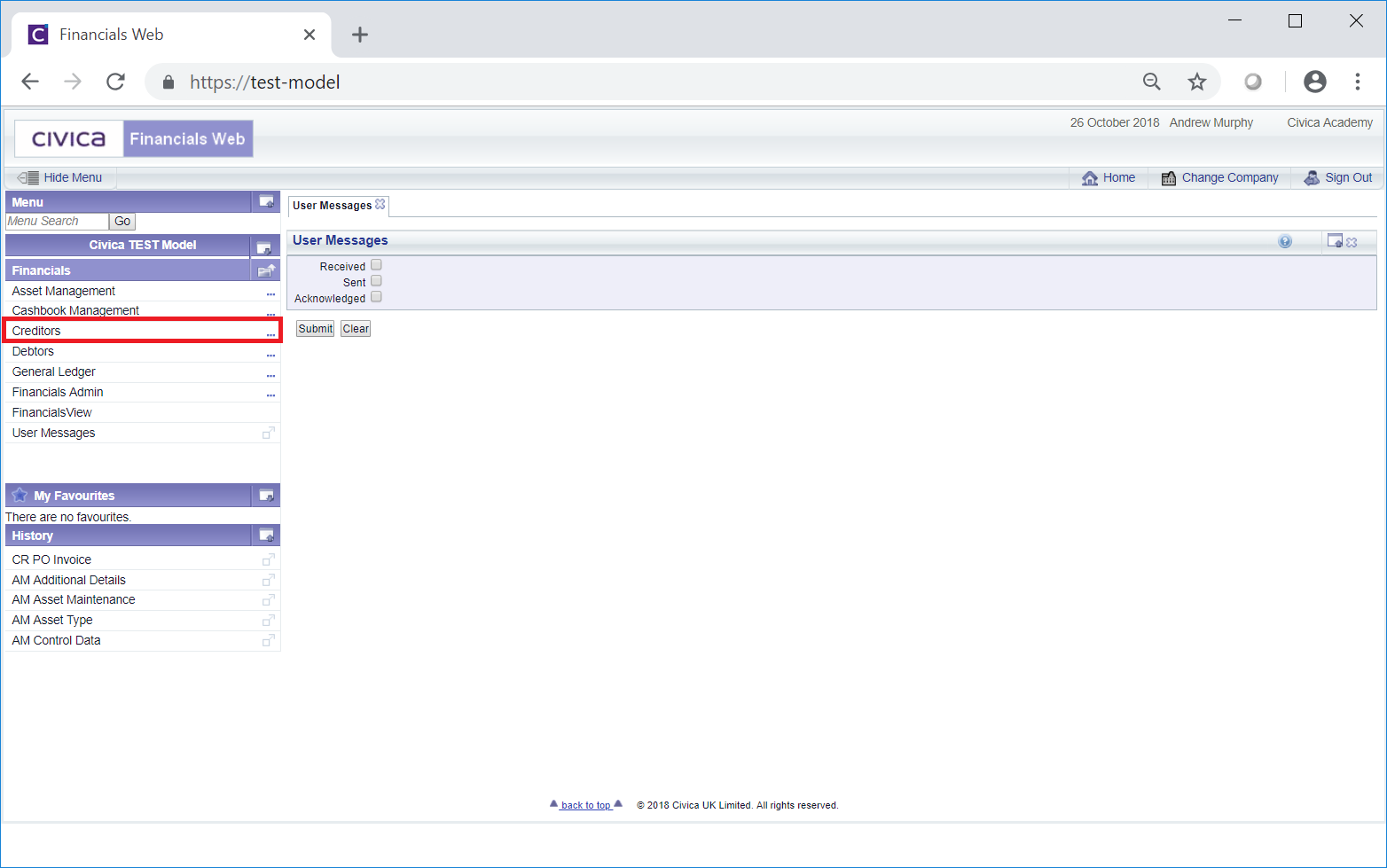

Credit Notes can be maintained via the CR Credit Note form, which can be accessed from the Financials Menu by selecting the Creditors menu option:

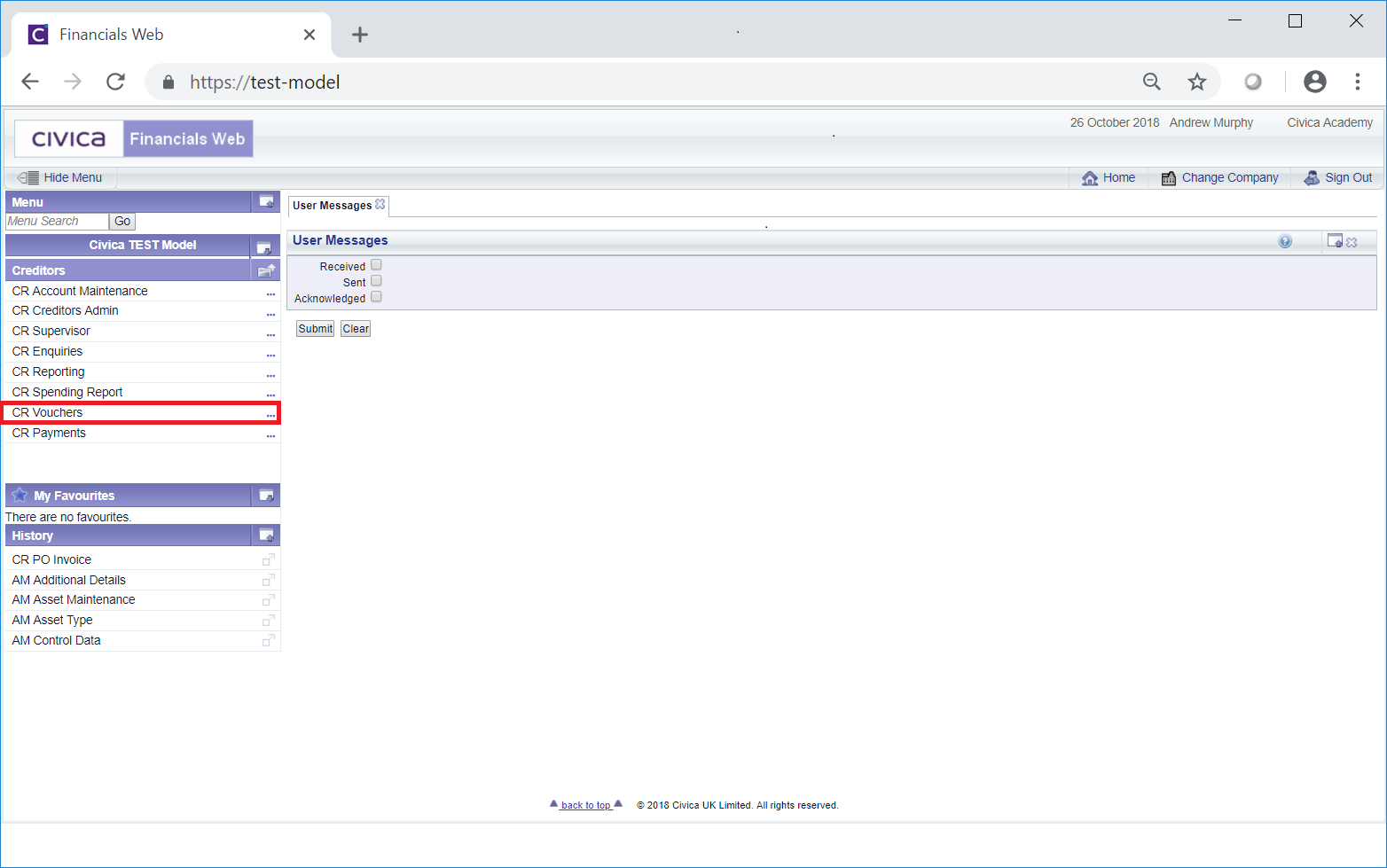

Then the CR Vouchers menu option:

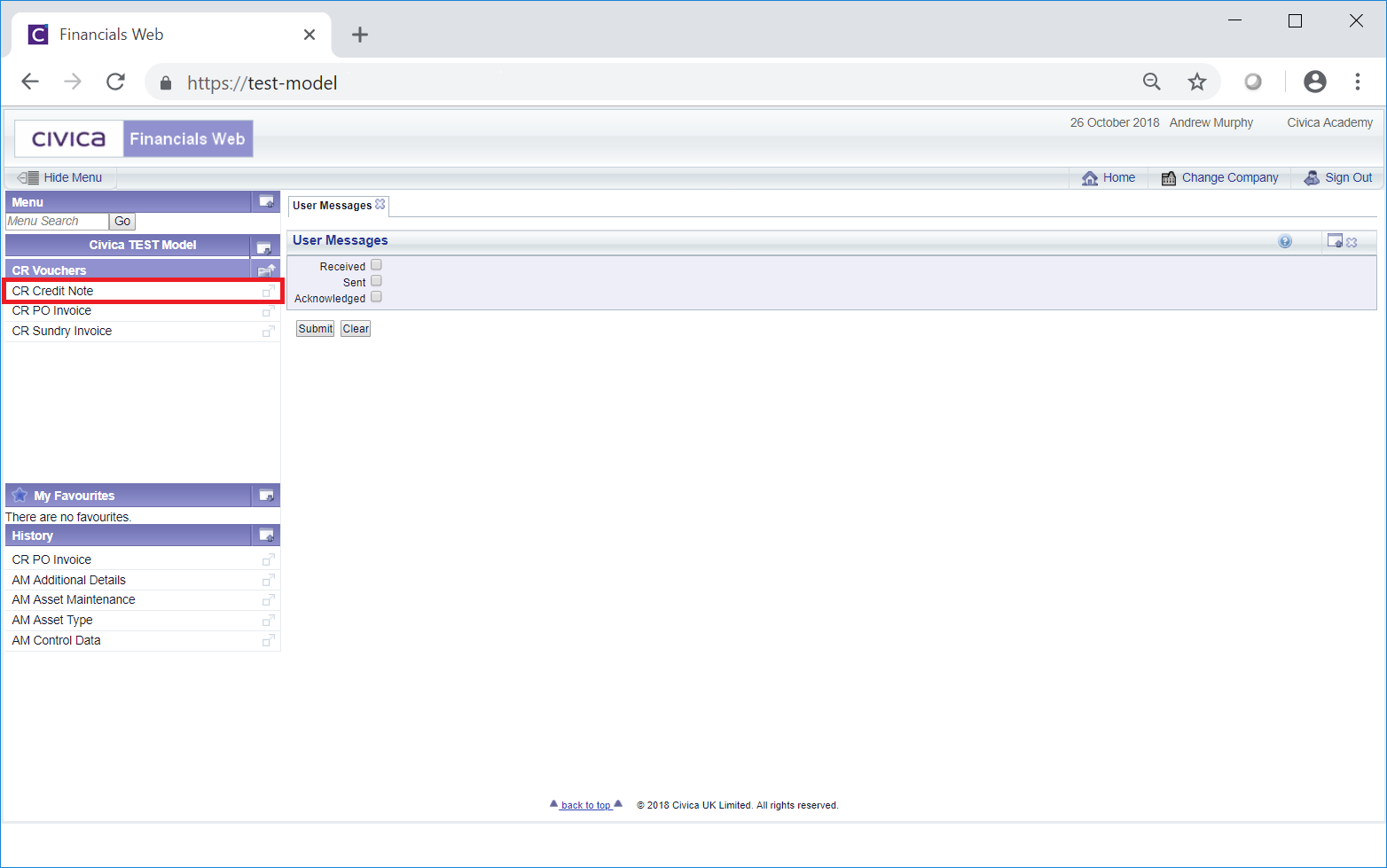

Then the CR Credit Note menu option:

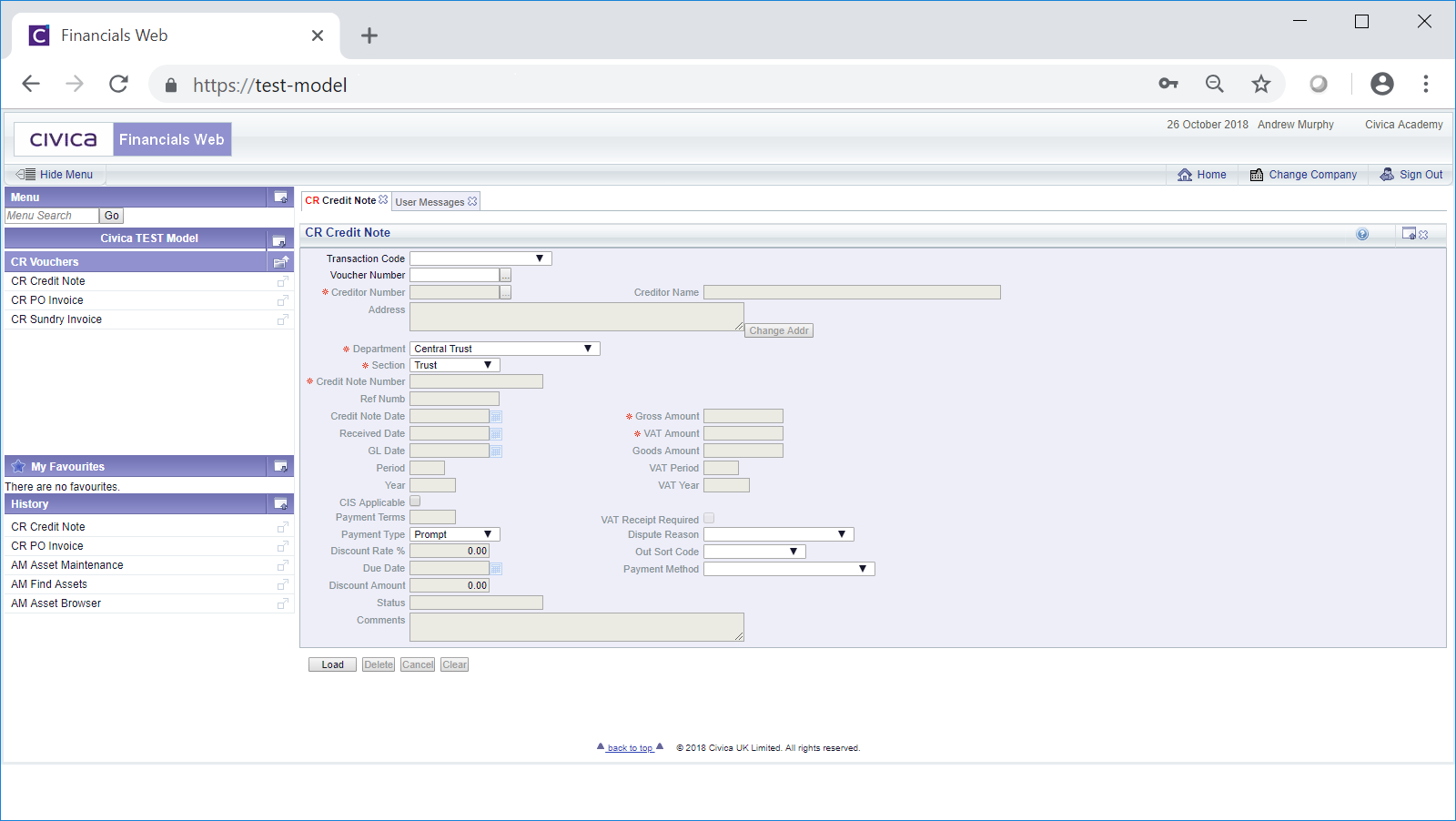

The CR Credit Note form will then be displayed

To view an existing Credit Note, add the Voucher Number to the ![]() field and click on the

field and click on the ![]() button.

button.

Alternatively clicking on the Find Credit Note button located immediately to the right of this field: ![]() will open the CR Credit Note Enquiry form, which will allow you to search for and select the required Credit Note. This form is further detailed in the Credit Note Enquiry section. The selected Credit Note will be added to the

will open the CR Credit Note Enquiry form, which will allow you to search for and select the required Credit Note. This form is further detailed in the Credit Note Enquiry section. The selected Credit Note will be added to the ![]() field.

field.

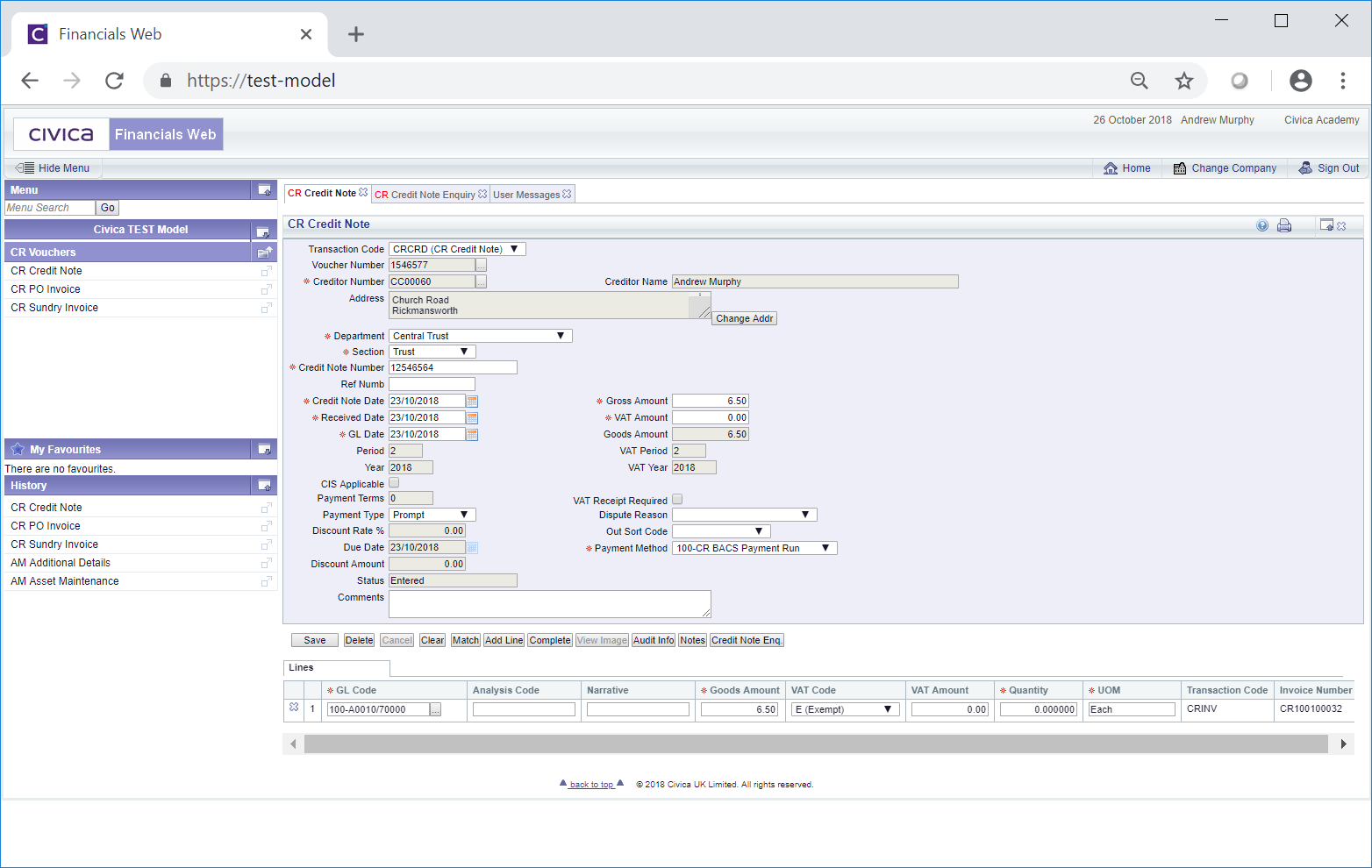

The details of the Credit Note will be added to the CR Credit Note form:

The fields available on the form and in the Grid will be dependant on the status of the Credit Note.

The fields below will be available if the status of the Credit Note is set at ![]() ,

, ![]() or

or ![]() (mandatory fields are notated with a red asterisk *):

(mandatory fields are notated with a red asterisk *):

button located at the bottom right hand corner of the field.

button located at the bottom right hand corner of the field.This will open the CR Find Creditor Addresses screen that will list all the Addresses that are on the Creditor record. Selecting a different Address on this form will replace the details in the Address field with the selected address details. This form is further detailed in the Find Creditor Addresses section.

Please note: when amending details to the Gross Amount field and the VAT Amount field, the Goods Amount field on the form will be updated with the net amount.

Please note: the option added to this field will be used when processing the payment for the Credit Note, which is further detailed in the Creditor Payments section.

The options available will be dependant on the set up of your organisation. Organisations that have responsibility for school/academies, e,g a Trust, will have payment method options for the Trust, which will be denoted with a Department of 100, and payment method options for each school/academy, which will be denoted with subsequent Department numbers, e.g, 101, 102, 103 etc.

There will also be separate options for both BACS and Cheque payments. For example BACS payment methods for the Trust will include 100-CRBACS. BACS payments for individual schools/academies in the Trust will include 101-CRBACS, 102-CRBACS, 103-CBACS etc. Cheque payment methods for the Trust will include100-CRCHQ and for individual schools/academies in the Trust will include 101-CRCHQ, 102-CRCHQ, 103-CRCHQ etc.

If the Credit Note is to be paid from the Trust, the option selected in the Payment Method field should include the Trust department number, e.g. 100-CRBACS for BACS payments or 100-CRCHQ for Cheques. If the Credit Note is to be paid from an individual school/academy, the option selected should include that school/academy Department number, e.g. for BACS payments 101-CRBACS, 102-CRBACS, 103-CBACS etc, or for Cheque payments 101-CRCHQ, 102-CRCHQ, 103-CRCHQ etc.

Ensure that the correct option is selected in this field.

