Where creating a new VAT Return clicking on the  button on the GL VAT Return Header form, as detailed in the Creating VAT Returns section, will open the GL VAT Return Adjustment form allowing you to enter Adjustment transactions into the VAT Return.

button on the GL VAT Return Header form, as detailed in the Creating VAT Returns section, will open the GL VAT Return Adjustment form allowing you to enter Adjustment transactions into the VAT Return.

Where amending an existing VAT Return, clicking on this button on the GL VAT Return Header form, as detailed in the Amending/Viewing VAT Returns section, will also open the GL VAT Return Adjustment form allowing you to enter Adjustment transactions into the VAT Return.

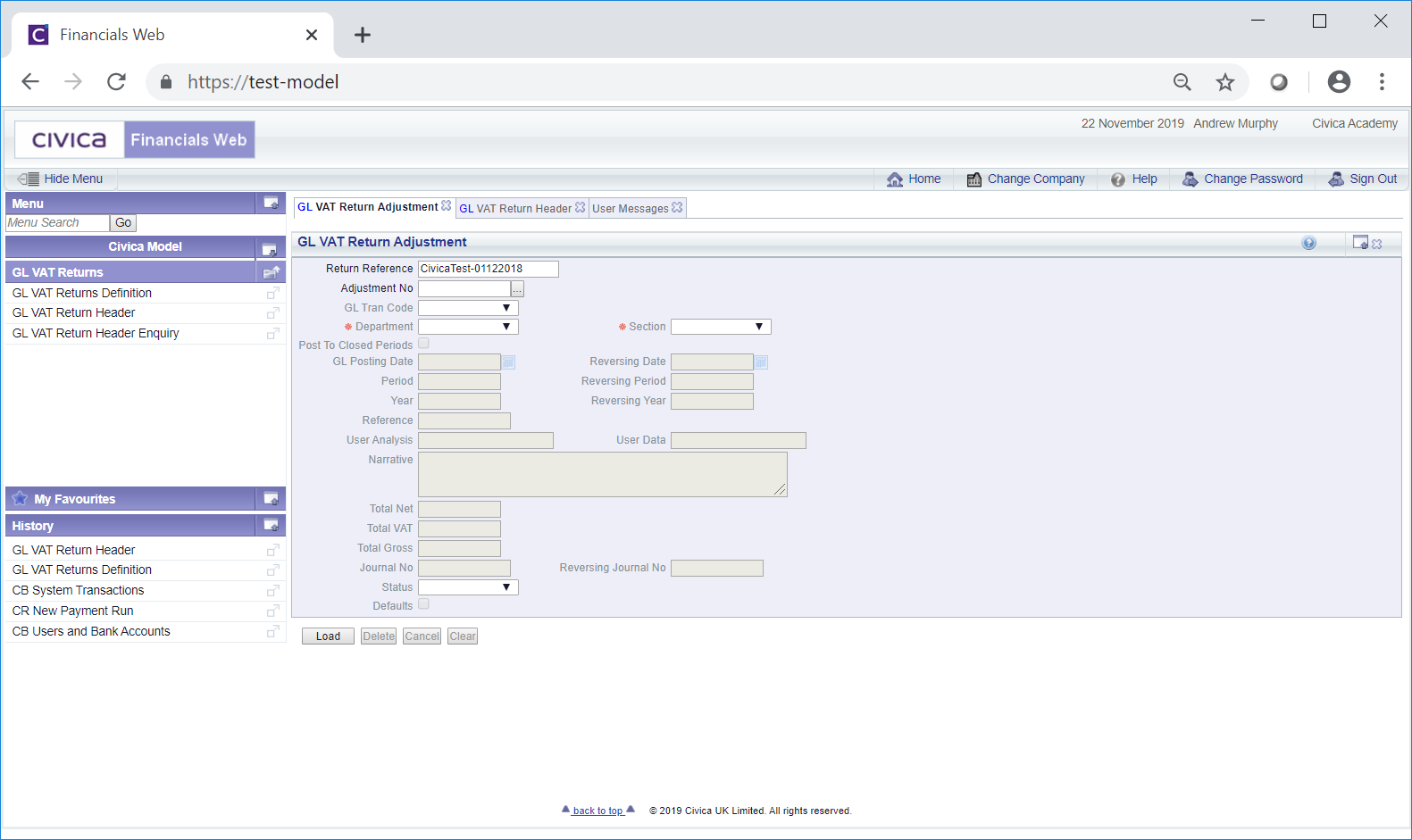

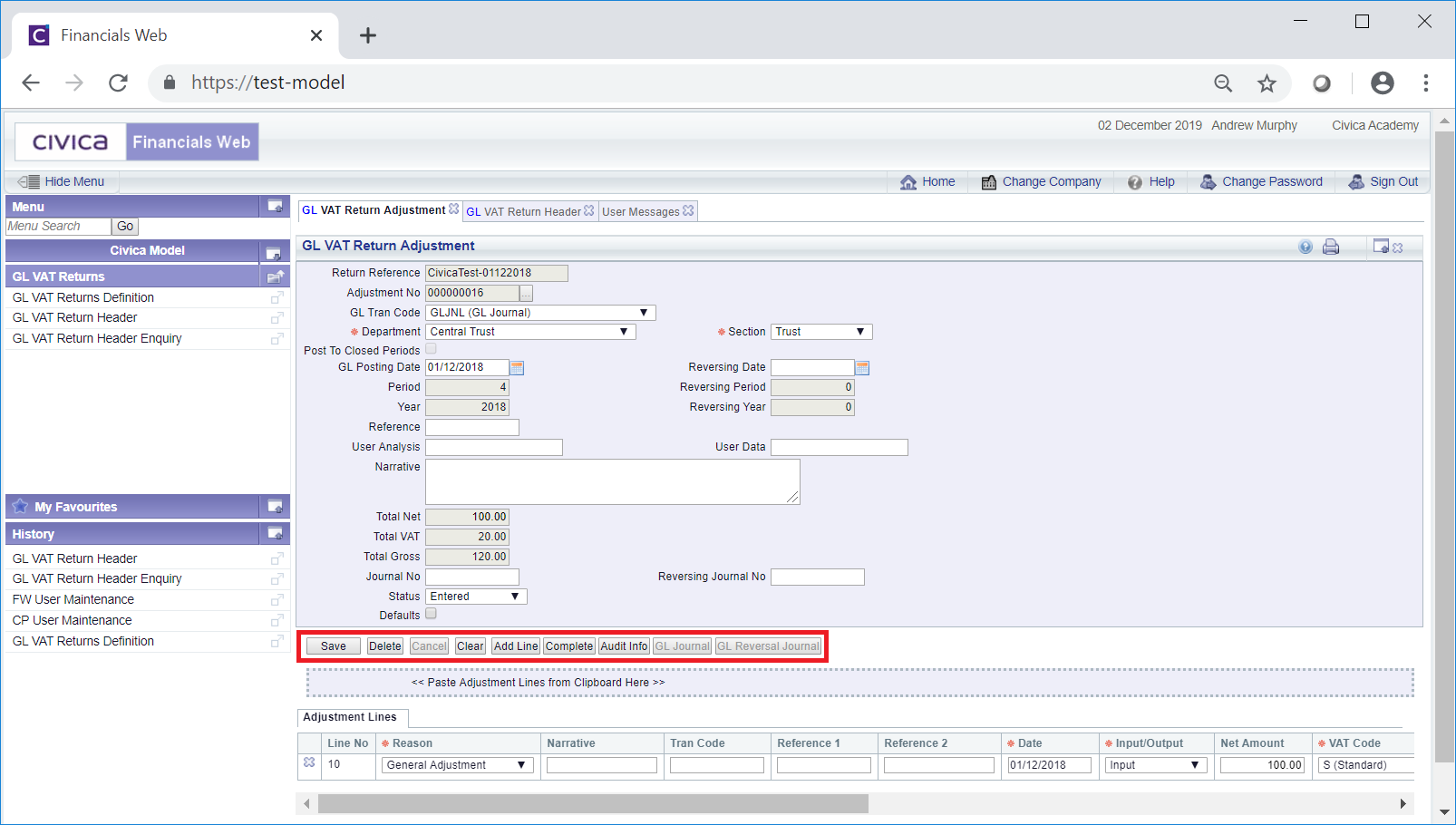

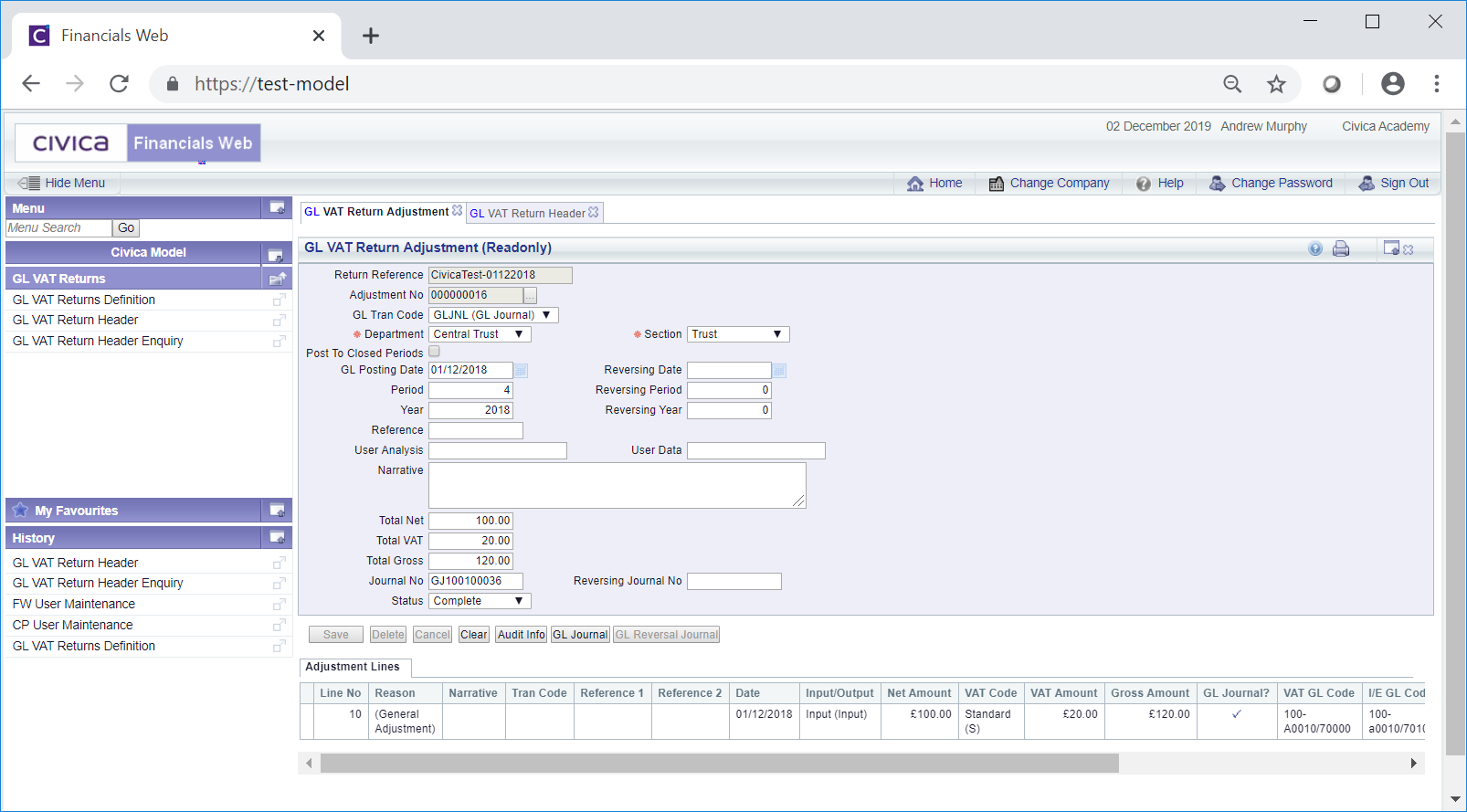

The GL VAT Return Adjustment form will open:

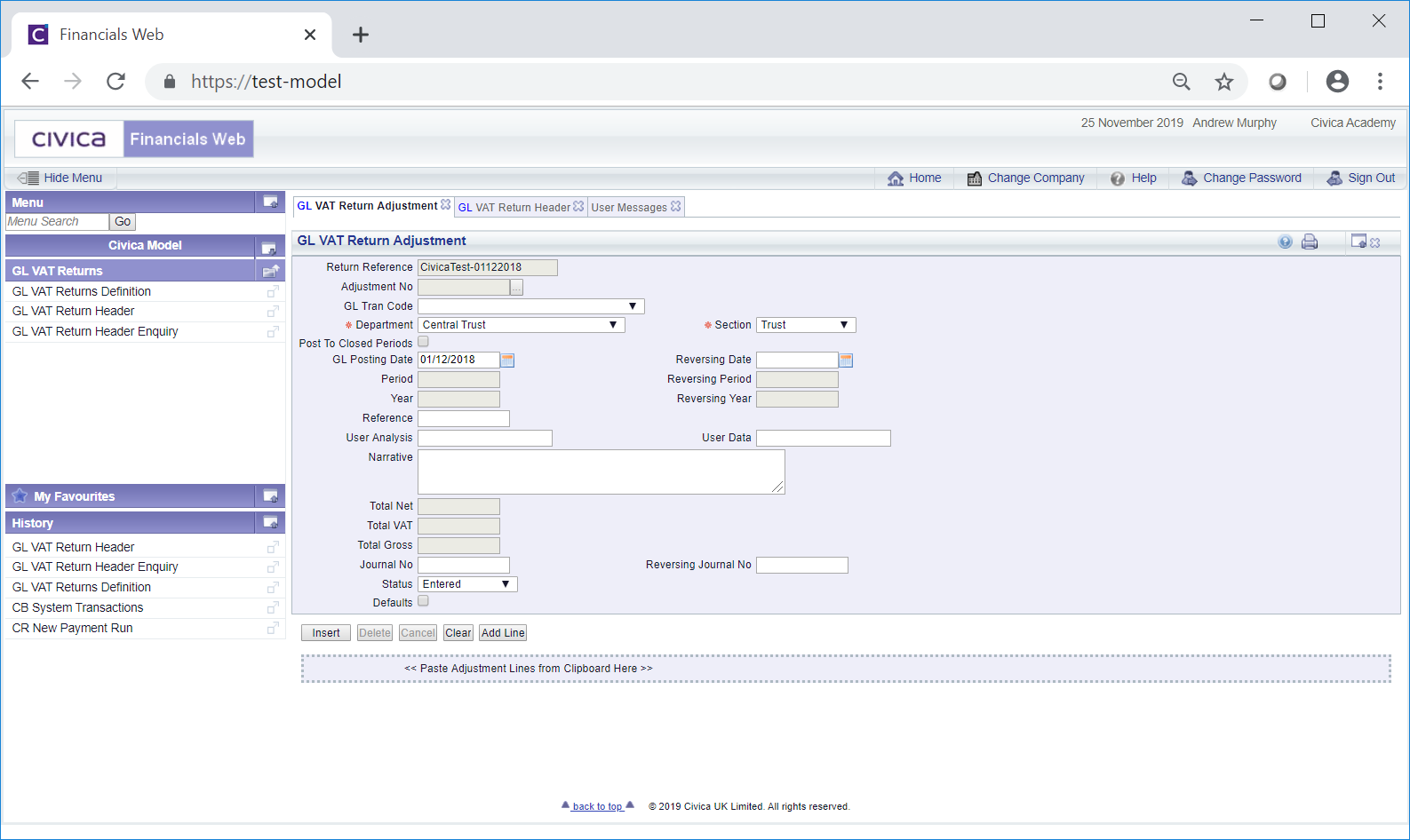

To create an adjustment click on the ![]() button and certain fields on the form will become available as well as new buttons:

button and certain fields on the form will become available as well as new buttons:

The adjustments created on this form will be held against the relevant Box line on the VAT Return.

Where required GL Journals can be created for these Adjustments that will also update the General Ledger.

The available fields on this form are as follows (mandatory items are notated with a red asterisk *):

Where the Adjustment should not update the General Ledger, i.e. it should only be added to the relevant Box line on the VAT Return, leave this field blank.

![]()

These fields are included in the Adjustment LInes tab on the Grid at the bottom of the form and selecting this option allows you to add default Ledger Codes for each of these fields, i.e. when an Adjustment Line is created in the Grid these fields will be populated with these default value. The Ledger Codes for these fields can still be changed in the Grid if required.

The Ledger Codes can be added in the above 'default' fields by clicking on these fields and adding the Ledger Code. Alternatively clicking on the Find Ledger button located to the right of each field, for example to the right of the VAT GL Code field,  , will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

, will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

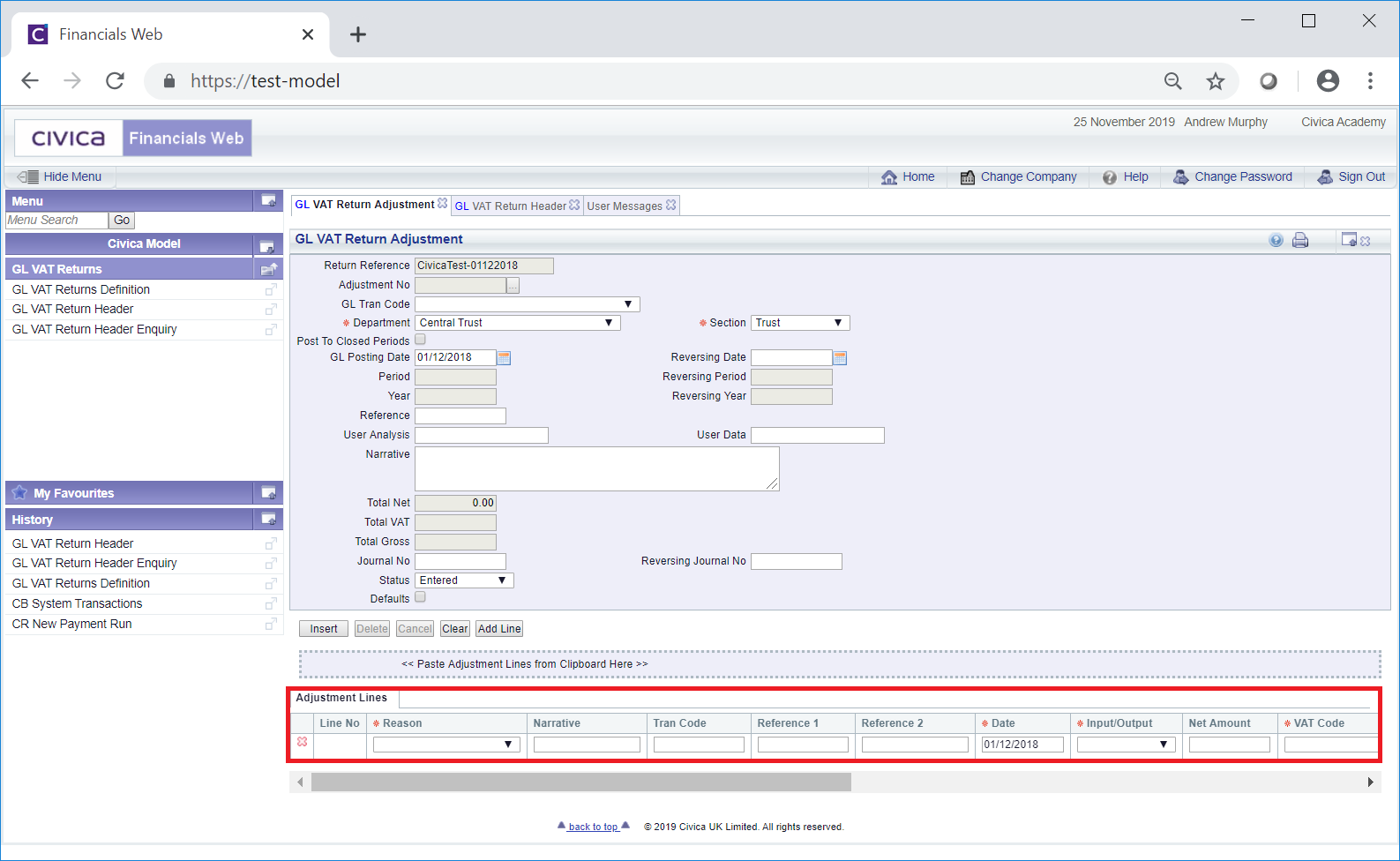

Click on the ![]() button and an Adjustment Lines tab will be displayed in a Grid at the bottom of the form:

button and an Adjustment Lines tab will be displayed in a Grid at the bottom of the form:

Add the following details to this Line, where required:

This value will be used in Boxes 6 to 9 on the VAT Return.

Where an amount is added to the Net Amount field and a code is added to the VAT Code field in the Adjustment Line, the amount in this field will be calculated when the ![]() button, as detailed below, is selected.

button, as detailed below, is selected.

The value in this field will be used in Boxes 1 to 5 on the VAT Return.

Where the Adjustment Line is to amend the VAT Return and create a GL Journal, this option should be selected. Where the Adjustment is only to amend the VAT Return, this option should not be selected.

