Assets are normally depreciated in bulk as detailed in the Asset Bulk Depreciation Process section but it may be necessary to depreciate an individual Asset before it is revalued, as detailed in the Revaluation section, or disposed, as detailed in the Disposal section

Where the Asset is already in the process of being depreciated, the Status of the Asset on the AM Asset Maintenance form will be set to  and clicking on the

and clicking on the  button on this form will open the Depreciation transaction on the AM Depreciation form where the transaction can be amended, if required, and/or completed.

button on this form will open the Depreciation transaction on the AM Depreciation form where the transaction can be amended, if required, and/or completed.

The AM Depreciation form can also be accessed via the AM Transaction Enquiry functionality by clicking on the  on the AM Depreciation Transaction Enquiry form where the status of the transaction is set to

on the AM Depreciation Transaction Enquiry form where the status of the transaction is set to  . This form is further detailed in the Depreciation Transaction Enquiry section.

. This form is further detailed in the Depreciation Transaction Enquiry section.

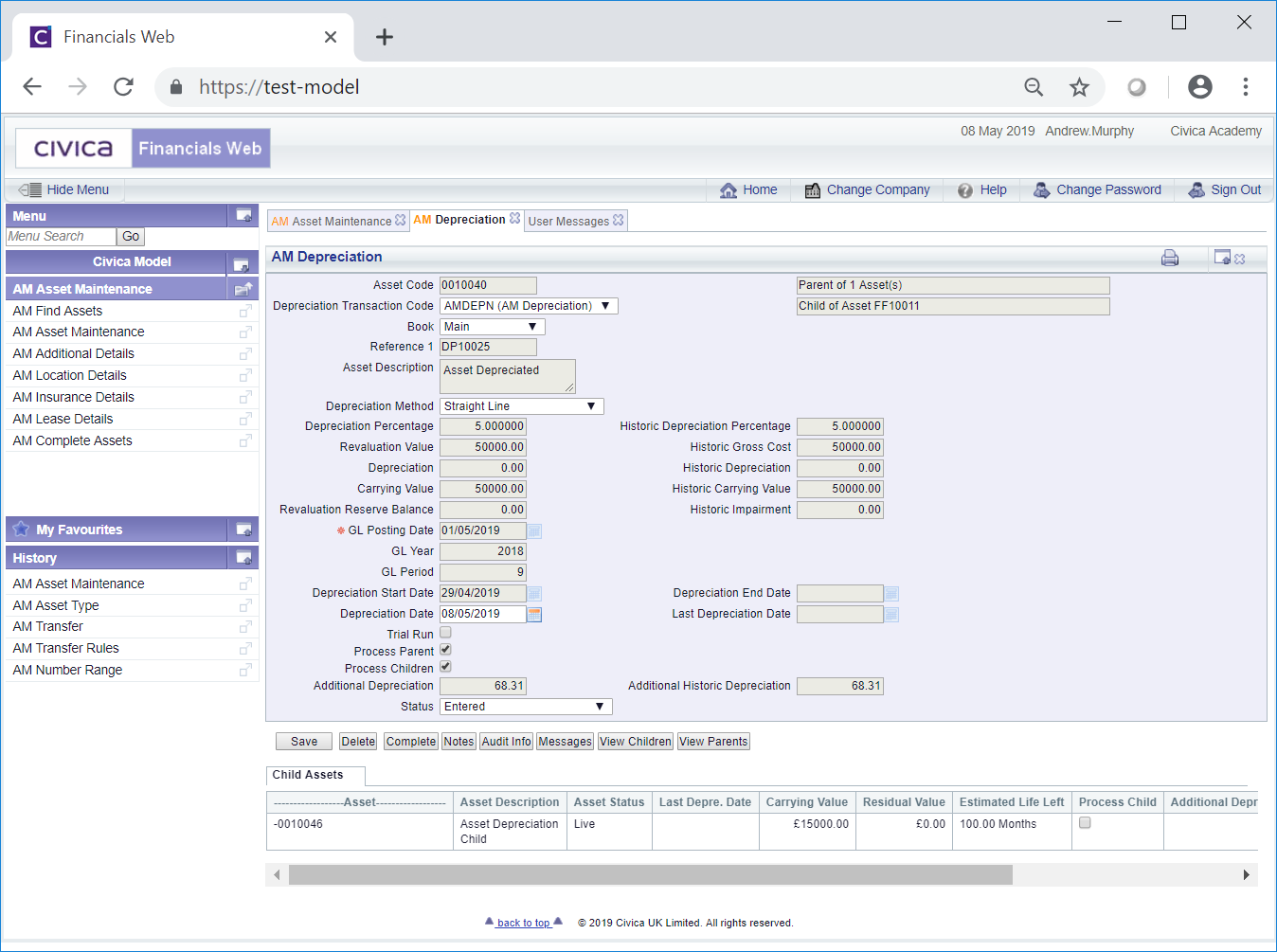

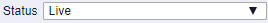

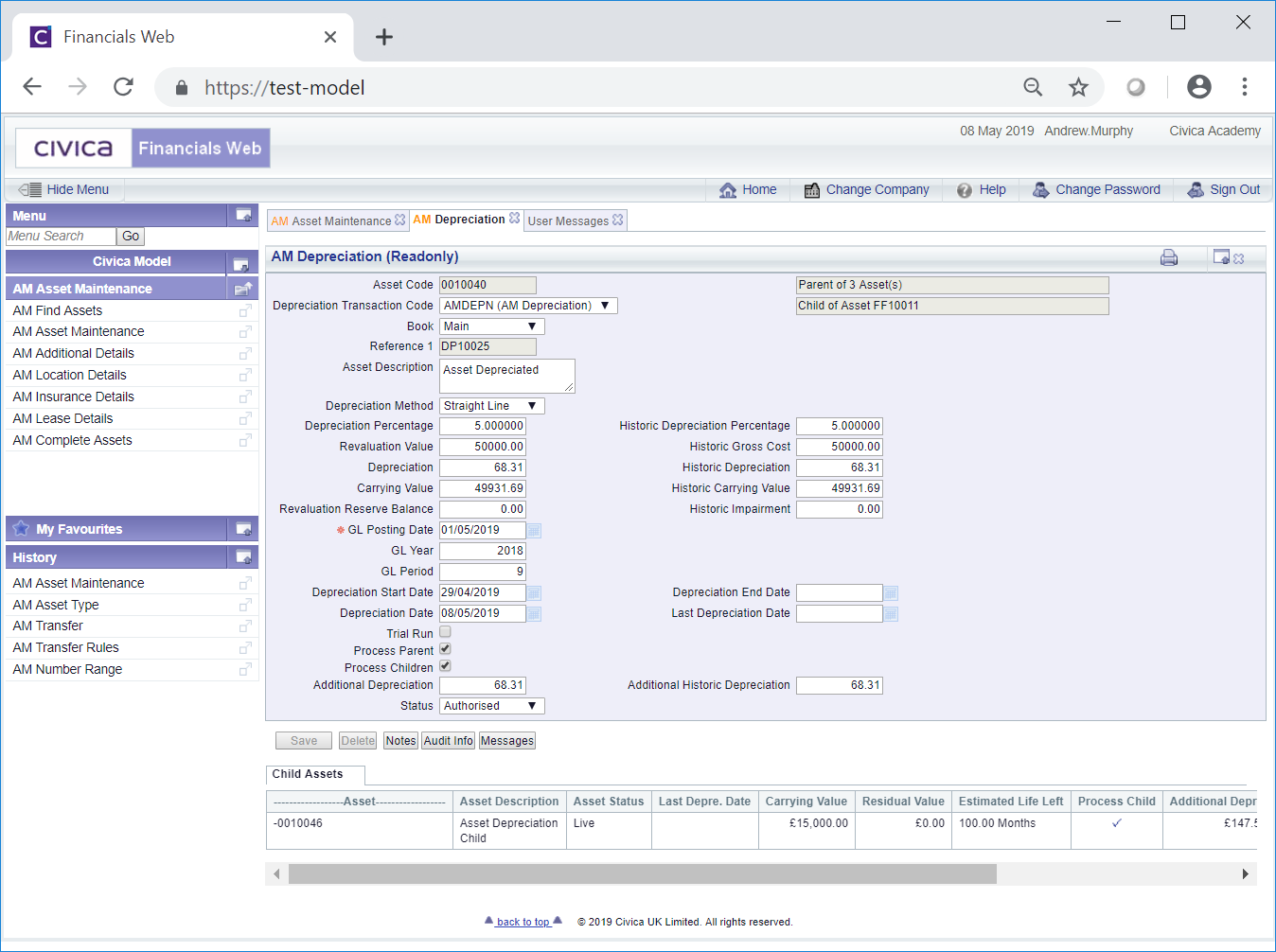

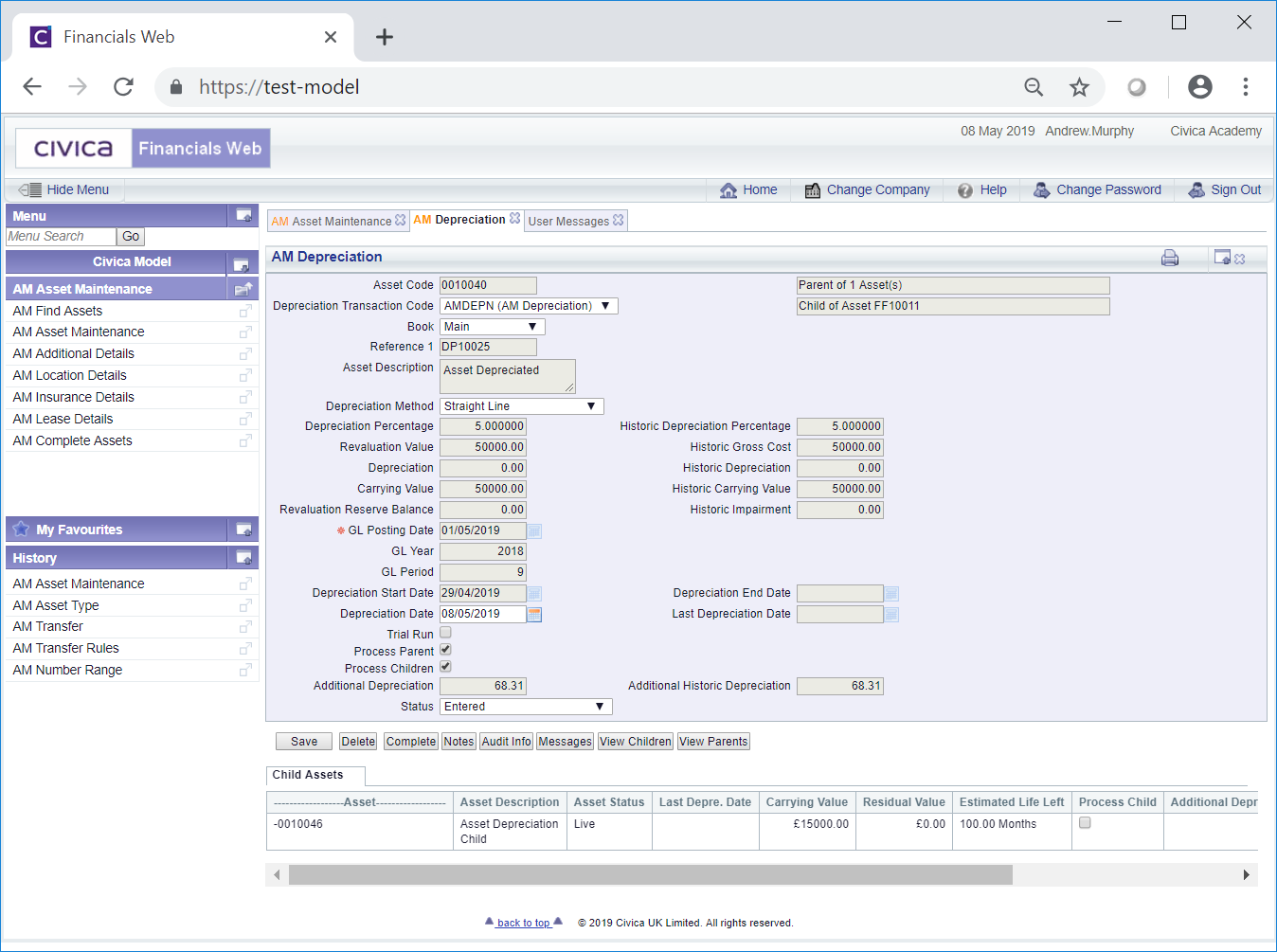

The AM Depreciation form will open:

The following fields are displayed (mandatory fields are notated with a red asterisk *):

- Asset Code: This field will display the code of the Asset to be depreciated and cannot be changed.

- Depreciation Transaction Code: This field will display the transaction code for the Depreciation transaction and cannot be changed.

