The AM Transfer form can be accessed from various forms and screens throughout the Asset Management module and will be displayed where the Transfer transaction has a status of  .

.

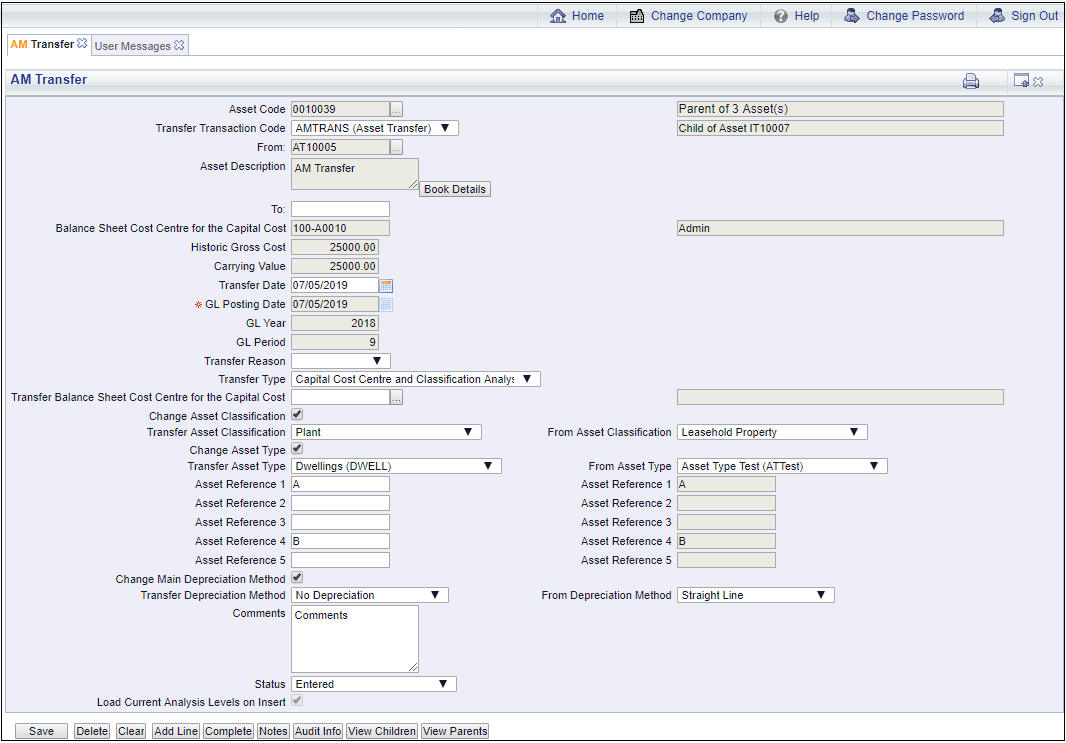

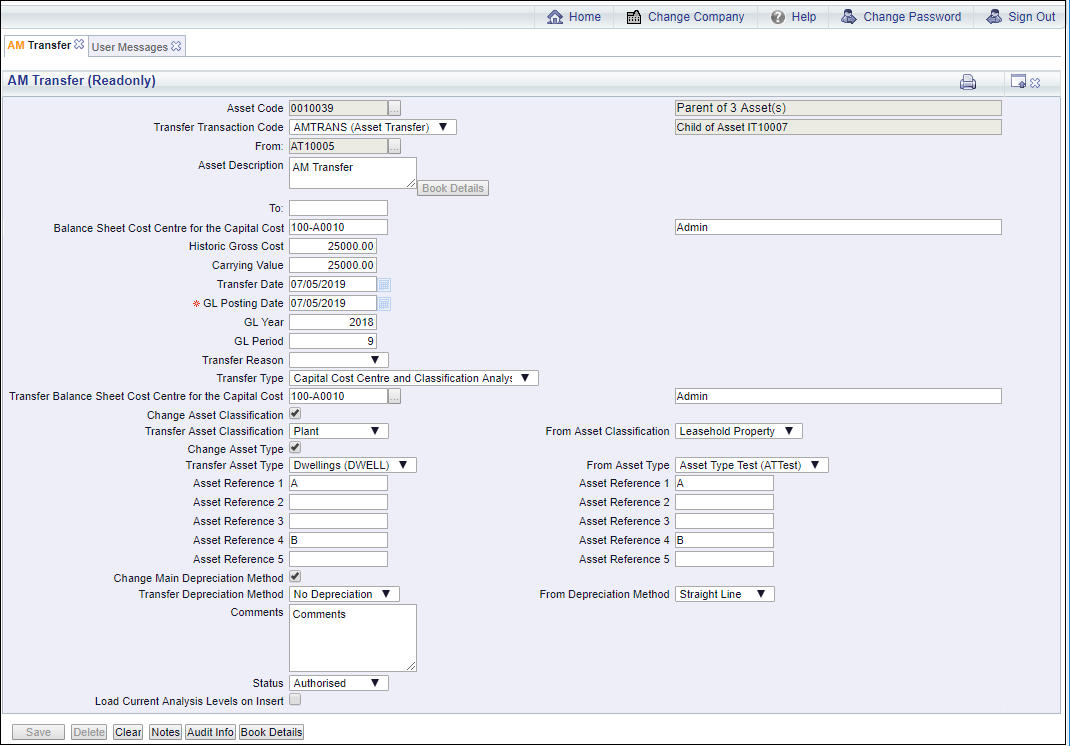

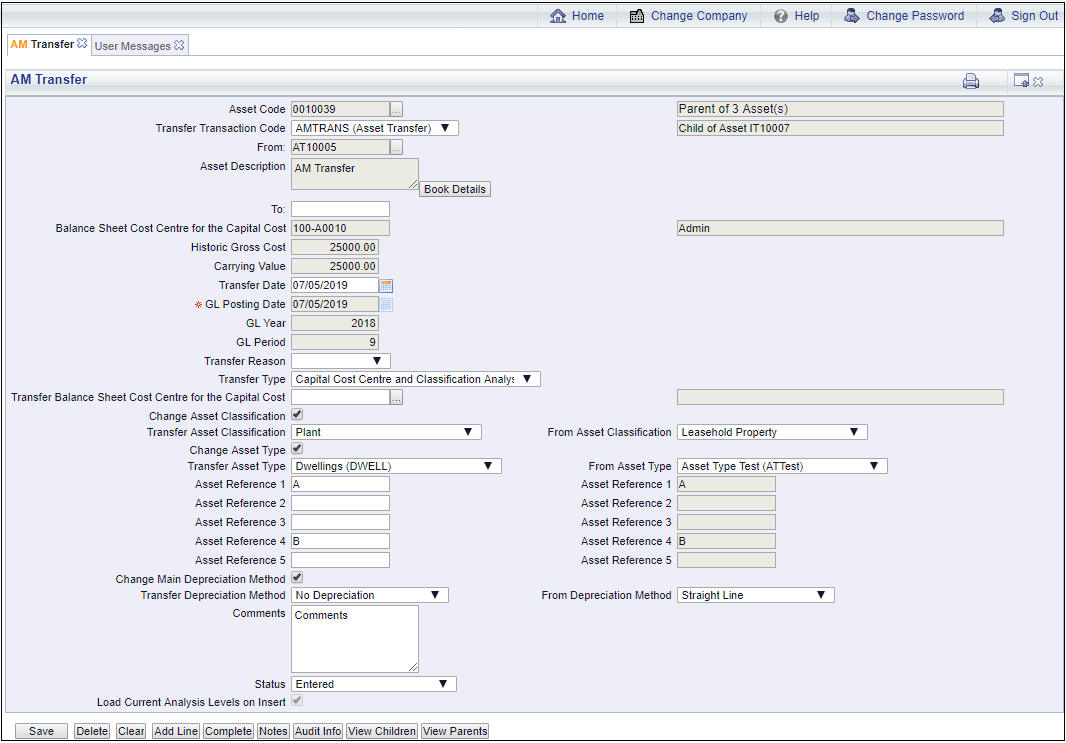

The AM Transfer form will open:

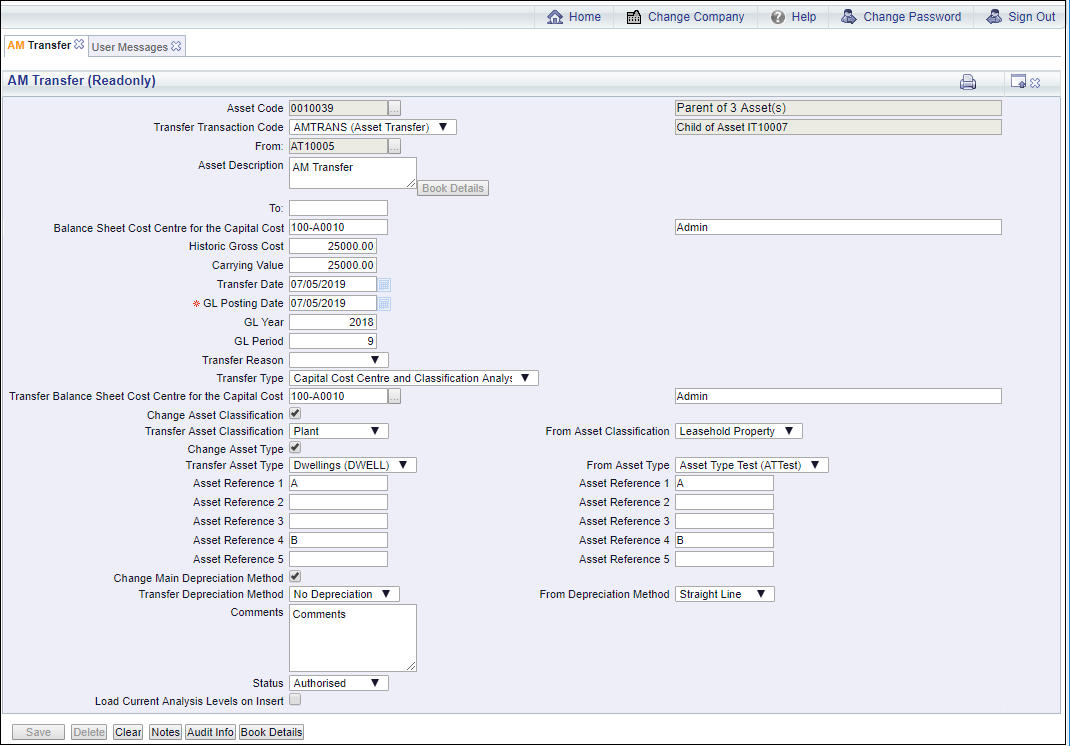

The following fields may be displayed:

- Asset Code: This field will display the code of the Asset to be transferred and cannot be changed.

- Transfer Transaction Code: This field will display the transaction code for the Transfer transaction and cannot be changed.

- Reference 1: This field will contain the reference for the transaction where it has been manually added. Where it is to be automatically generated this field will be blank. The details in this field cannot be changed. Please note: this field may have a different label dependent on your configuration.

- Asset Description: This field will contain the description of the Asset to be transferred and cannot be changed.

At the bottom right of this field is a  button. Clicking on this button will open the AM Asset Book Values Before the Transaction screen, detailing values of the Main Asset Book before the Transfer transaction. This screen is further detailed in the Asset Book Values section.

button. Clicking on this button will open the AM Asset Book Values Before the Transaction screen, detailing values of the Main Asset Book before the Transfer transaction. This screen is further detailed in the Asset Book Values section.

- Reference 2: This field that may include a second reference and can be changed or where it is blank a reference may be added, if required. Dependant on your configuration this field may not be displayed and if displayed may have a different label and will either be a mandatory or an optional field.

- Balance Sheet Cost Centre for the Capital Cost: This field will display the Balance Sheet Cost Centre for the Capital Cost for the Asset. The description of the Balance Sheet Cost Centre for the Capital Cost will also be displayed in the adjacent field. Both these fields cannot be changed.

- Historic Gross Cost: This field will be populated from the Main Book of the Asset and cannot be changed. This value can be found by clicking on the

button as detailed above.

button as detailed above.

- Carrying Value: This field will be populated from the Main Book of the Asset and cannot be changed. This value can be found by clicking on the

button as detailed above.

button as detailed above.

- Transfer Date: This field will display the date of the Transfer transaction and will default to the current Assets Processing Date (normally today's date) but can be changed if required.

- GL Posting Date: This field will display the date that the Transfer transaction is to be posted to the General Ledger and cannot be changed.

- GL Year: The Year in this field will be determined by the date added to the GL Posting Date field, as detailed immediately above.

- GL Period: The Period in this field will be determined by the date added to the GL Posting Date field, as detailed above.

- Transfer Reason: An option may be selected in this drop-down field to provide a reason for the transaction. A different or new option can be selected from the drop-down list if required. Reasons are defined as detailed in the Reasons section within Asset Admin.

