Where creating a new VAT Return clicking on the  button on the GL VAT Return Header form, as detailed in the Creating VAT Returns section, will open the GL VAT Return Generation form allowing you to submit a Job Request that will generate the information required for the VAT Return.

button on the GL VAT Return Header form, as detailed in the Creating VAT Returns section, will open the GL VAT Return Generation form allowing you to submit a Job Request that will generate the information required for the VAT Return.

Where amending an existing VAT Return, clicking on this button on the GL VAT Return Header form, as detailed in the Amending/Viewing VAT Returns section, will also open the GL VAT Return Generation form allowing you to submit the relevant Job Request to add or change the information required for the VAT Return.

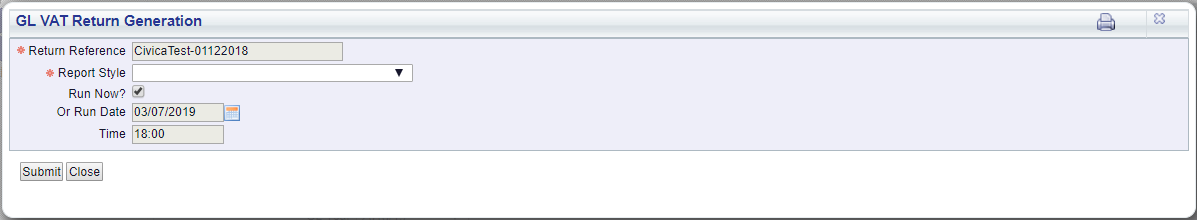

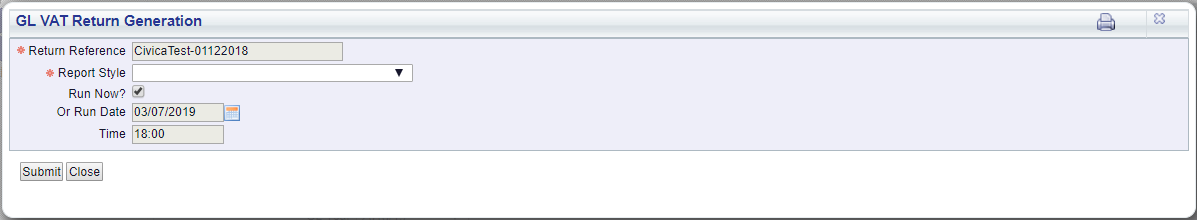

The GL VAT Return Generation form will open:

Add details to the following fields as required (mandatory fields are notated with a red asterisk *):

- Report Style: Select the VAT Return Generation Report Rerun option from this drop-down field.

- Run Now: This option should be selected if the Job Request is to be run immediately when the

button, as detailed below, is selected. Where this option is not selected the Job Request will run at a date and time detailed in the fields immediately below this field.

button, as detailed below, is selected. Where this option is not selected the Job Request will run at a date and time detailed in the fields immediately below this field.

- Or Run Date: This field will default to today's date and will only be available where the Run Now option, as detailed immediately above, is not selected. This will be the date that the Job Request is to be run when it is not to be run immediately - the date can be changed, if required.

- Time: This field will default to 18:00 and will only be available where the Run Now option, as detailed above, is not selected. This will be the time that the Job Request is to be run when it is not to be run immediately - the time can be changed, if required.

The buttons at the bottom of the form are as follows:

: Click on this button and the Job Request will be run immediately where the Run Now option has been selected. Otherwise it will run at the date and time as detailed in the Or Run Date and Time fields.

: Click on this button and the Job Request will be run immediately where the Run Now option has been selected. Otherwise it will run at the date and time as detailed in the Or Run Date and Time fields. : Clicking on this button will close the form.

: Clicking on this button will close the form.

Where creating a new VAT Return you will be returned to the GL VAT Return Header form as detailed in the Creating VAT Returns section.

Where amending an existing VAT Return you will be returned to the GL VAT Return Header form, as detailed in the Amending/Viewing VAT Returns section.

![]() button on the GL VAT Return Header form, as detailed in the Creating VAT Returns section, will open the GL VAT Return Generation form allowing you to submit a Job Request that will generate the information required for the VAT Return.

button on the GL VAT Return Header form, as detailed in the Creating VAT Returns section, will open the GL VAT Return Generation form allowing you to submit a Job Request that will generate the information required for the VAT Return.