- Book: This field will display the Asset Book of the Asset and cannot be changed.

- Reference 1: This field will contain the reference for the transaction and cannot be changed. Please note: this field may have a different label dependent on your configuration.

- Asset Description: This field will contain the description of the Asset to be transferred and cannot be changed.

- Depreciation Method: This field will display the Depreciation Method field as on the Asset Book displayed in the Book field detailed above and cannot be changed. This can be found on the Grid at the bottom of the AM Asset Maintenance form of the Asset.

- Depreciation Percentage: This field will display the amount in the Depreciation Percentage field on the Asset Book in the Book field detailed above and cannot be changed. This can be found on the Grid at the bottom of the AM Asset Maintenance form of the Asset.

- Revaluation Value: Where the Asset has not been revalued this field will display the amount in the Capital Cost field on the Asset Book in the Book field detailed above. Where the Asset has been revalued this field will display the amount in the Revaluation Value field from the Asset Book in the Book field detailed above. This amount can be found on the AM Asset Other Details screen that can be accessed by clicking on the

button on the new Asset on the AM Asset Maintenance form.

button on the new Asset on the AM Asset Maintenance form.

You will not be able to change the amount in this field.

- Depreciation: This field will display the amount on the Depreciation field on the Asset Book in the Book field detailed above and cannot be changed. This amount can be found on the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- Carrying Value: This field will display the amount in the Carrying Value field on the Asset Book in the Book field detailed above and cannot be changed. This amount can be found on the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- Revaluation Reserve Balance: This field will display the amount in the Revaluation Reserve Balance field on the Asset Book in the Book field detailed above and cannot be changed. This amount can be found on the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- Historic Depreciation Percentage: This field will display the amount in the Historic Depreciation Percentage field on the Asset Book in the Book field detailed above and cannot be changed. This percentage can be found in the Depreciation Percentage field on the Historic tab of the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- Historic Gross Cost: This field will display the amount in the Historic Gross Cost field on the Asset Book in the Book field detailed above and cannot be changed. It will initially be set to the amount in the Capital Cost field on the Asset Book but can be changed by a Revaluation Enhancement, as detailed in the Revaluation section. This amount can be found in the Gross Cost field on the Historic tab of the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- Historic Depreciation: This field will display the amount in the Historic Depreciation field on the Asset Book in the Book field detailed above and cannot be changed. This amount can be found in the Depreciation field on the Historic tab of the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- Historic Carrying Value: This field will display the amount in the Historic Carrying Value field on the Asset Book in the Book field detailed above and cannot be changed. This amount can be found in the Carrying Value field on the Historic tab of the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- Historic Impairment: This field will display the amount in the Historic Impairment field on the Asset Book in the Book field detailed above and cannot be changed. This amount can be found in Impairment field on the Historic tab of the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- GL Posting Date: This field will include the date that the Depreciation transaction is to be posted to the General Ledger and cannot be changed.

- GL Year: The Year in this field will be determined by the date added to the GL Posting Date field, as detailed immediately above.

- GL Period: The Period in this field will be determined by the date added to the GL Posting Date field, as detailed above.

- Depreciation Start Date: This field will display the date in the Depreciation Start Date field on the Asset Book in the Book field detailed above and cannot be changed.

- Depreciation End Date: This field will display the date in the Depreciation End Date field on the Asset Book in the Book field detailed above and cannot be changed. Where there is no date on the Depreciation End Date field on the Asset Book this field will be blank.

- Depreciation Date: This field will default to the current Assets Processing Date and will be the date up to which the depreciation will be calculated. The date can be changed, if required.

- Last Depreciation Date: This field will display the date in the Last Depreciation Date field on the Asset Book in the Book field detailed above and cannot be changed. This will be the date that the Asset was last depreciated up to. The Asset will be depreciated from the day after this date up to and including the date in the Depreciation Date field, detailed immediately above. Where the date in the Depreciation Date field is after the date in the Depreciation End Date field, as detailed above, the Asset will be depreciated from the date after the date in the Last Depreciation Date field up to and including the date in the Depreciation End Date field.

Where there is no date on the Last Depreciation Date field on the Asset Book this field will be blank, in which case the Asset will be depreciated from the date in the Depreciation Start Date field up to and including the date in the Depreciation Date field. Where the date in the Depreciation Date field is after the date in the Depreciation End Date field, the Asset will be depreciated from the date in the Depreciation Start Date field up to and including the date in the Depreciation End Date field.

- Trial Run: When this option is selected the Depreciation transaction will still be created detailing the changes but no values will be updated on the Asset. This option can be selected or deselected as required.

- Number of Units: This field will only be displayed where the Depreciation Method field, as detailed above, is set to Units of Use. This field will initially display the amount in the Number of Units field on the Asset Book in the Book field, as detailed above, but may have been changed. This can be found on the Grid at the bottom of the AM Asset Maintenance form of the Asset.

This amount can be changed and must be greater than the amount in the Last Number of Units field, as detailed immediately below. For example if the Asset is a vehicle with a mileage of 500 when purchased (Starting Units) and an expected life of 200,000 miles (Estimated Life Units), when it is depreciated for the first time, 500 will be in the Last Number of Units field and the current mileage should be added to this field, e.g 1,500 miles. Once depreciated the Last Number of Units field will contain 1,500.

- Last Number of Units: This field will only be displayed where the Depreciation Method field, as detailed above, is set to Units of Use. This field will display the amount in the Last Number of Units field on the Asset Book in the Book field, as detailed above, and amount cannot be changed. This can be found on the Grid at the bottom of the AM Asset Maintenance form of the Asset.

Where the Last Number of Units field on the Asset Book is blank, this will display the same amount as in the Number of Units field, as detailed above.

Depreciation will be calculated for the number of additional units between the amount in the Number of Units field, as detailed immediately above, and the amount in the Last Number of Units field.

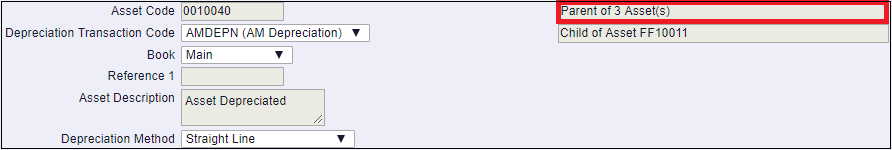

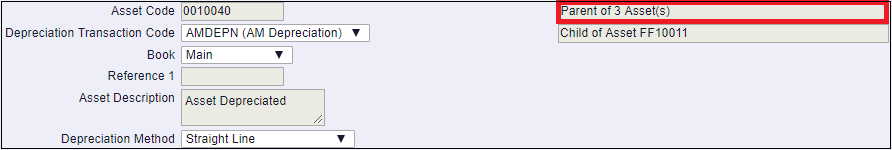

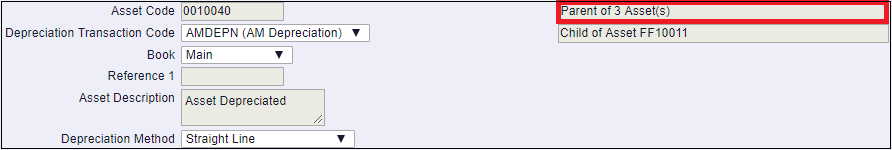

- Process Parent: This option will be available where the Asset has one or more Child Assets, i.e. it is a Parent Asset, and it may be selected. Whether the Asset is a Parent Asset will also be detailed at the top of the from:

Please note: the number of Children in this field will not include any Child Assets that have been Disposed or have been Cancelled.

Where this option is selected this Asset, i.e. the Parent Asset, will be depreciated. This option can be deselected where only the Child Assets are to be processed - some of the fields and options detailed above will be used when processing Child Assets such as the GL Posting Date and Depreciation Date fields as well as the Trial Run option.

Please also note: Assets with a Depreciation Method specified on the Asset Book of Units of Use will not be able to include any Child Assets for depreciation. The Depreciation Method can be found on the Grid at the bottom of the AM Asset Maintenance form of the Asset.

- Process Children: This option will be available where the Asset has one or more Child Assets, i.e. it is a Parent Asset, but the option will not be selected. Whether the Asset is a Parent Asset will also be detailed at the top of the form:

Please note: the number of Children in this field will not include any Child Assets that have been Disposed or have been Cancelled - only these Child Assets will be processed. In addition Assets with a Depreciation Method specified on the Asset Book of Units of Use will not be able to include any Child Assets for depreciation. The Depreciation Method can be found on the Grid at the bottom of the AM Asset Maintenance form of the Asset.

Where both the Parent and it's Children are selected to be processed there will be the option to process any Child Asset that has a status of  at the same time as the Parent.

at the same time as the Parent.

- Additional Depreciation: Where populated this field will display the depreciation to date above the Net Book value of the Asset as a result of the transaction.

- Historic Additional Depreciation: Where populated this field will display the accumulated historic depreciation to date above the Net Book value of the Asset as a result of the transaction.

- Status: This will be set to

and you will not be able to change this field.

and you will not be able to change this field.

The buttons at the bottom of the form are as follows:

: Click on this button to save any further changes to the fields on the form and to any Grid at the bottom of the form.

: Click on this button to save any further changes to the fields on the form and to any Grid at the bottom of the form. : Click on this button to delete the transaction. A message will be displayed asking for confirmation that the transaction is to be deleted.

: Click on this button to delete the transaction. A message will be displayed asking for confirmation that the transaction is to be deleted. : Clicking on this button will allow you to add a Note with regard to the Depreciation transaction. Where there is an existing Note the button will be displayed as

: Clicking on this button will allow you to add a Note with regard to the Depreciation transaction. Where there is an existing Note the button will be displayed as  . This is further detailed in the Notes section.

. This is further detailed in the Notes section. : Clicking on this button will open the Audit Info screen, providing audit details of the Depreciation transaction. This is further detailed in the Audit Info section.

: Clicking on this button will open the Audit Info screen, providing audit details of the Depreciation transaction. This is further detailed in the Audit Info section. : Clicking on this button will open the AM Asset Depreciation Messages screen allowing you to see any exception conditions when calculating the depreciation.

: Clicking on this button will open the AM Asset Depreciation Messages screen allowing you to see any exception conditions when calculating the depreciation. : This button will be displayed where the Asset is a Parent Asset, i.e. it has one or more Children. Clicking on this button will open the AM Asset's Children form, displaying the Asset's Children. This form is further detailed in the Assets Children section.

: This button will be displayed where the Asset is a Parent Asset, i.e. it has one or more Children. Clicking on this button will open the AM Asset's Children form, displaying the Asset's Children. This form is further detailed in the Assets Children section. : This button will be displayed where the Asset is a Child Asset, i.e. it has a Parent. Clicking on this button will open the AM Asset's Parents form, displaying the Asset's Parents. This form is further detailed in the Assets Parents section.

: This button will be displayed where the Asset is a Child Asset, i.e. it has a Parent. Clicking on this button will open the AM Asset's Parents form, displaying the Asset's Parents. This form is further detailed in the Assets Parents section. : Clicking on this button will complete the Depreciation transaction.

: Clicking on this button will complete the Depreciation transaction.