- Transfer Type: An option will be selected in this drop-down field for the type of transfer and can be changed by selecting a different option from the drop-down field.

The options are:

- Classification Analysis: Where this option is selected, new Classification Analysis Codes must be added, as detailed in the Load Current Analysis Levels on Insert field below.

- Capital Cost Centre: Where this option is selected, the new Balance Sheet Cost Centre for the Capital Cost must be added. as detailed in the Transfer Balance Sheet Cost Centre for the Capital Cost field below.

- Capital Cost Centre and Classification Analysis: Where this option is selected either new Classification Analysis Codes, as detailed in the Load Current Analysis Levels on Insert field below, and/or a new Cost Centre, as detailed in the Transfer Balance Sheet Cost Centre for the Capital Cost field below, can be added

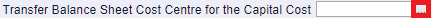

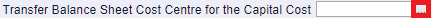

- Transfer Balance Sheet Cost Centre for the Capital Cost: A Cost Centre may be included in this field that will be the new Balance Sheet Cost Centre for the Capital Cost for the Asset. Where populated it can be changed by adding a different Cost Centre or where the field is blank a Cost Centre can be added.

This can be also be changed or added by clicking on the Find Cost Centre button located to the right of this field,  . This will open the AM Find Balance Sheet Cost Centre for the Capital Cost form allowing you to search for and select the required Capital Cost Centre. This form is further detailed in the Find Capital Cost Centre section.

. This will open the AM Find Balance Sheet Cost Centre for the Capital Cost form allowing you to search for and select the required Capital Cost Centre. This form is further detailed in the Find Capital Cost Centre section.

Where this field is populated the description of the Cost Centre will be displayed in the adjacent field.

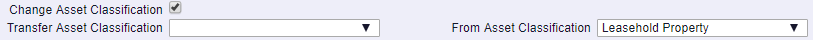

- Change Asset Classification: This option will be selected where the Classification of the Asset is to be changed and this option can be selected or deselected as required.

Where selected the following fields will be displayed:

These are:

- Transfer Asset Classification: An option may be selected in this drop-down field that will be the new Classification for the Asset. Where an option is selected it can be changed, if required, by selecting a different option from the drop-down list. Where no option is selected a new option can be added by selecting an option from the drop-down list.

- From Asset Classification: This field will display the current Classification for the Asset and is for information purposes only.

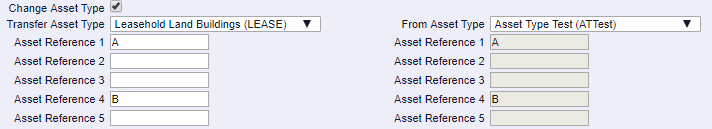

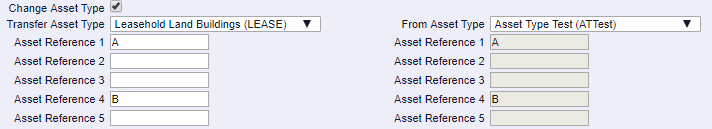

- Change Asset Type: This option will be selected where the Asset Type on the Asset is to be changed and can be selected or deselected as required.

Where selected the following fields will be displayed:

These are:

- Transfer Asset Type: An option may be selected in this drop-down field that will be the new Asset Type for the Asset. Where an option is selected it can be changed if required, by selecting a different option from the drop-down list. Where no option is selected a new option can be added by selecting an option from the drop-down list.

The 5 fields under the Transfer Asset Classification field, i.e. Asset Reference 1 to Asset Reference 5, are the user defined Reference fields for the selected Asset Type to be included in the Asset. These are further detailed in the Asset Types section. These fields may display information and details can be added or removed as required. The information to these fields will be displayed on the Asset once the Transfer transaction has been completed.

- From Asset Type: This field will display the current Asset Type for the Asset and is for information purposes only.

The 5 fields under the From Asset Type field, i.e. Asset Reference 1 to Asset Reference 5, are the user defined Reference fields for the Asset Type currently included in the Asset. These are further detailed in the Asset Types section. These will populated with the information that is currently on these fields on the Asset and is for information purposes only.

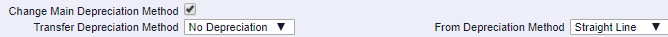

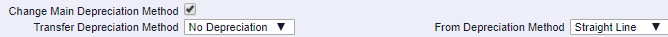

- Change Main Depreciation Method: This option will be selected where the Depreciation Method in the Main Asset Book of the Asset is to be changed and the option can be selected or deselected as required.

Where selected the following fields will be displayed:

These are:

- Transfer Depreciation Method: An option may be selected in this drop-down field that will be the new Depreciation Method for the Main Asset Book on the Asset. Where an option is selected it can be changed, if required, by selecting a different option from the drop-down list. Where no option is selected a new option can be added by selecting an option from the drop-down list.

- From Depreciation Method: This field will display the current Depreciation Method for the Main Asset Book of the Asset and is for information purposes only.

- Comments: Dependant on your configuration this field may not be displayed. Where it is displayed it will either be a mandatory or an optional field.

Where it is a mandatory field, further details of the Transfer transaction will be displayed and can be changed or amended as required.

Where it is an optional field further details on the Transfer transaction may be displayed and can be amended, added to or removed, as required. Where the field is blank details can be added.

- Status: This will be set to

and you will not be able to change this field.

and you will not be able to change this field.

- Load Current Analysis Levels on Insert: This option will be selected where the Transaction Code added to the Transfer Transaction Code field, as detailed above, specifies that the Classification Analysis Codes can be changed. You will not be able to change this option directly.

It is possible to add different levels in the Classification Code to includes Analysis Codes The Asset will then be linked to these Analysis Codes via the Classification Code. If you wish to use this functionality please contact a Civica Consultant.

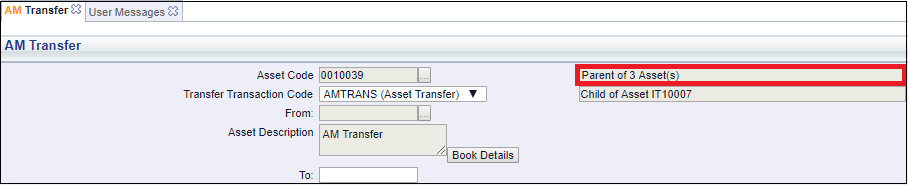

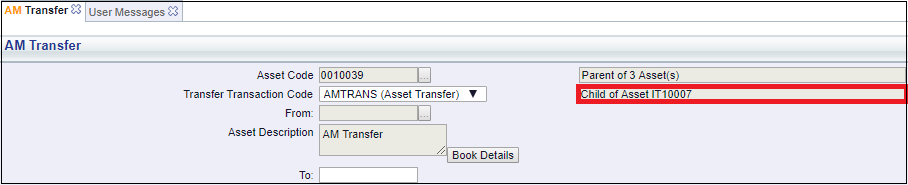

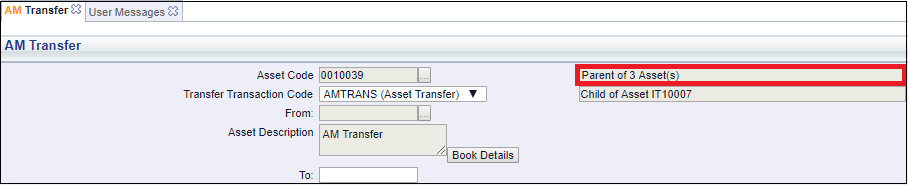

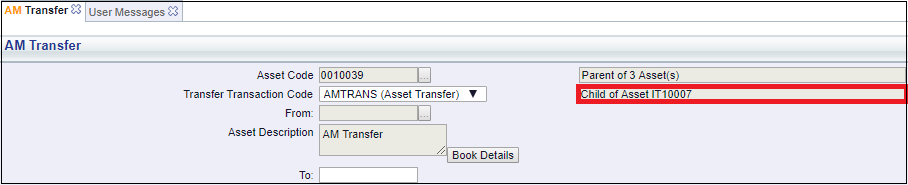

Where the Asset is a Parent of one or more Child Assets, details will be provided at the top of the form:

Please note: the number of Children in this field will not include any Child Assets that have been Disposed or have been Cancelled.

Where the Asset is a Child of another Asset, details will be provided at the top of the form:

The buttons at the bottom of the form are as follows:

These are:

: Click on this button to save any further changes to the fields on the form.

