Where creating a new VAT Return clicking on the  button on the GL VAT Return Header form, as detailed in the Creating VAT Returns section, will open the GL VAT Return Header Obligation form that will return the Obligation date details from HMRC, i.e. the Obligation Start Date, Obligation End Date and Obligation Due Date, for the next VAT Return that is due from your organisation.

button on the GL VAT Return Header form, as detailed in the Creating VAT Returns section, will open the GL VAT Return Header Obligation form that will return the Obligation date details from HMRC, i.e. the Obligation Start Date, Obligation End Date and Obligation Due Date, for the next VAT Return that is due from your organisation.

Where amending an existing VAT Return, clicking on this button on the GL VAT Return Header form, as detailed in the Amending/Viewing VAT Returns section, will also open the GL VAT Return Header Obligation form allowing you to add to or change these details.

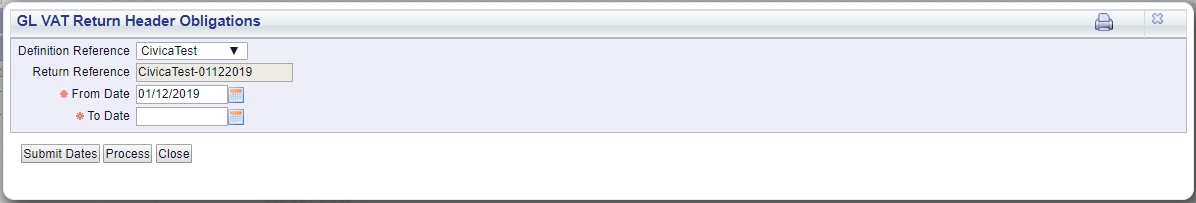

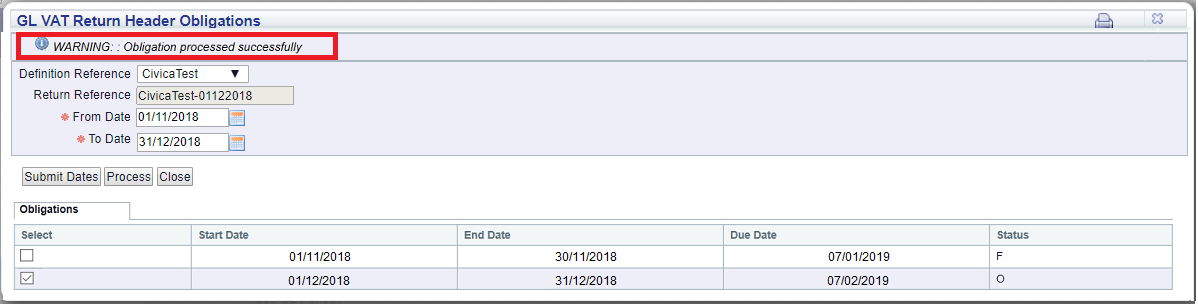

The GL VAT Return Header Obligation form will open:

The following fields are available: (mandatory fields are notated with a red asterisk *):

The following buttons are also available:

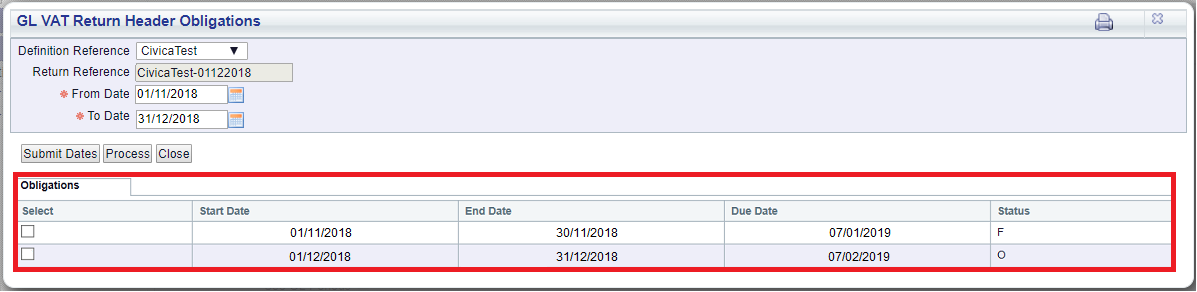

: Clicking on this button will open an Obligation tab on a Grid at the bottom of the form containing HMRC Obligation dates that meet the search criteria on the form:

: Clicking on this button will open an Obligation tab on a Grid at the bottom of the form containing HMRC Obligation dates that meet the search criteria on the form:

The status column on the Grid will display either:

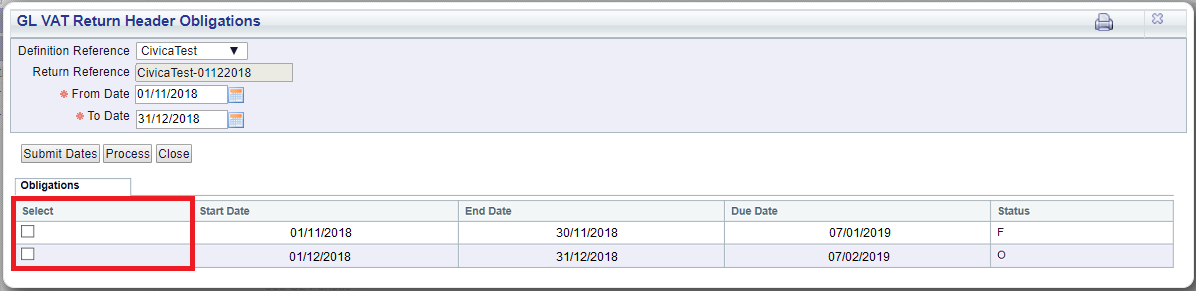

Select the tick box in the Select column on the Obligation tab Grid for the required Line (Obligation):