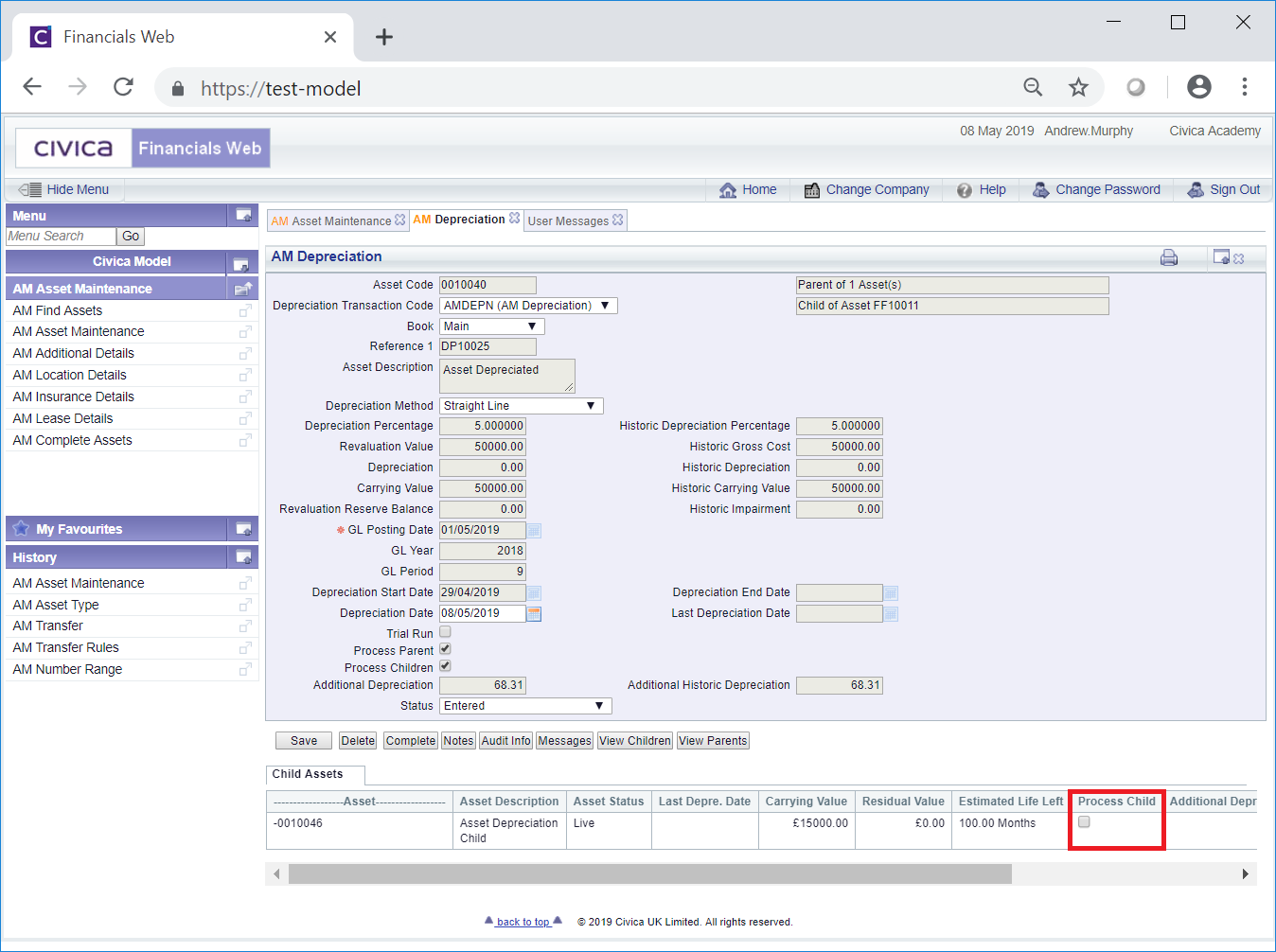

Where the Process Child option has been selected on the form ensure that the Process Child column in the Grid at the bottom of the form is also selected.

Where more than one Line is included in the Grid select this column for each Child that is to be processed.

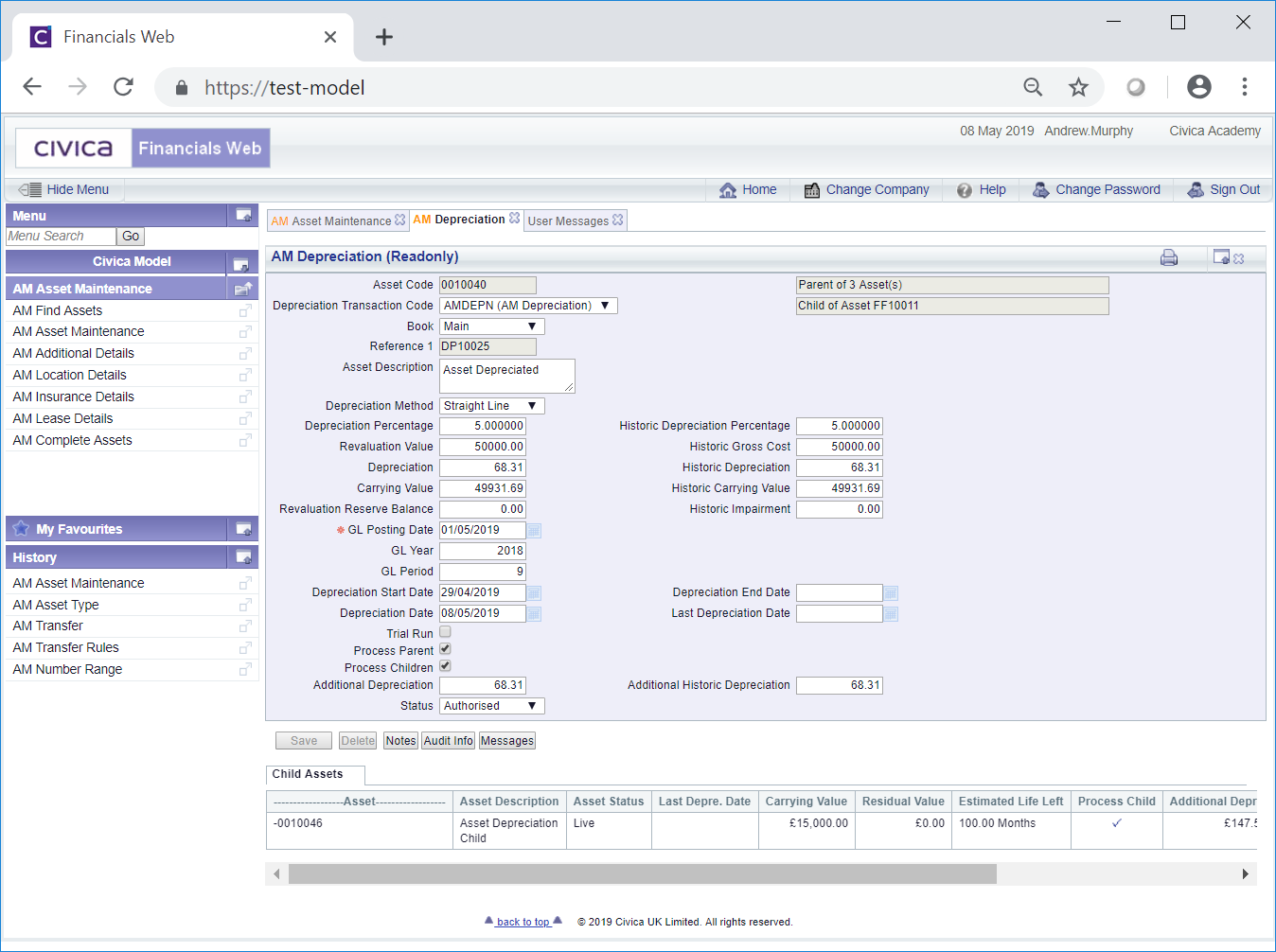

Once the  button has been selected the form will change to a read only version of the AM Depreciation form where no further changes can be made and the Status of the Depreciation transaction will change to

button has been selected the form will change to a read only version of the AM Depreciation form where no further changes can be made and the Status of the Depreciation transaction will change to  :

:

This form is further detailed in the AM Depreciation (Readonly) form section.

and clicking on the

and clicking on the  button on this form will open the Depreciation transaction on the AM Depreciation form where the transaction can be amended, if required, and/or completed.

button on this form will open the Depreciation transaction on the AM Depreciation form where the transaction can be amended, if required, and/or completed. on the AM Depreciation Transaction Enquiry form where the status of the transaction is set to

on the AM Depreciation Transaction Enquiry form where the status of the transaction is set to ![]() . This form is further detailed in the Depreciation Transaction Enquiry section.

. This form is further detailed in the Depreciation Transaction Enquiry section.

button on the new Asset on the AM Asset Maintenance form.

button on the new Asset on the AM Asset Maintenance form.  button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form. button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form. button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form. button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form. button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.  button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form. button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form. button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

![]() at the same time as the Parent.

at the same time as the Parent. . This is further detailed in the Notes section.

. This is further detailed in the Notes section. : Clicking on this button will open the AM Asset Depreciation Messages screen allowing you to see any exception conditions when calculating the depreciation.

: Clicking on this button will open the AM Asset Depreciation Messages screen allowing you to see any exception conditions when calculating the depreciation. : This button will be displayed where the Asset is a Parent Asset, i.e. it has one or more Children. Clicking on this button will open the AM Asset's Children form, displaying the Asset's Children. This form is further detailed in the Assets Children section.

: This button will be displayed where the Asset is a Parent Asset, i.e. it has one or more Children. Clicking on this button will open the AM Asset's Children form, displaying the Asset's Children. This form is further detailed in the Assets Children section. : This button will be displayed where the Asset is a Child Asset, i.e. it has a Parent. Clicking on this button will open the AM Asset's Parents form, displaying the Asset's Parents. This form is further detailed in the Assets Parents section.

: This button will be displayed where the Asset is a Child Asset, i.e. it has a Parent. Clicking on this button will open the AM Asset's Parents form, displaying the Asset's Parents. This form is further detailed in the Assets Parents section.

![]() button has been selected the form will change to a read only version of the AM Depreciation form where no further changes can be made and the Status of the Depreciation transaction will change to

button has been selected the form will change to a read only version of the AM Depreciation form where no further changes can be made and the Status of the Depreciation transaction will change to ![]() :

: