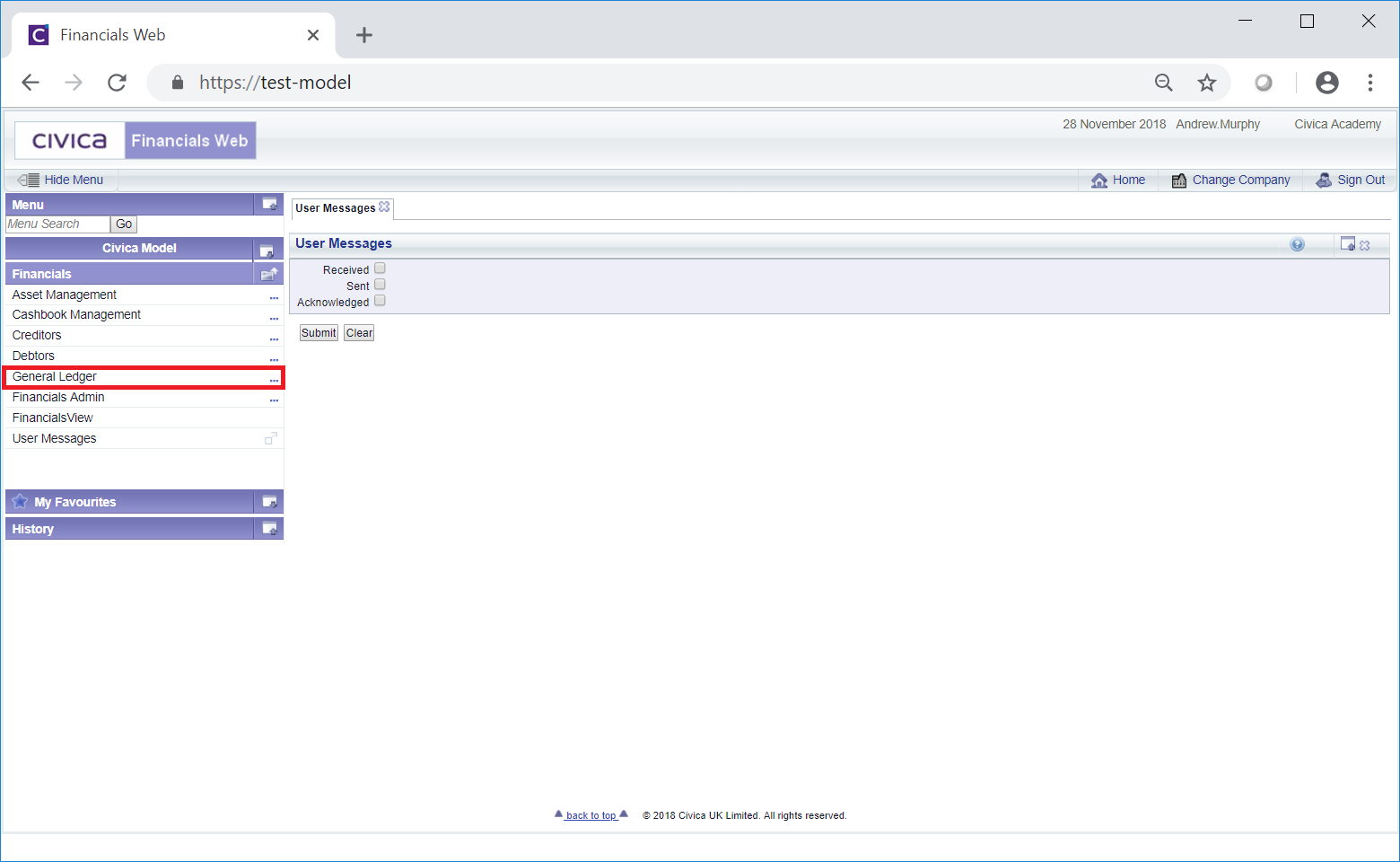

Then the General Ledger menu option:

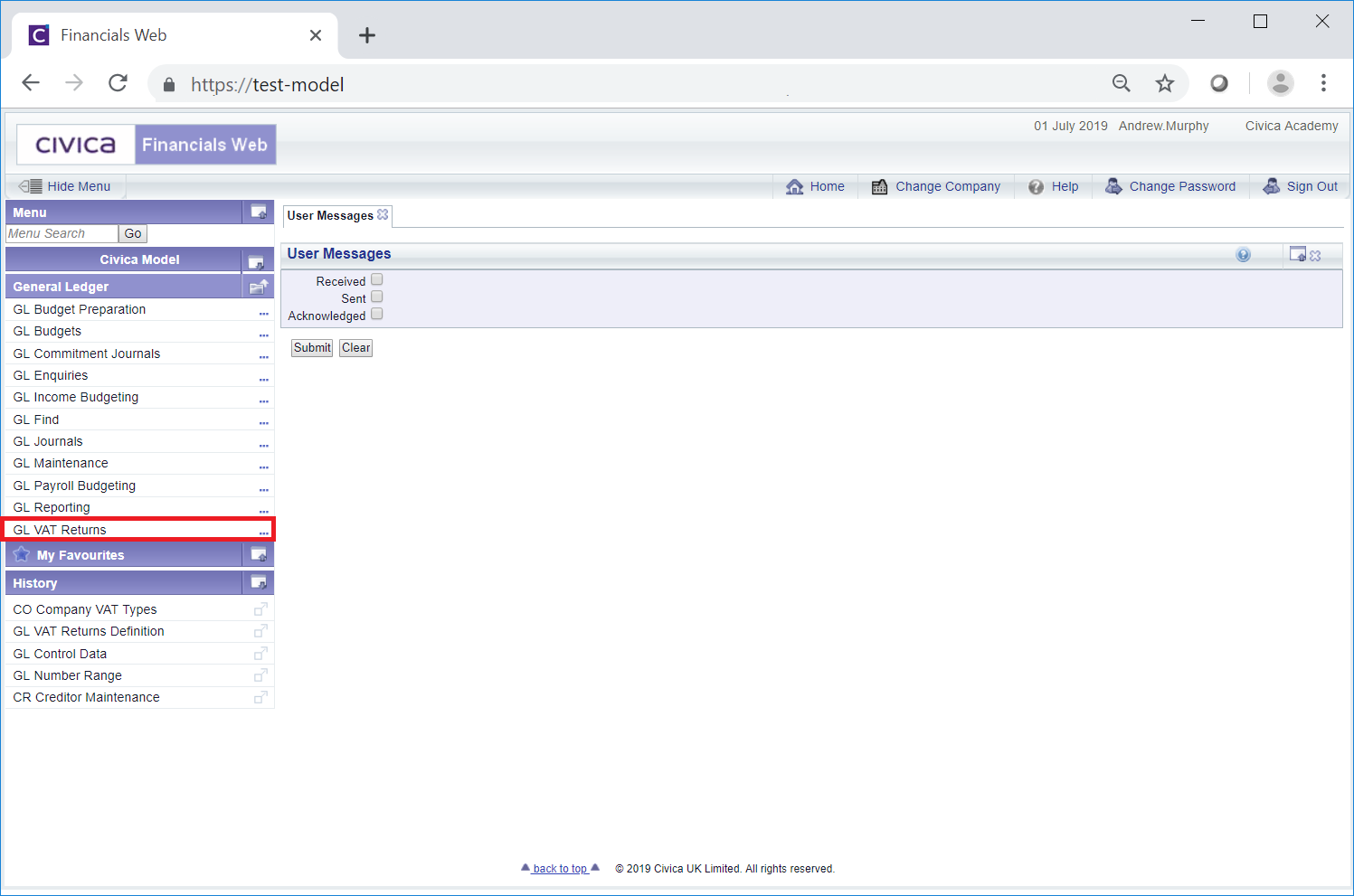

Then the GL VAT Returns menu option:

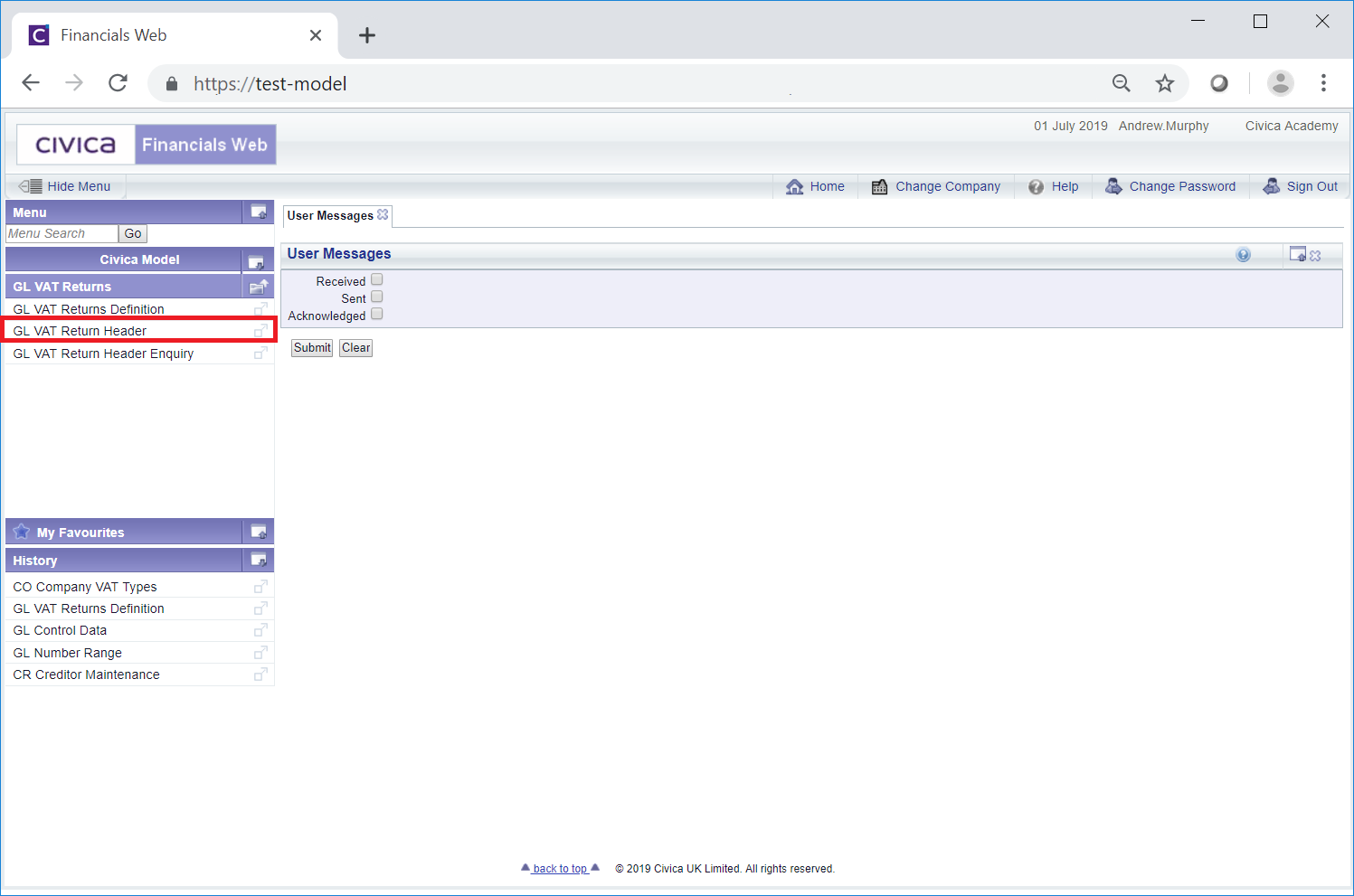

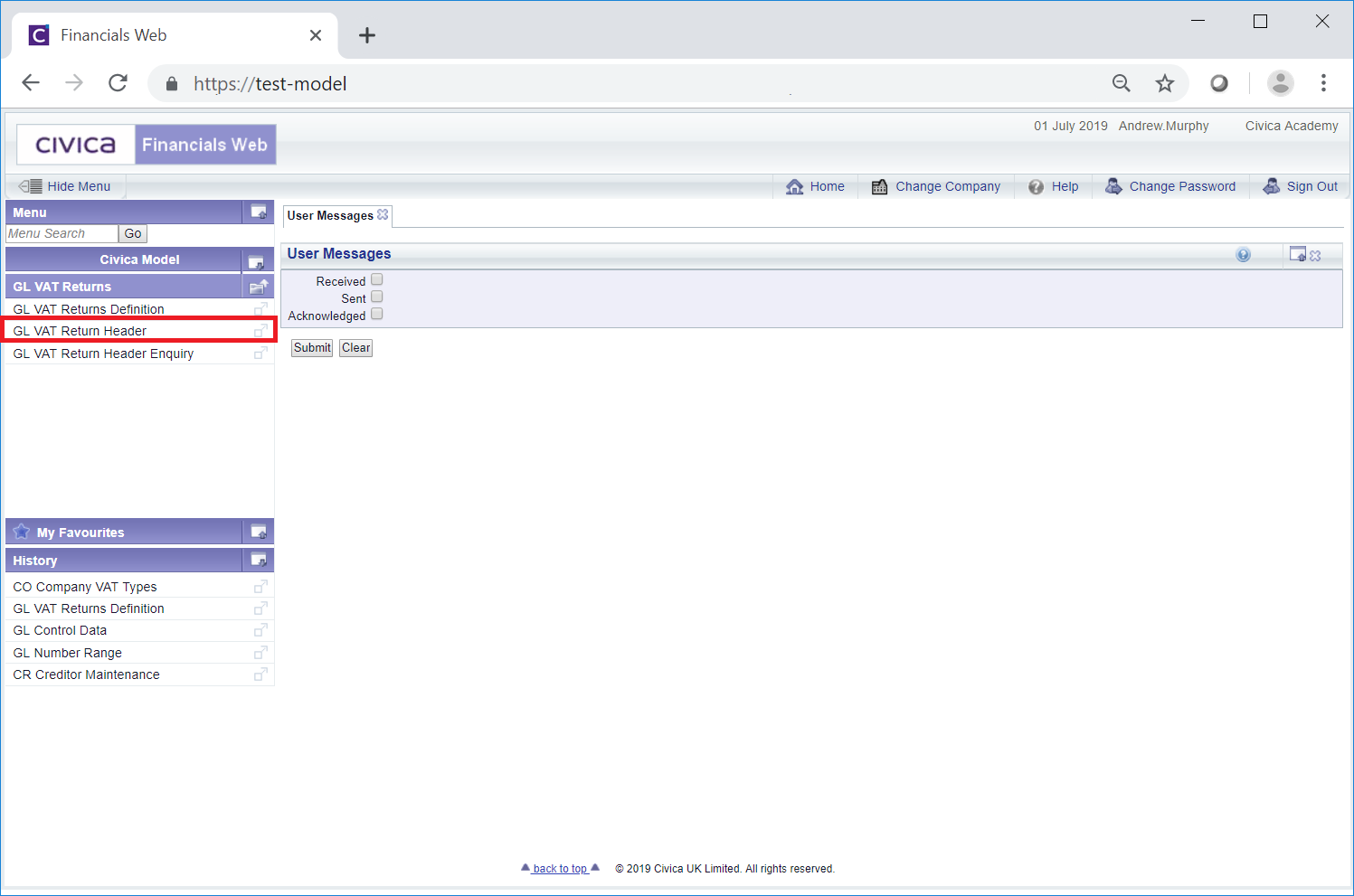

Then the GL VAT Return Header menu option:

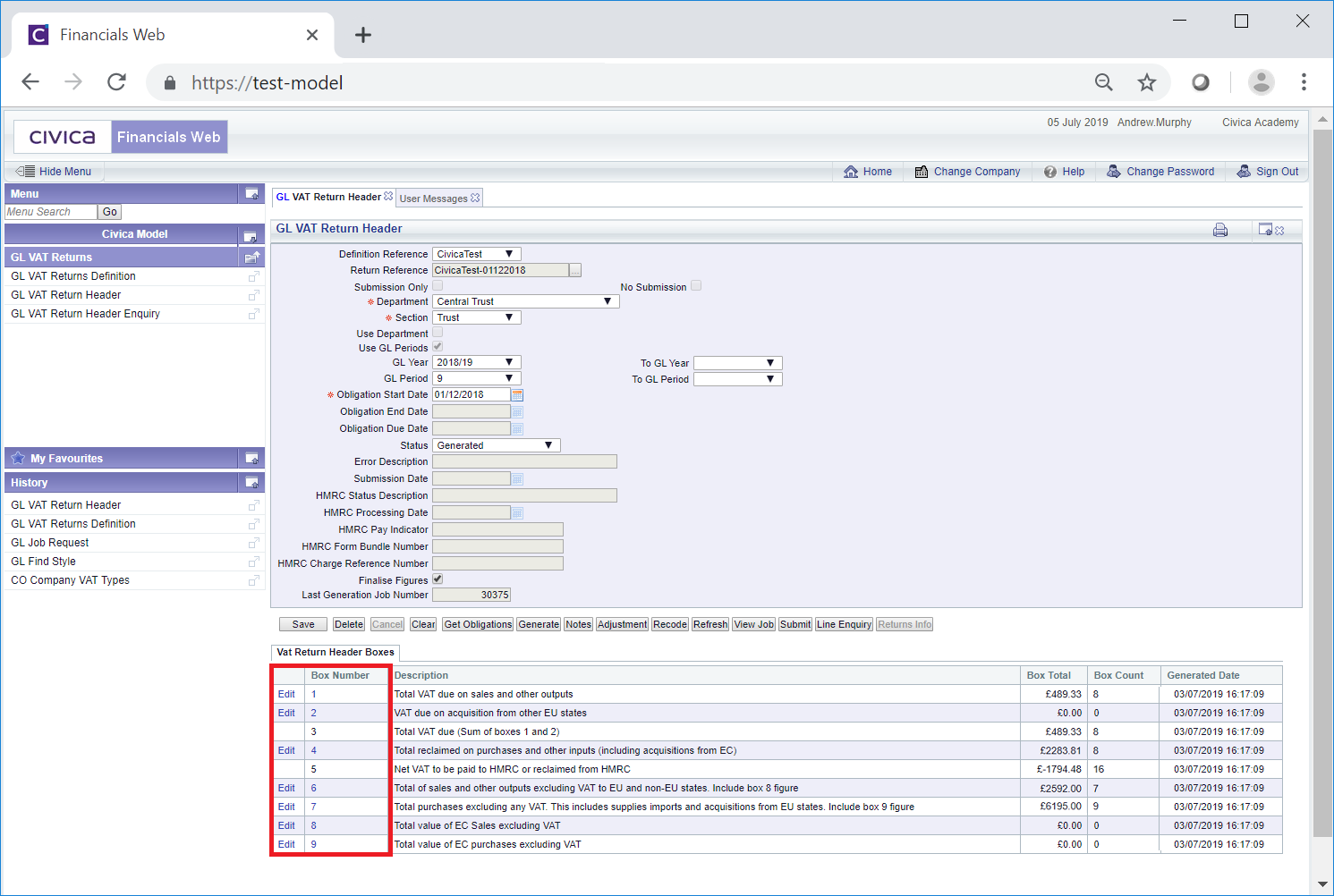

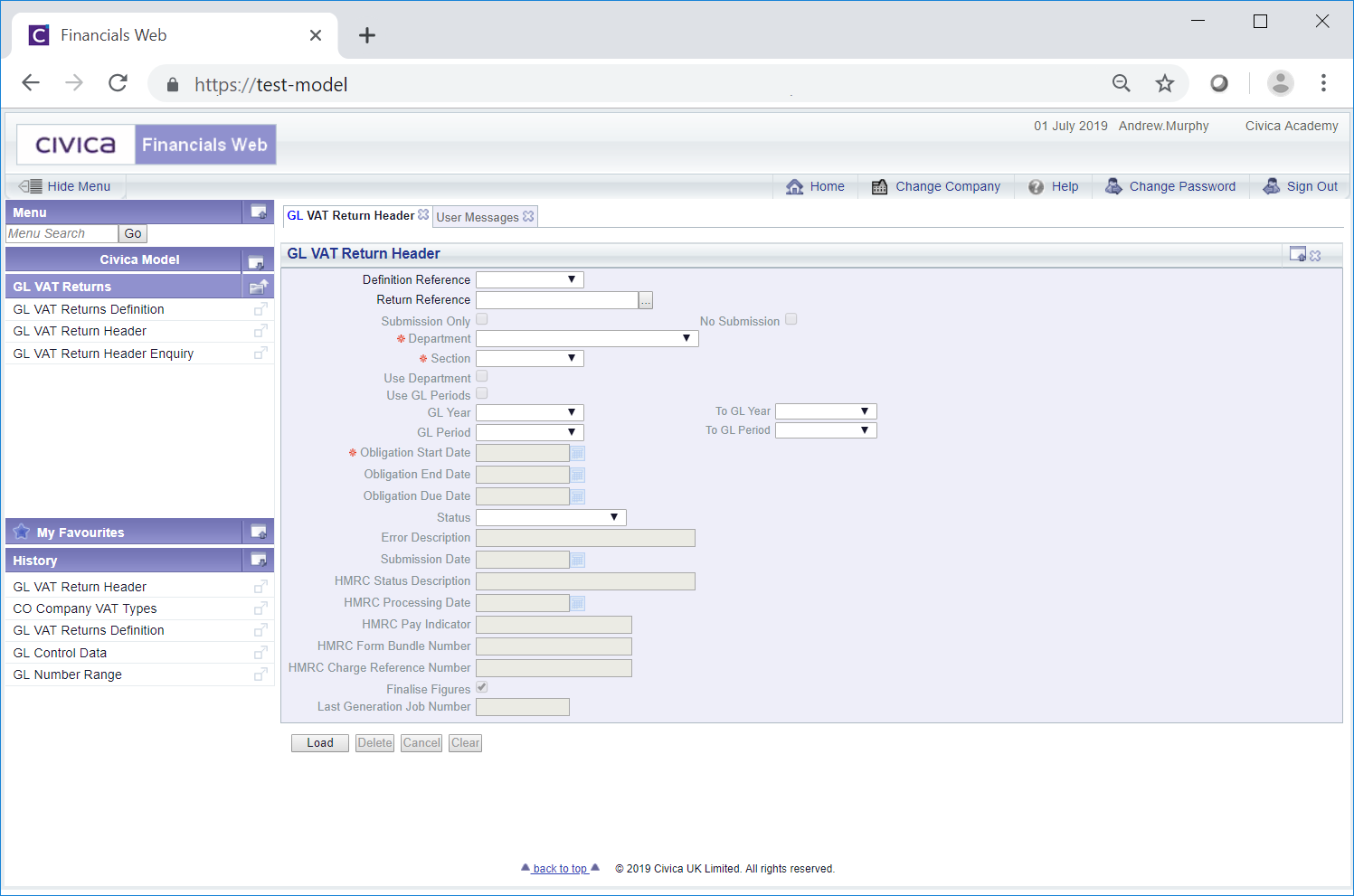

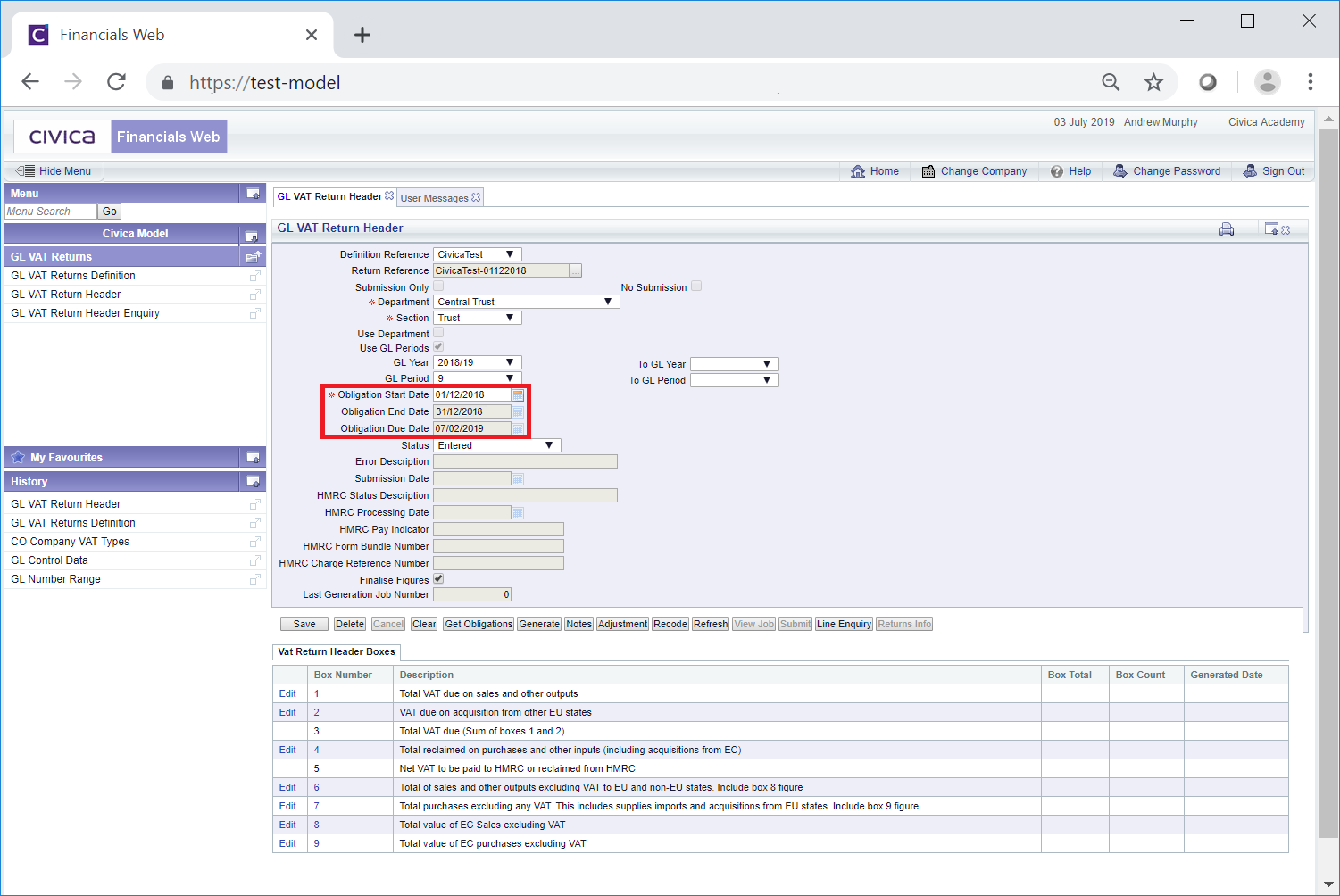

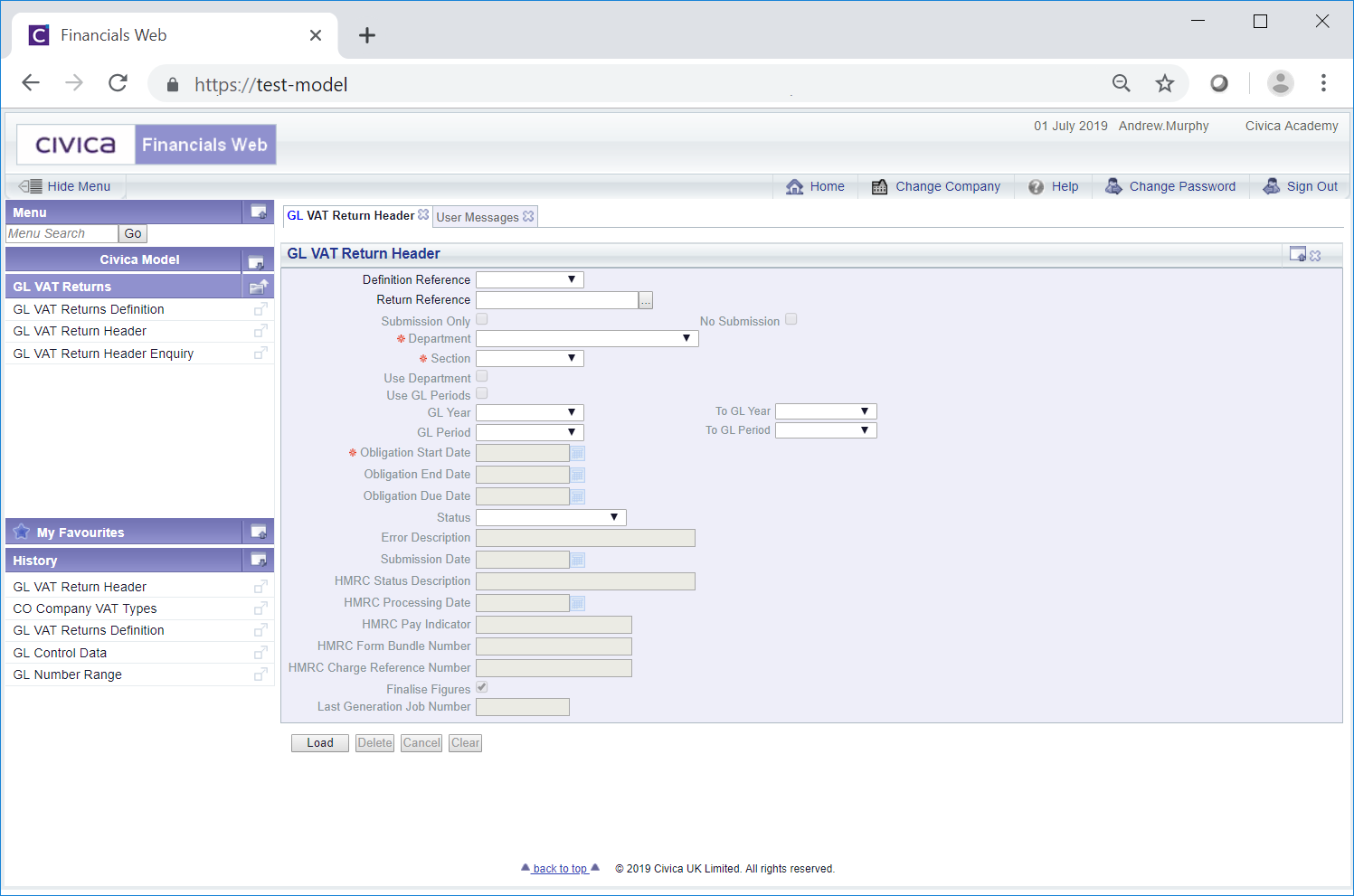

The GL VAT Return Header form will open:

Add the reference of the required VAT Return to the Return Reference field on the form and click on the  button.

button.

Alternatively click on the Find VAT Return Header button to the right of this field,  , and the Find VAT Return Header form will open, allowing you to search for and select the required VAT Return. This form is further detailed in the Find VAT Return section.

, and the Find VAT Return Header form will open, allowing you to search for and select the required VAT Return. This form is further detailed in the Find VAT Return section.

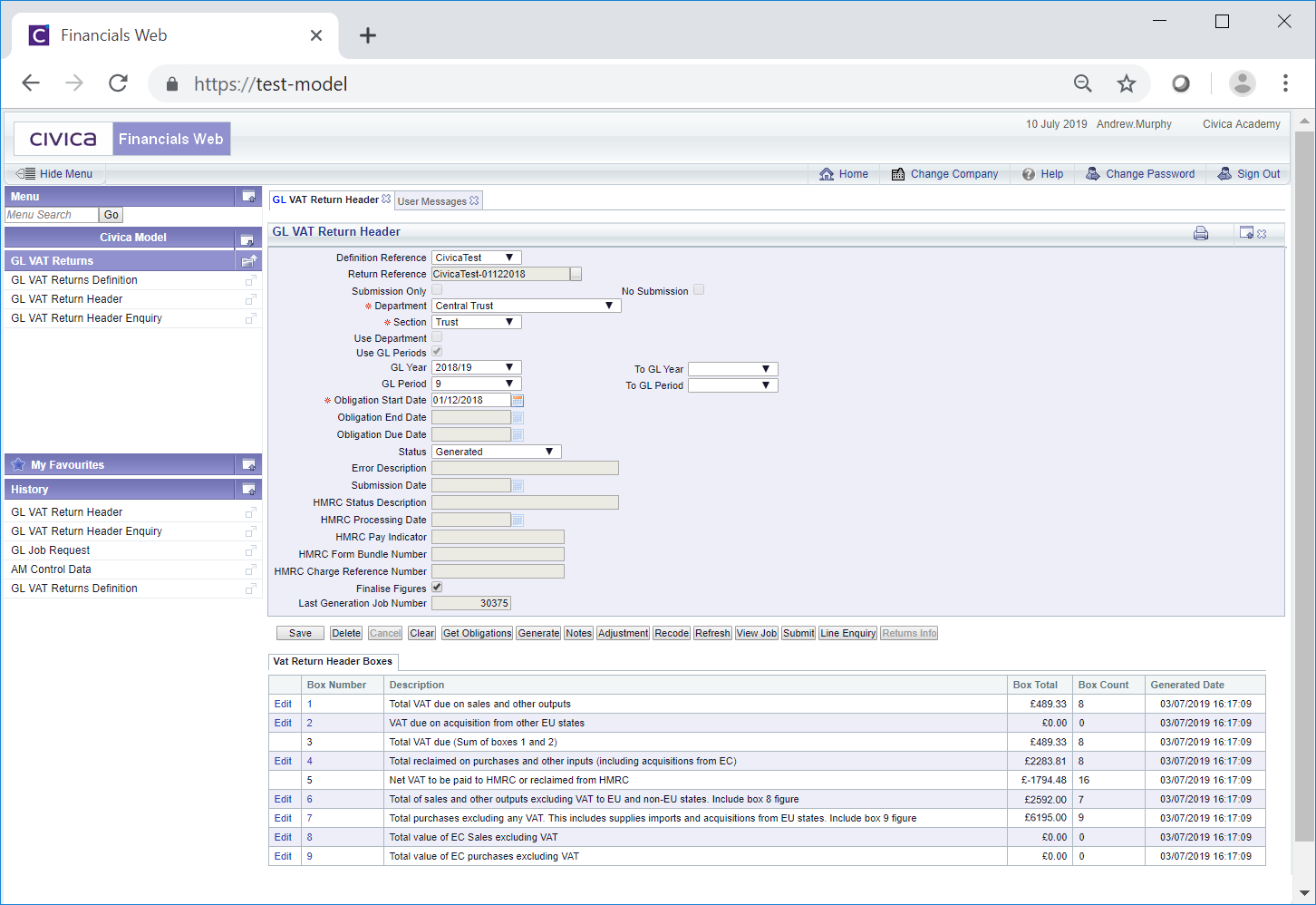

The details of the VAT Return will then be added to the GL VAT Return Header. Please note: this form can also be accessed by clicking on the link in the Return Reference column on the Grid at the bottom of the GL VAT Return Header Enquiry form, as detailed in the VAT Returns Enquiry section:

Where the Return has been submitted to HMRC successfully, i.e. the Status field is set to Submitted, a read-only version of the GL VAT Return Header form will be displayed and although it will display the same fields and Grid as detailed below, you will not be able to make any changes.

The fields on the form are as follows:

- Definition Reference: This field will display the reference for the selected VAT Returns Definition and cannot be changed.

- Returns Reference: This Read Only field will be set to the reference in the Definition Reference field, detailed immediately above, followed by the date that was added to the Obligation Start Date field, which is displayed further down the form, when the Return was created. The details in this field cannot be changed.

- Submission Only: This Read Only option should not be selected.

- No Submission: This Read Only option should not be selected..

- Department: This field will display the Department for the VAT Return and should not be changed.

- Section: This field will display the Section for the VAT Return and should not be changed.

- Use Department: This option can be ignored.

- Use GL Periods: This Read Only option should be selected

- GL Year: A Year will be included in this Read Only field that will be the Year from which the information has been or will be extracted for the VAT Return.

- GL Period: A Period will be included in this Read Only field that will be the Period from which the information has been or will be extracted for the VAT Return.

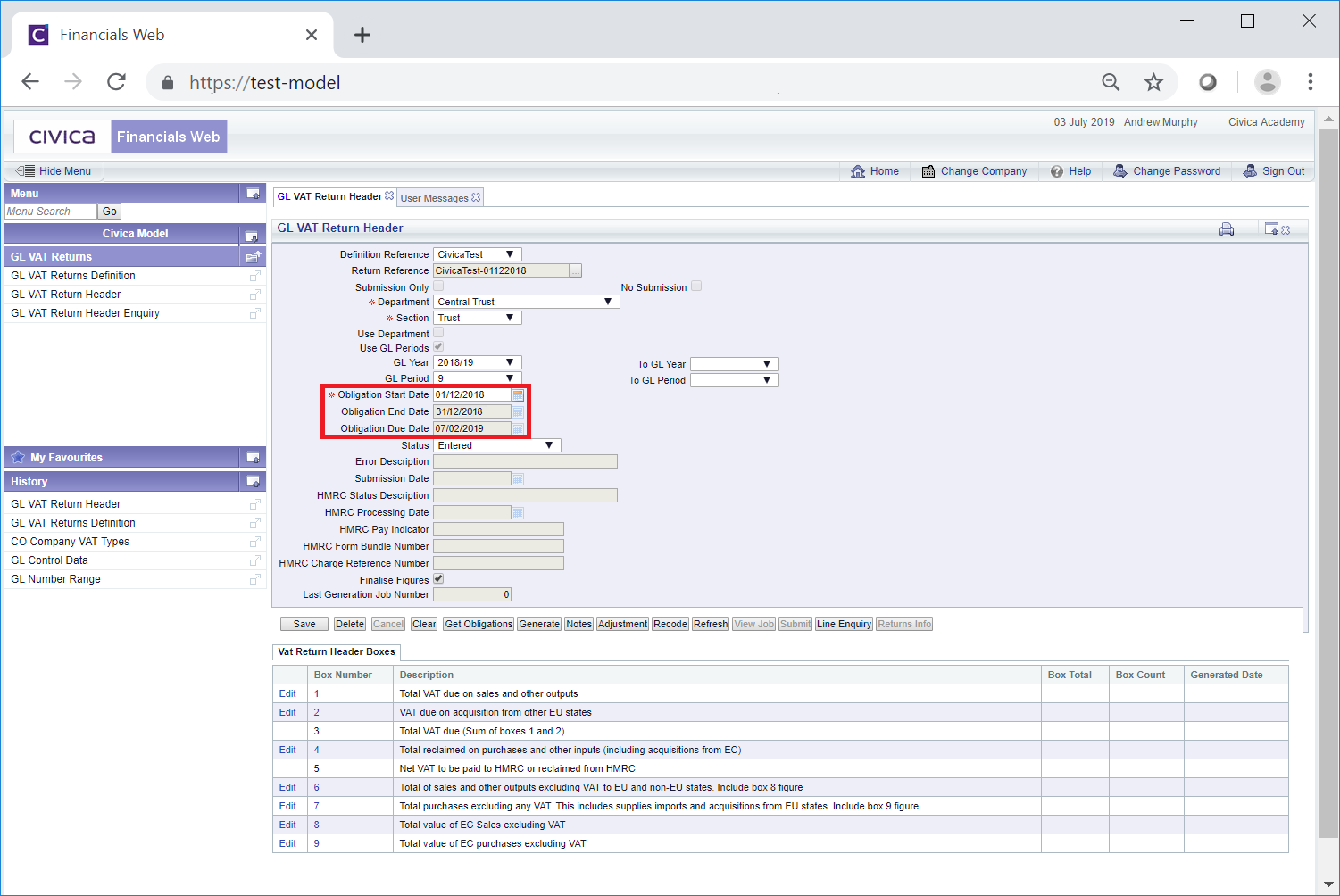

- Obligation Start Date: This field will include the start date of the VAT Return and, unless the Status field is set to Submitted, can be changed if required. This is specified by HMRC and can be obtained by clicking on the

button, as further detailed below.

button, as further detailed below.

Where the Status field is set to Submitted a date will be included in this field and you will not be able to change this date.

- Obligation End Date: This field should include the end date for the VAT Return as specified by HMRC and can be obtained by clicking on the

button, as further detailed below. You will not be able to change this date directly.

button, as further detailed below. You will not be able to change this date directly.

Where the Status field is set to Submitted a date will be included in this field and you will not be able to change it.

- Obligation Due Date: This field should include the date that the VAT Return is due. For monthly or quarterly Returns this is one month and seven days from the Obligation End Date for the VAT Return. This date can be obtained by clicking on the

button, as further detailed below. You will not be able to change this date directly.

button, as further detailed below. You will not be able to change this date directly.

Where the Status field is set to Submitted a date will be included in this field and you will not be able to change this date.

- Status: This field will include one of the following:

- Entered: This is the initial Status of the VAT Return where it has been or is in the process of being created.

- Generation Submission: Clicking on the

button, as detailed below, will allow you to submit a GL VAT Generation Report Job Request that generates the information for the VAT Return. Once the Job Request is submitted, the Status of the Return will be set to Generation Submission.

button, as detailed below, will allow you to submit a GL VAT Generation Report Job Request that generates the information for the VAT Return. Once the Job Request is submitted, the Status of the Return will be set to Generation Submission.

- Generating: This will be the Status of the VAT Return when the GL VAT Generation Report is running.

