Where creating a new VAT Return clicking on the link in the Box Number column on the VAT Return Header Boxes tab on the Grid in the GL VAT Return Header form, as detailed in the Creating VAT Returns section, will open the GL VAT Return Lines form, allowing you to view the transactions that make the amount in the selected Box (or Line).

Where amending or viewing a VAT Return clicking on this link on the GL VAT Return Header form, as detailed in the Amending/Viewing VAT Returns section, will also open the GL VAT Return Lines form, allowing you to view these transactions.

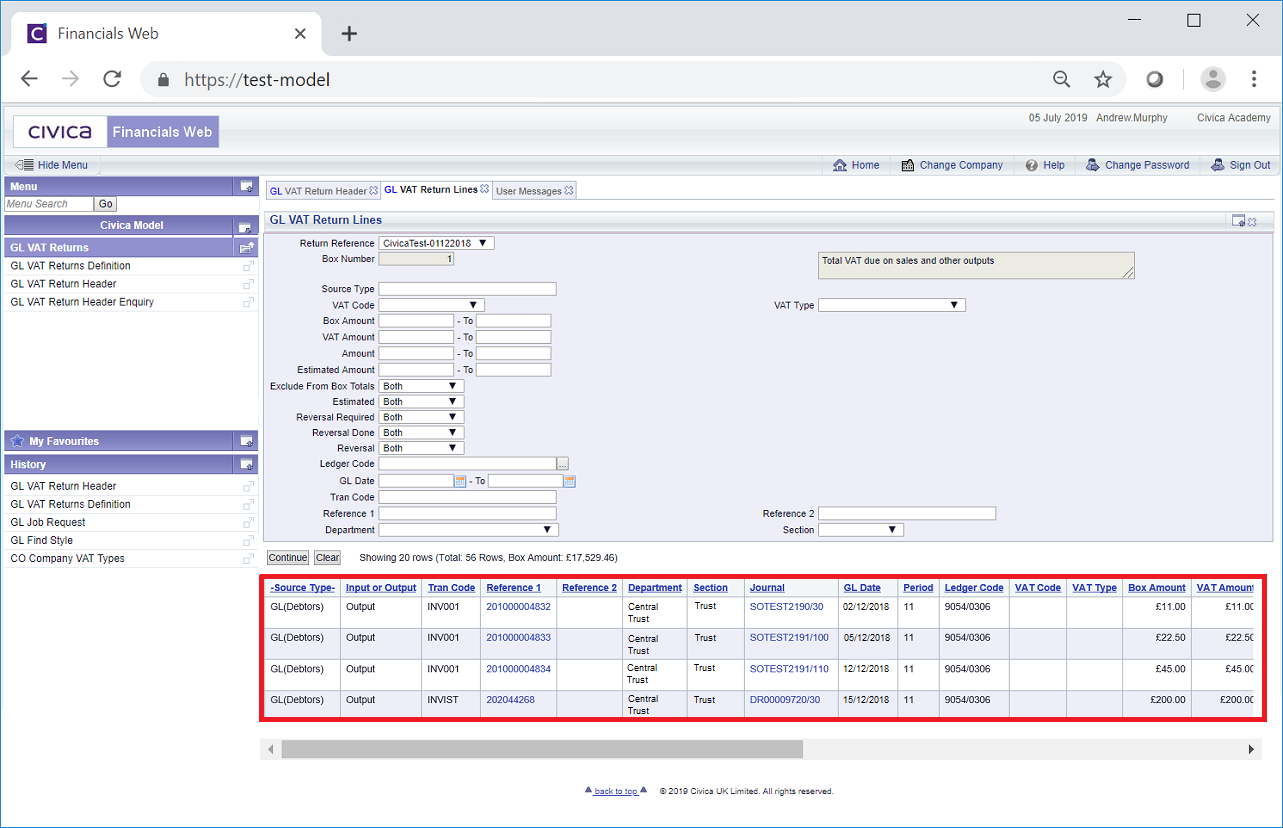

The GL VAT Return Lines form will open with the transactions that are included in the selected Box Number displayed in the Grid at the bottom of the form:

Search criteria can be added to the fields on the form to filter these transactions.

Clicking on the ![]() button will remove the Grid as well as any search criteria that has been added to the form, allowing you to add fresh search criteria.

button will remove the Grid as well as any search criteria that has been added to the form, allowing you to add fresh search criteria.

If a ![]() button is displayed, further pages will be available - click on this button to go to the next page.

button is displayed, further pages will be available - click on this button to go to the next page.

A ![]() will be displayed if there is only one page. Where there are multiple pages this button will be displayed on the last page. When this button is displayed adding new search criteria to the fields on the form and clicking on this button will refresh the Grid with transactions that meet the new search criteria.

will be displayed if there is only one page. Where there are multiple pages this button will be displayed on the last page. When this button is displayed adding new search criteria to the fields on the form and clicking on this button will refresh the Grid with transactions that meet the new search criteria.

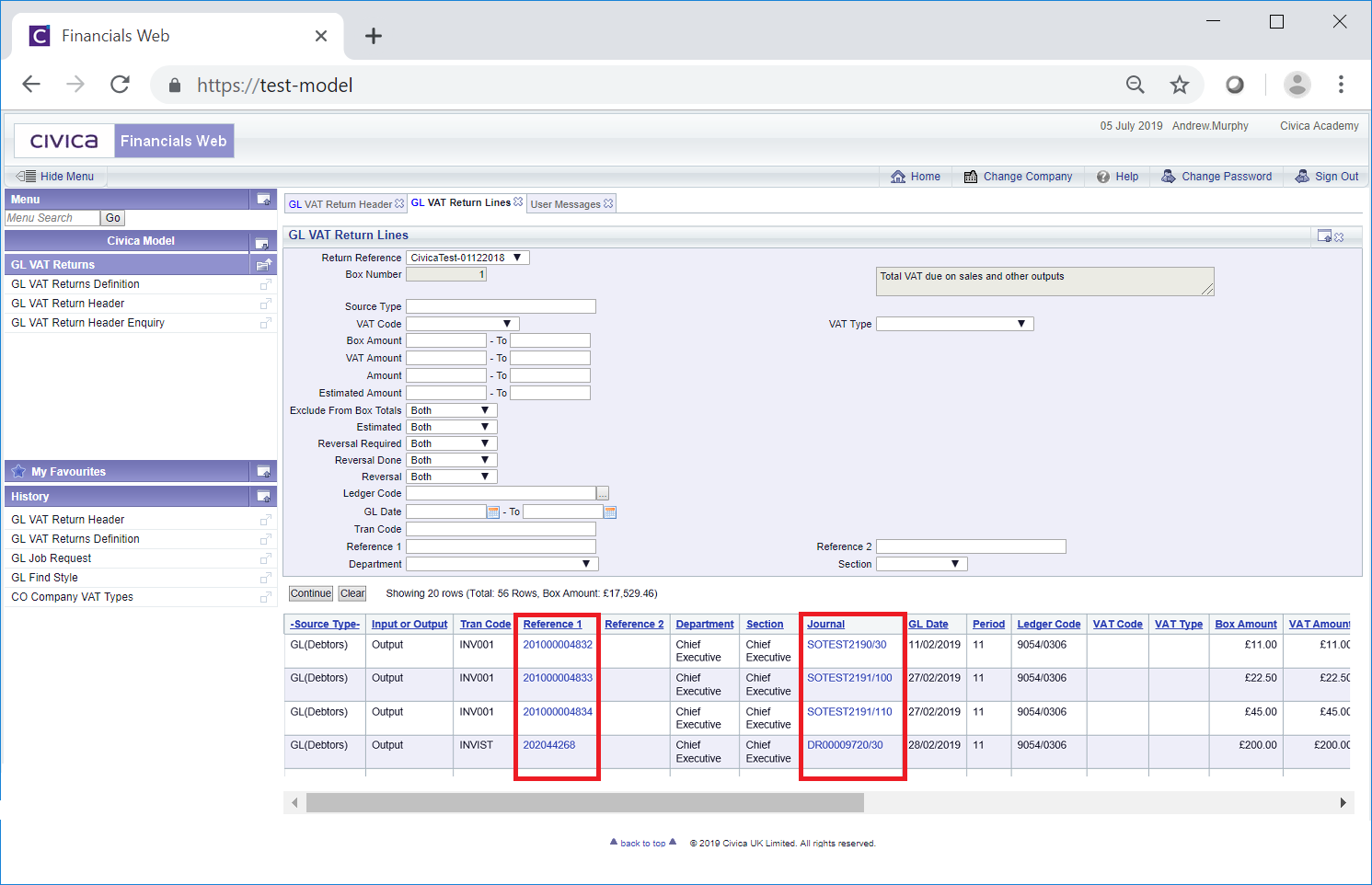

Links are available on the following columns on the Grid:

Clicking on the link in the Reference 1 column will provide details of the original transaction, e.g. a Debtors or Creditors transaction - where the transaction originates will be detailed in the Source column.

Clicking on the link in the Journal column will provide details of the original GL Journal.