: Click on this button to save any further changes to the fields on the form. : Click on this button to delete the transaction. A message will be displayed asking for confirmation that the transaction is to be deleted. Please note the transaction can only be deleted where the status is set to

: Click on this button to delete the transaction. A message will be displayed asking for confirmation that the transaction is to be deleted. Please note the transaction can only be deleted where the status is set to  .

. : Clicking on this button will clear all the fields on the form. The initial version of the form will be displayed where you can create a new Transfer transaction or view an existing one.

: Clicking on this button will clear all the fields on the form. The initial version of the form will be displayed where you can create a new Transfer transaction or view an existing one. : Please ignore this button as it should only be selected when using the Classification Analysis Code functionality. It is possible to add different levels in the Classification Code of the Asset to include Analysis Codes. The Asset will then be linked to these Analysis Codes via the Classification Code. If you wish to use this functionality please contact a Civica Consultant.

: Please ignore this button as it should only be selected when using the Classification Analysis Code functionality. It is possible to add different levels in the Classification Code of the Asset to include Analysis Codes. The Asset will then be linked to these Analysis Codes via the Classification Code. If you wish to use this functionality please contact a Civica Consultant. : Clicking on this button will allow you to add a Note with regard to the Transfer transaction. Where there is an existing Note the button will be displayed as

: Clicking on this button will allow you to add a Note with regard to the Transfer transaction. Where there is an existing Note the button will be displayed as  . This is further detailed in the Notes section.

. This is further detailed in the Notes section. : Clicking on this button will open the Audit Info screen, providing audit details of the Transfer transaction. This is further detailed in the Audit Info section.

: Clicking on this button will open the Audit Info screen, providing audit details of the Transfer transaction. This is further detailed in the Audit Info section.

: This button will be displayed where the Asset is a Parent Asset, i.e. it has one or more Children. Clicking on this button will open the AM Asset's Children form, displaying the Asset's Children. This form is further detailed in the Assets Children section.

: This button will be displayed where the Asset is a Parent Asset, i.e. it has one or more Children. Clicking on this button will open the AM Asset's Children form, displaying the Asset's Children. This form is further detailed in the Assets Children section. : This button will be displayed where the Asset is a Child Asset, i.e. it has a Parent. Clicking on this button will open the AM Asset's Parents form, displaying the Asset's Parents. This form is further detailed in the Assets Parents section.

: This button will be displayed where the Asset is a Child Asset, i.e. it has a Parent. Clicking on this button will open the AM Asset's Parents form, displaying the Asset's Parents. This form is further detailed in the Assets Parents section. : Clicking on this button will complete the Transfer transaction and the form will change to the AM Transfer Readonly form:

: Clicking on this button will complete the Transfer transaction and the form will change to the AM Transfer Readonly form:

As this form is read only no further changes can be made to the form. The Status of the Transfer transaction will change to  . This form is further detailed in the AM Transfer (Readonly) form section.

. This form is further detailed in the AM Transfer (Readonly) form section.

![]() .

.

button. Clicking on this button will open the AM Asset Book Values Before the Transaction screen, detailing values of the Main Asset Book before the Transfer transaction. This screen is further detailed in the Asset Book Values section.

button. Clicking on this button will open the AM Asset Book Values Before the Transaction screen, detailing values of the Main Asset Book before the Transfer transaction. This screen is further detailed in the Asset Book Values section. button as detailed above.

button as detailed above. button as detailed above.

button as detailed above. . This will open the AM Find Balance Sheet Cost Centre for the Capital Cost form allowing you to search for and select the required Capital Cost Centre. This form is further detailed in the Find Capital Cost Centre section.

. This will open the AM Find Balance Sheet Cost Centre for the Capital Cost form allowing you to search for and select the required Capital Cost Centre. This form is further detailed in the Find Capital Cost Centre section.![]()

. This is further detailed in the Notes section.

. This is further detailed in the Notes section. : This button will be displayed where the Asset is a Child Asset, i.e. it has a Parent. Clicking on this button will open the AM Asset's Parents form, displaying the Asset's Parents. This form is further detailed in the Assets Parents section.

: This button will be displayed where the Asset is a Child Asset, i.e. it has a Parent. Clicking on this button will open the AM Asset's Parents form, displaying the Asset's Parents. This form is further detailed in the Assets Parents section.

![]() . This form is further detailed in the AM Transfer (Readonly) form section.

. This form is further detailed in the AM Transfer (Readonly) form section.