Please note: Where this option is selected, also ensure that the relevant GL Transaction Code has been added to the GL Trans Code field on the form.

Alternatively clicking on the Find Ledger button located to the right of this field,  , will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

, will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

Alternatively clicking on the Find Ledger button located to the right of this field,  , will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

, will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

Alternatively clicking on the Find Ledger button located to the right of this field,  , will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

, will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

To add more Lines to the Adjustment Lines tab on the Grid, re-click on the ![]() button.

button.

Lines can be removed from the Adjustment Lines tab by clicking on the  button to the left of the required Line. A message will be displayed asking for confirmation that the Line is to be removed.

button to the left of the required Line. A message will be displayed asking for confirmation that the Line is to be removed.

Click on the ![]() button and new buttons will be displayed at the bottom of the form:

button and new buttons will be displayed at the bottom of the form:

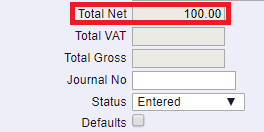

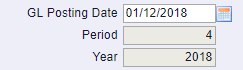

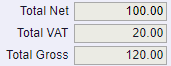

The following fields will also be updated on the form:

The Period and Year fields will include the relevant Period and Year as defined by the date in the GL Posting Date field.

Where not already updated these fields will be updated to reflect the same fields as in the Adjustment Line.

Further changes can be made to the fields in the form or in the Adjustment Line as detailed above.

Lines can be removed from the Adjustment Lines tab by clicking on the  button to the left of the required Line. A message will be displayed asking for confirmation that the Line is to be removed.

button to the left of the required Line. A message will be displayed asking for confirmation that the Line is to be removed.

The button displayed are as follows:

The status field will also change to Complete. As the form is a Read Only form no further changes can be made.

Where a GL Journal has been created from the Adjustment, the Journal No field on the form will be populated and the  button will be enabled. Clicking on this button will open the GL Standard Journal (Readonly) screen providing details of the Journal. This screen is further detailed in the Viewing Standard Journals section.

button will be enabled. Clicking on this button will open the GL Standard Journal (Readonly) screen providing details of the Journal. This screen is further detailed in the Viewing Standard Journals section.

The Boxes Populated column on the Adjustment Lines tab on the Grid will detail the Boxes on the VAT Return that have been updated.

Please note: The VAT Return boxes for each Adjustment Line are updated according to the entered Input/Output type and the VAT Type associated with the input VAT Code as determined by the CO Company VAT Types form.

In some cases two or more VAT Return transactions are created from the one Adjustment line, as indicated in the Boxes Populated column on the Adjustment line.

The following table details the Boxes that will updated on the VAT Return dependent on the information added to the Adjustment Line:

Processing of Adjustment lines for each Input/Output Type and VAT Type |

|||

Input/Output |

VAT Type |

Update Boxes |

Description |

Input (i.e. Creditors) |

Standard Rate (S) |

4 and 7 |

Box 4 – VAT Reclaimed on Purchases updated with the entered VAT Amount Box 7 – Total Purchases excluding VAT updated with the entered Net Amount |

Reduced Rate (R) |

4 and 7 |

Box 4 – VAT Reclaimed on Purchases updated with the entered VAT Amount Box 7 – Total Purchases excluding VAT updated with the entered Net Amount |

|

Zero Rated (Z) |

7 |

Box 7 – Total Purchases excluding VAT updated with the entered Net Amount |

|

Exempt (E) |

7 |

Box 7 – Total Purchases excluding VAT updated with the entered Net Amount |

|

Outside Scope (O) |

7 |

Box 7 – Total Purchases excluding VAT updated with the entered Net Amount |

|

Output (i.e. Debtors) |

Standard Rate (S) |

1 and 6 |

Box 1 – VAT Due on Sales updated with the entered VAT Amount Box 6 – Total Sales excluding VAT updated with the entered Net Amount |

Reduced Rate (R) |

1 and 6 |

Box 1 – VAT Due on Sales updated with the entered VAT Amount Box 6 – Total Sales excluding VAT updated with the entered Net Amount |

|

Zero Rated (Z) |

6 |

Box 6 – Total Sales excluding VAT updated with the entered Net Amount |

|

Exempt (E) |

6 |

Box 6 – Total Sales excluding VAT updated with the entered Net Amount |

|

Outside Scope (O) |

6 |

Box 6 – Total Sales excluding VAT updated with the entered Net Amount |

|