: Before clicking on this button ensure that a Line has been selected on the Grid as detailed immediately above. Click on this button and HMRC will validate the selected Line. Once validated a message will be displayed at the top of the form:

: Before clicking on this button ensure that a Line has been selected on the Grid as detailed immediately above. Click on this button and HMRC will validate the selected Line. Once validated a message will be displayed at the top of the form:

: Clicking on this button will close the form.

: Clicking on this button will close the form.Where creating a new VAT Return you will be returned to the GL VAT Return Header form as detailed in the Creating VAT Returns section.

Where amending an existing VAT Return you will be returned to the GL VAT Return Header form, as detailed in the Amending/Viewing VAT Returns section.

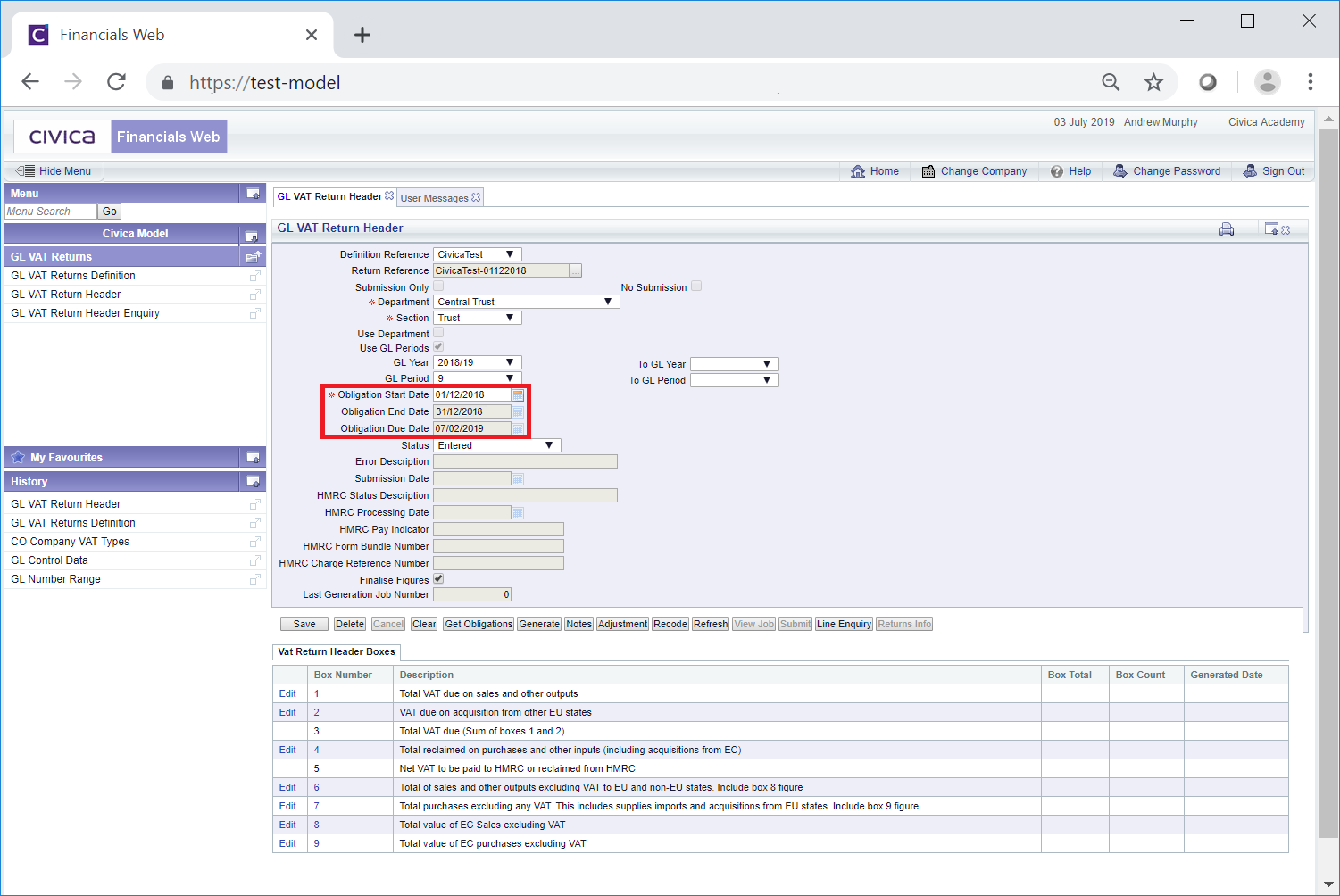

Click on the  button on the GL VAT Return Header form and the Obligation Start Date, Obligation End Date and Obligation Due Date fields will be updated with the dates of the selected Obligation:

button on the GL VAT Return Header form and the Obligation Start Date, Obligation End Date and Obligation Due Date fields will be updated with the dates of the selected Obligation: