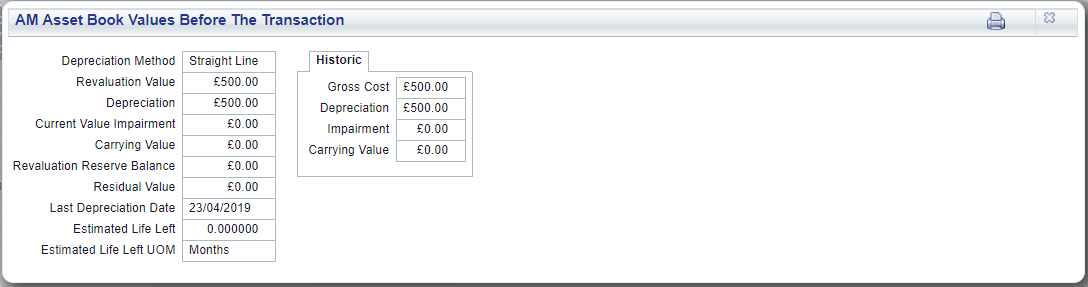

Clicking on the  button where it is available on the AM Disposal form will open the AM Asset Book Values Before the Transaction screen:

button where it is available on the AM Disposal form will open the AM Asset Book Values Before the Transaction screen:

This screen provides values of the Main Asset Book before the Disposal transaction.

The details on this form are as follows:

- Depreciation Method: This will display the Depreciation Method on the Asset Book in the Asset.

- Revaluation Value: This will display the amount in the Original Capital Cost field on the AM Asset Maintenance form of the Asset or the changed value following a Revaluation transaction.

- Depreciation: This will display the accumulated depreciation of the Asset.

- Current Value Impairment: This field can be ignored as Impairments cannot currently be recorded in FinancialsLIVE other than as a Revaluation transaction, as detailed in the Revaluation section. The amount in this field will always be zero.

- Carrying Value: This will display the current cost Carrying Value (or the Net book Value). This will be the Revaluation Value less the Current Value Impairment, which is always zero, less the Depreciation.

- Revaluation Reserve Balance: This will display the balance of the Revaluation Reserve account.

- Residual Value: This will display the current Residual Value held on the Asset Book.

- Last Depreciation Date: Where a date is displayed in this field it will be the date that the Asset was last depreciated up to (including this date). Where the field is blank, the Asset has not yet been depreciated.

- Estimated Life Date: This field will not appear where the Depreciation Method as detailed above is Units of Use. Instead other fields will be displayed as detailed below.

Where this field is displayed it will include an estimated life left for the time period displayed in the Estimated Life Left UOM field detailed immediately below, e.g. 1.

- Estimated Life Left UOM: This Unit of Measure field will not appear where the Depreciation Method as detailed above is Units of Use. Instead other fields will be displayed as detailed below.

Where this field is displayed it will include the Unit of Measure or time period for the amount added in the Estimated Life Date field detailed immediately above, e..g. months.

Where the Depreciation Method, as detailed above, is Units of Use, the Estimated Life Date and Estimated Life Left UOM fields, as detailed above will not be displayed but the following fields will be displayed instead:

- Starting Units: This will display the Starting Units from the Asset Book.

- Last Number of Units: This will display the Number of Units when the last Depreciation calculation was performed.

- Estimated Life Left Units: This will display the estimated number of units of life left.

- Estimated Life Left Unit UOM: This will display the Units of Measure for the units, as set on the Asset.

The Historic tab includes the following information:

- Gross Cost: This field will contain the amount added to the Original Capital Cost field on the Main tab of the AM Asset Maintenance form when the Asset was created and will only change where the Asset has been revalued resulting in a Revaluation Enhancement transaction that increases the Asset's value. Revaluations are further detailed in the Revaluation section.

- Depreciation: The amount in this field will be the accumulated depreciation amount of the Asset, rounded to 2 decimal places.

- Impairment: This field would normally display the value of any Historic Cost Impairment but as Impairments are not currently being used, this field can be ignored,

- Carrying Value: This will be the Gross Cost less the Depreciation less the Impairment.

button where it is available on the AM Disposal form will open the AM Asset Book Values Before the Transaction screen:

button where it is available on the AM Disposal form will open the AM Asset Book Values Before the Transaction screen: