Where creating a new VAT Return clicking on the ![]() button on the GL VAT Return Header form, as detailed in the Creating VAT Returns section, will open the GL VAT Return Recode form. This form will allow you to change the VAT Code items in Box 6 or Box 7 on the VAT Return that results in a change to the VAT Amount.

button on the GL VAT Return Header form, as detailed in the Creating VAT Returns section, will open the GL VAT Return Recode form. This form will allow you to change the VAT Code items in Box 6 or Box 7 on the VAT Return that results in a change to the VAT Amount.

Where amending an existing VAT Return, clicking on this button on the GL VAT Return Header form, as detailed in the Amending/Viewing VAT Returns section will also open the GL VAT Return Recode form, allowing you to change the VAT Code items in Box 6 or Box 7 on the VAT Return that results in a change to the VAT Amount.

The GL VAT Return Recode form is designed to handle cases where the VAT Code is being changed and the associated VAT Rate is therefore changed. These changes are required to the values in the VAT Return boxes and a GL Journal is potentially required to reflect the changes back into the General Ledger.

Such changes could be made via the GL VAT Return Adjustment form as detailed in the Creating VAT Return Adjustments section, by entering an Adjustment to reverse out the original entries and another Adjustment to put in the correct entries. The GL VAT Return Recode form provides a short cut method to do this by specifying the amended VAT Code and VAT Amount for an existing VAT Return transaction line. On completion, this then generates new VAT Return adjustment lines to effect the change, along with a GL Journal if required.

For example, if an original Input transaction has been input with a zero-rated VAT Code but should have been standard rated:

Creating Recode Adjustments via the  button is detailed below.

button is detailed below.

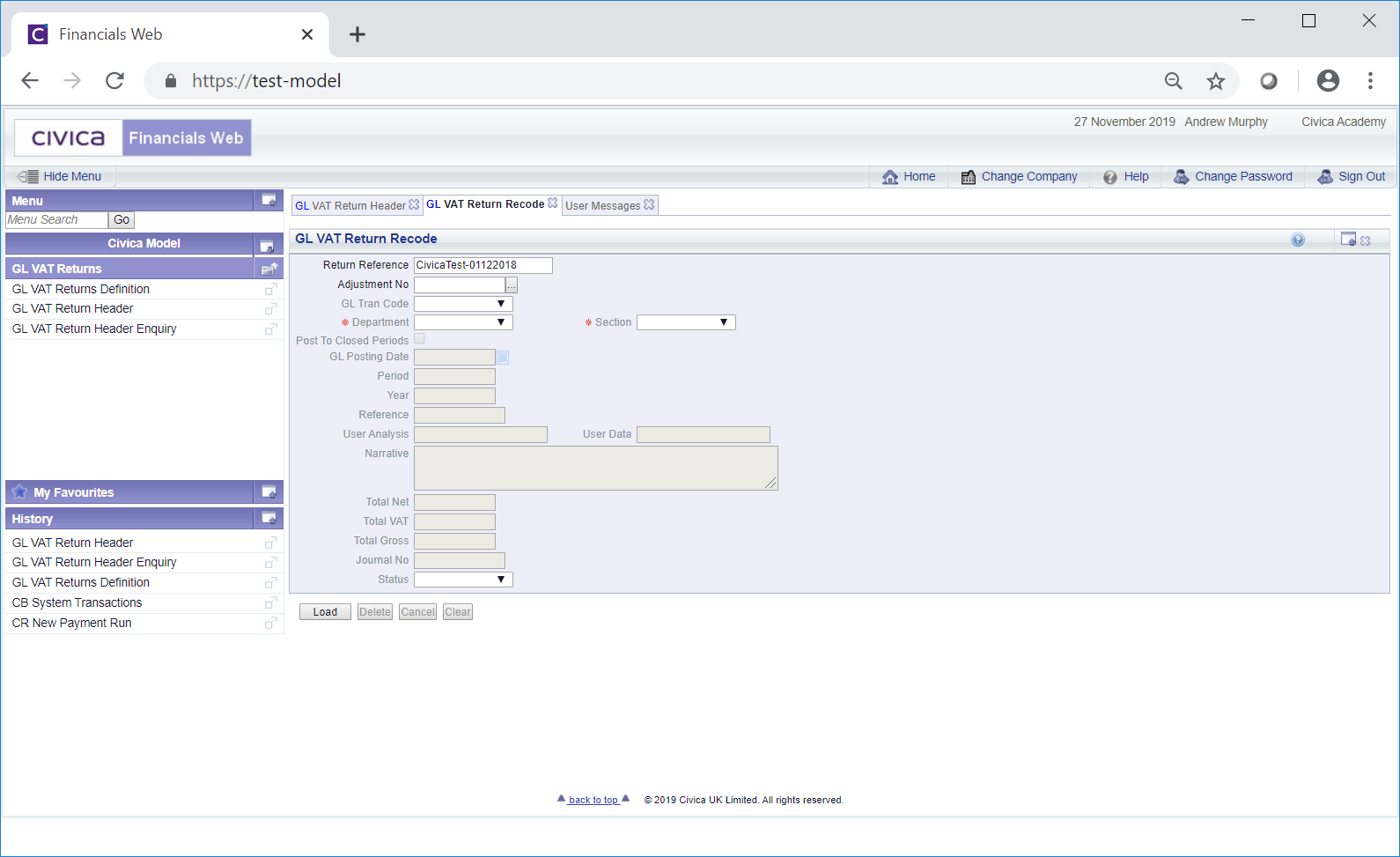

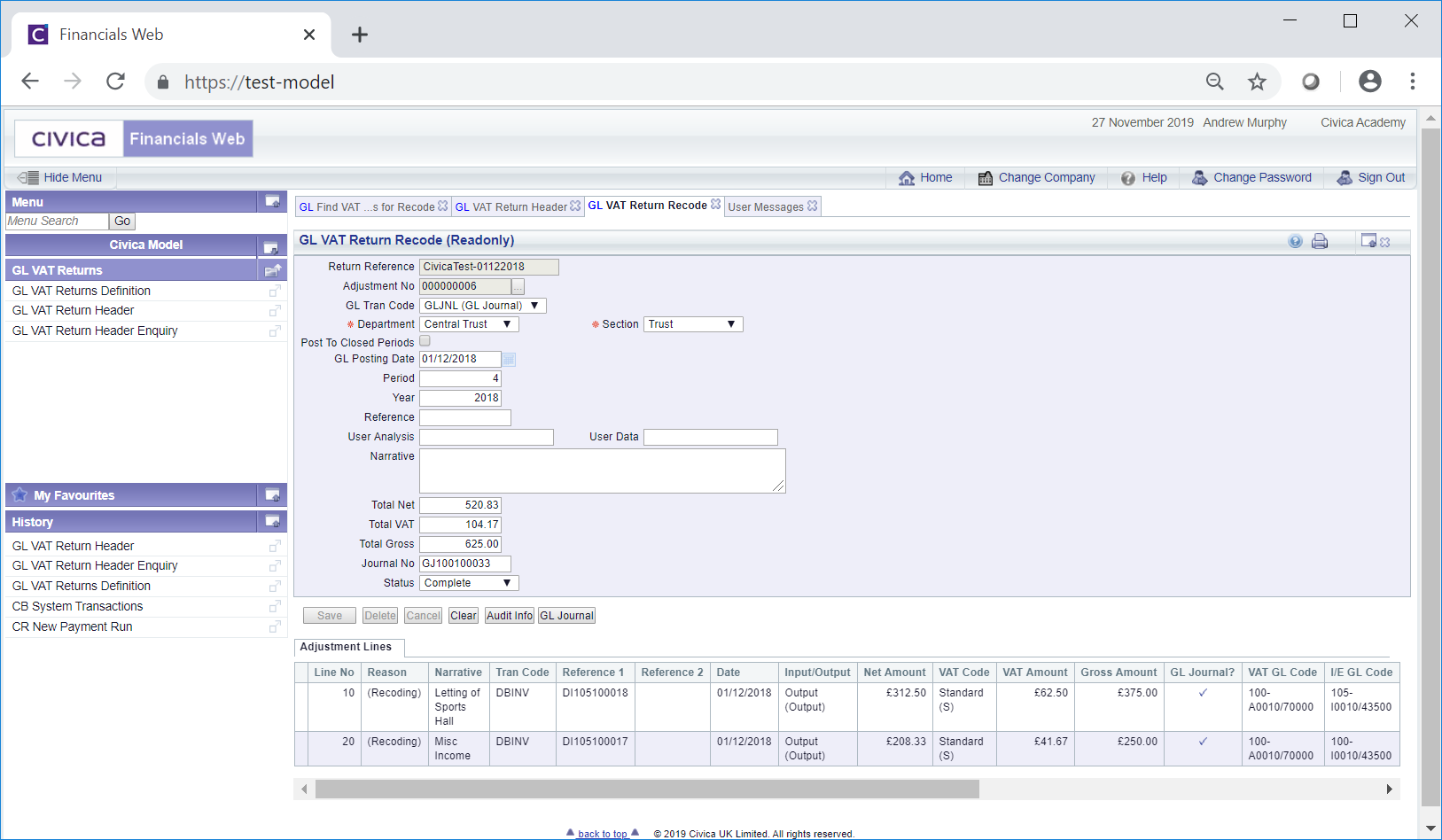

The GL VAT Return Recode form will open:

