Customers that submit the VAT100 Return are required to so do using automated internet submission directly to Her Majesty's Revenue and Customs (HMRC). This is called Making Tax Digital (MTD).

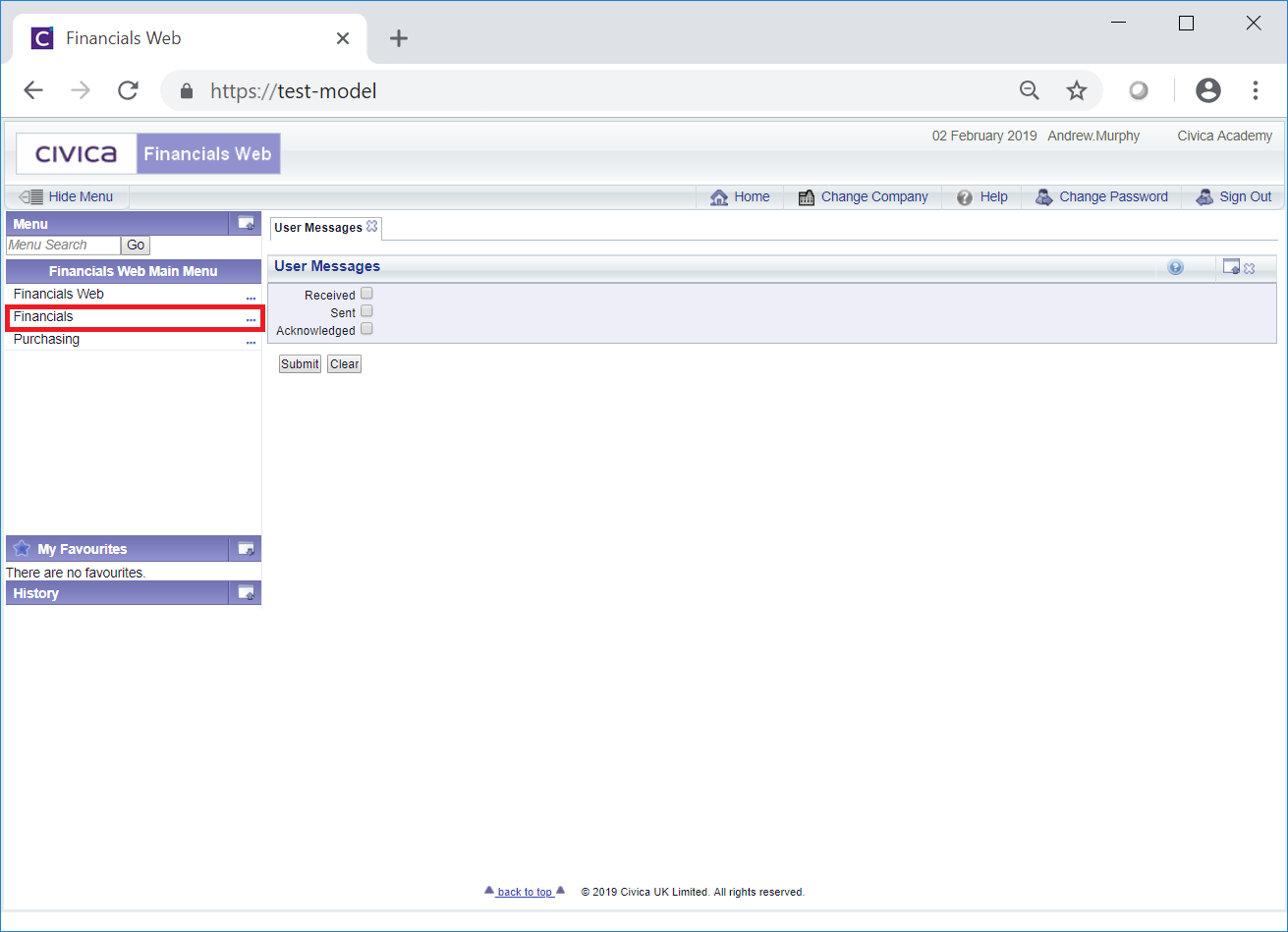

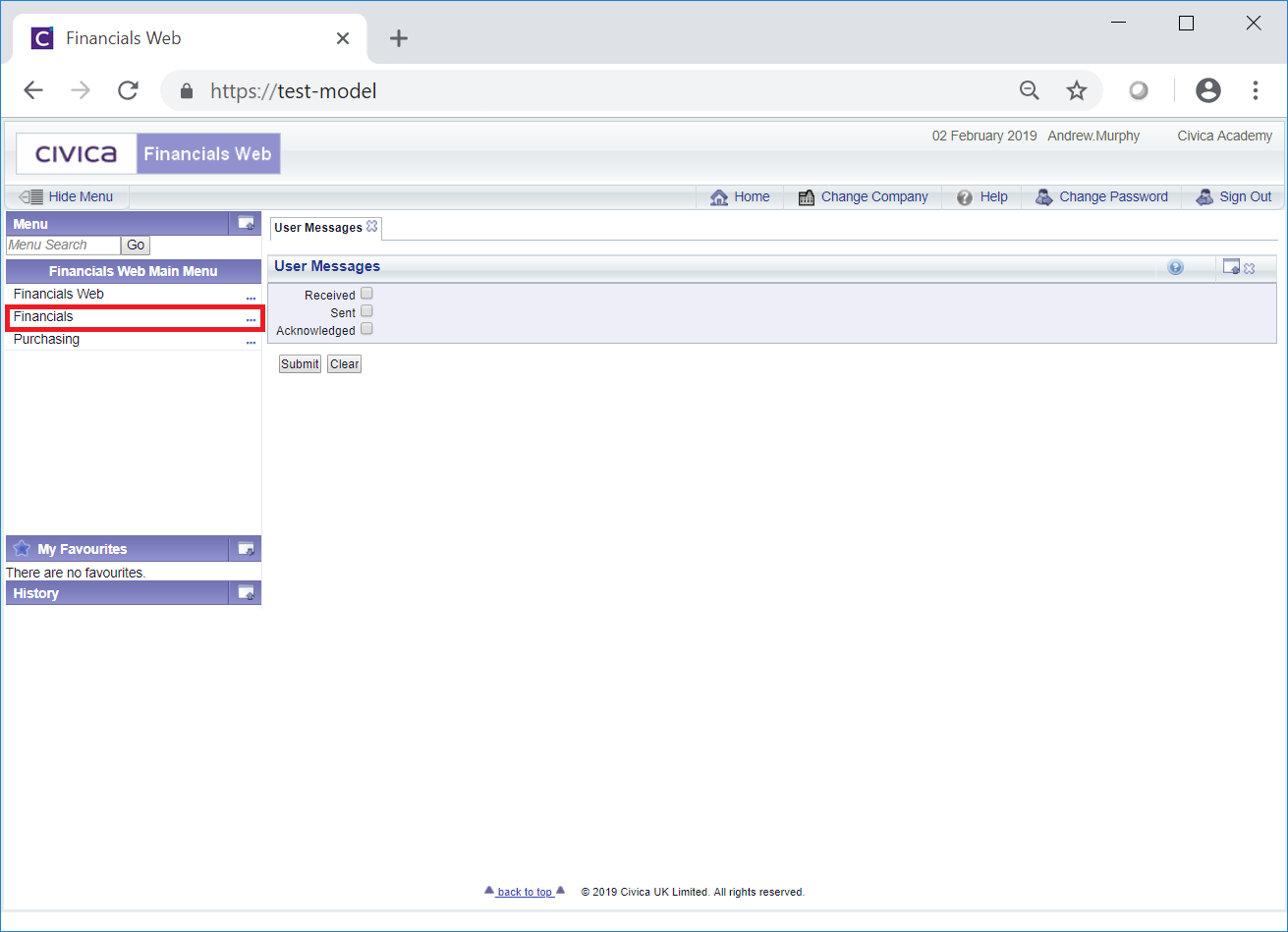

These VAT Returns can be created and viewed on the General Ledger Module by selecting the Financials option on the Financials Web Main Menu:

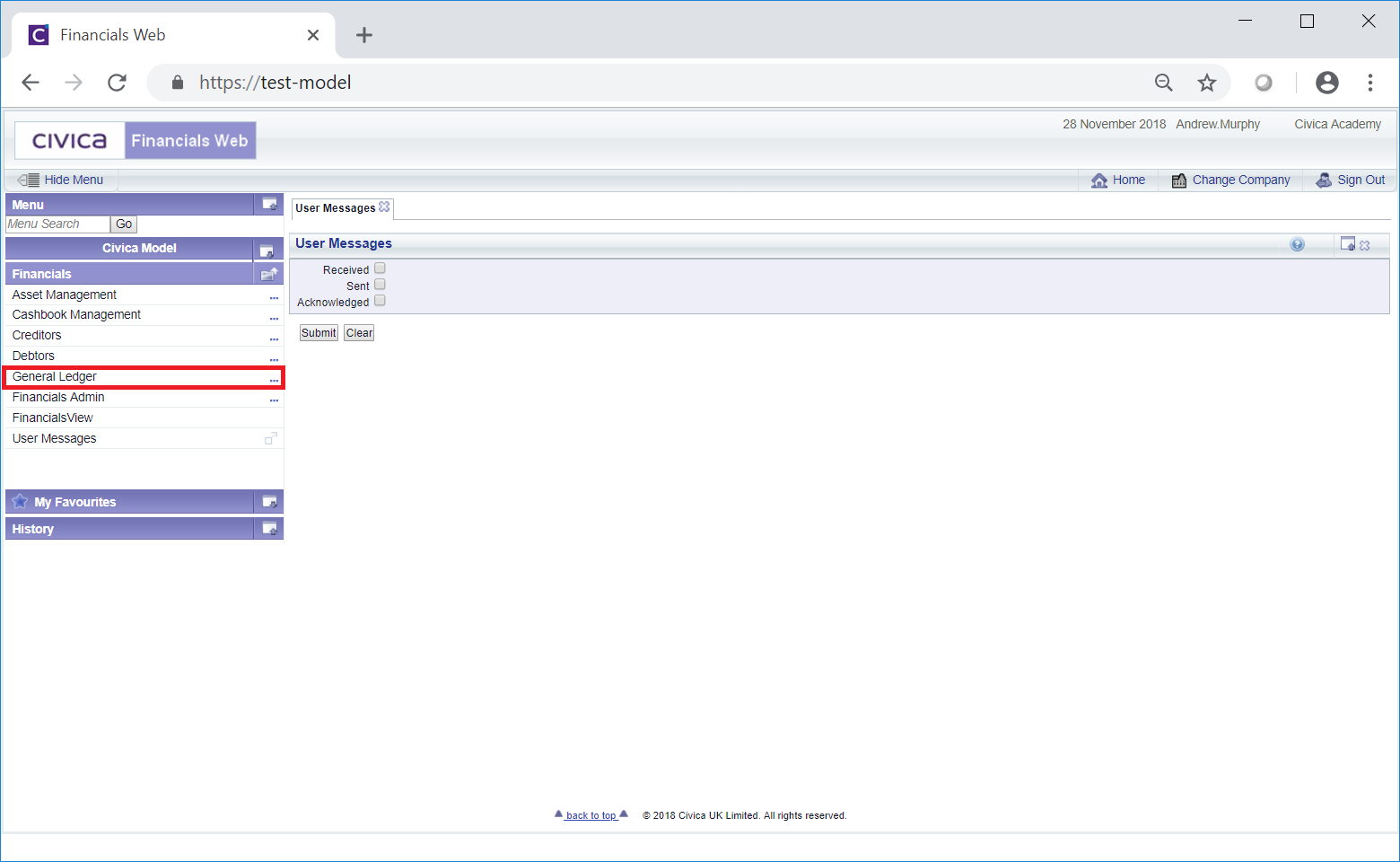

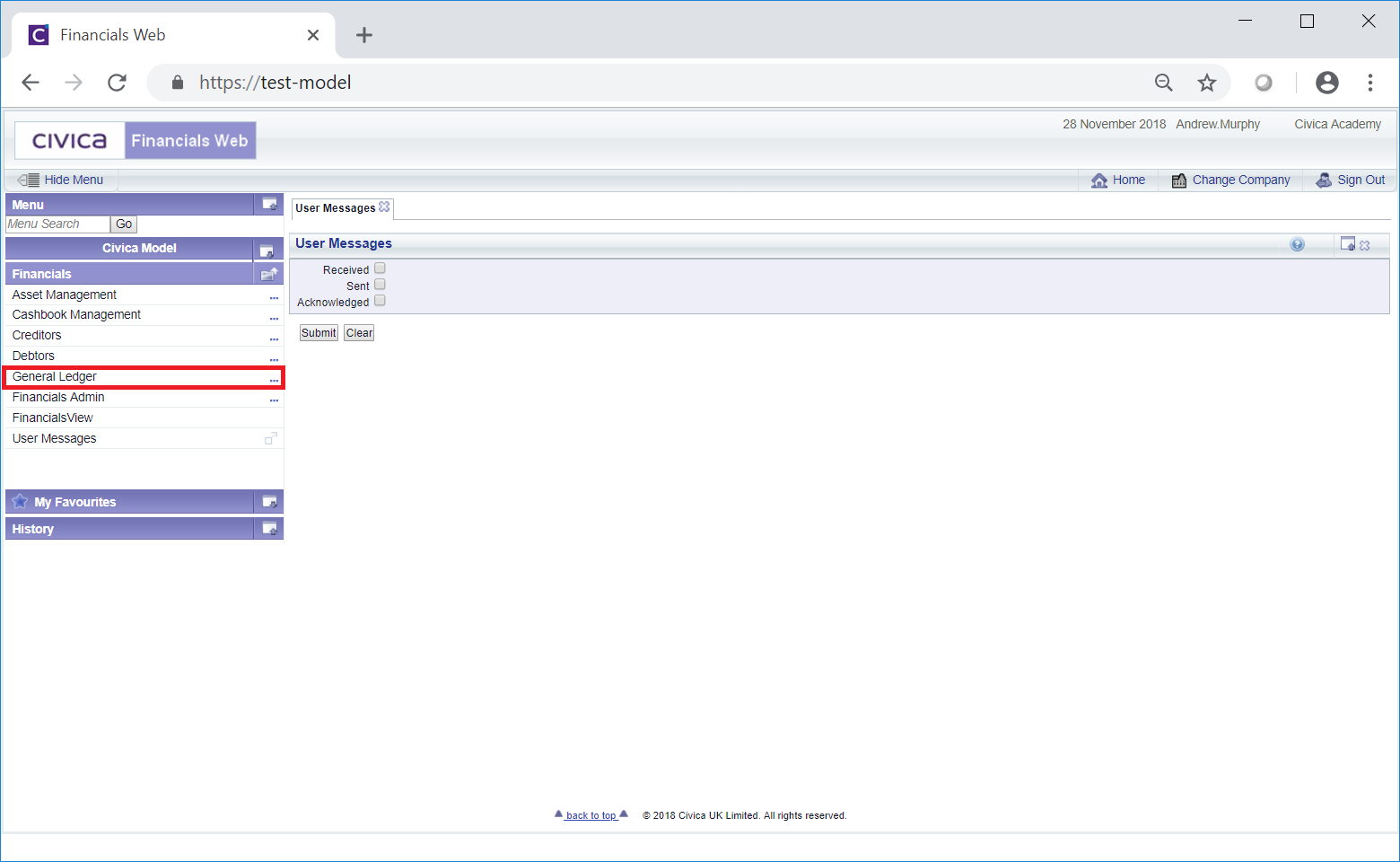

Then the General Ledger menu option:

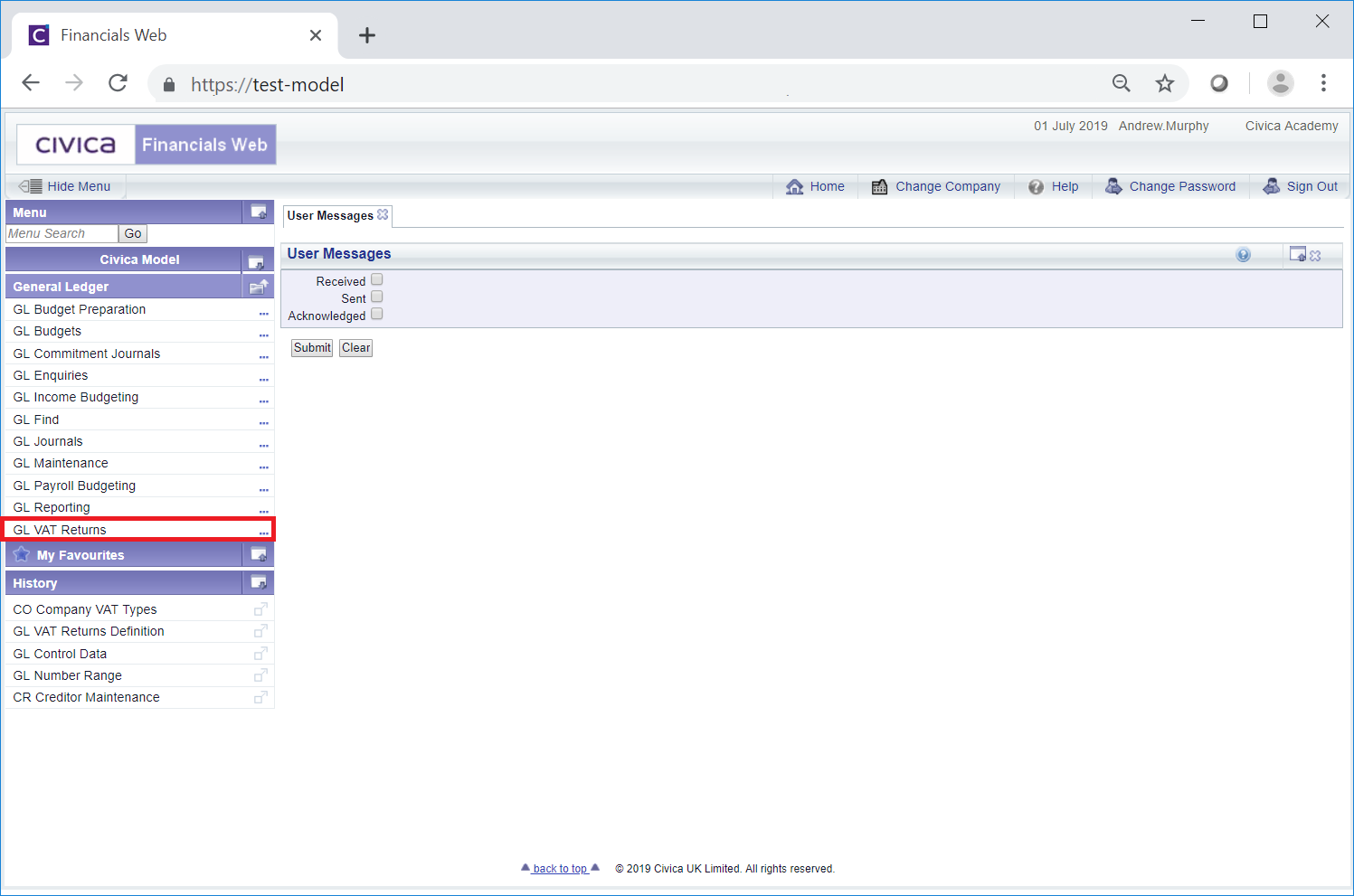

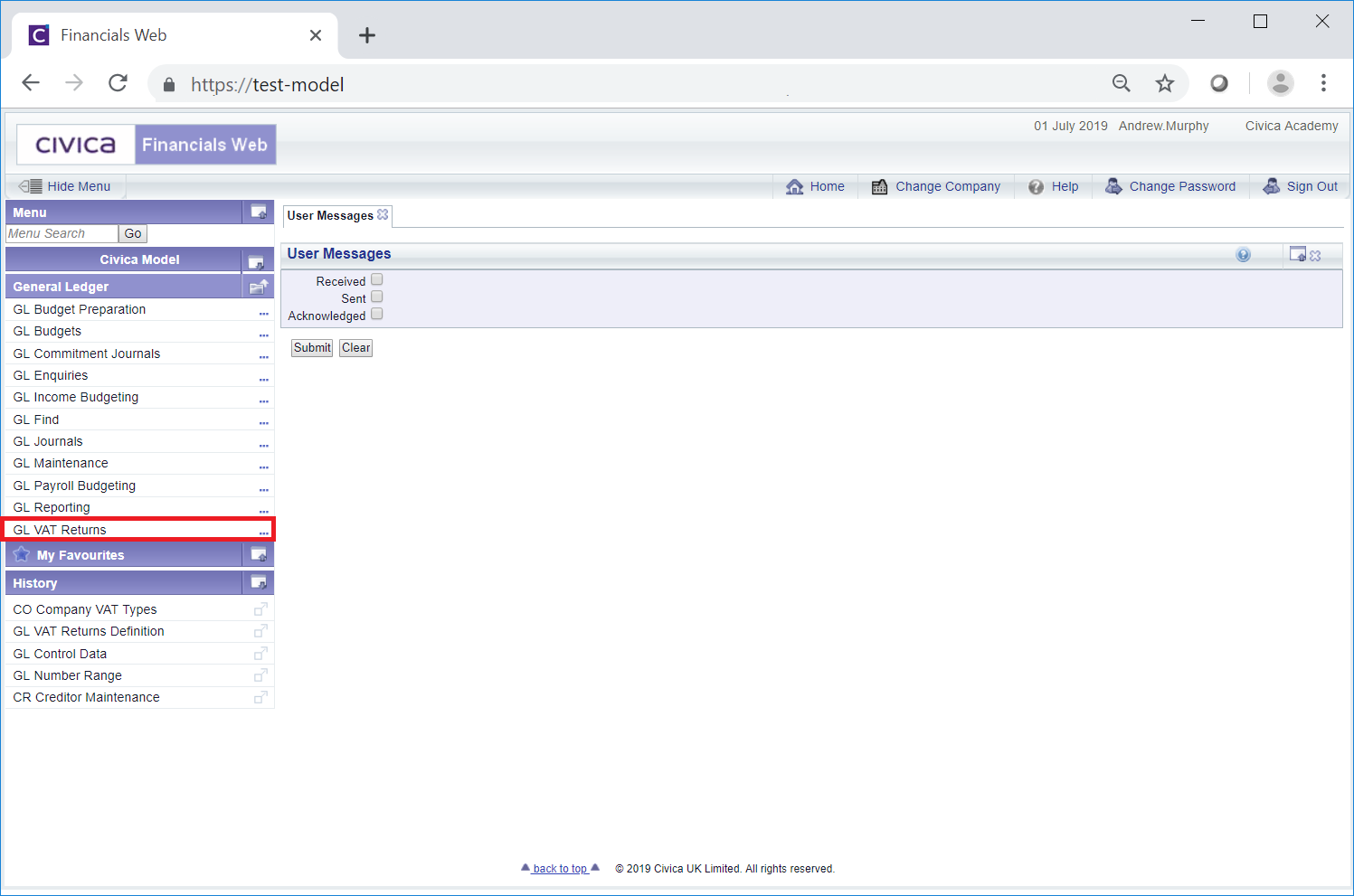

Then the GL VAT Returns menu option:

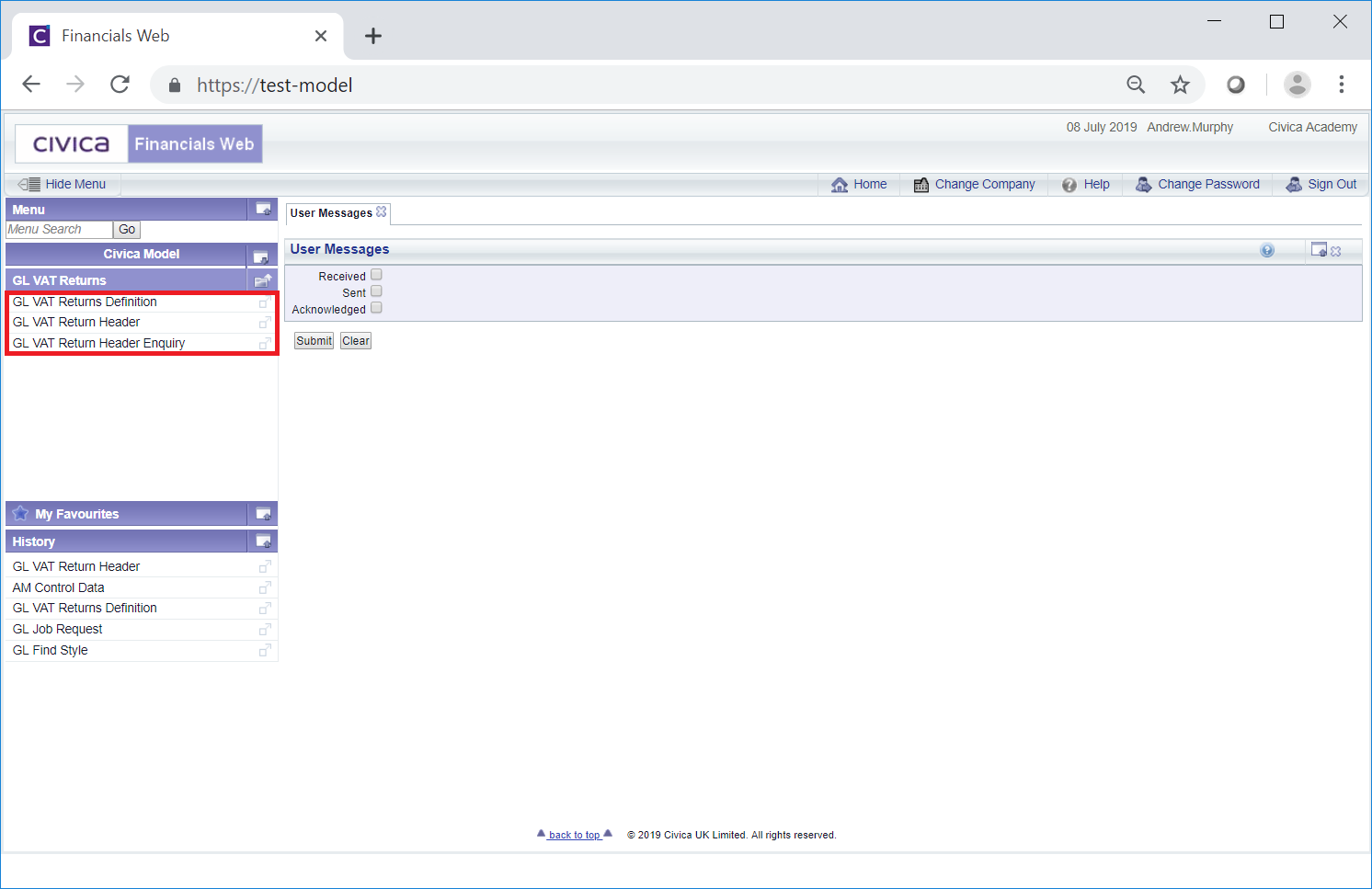

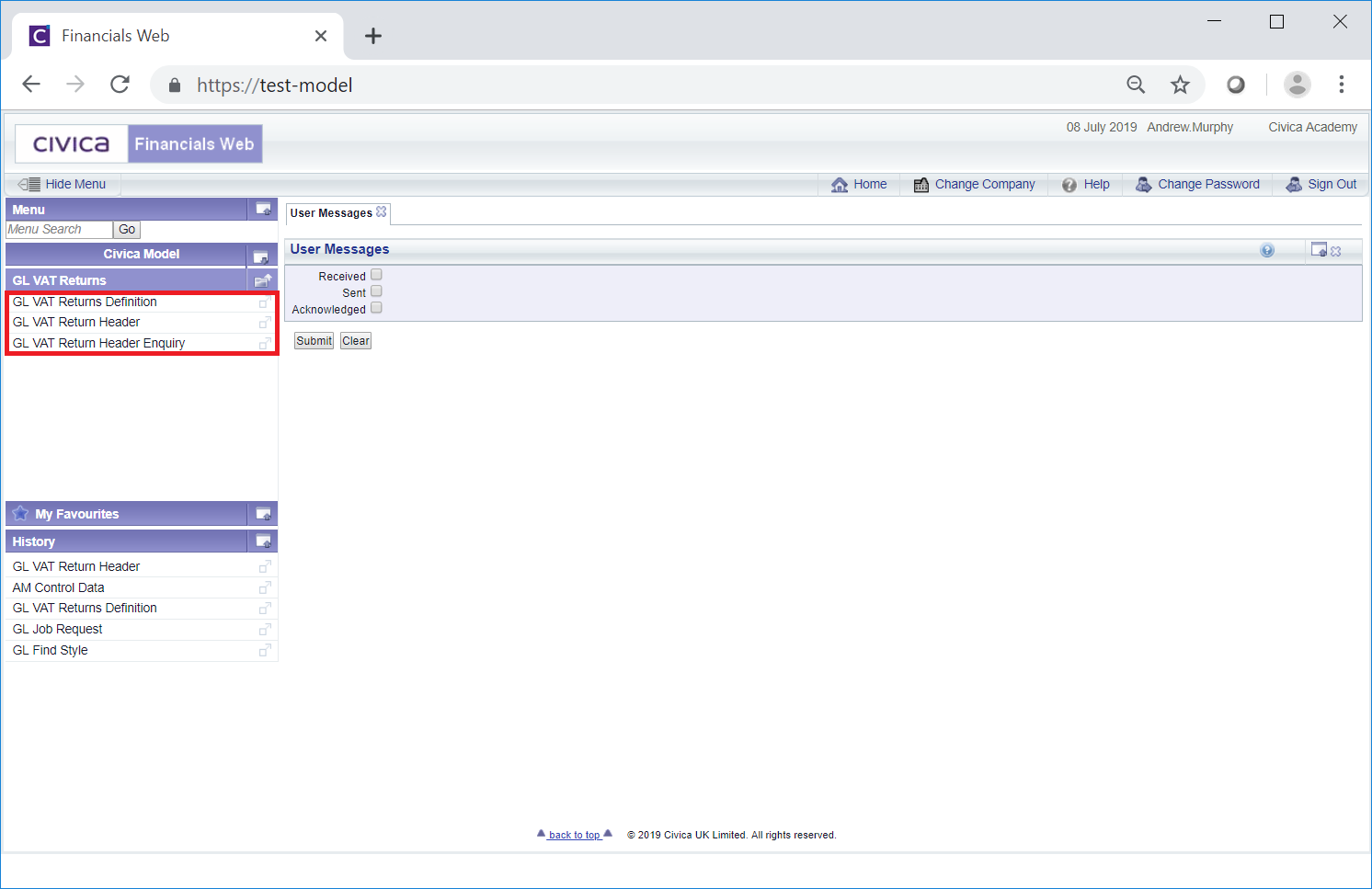

The following menu options will become available:

These are:

- GL VAT Returns Definition: A Return Definition will be need to be created for each organisation that you have responsibility for and where they also have different VAT Registration Numbers. Where you have one VAT Registration Number, e.g. a Multi Academy Trust (MAT), you will only require one Return Definition.

Please note: These Return Definitions will be created for you by a Civica Consultant.

- GL VAT Return Header: This option will allow you to create and submit the VAT Return to HMRC. It will also allow you to amend these Returns prior to submission and is further detailed in the Maintaining VAT Returns section.

- GL VAT Return Header Enquiry: This option will allow you to display a range of VAT Returns, including the information that will be or has been submitted to HMRC. This option is further detailed in the VAT Return Enquiry section.