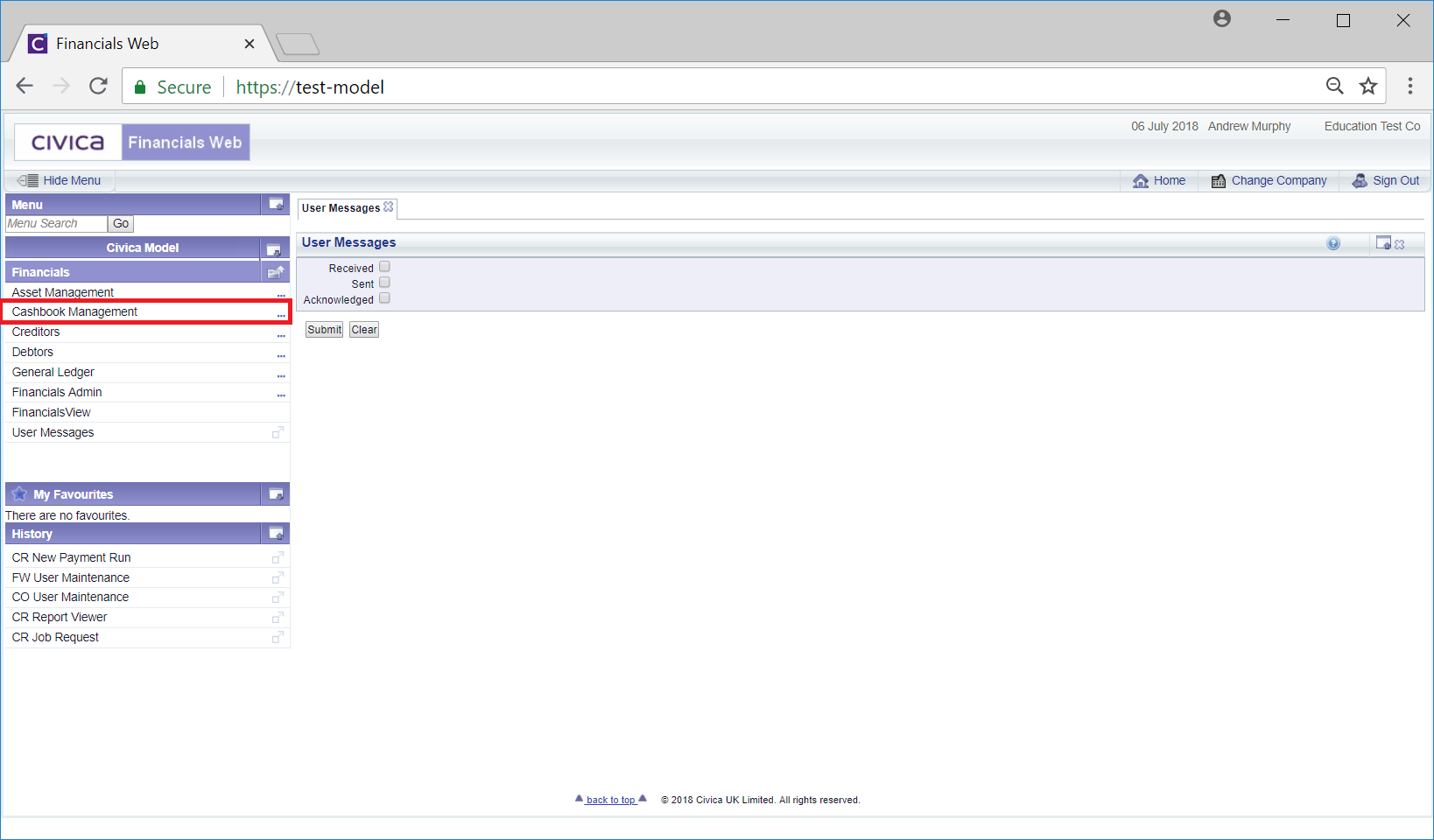

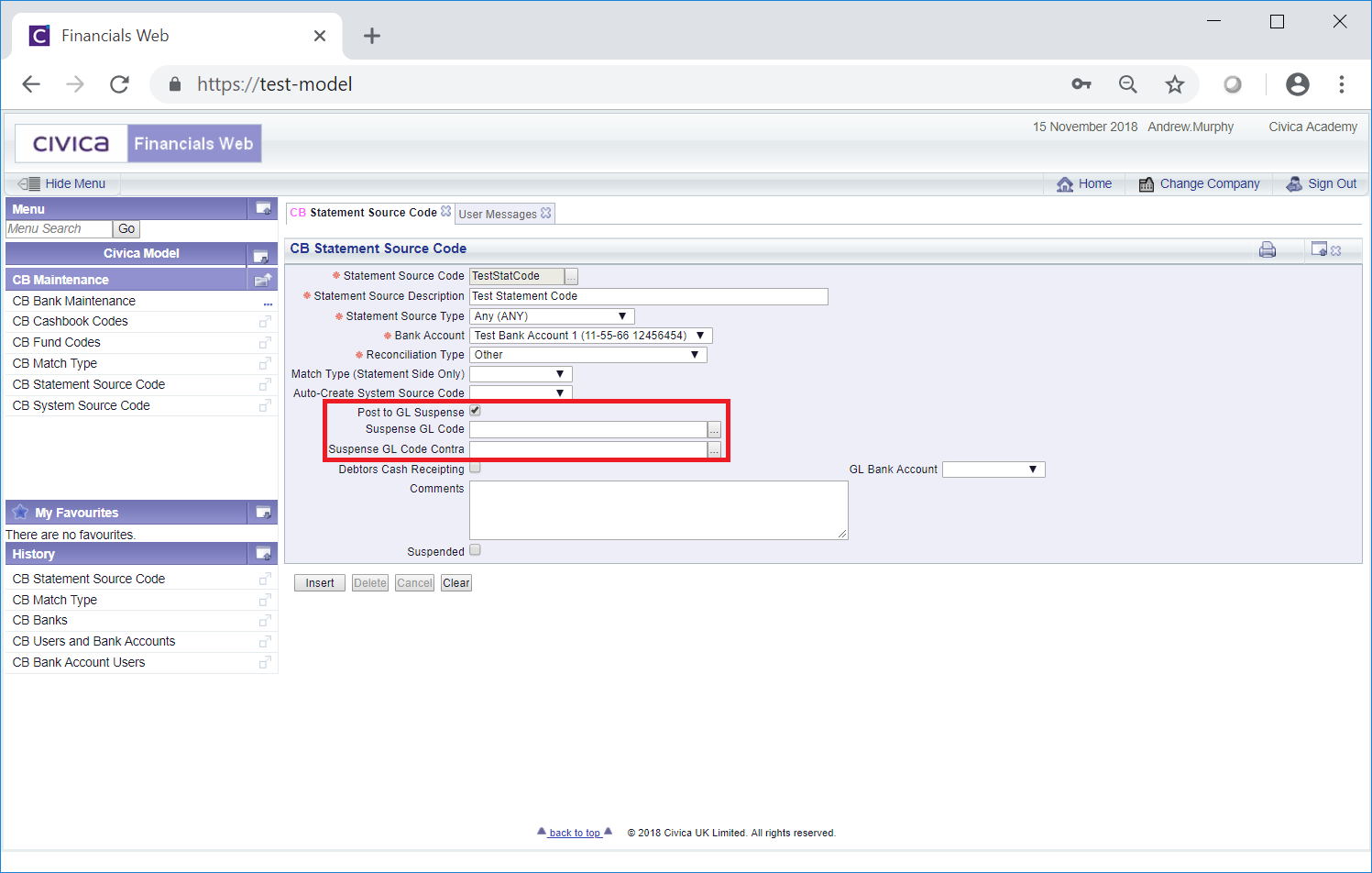

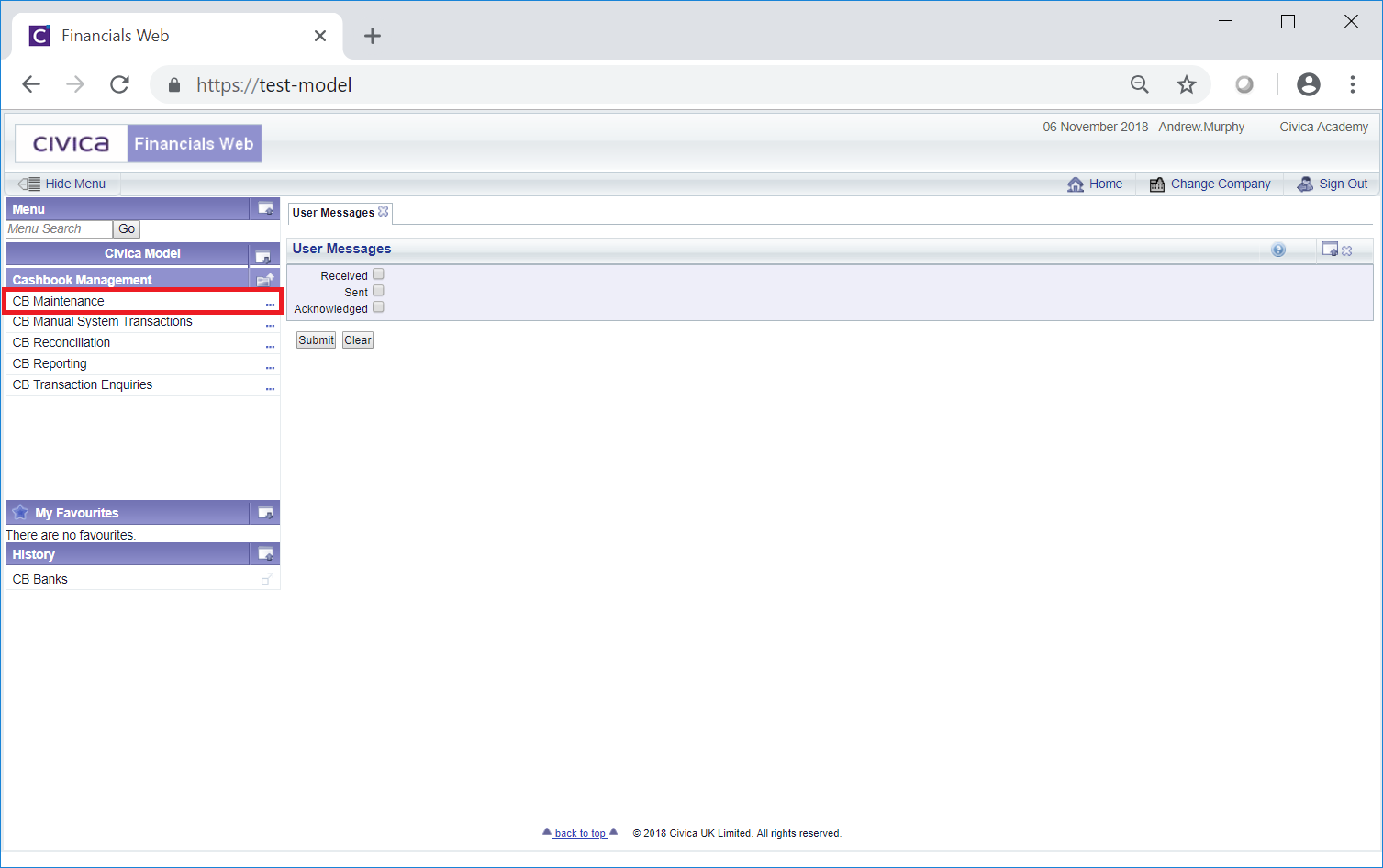

Statement Source Codes can be viewed and/or amended on the CB Statement Source Code form, which can be accessed by selecting the Cashbook Management option on the Financials menu:

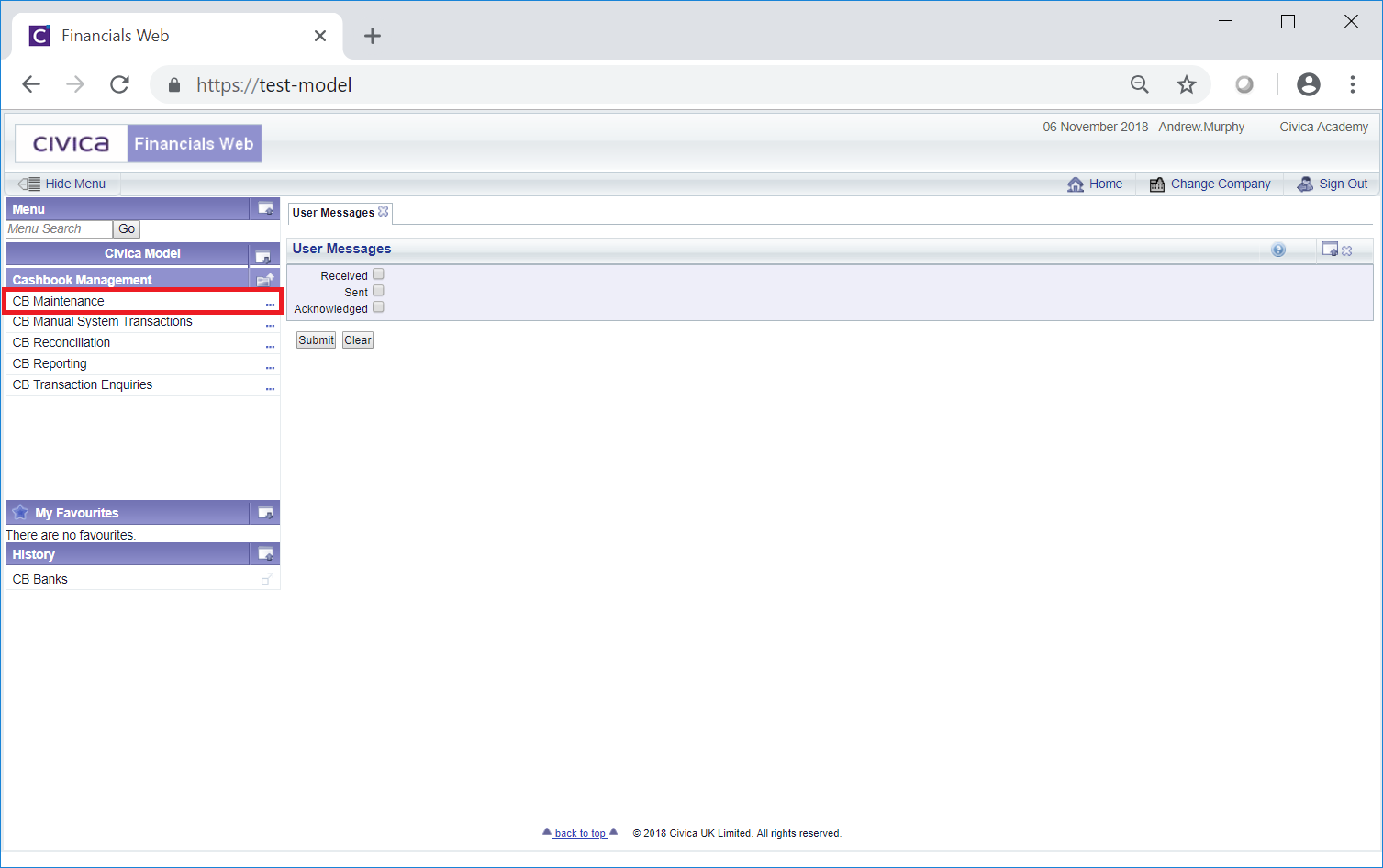

Then the CB Maintenance menu option:

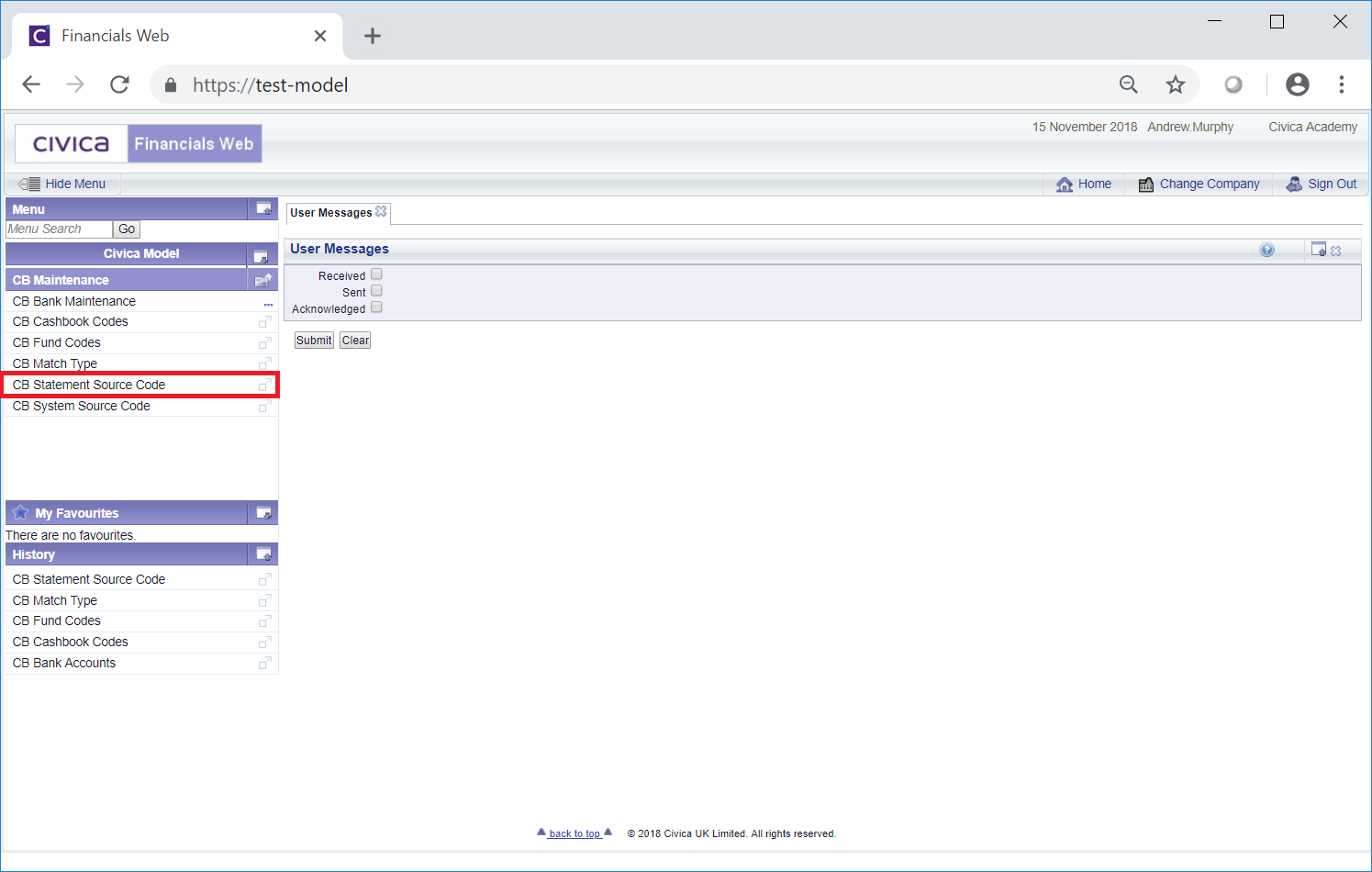

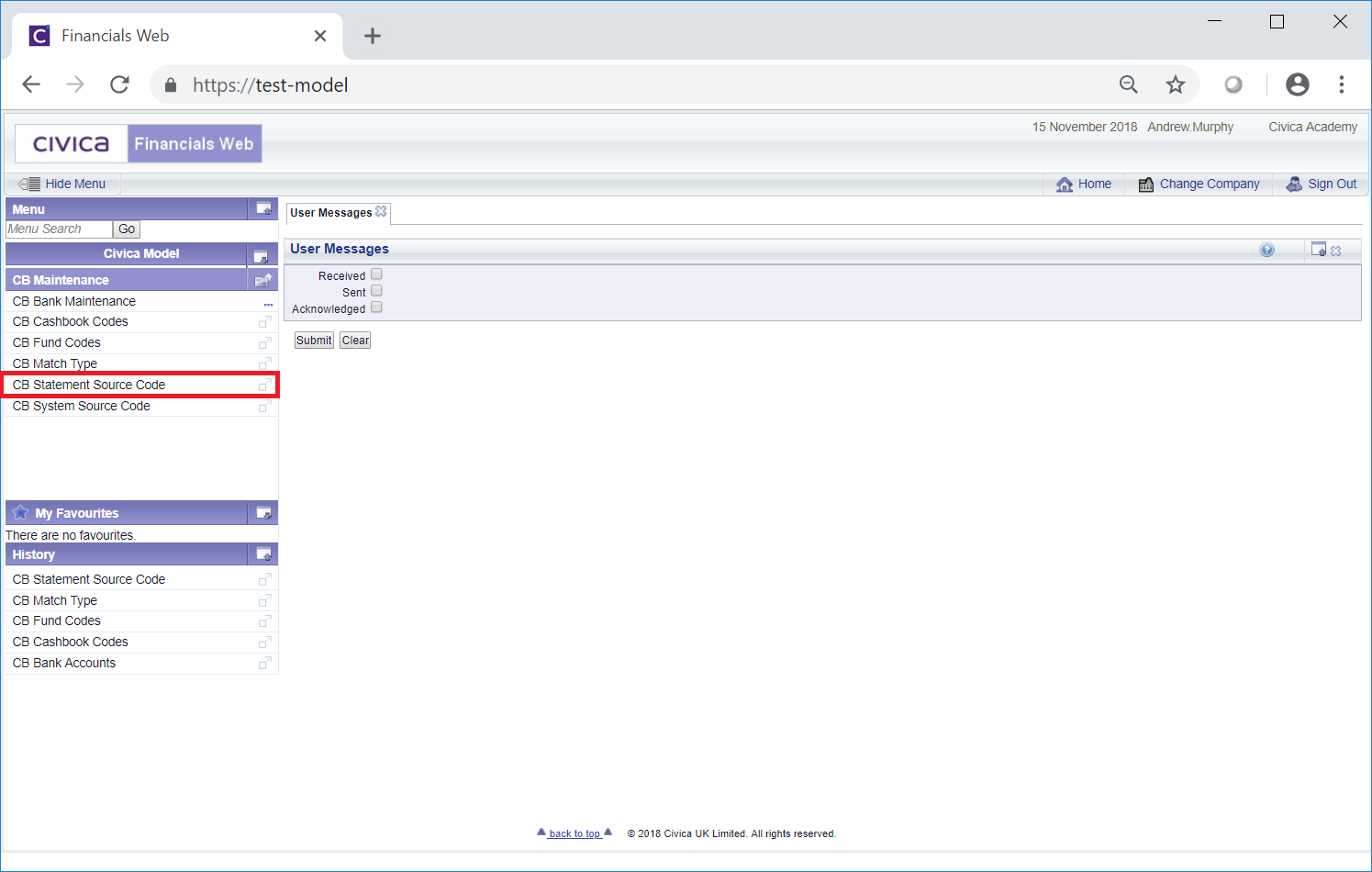

Then the CB Statement Source Code menu option:

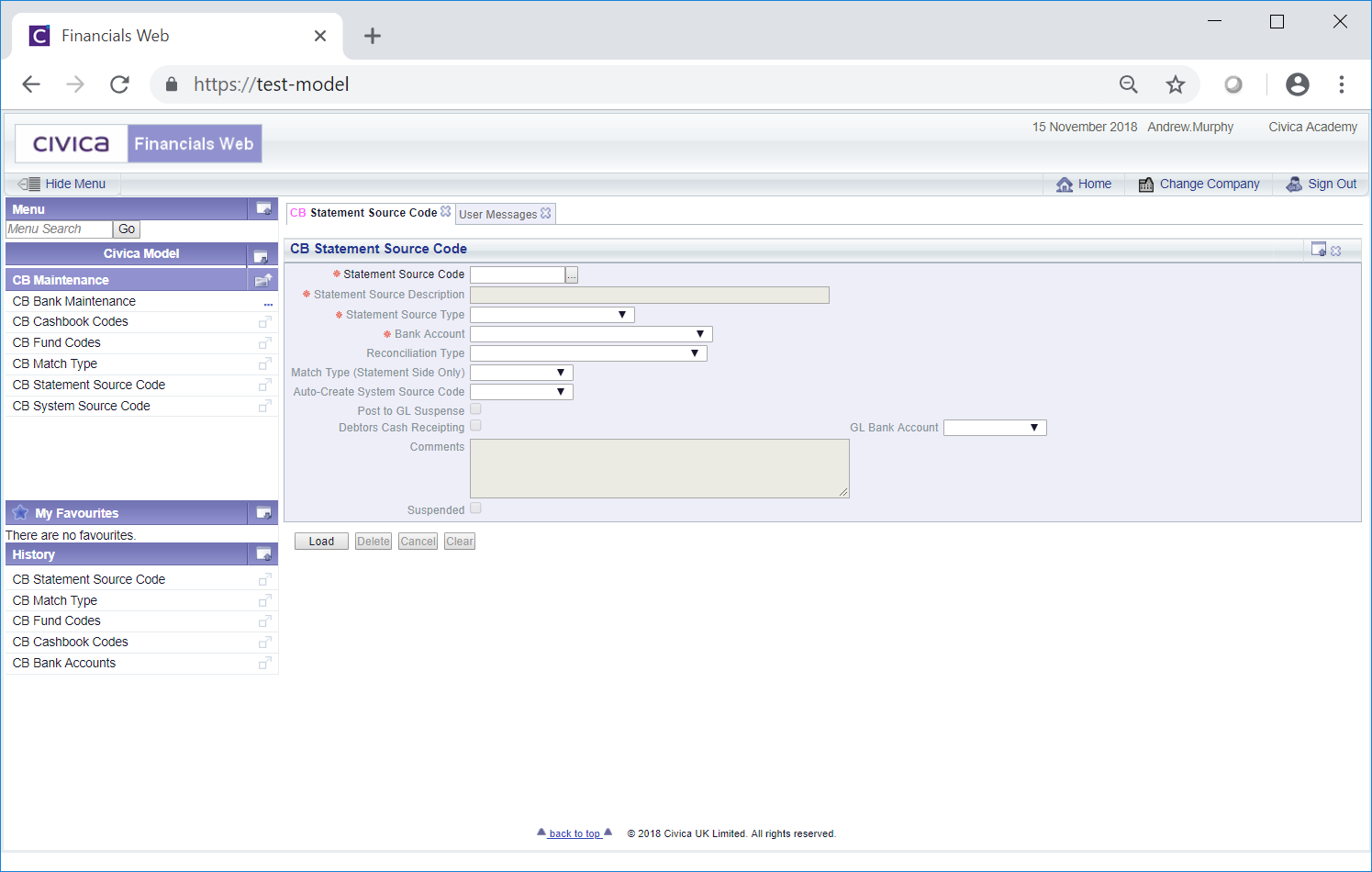

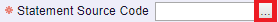

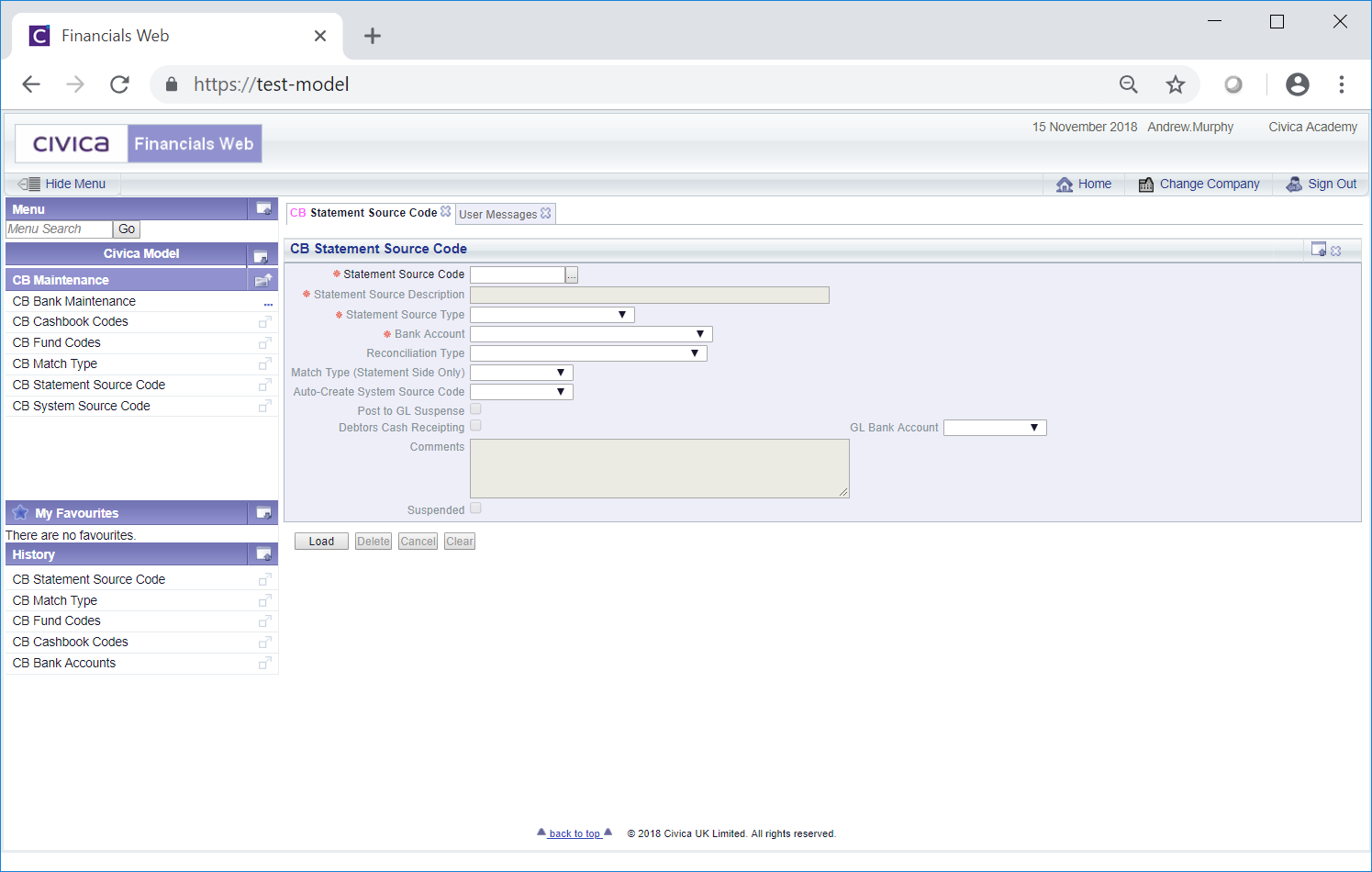

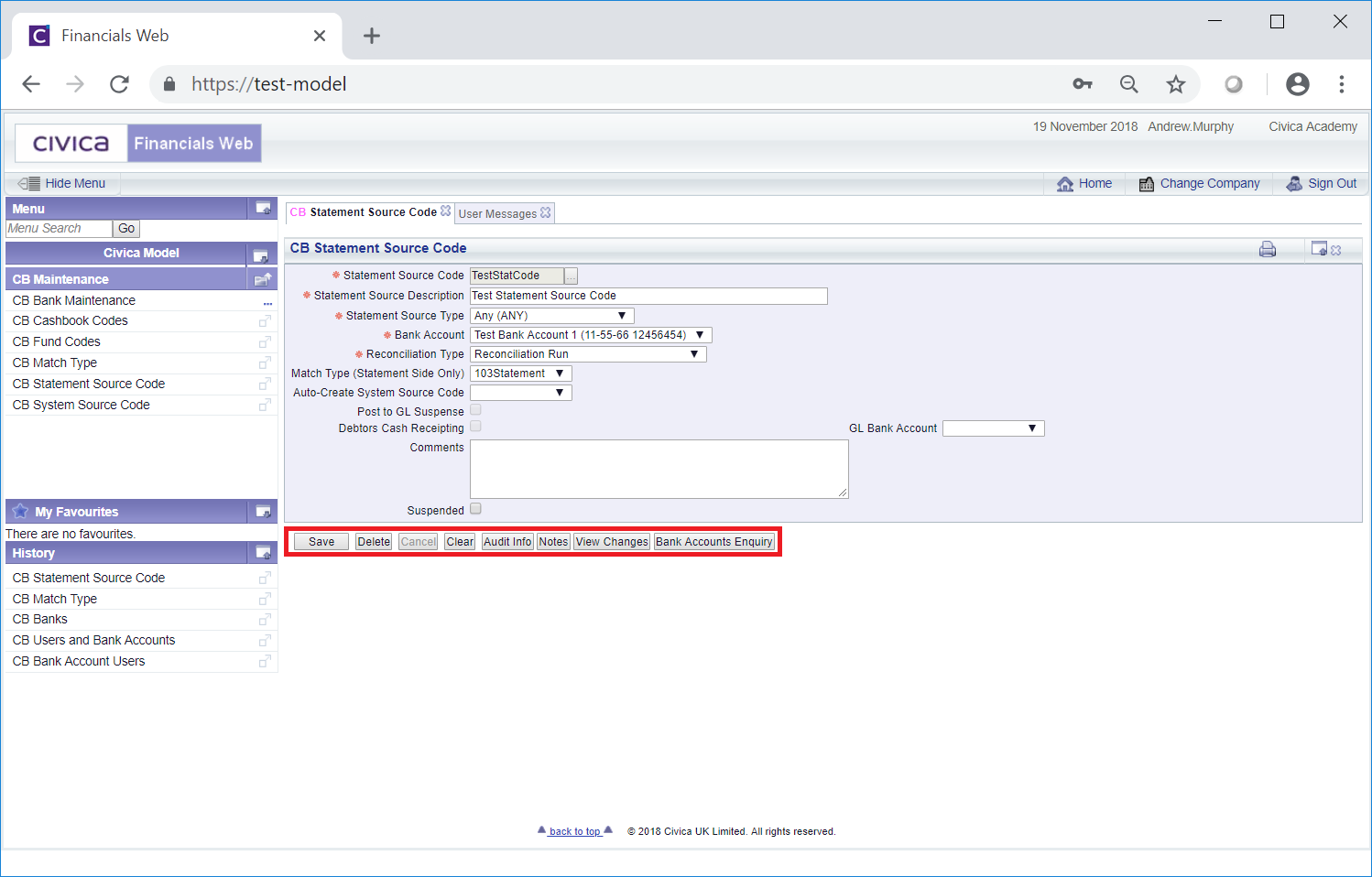

The CB Statement Source Code form will open:

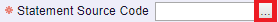

To open a Statement Source Code add the code of the Statement Source to the Statement Source Code field and click on the  button. The details of the Statement Source Code will be added to the form.

button. The details of the Statement Source Code will be added to the form.

Alternatively clicking on the Find Statement Source Code button located to the right of the Statement Source Code field,  , will open the CB Find Statement Source Code form allowing you to search for and select the required Statement Source Code. This form is further detailed in the Find Statement Source Code section. Once selected the details of the Statement Source Code will be loaded into the Statement Source Code form.

, will open the CB Find Statement Source Code form allowing you to search for and select the required Statement Source Code. This form is further detailed in the Find Statement Source Code section. Once selected the details of the Statement Source Code will be loaded into the Statement Source Code form.

Further buttons will also then be available at the bottom of the form:

The following fields and options on the form will be displayed (mandatory items are notated with a red asterisk *):

- Statement Source Code: This field will display the code for the Statement Source and cannot be amended.

- Statement Source Description: The description for the Statement Source Code will be included in this field and can be amended, if required.

- Statement Source Type: One of the following options will be displayed and can be amended by selecting a different option from this drop-down field.

The options are:

- Any

- Income

- Income Reversal

- Expenditure

- Expenditure Reversal

These options are mainly for information purposes but will also be used to validate items at import with regard to positive items (Income or Expenditure items) or negative items (Income Reversal or Expenditure Reversal items).

- Bank Account: The Bank Account linked to the Statement Source Code will be including in this field and can be changed by selecting a different Bank Account option form the drop-down. Please note: the Bank Account options in the drop-down list will only be those that you have access to. Access to Bank Accounts is further detailed in the Bank Account Users section, which details how to add Users to an individual Bank Account, and the Users and Bank Account section, which details how to add Bank Accounts to individual Users.

- Reconciliation Type: The option in this drop-down field will determine how items are to be matched and can be changed if required by selecting a different option.

The options are:

- Reconciliation Run

- Automatically Create System Transaction

- Other

Each of these options will determine which of the following fields required to be populated.

- Match Type (Statement Side Only): This field will be populated where the Reconciliation Type field, as detailed above, has the Reconciliation Run option selected and can be changed by selecting a different option from this drop down field. The options displayed will be the Match Types that have a Rule Type of Statement Side only. Match Types are further detailed in the Match Types section. The relevant option should be selected in this optional field where an entry is to be matched off against an existing Statement item, e.g. for a re-presented cheque.

- Auto-Create System Source Code: This field will be populated where the Reconciliation Type field, as detailed above, has the Automatically Create System Transaction option selected and can be changed by selecting a different option in this drop down field. The options displayed will be the System Source Codes that can be used - but is must be for the same Bank Account. System Source Codes are further detailed in the System Source Codes section.

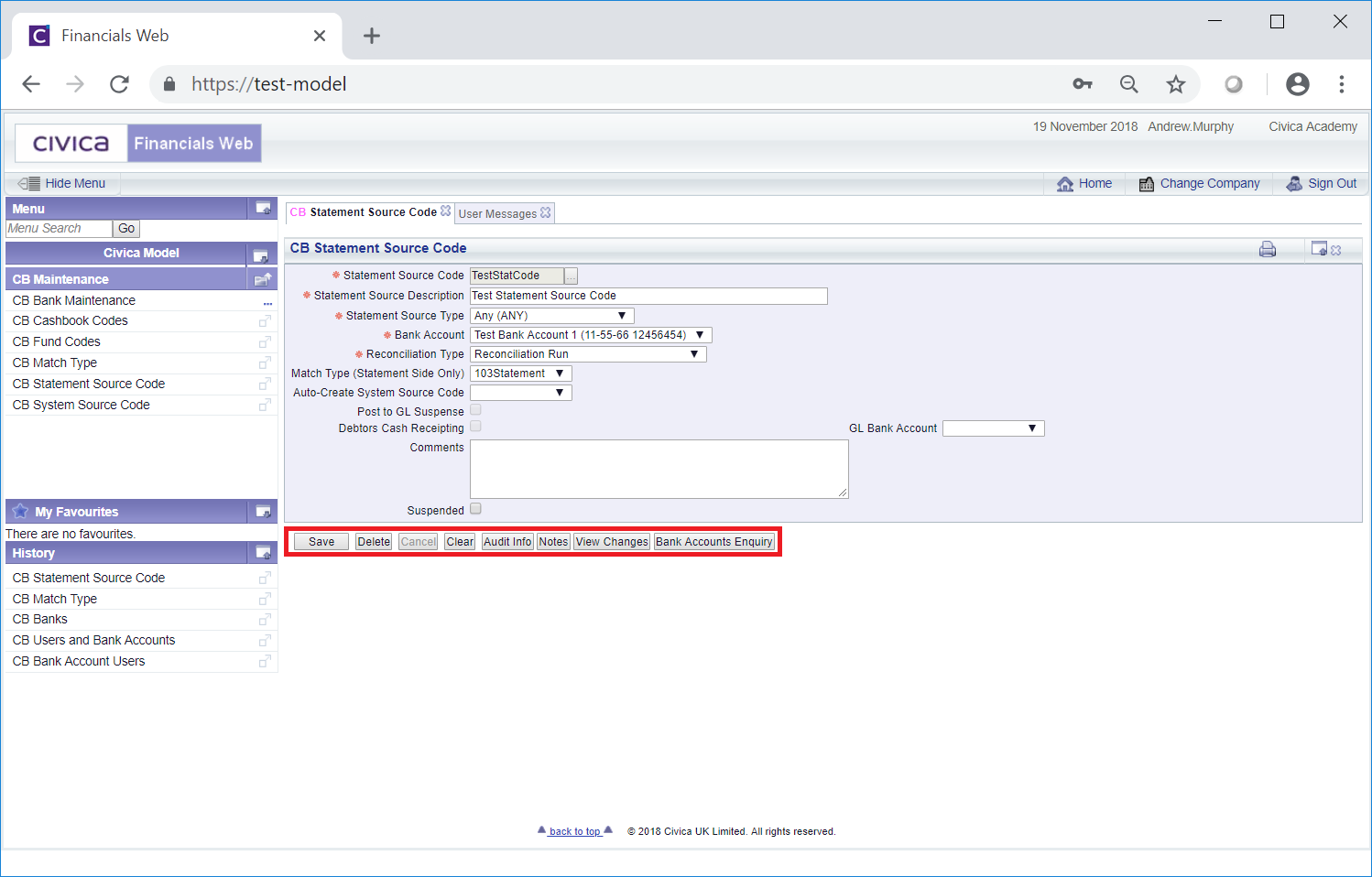

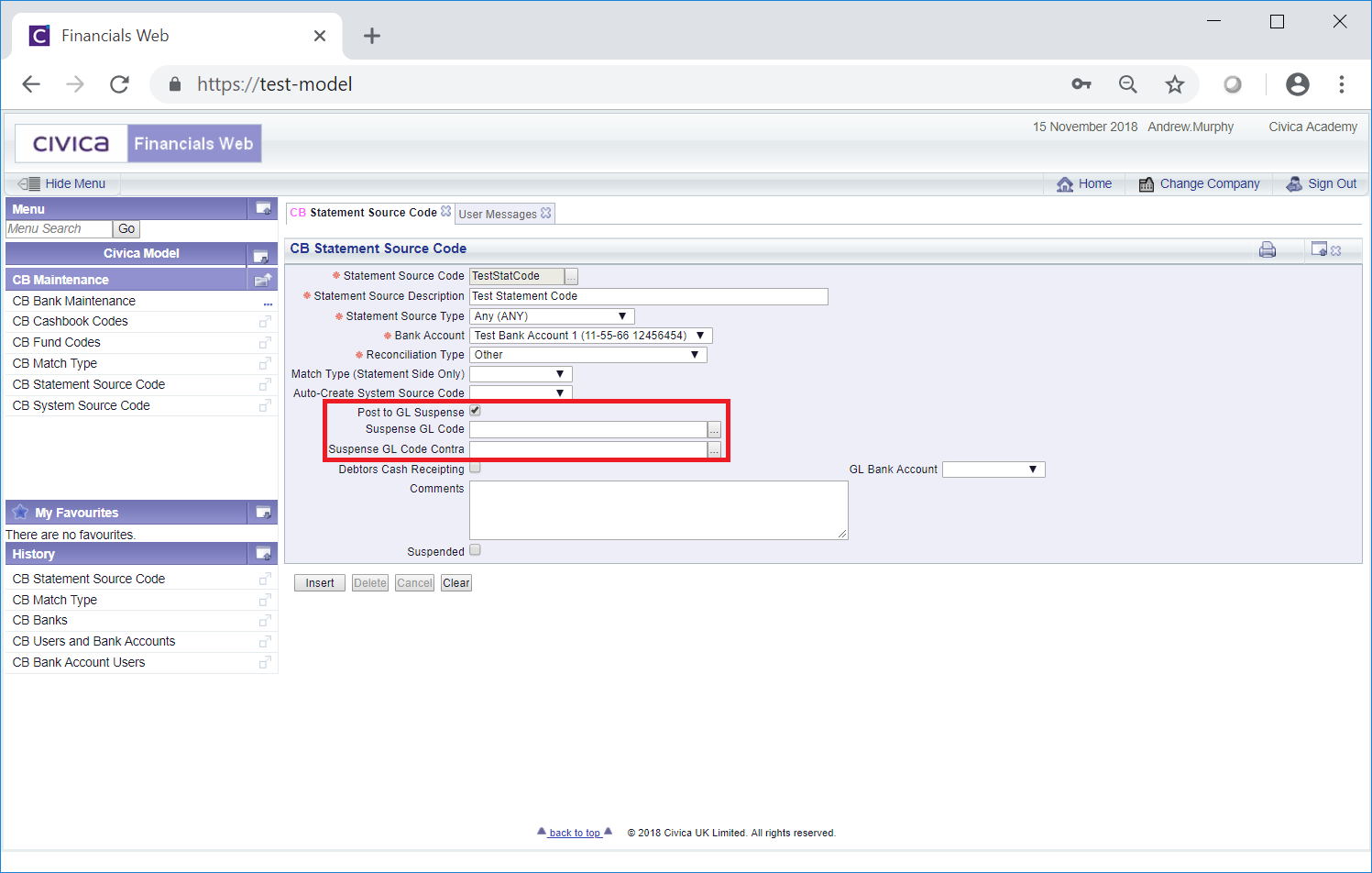

- Post to GL Suspense: This tick box will be available where the Reconciliation Type field, as detailed above, has the Other option selected and can be selected and deselected as required. If this tick box is selected the following fields will be displayed:

These fields are:

- Suspense GL Code: The Ledger Code that is to be used for suspended items may be included in this field and can be changed or added by typing in the required Ledger Code or clicking on the Find GL Code button located to the right of this field,

, will open the CB Find Ledger Code form allowing you to search for and select the required income or expenditure Ledger Code. This form is further detailed in the Find Ledger Code section. Once selected the Ledger Code will be loaded into this field.

, will open the CB Find Ledger Code form allowing you to search for and select the required income or expenditure Ledger Code. This form is further detailed in the Find Ledger Code section. Once selected the Ledger Code will be loaded into this field.

- Suspense GL Code Contra: The Ledger Code that is to be used for contra suspended items may be included in this field and can be changed or added to by typing in the required Ledger Code or clicking on the Find GL Code button located to the right of this field,

, will open the CB Find Ledger Code form allowing you to search for and select the required income or expenditure Ledger Code. This form is further detailed in the Find Ledger Code section. Once selected the Ledger Code will be loaded into this field.

, will open the CB Find Ledger Code form allowing you to search for and select the required income or expenditure Ledger Code. This form is further detailed in the Find Ledger Code section. Once selected the Ledger Code will be loaded into this field.

- Debtors Cash Receipting: This tick box will be available where the Reconciliation Type field, as detailed above, has the Other option selected. If already selected a GL Bank Account will also be added to the GL Bank Account field, as detailed immediately below. Where the Statement Source Code is set for a Bank Statement line that pertains to a transaction in the Debtors module that has not come through a Cash Receipting System but sent through the Debtors Cash Receipting functionality, as detailed in the Debtors Payments section, a GL Bank Account for the cash transaction will be required. This option can be selected and deselected as required.

- GL Bank Account: This field will be available and populated where the Debtors Cash Receipting option, as detailed immediately above, has been selected. The GL Bank Account can be changed by selecting a different option from this drop-down field. The options will be restricted to the GL Bank Accounts that have been added to the Bank Account that is displayed in the Bank Account field, as detailed above. Adding GL Bank Accounts to bank Accounts is further detailed in the GL Bank Accounts section.

- Comments: Details may be added to this text box to further describe the Statement Source Code and can be added or amended as required.

- Suspended: This tick box should be selected if the Statement Source Code is not to be used.

The following buttons are also available:

: Click on this button to save any changes made to the form. If changes have been made and you close the form, a message will be displayed stating that changes have not been saved and giving you the opportunity to go back to the form to save the changes.

: Click on this button to save any changes made to the form. If changes have been made and you close the form, a message will be displayed stating that changes have not been saved and giving you the opportunity to go back to the form to save the changes. : Click on this button to delete the Statement Source Code. A message will be displayed asking for confirmation that it is to be deleted.

: Click on this button to delete the Statement Source Code. A message will be displayed asking for confirmation that it is to be deleted.

Please note: a Statement Source Code can only be deleted if it has not been used, in which case it can be suspended instead by selecting the Suspended tick box.

: Clicking on this button will clear all the details on the form - the initial form will be displayed where you can search for or create a Statement Source Code. If changes have been made to the form and not saved, a message will be displayed stating that changes have not been saved and giving you the opportunity to go back to the form to save the changes.

: Clicking on this button will clear all the details on the form - the initial form will be displayed where you can search for or create a Statement Source Code. If changes have been made to the form and not saved, a message will be displayed stating that changes have not been saved and giving you the opportunity to go back to the form to save the changes. : Clicking on this button will open the Audit Info screen providing audit details for the Statement Source Code. This screen is further detailed in the Audit Info section.

: Clicking on this button will open the Audit Info screen providing audit details for the Statement Source Code. This screen is further detailed in the Audit Info section. : Clicking on this button will allow you to add a note with regard to the Statement Source Code. If there is an existing note for the Statement Source Code the button will be displayed as

: Clicking on this button will allow you to add a note with regard to the Statement Source Code. If there is an existing note for the Statement Source Code the button will be displayed as  . Notes are further detailed in the Notes section.

. Notes are further detailed in the Notes section. : Clicking on this button will open the CB Find Changes to Statement Source Code screen and will detail changes made to the Statement Source Code. This screen is further detailed in the View Statement Source Code Changes section.

: Clicking on this button will open the CB Find Changes to Statement Source Code screen and will detail changes made to the Statement Source Code. This screen is further detailed in the View Statement Source Code Changes section. : Clicking on this button will open the CB Bank Accounts Enquiry form, detailing the Bank Account added to added Bank Account field. This form is further detailed in the Bank Accounts Enquiry section.

: Clicking on this button will open the CB Bank Accounts Enquiry form, detailing the Bank Account added to added Bank Account field. This form is further detailed in the Bank Accounts Enquiry section.

button. The details of the Statement Source Code will be added to the form.

button. The details of the Statement Source Code will be added to the form. , will open the CB Find Statement Source Code form allowing you to search for and select the required Statement Source Code. This form is further detailed in the Find Statement Source Code section. Once selected the details of the Statement Source Code will be loaded into the Statement Source Code form.

, will open the CB Find Statement Source Code form allowing you to search for and select the required Statement Source Code. This form is further detailed in the Find Statement Source Code section. Once selected the details of the Statement Source Code will be loaded into the Statement Source Code form.

, will open the CB Find Ledger Code form allowing you to search for and select the required income or expenditure Ledger Code. This form is further detailed in the Find Ledger Code section. Once selected the Ledger Code will be loaded into this field.

, will open the CB Find Ledger Code form allowing you to search for and select the required income or expenditure Ledger Code. This form is further detailed in the Find Ledger Code section. Once selected the Ledger Code will be loaded into this field. , will open the CB Find Ledger Code form allowing you to search for and select the required income or expenditure Ledger Code. This form is further detailed in the Find Ledger Code section. Once selected the Ledger Code will be loaded into this field.

, will open the CB Find Ledger Code form allowing you to search for and select the required income or expenditure Ledger Code. This form is further detailed in the Find Ledger Code section. Once selected the Ledger Code will be loaded into this field. : Click on this button to save any changes made to the form. If changes have been made and you close the form, a message will be displayed stating that changes have not been saved and giving you the opportunity to go back to the form to save the changes.

: Click on this button to save any changes made to the form. If changes have been made and you close the form, a message will be displayed stating that changes have not been saved and giving you the opportunity to go back to the form to save the changes. : Click on this button to delete the Statement Source Code. A message will be displayed asking for confirmation that it is to be deleted.

: Click on this button to delete the Statement Source Code. A message will be displayed asking for confirmation that it is to be deleted. : Clicking on this button will clear all the details on the form - the initial form will be displayed where you can search for or create a Statement Source Code. If changes have been made to the form and not saved, a message will be displayed stating that changes have not been saved and giving you the opportunity to go back to the form to save the changes.

: Clicking on this button will clear all the details on the form - the initial form will be displayed where you can search for or create a Statement Source Code. If changes have been made to the form and not saved, a message will be displayed stating that changes have not been saved and giving you the opportunity to go back to the form to save the changes. : Clicking on this button will open the Audit Info screen providing audit details for the Statement Source Code. This screen is further detailed in the Audit Info section.

: Clicking on this button will open the Audit Info screen providing audit details for the Statement Source Code. This screen is further detailed in the Audit Info section. : Clicking on this button will allow you to add a note with regard to the Statement Source Code. If there is an existing note for the Statement Source Code the button will be displayed as

: Clicking on this button will allow you to add a note with regard to the Statement Source Code. If there is an existing note for the Statement Source Code the button will be displayed as  . Notes are further detailed in the Notes section.

. Notes are further detailed in the Notes section. : Clicking on this button will open the CB Find Changes to Statement Source Code screen and will detail changes made to the Statement Source Code. This screen is further detailed in the View Statement Source Code Changes section.

: Clicking on this button will open the CB Find Changes to Statement Source Code screen and will detail changes made to the Statement Source Code. This screen is further detailed in the View Statement Source Code Changes section. : Clicking on this button will open the CB Bank Accounts Enquiry form, detailing the Bank Account added to added Bank Account field. This form is further detailed in the Bank Accounts Enquiry section.

: Clicking on this button will open the CB Bank Accounts Enquiry form, detailing the Bank Account added to added Bank Account field. This form is further detailed in the Bank Accounts Enquiry section.