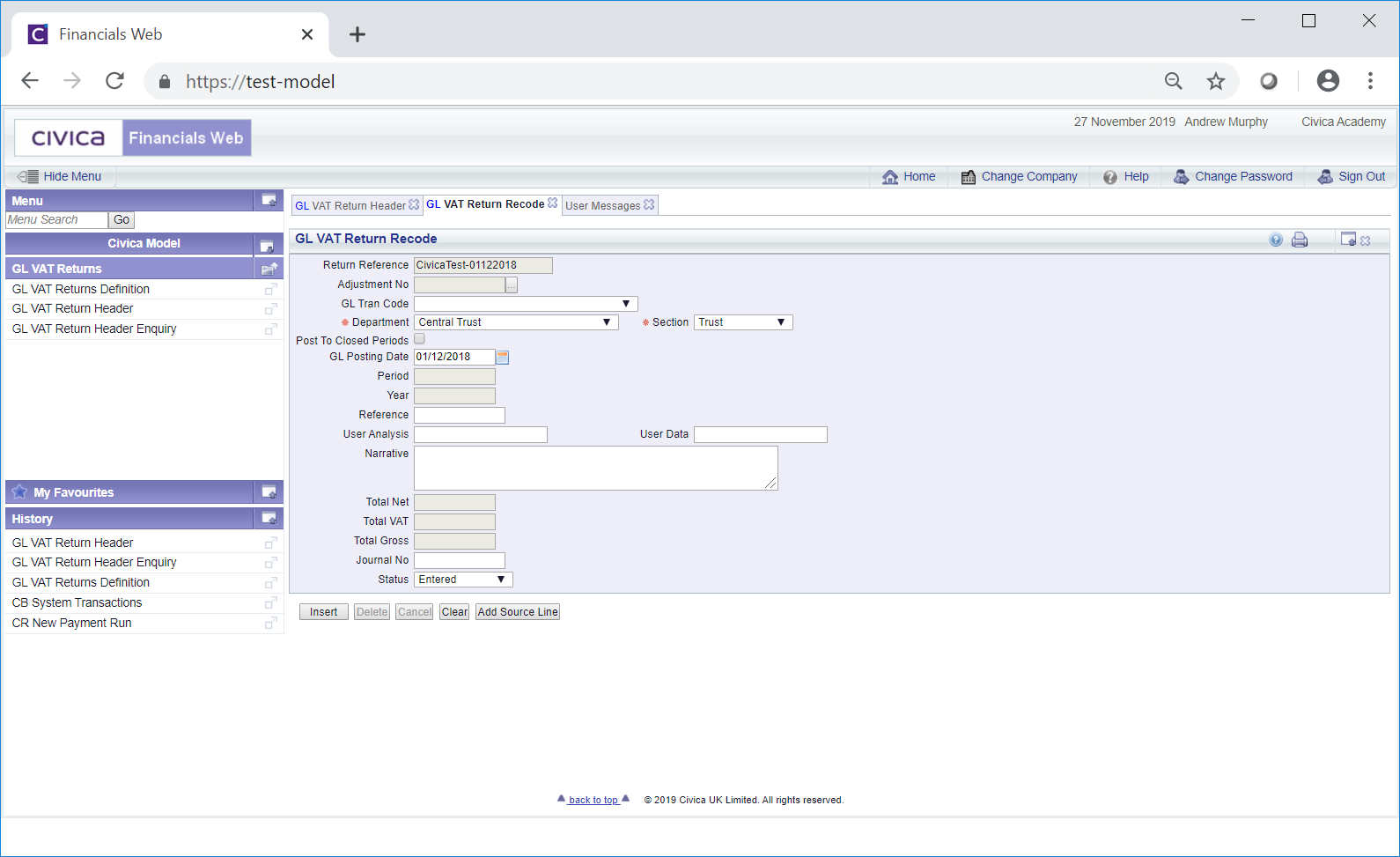

To create an VAT Recode adjustment click on the ![]() button and certain fields on the form will become available as well as new buttons:

button and certain fields on the form will become available as well as new buttons:

The VAT Recode adjustments created on this form will be held against the relevant item in Box 6 or Box 7 on the VAT Return.

Where required GL Journals can be created for these adjustments that will also update the General Ledger.

The following fields on this form are available: (mandatory items are notated with a red asterisk *):

Where the VAT Recode adjustment should not update the General Ledger, i.e. it should only adjust the relevant item in Box 6 or 7 on the VAT Return, leave this field blank.

Click on the  button and a GL Find VAT Return Lines for Recode form will open allowing you to search for and select the relevant item (or Line) in Box 6 or 7 that is to be adjusted. This form is further detailed in the Find VAT Return Lines section.

button and a GL Find VAT Return Lines for Recode form will open allowing you to search for and select the relevant item (or Line) in Box 6 or 7 that is to be adjusted. This form is further detailed in the Find VAT Return Lines section.

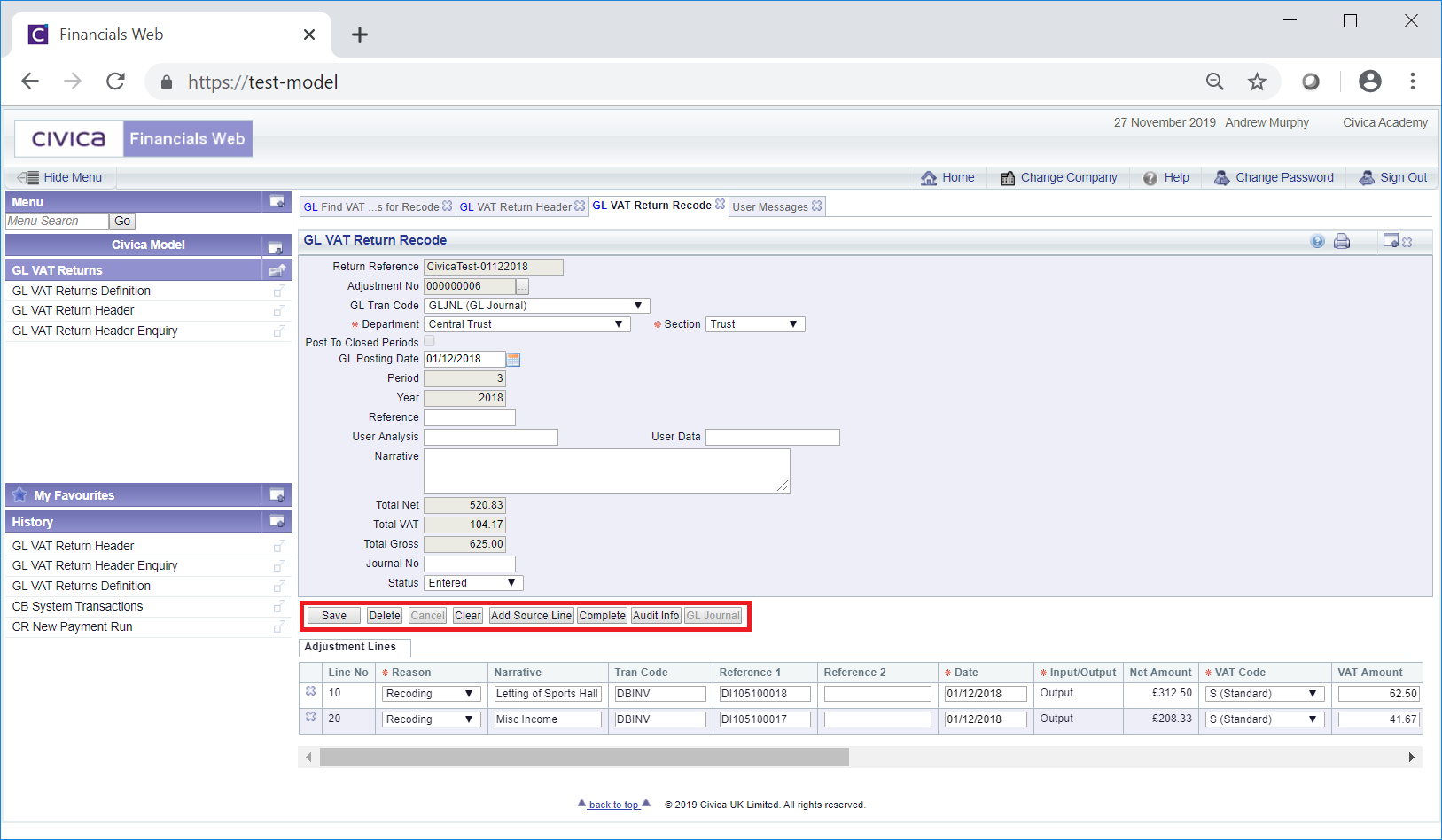

Once the relevant Line has been selected, it will be added to an Adjustment Lines tab on a Grid at the bottom of the GL VAT Return Recode form:

The fields available on the Lines in the Grid are as follows (mandatory items are notated with a red asterisk *):

Please note: the original VAT Code and Original VAT Type is displayed in the Original VAT Code and Original VAT Type columns on the Line.

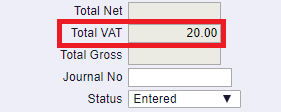

Where this field is blank when the VAT Recode adjustment is completed, a calculated amount will be added that will be the amount in the Gross Amount field less the amount determined by the code in the VAT Code field.

Please note: the original VAT Amount is displayed in the Original VAT Amount column on the Line.

Where the VAT Recode adjustment is to amend the Line in the VAT Return and create a GL Journal, this option should be selected. Where the VAT Recode adjustment is only to amend the Line in the VAT Return, this option should not be selected.

Please note: Where this option is selected, also ensure that the relevant GL Transaction Code has been added to the GL Trans Code field on the form.

Alternatively clicking on the Find Ledger button located to the right of this field,  , will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

, will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

Alternatively clicking on the Find Ledger button located to the right of this field,  , will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

, will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

Click on the  button and further buttons will be displayed:

button and further buttons will be displayed:

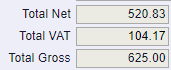

The following fields on the form will be updated:

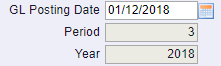

The Period and Year fields will include the relevant Period and Year as defined by the date in the GL Posting Date field.

Where not already updated these fields will be updated to reflect the same fields as in the Adjustment Line.

The Lines in the Adjustments LInes tab on the Grid will also be updated.

The following buttons are available:

: Clicking on this button take you to the GL Find VAT Return Lines for Recode form allowing you to search for and add another item (or Line) to the Adjustment Lines tab on the GL VAT Return Recode form, as detailed above.

: Clicking on this button take you to the GL Find VAT Return Lines for Recode form allowing you to search for and add another item (or Line) to the Adjustment Lines tab on the GL VAT Return Recode form, as detailed above.

The status field will also change to Complete. As the form is a Read Only form no further changes can be made.

Where a GL Journal has been created from the VAT Recode Adjustment, the Journal No field on the form will be populated and the  button will be enabled. Clicking on this button will open the GL Standard Journal (Readonly) screen providing details of the Journal. This screen is further detailed in the Viewing Standard Journals section.

button will be enabled. Clicking on this button will open the GL Standard Journal (Readonly) screen providing details of the Journal. This screen is further detailed in the Viewing Standard Journals section.