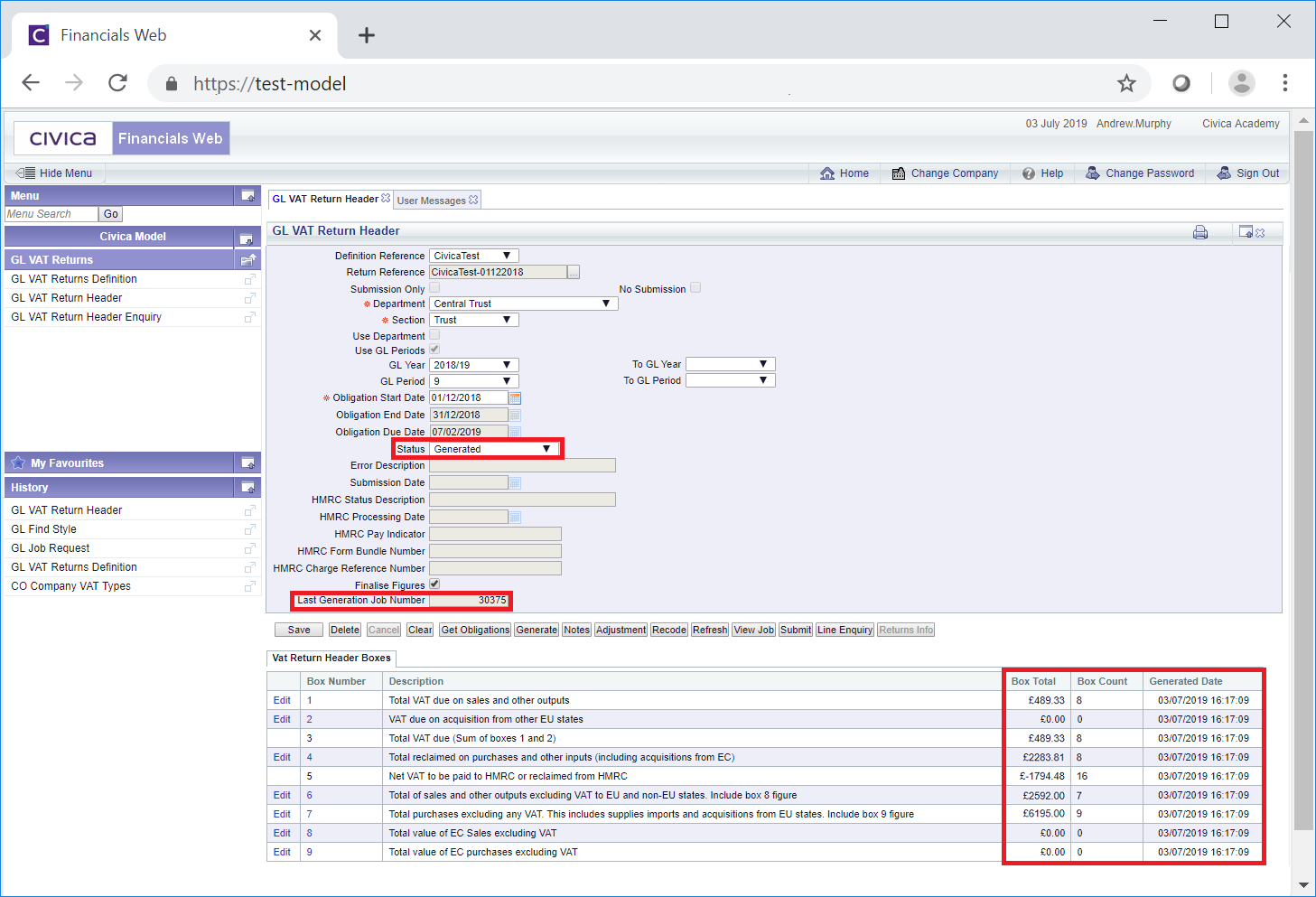

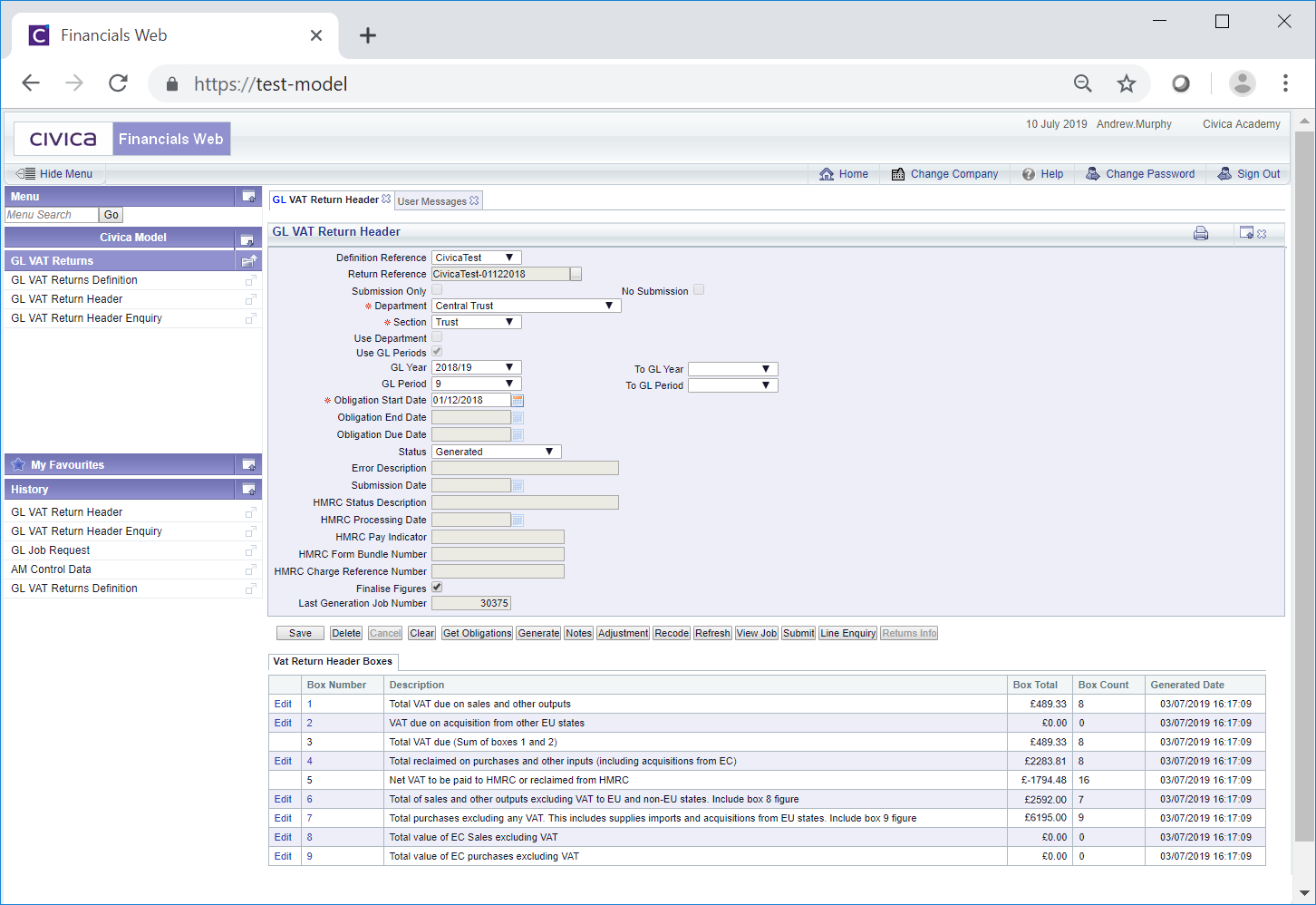

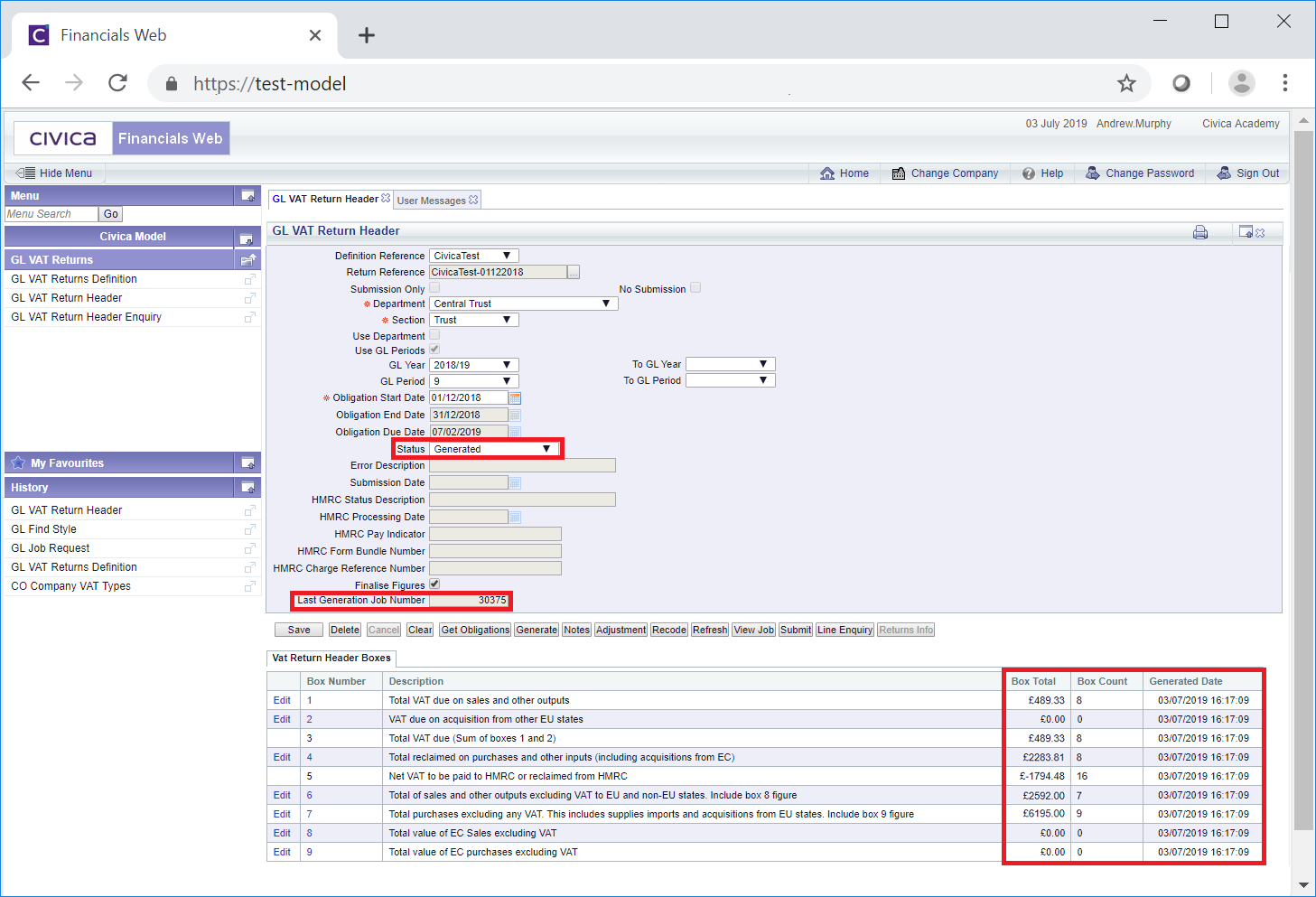

- Generated: This will be the Status of the VAT Return when the GL VAT Generation Report has finished running and there are no errors.

- Generated with Errors: This will be the Status of the VAT Return when the GL VAT Generation Report has finished running and there are errors.

- Submitted: This will be the Status of the VAT Return once it has been submitted successfully to HMRC, i.e. by selecting the

button as detailed below, in which case the GL VAT Return Header form will be a read-only version.

button as detailed below, in which case the GL VAT Return Header form will be a read-only version.

- Error Description: This Read Only field will be populated where there has been an error when submitting the VAT Return to HMRC. The description of the most recent error will be displayed in this field. Otherwise it will be blank.

- Submission Date: This Read Only field will be blank until the VAT Return has been submitted to HMRC, in which case it will contain the date it was last submitted.

- HMRC Status Description: This Read Only field will be blank until the VAT Return has been submitted to HMRC, in which case it will contain the latest Status Description of the VAT Return in the response from HMRC.

- HMRC Processing Date: This REad Only field will be blank until the VAT Return has been submitted to HMRC successfully, in which case it will contain the processing date and time of the response from HMRC.

- HMRC Pay Indicator: This Read Only field will be blank until the VAT Return has been submitted to HMRC successfully, in which case it may contain one of the following Pay Indicators in the response from HMRC:

- DD: This will be displayed where an amount is due to HMRC and these are normally paid by Direct Debit.

- BANK: This will be displayed where an amount is due from HMRC and they hold your Bank details.

Otherwise the field will be blank.

- HMRC Form Bundle Number: This Read Only field will be blank until the VAT Return has been submitted successfully, in which case the response from HMRC will include a unique number that represents the form bundle - HMRC stores VAT Returns data in forms that are held in a unique form bundle. This unique number will be added to this field.

- HMRC Charge Reference Number: This Read Only field will be blank until the VAT Return is submitted successfully and an amount is owed to HMRC, in which case HMRC will include a charge reference number between 1 and 16 characters in their response. This reference number will be added to this field.

- Finalise Figures: Where this option is selected and the VAT Return is submitted, it will be sent to HMRC. Where this option is deselected and the VAT Return is submitted, some validation will be performed but the VAT Return will not be sent to HMRC. This will allow you to view VAT information and make any relevant changes before sending it to HMRC. The option can be selected or deselected as required unless the Status field is set to Submitted.

- Last Generation Job Number: This Read Only field will be blank until a Job Request for the GL VAT Generation Report is submitted for the VAT Return via the

button, as detailed below, in which case it will contain the job number of the Job Request.

button, as detailed below, in which case it will contain the job number of the Job Request.

The following buttons will be available at the bottom of the form unless the Status field is set to Submitted, i.e. the GL VAT Return Header form is a read-only version, in which case most of these buttons will not be enabled:

: This button will not be enabled where the Status field is set to Submitted. Click on this button to save any changes to the form.

: This button will not be enabled where the Status field is set to Submitted. Click on this button to save any changes to the form. : This button will not be enabled where the Status field is set to Submitted. Click on this button to delete the VAT Return.

: This button will not be enabled where the Status field is set to Submitted. Click on this button to delete the VAT Return. : Clicking on this button will clear all the fields and the Grid, returning you to the original version of the GL VAT Return Header form where you can create a VAT Return or search for an existing one.

: Clicking on this button will clear all the fields and the Grid, returning you to the original version of the GL VAT Return Header form where you can create a VAT Return or search for an existing one.

: This button will not be enabled where the Status field is set to Submitted. Where the Obligation Start Date, Obligation End Date and Obligation Due Date fields, which are further detailed above, are blank, clicking on this button will open the GL VAT Return Header Obligation form that will allow you to add these dates for the next VAT Return that is due for your organisation. These dates will be provided by HMRC.

: This button will not be enabled where the Status field is set to Submitted. Where the Obligation Start Date, Obligation End Date and Obligation Due Date fields, which are further detailed above, are blank, clicking on this button will open the GL VAT Return Header Obligation form that will allow you to add these dates for the next VAT Return that is due for your organisation. These dates will be provided by HMRC.

Where these fields are already populated, clicking on this button will open this form and allow you to replace these Obligation Dates with dates provided by HMRC and this form is further detailed in the Get Obligations section.

Once these Obligation Dates have been obtained from HMRC you will be directed back to the GL VAT Return Header form and clicking on the  button will update these fields:

button will update these fields:

: This button will not be enabled where the Status field is set to Submitted. Selecting this option will open the GL VAT Return Generation form that will allow you to submit a Job Request that will generate the information for the VAT Return. This form is further detailed in the Generate Return Information section.

: This button will not be enabled where the Status field is set to Submitted. Selecting this option will open the GL VAT Return Generation form that will allow you to submit a Job Request that will generate the information for the VAT Return. This form is further detailed in the Generate Return Information section.

Once the Job Request has been submitted, the Status field on the GL VAT Return Header form will change to Generate Submitted and the Last Generation Job Number field will be populated with the number of the Job Request.

Where the Job Request is running the Status field will change to Generating and once it has completed the Status field will change to Generated and the Grid at the bottom of the form will be updated with the results:

Where the Job Request has completed but with errors, the Status field will change to Generated with Errors.

Once submitted the Job Request can be viewed by clicking on the  button, which is further detailed below.

button, which is further detailed below.

Please note: Where these details have already been generated, clicking on the  button and running the Job Request will result in these details being updated once the Job Request has completed.

button and running the Job Request will result in these details being updated once the Job Request has completed.

: Clicking on this button will open the GL Notes for VAT Return Header form allowing you to add a Note with regard to the VAT Return. Where there is an existing Note the button will be displayed as

: Clicking on this button will open the GL Notes for VAT Return Header form allowing you to add a Note with regard to the VAT Return. Where there is an existing Note the button will be displayed as  . This form is further detailed in the Notes section.

. This form is further detailed in the Notes section. : This button will not be enabled where the Status field is set to Submitted. Once the information has been generated for the VAT Return, clicking on this button will open the GL VAT Return Adjustment form allowing you to create adjustment transactions and add them into the VAT Return.

: This button will not be enabled where the Status field is set to Submitted. Once the information has been generated for the VAT Return, clicking on this button will open the GL VAT Return Adjustment form allowing you to create adjustment transactions and add them into the VAT Return.

These adjustments may be for Partial VAT Exemption adjustments, recording of anticipated future Purchasing/Creditors invoices, adjustments for Bad Debt Relief, and any other required adjustments. This form is further detailed in the Creating VAT Return Adjustments section.

Once created the Adjustment can be viewed and/or amended on the GL VAT Return Adjustment form by clicking on this button. This is further detailed in the Viewing/Amending Adjustments section.

: This button will not be enabled where the Status field is set to Submitted. Clicking on this button will open the GL VAT Return Recode form allowing you to change the VAT Code of items in Box 6 or Box 7 that results in a change to the VAT Amount. This form is further detailed in the Recoding VAT Codes section.

: This button will not be enabled where the Status field is set to Submitted. Clicking on this button will open the GL VAT Return Recode form allowing you to change the VAT Code of items in Box 6 or Box 7 that results in a change to the VAT Amount. This form is further detailed in the Recoding VAT Codes section.

For example changing a VAT Code from Zero-rated to Standard would change the VAT Amount whereas changing it from Zero-rated to Exempt would not. In this example you would click on this button to change the VAT Code of an item from Zero-rated to Standard.

: This button will not be enabled where the Status field is set to Submitted. Click on this button to refresh the details on the form and/or on the Grid. e.g. when obtaining the Obligation Dates by clicking on the

: This button will not be enabled where the Status field is set to Submitted. Click on this button to refresh the details on the form and/or on the Grid. e.g. when obtaining the Obligation Dates by clicking on the  button and returning to the GL VAT Return Header form, clicking on the

button and returning to the GL VAT Return Header form, clicking on the  button will refresh the Obligation Date fields.

button will refresh the Obligation Date fields. : Once a Job Request has been submitted to generate the information for the VAT Return via the

: Once a Job Request has been submitted to generate the information for the VAT Return via the  button, as detailed above, clicking on the

button, as detailed above, clicking on the  button will open the GL Report Viewer form so you can view the progress of the Job Request.

button will open the GL Report Viewer form so you can view the progress of the Job Request.

Once the information has been generated, clicking on this button will allow you to view that Job Request,

Viewing Job Requests is further detailed in the Report Viewer section in the Reporting How to Guide.

: This button will not be enabled where the Status field is set to Submitted. Click on this button to submit the VAT Return to HMRC. This is further detailed in the Submit Return to HMRC section.

: This button will not be enabled where the Status field is set to Submitted. Click on this button to submit the VAT Return to HMRC. This is further detailed in the Submit Return to HMRC section. : Once the VAT Return information has been generated via the

: Once the VAT Return information has been generated via the  button, as detailed above, clicking on

button, as detailed above, clicking on  button will open the GL VAT Return Lines form, allowing you to search for and view the transactions that make up the amounts in the Boxes (or Lines) in the VAT Return Header Boxes Grid at the bottom of the GL VAT Return Header form. This form is further detailed in the VAT Return Lines All Boxes section.

button will open the GL VAT Return Lines form, allowing you to search for and view the transactions that make up the amounts in the Boxes (or Lines) in the VAT Return Header Boxes Grid at the bottom of the GL VAT Return Header form. This form is further detailed in the VAT Return Lines All Boxes section.

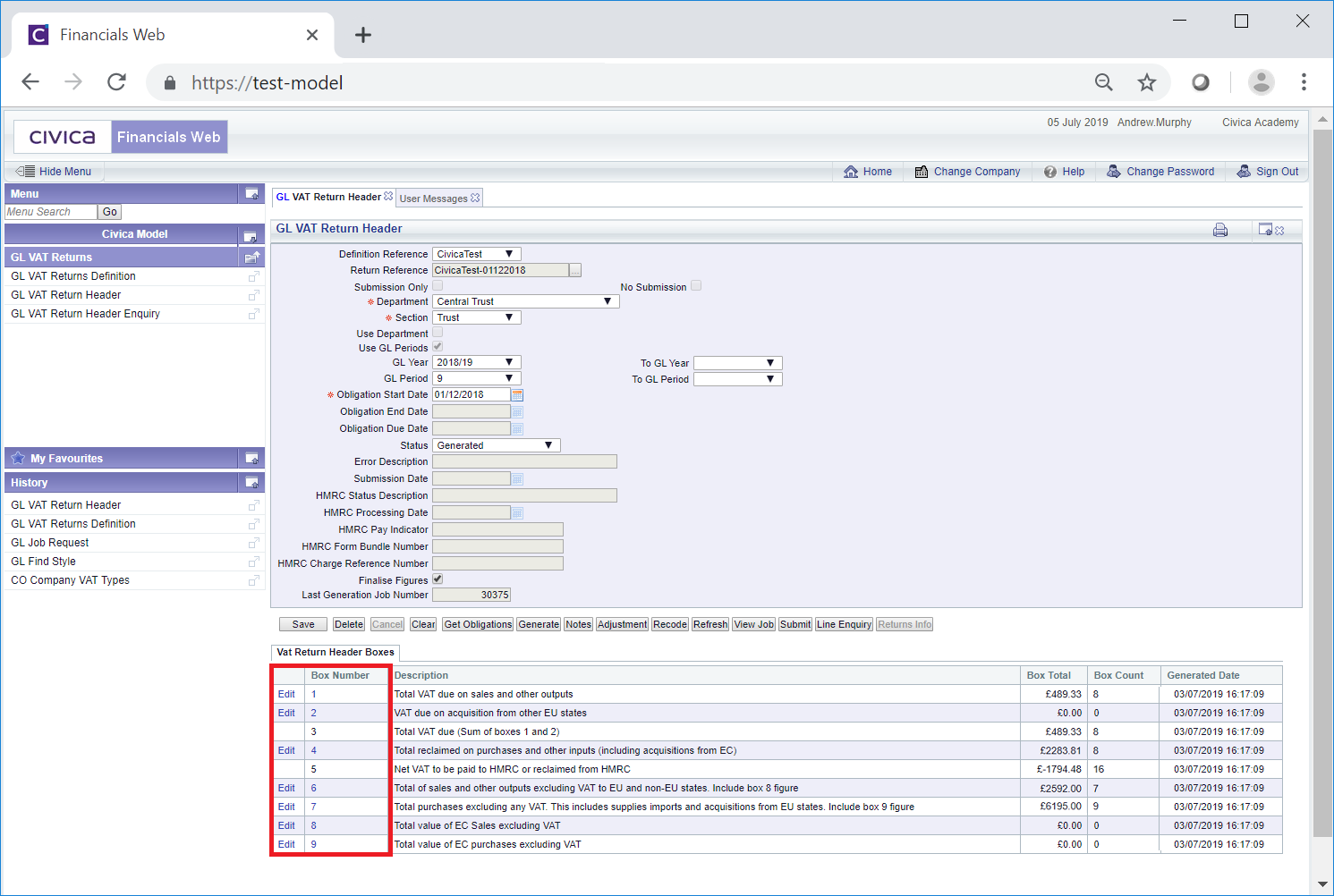

Transactions for individual Boxes (or Lines) can be displayed by clicking on the link in the Box Number column in the Grid, as detailed further below.

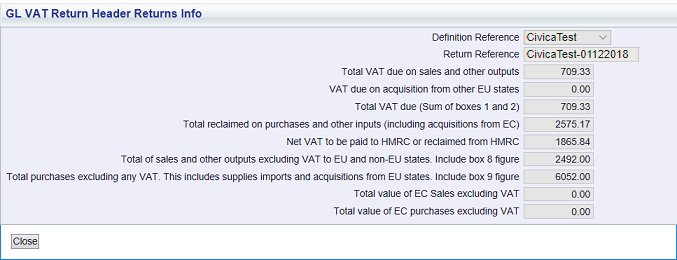

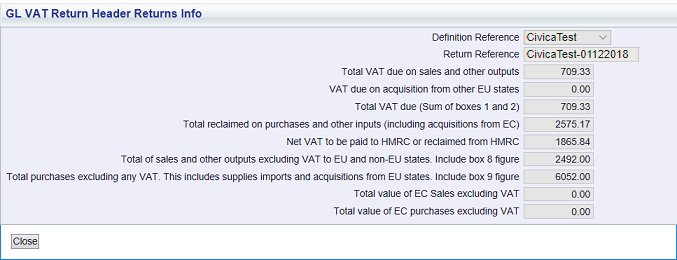

: This button will only be enabled once the VAT Return has been submitted successfully via the

: This button will only be enabled once the VAT Return has been submitted successfully via the  button, as detailed immediately above, i.e. on the read-only version of the GL VAT Return Header form. Clicking on this button will open the GL VAT Return Header Returns Info screen:

button, as detailed immediately above, i.e. on the read-only version of the GL VAT Return Header form. Clicking on this button will open the GL VAT Return Header Returns Info screen:

The Grid at the bottom of the GL VAT Return Header form has links in the following columns:

The first column will have an Edit link unless the Status field is set to Submitted - please do not use this link as the Boxes have already been configured to produce the required information.

The second column - Box Number - has a link that when clicked on will open the GL VAT Return Lines form detailing the transactions that are contained in that Box (or Line). This form is further detailed in the VAT Return Lines Individual Boxes section. Please note: there are no links for Boxes 3 and 5 as these Lines sum up amounts in the other Boxes (or Lines).

button.

button. , and the Find VAT Return Header form will open, allowing you to search for and select the required VAT Return. This form is further detailed in the Find VAT Return section.

, and the Find VAT Return Header form will open, allowing you to search for and select the required VAT Return. This form is further detailed in the Find VAT Return section.

button, as further detailed below.

button, as further detailed below. button, as further detailed below. You will not be able to change this date directly.

button, as further detailed below. You will not be able to change this date directly. button, as further detailed below. You will not be able to change this date directly.

button, as further detailed below. You will not be able to change this date directly. : This button will not be enabled where the Status field is set to Submitted. Where the Obligation Start Date, Obligation End Date and Obligation Due Date fields, which are further detailed above, are blank, clicking on this button will open the GL VAT Return Header Obligation form that will allow you to add these dates for the next VAT Return that is due for your organisation. These dates will be provided by HMRC.

: This button will not be enabled where the Status field is set to Submitted. Where the Obligation Start Date, Obligation End Date and Obligation Due Date fields, which are further detailed above, are blank, clicking on this button will open the GL VAT Return Header Obligation form that will allow you to add these dates for the next VAT Return that is due for your organisation. These dates will be provided by HMRC. button will update these fields:

button will update these fields:

button, which is further detailed below.

button, which is further detailed below.![]() button and running the Job Request will result in these details being updated once the Job Request has completed.

button and running the Job Request will result in these details being updated once the Job Request has completed. . This form is further detailed in the Notes section.

. This form is further detailed in the Notes section. : This button will not be enabled where the Status field is set to Submitted. Once the information has been generated for the VAT Return, clicking on this button will open the GL VAT Return Adjustment form allowing you to create adjustment transactions and add them into the VAT Return.

: This button will not be enabled where the Status field is set to Submitted. Once the information has been generated for the VAT Return, clicking on this button will open the GL VAT Return Adjustment form allowing you to create adjustment transactions and add them into the VAT Return. button and returning to the GL VAT Return Header form, clicking on the

button and returning to the GL VAT Return Header form, clicking on the  : Once a Job Request has been submitted to generate the information for the VAT Return via the

: Once a Job Request has been submitted to generate the information for the VAT Return via the  button will open the GL Report Viewer form so you can view the progress of the Job Request.

button will open the GL Report Viewer form so you can view the progress of the Job Request.