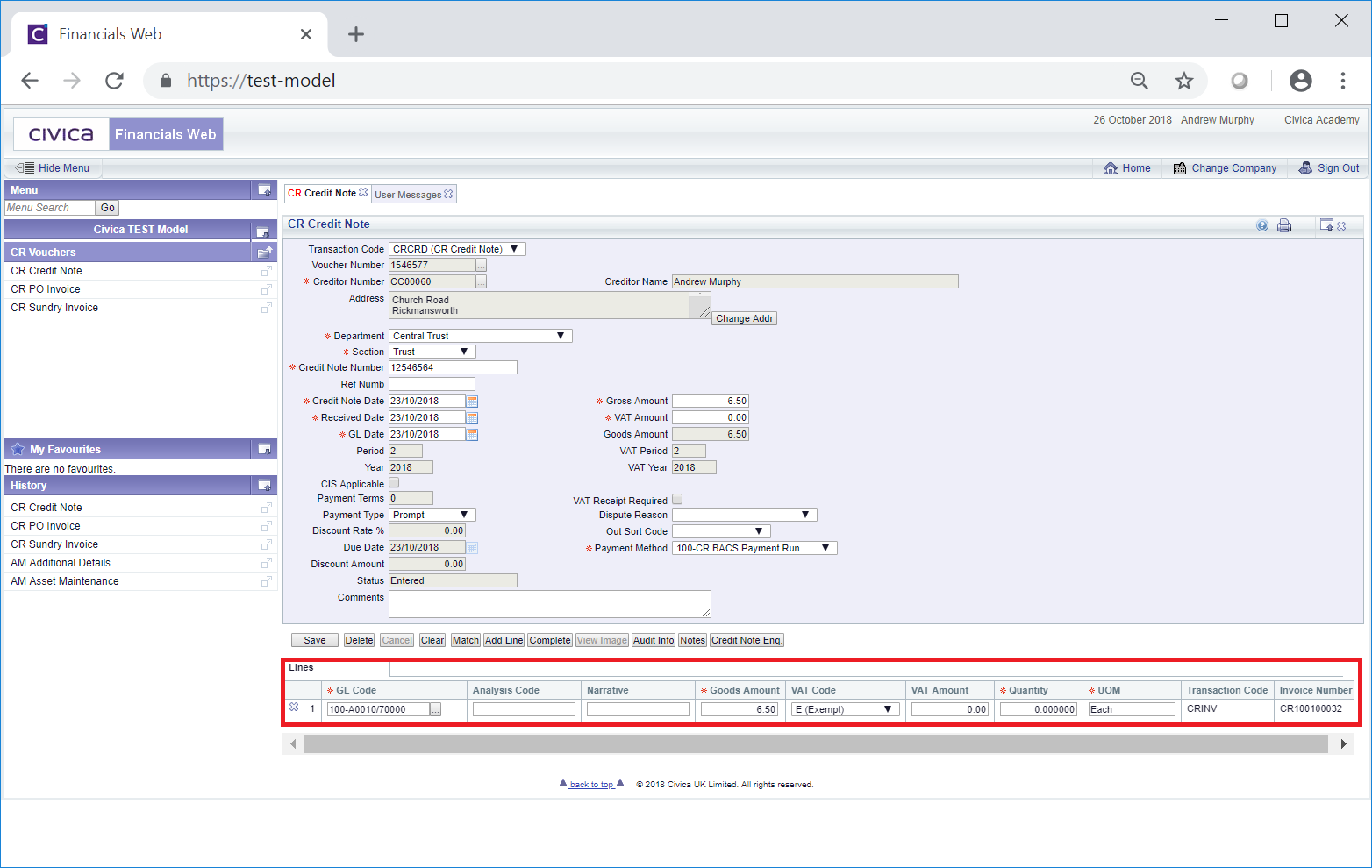

The details on the Grid can also be amended if the status of the Credit Note is set at ![]() ,

,  or

or ![]() and the Lines on the Grid can also be removed by clicking on the

and the Lines on the Grid can also be removed by clicking on the  button located to the left of each Line.

button located to the left of each Line.

The following buttons will only be available when the status of the Credit Note is set at ![]() ,

,  or

or ![]() :

:

The Lines on the Grid can also be removed by clicking on the ![]() button located to the left of each Line.

button located to the left of each Line.

Further Invoices can be added to the Grid by clicking on the ![]() button, which will open the CR Find Invoice for Matching form allowing you to search for and select further Invoices for the Creditor, i.e. the Creditor in the Creditor Number field. This form is further detailed in the Matching Credit Notes section.

button, which will open the CR Find Invoice for Matching form allowing you to search for and select further Invoices for the Creditor, i.e. the Creditor in the Creditor Number field. This form is further detailed in the Matching Credit Notes section.

If no further Invoices are to be matched and no further Line are to be added to the Grid please ensure that the total of the Goods Amount column in the Grid equals the amount on the Goods Amount field on the form. Also the total of the amounts in the VAT Amount column in the Grid should equal the amount in the VAT Amount field on the form.

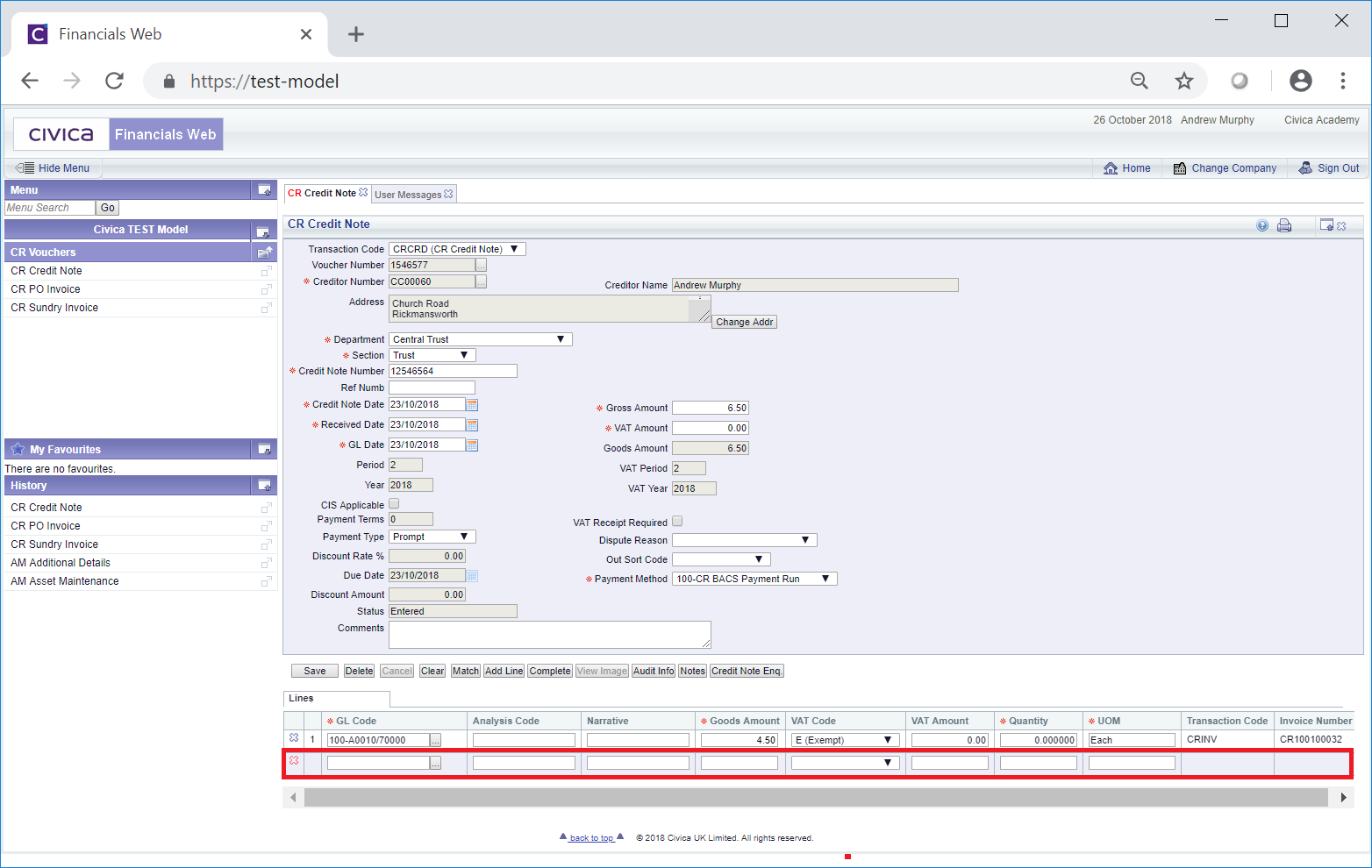

Where any new Invoices are matched, i.e. added to the Grid, clicking on the ![]() button located to the left of the new Line will remove it from the Grid.

button located to the left of the new Line will remove it from the Grid.

Add details to the fields in the Line as required (mandatory fields are notated with a red asterisk *).

The required Ledger Code can be added directly into the GL Code column for the Line. Alternatively clicking on the Find Ledger Code button located next to this field: ![]() will open the CR Ledger Code Search form allowing you to search for and select the required Ledger Code. This form is further detailed in the Ledger Code Search section. Once selected the required Ledger Code will be added to this field.

will open the CR Ledger Code Search form allowing you to search for and select the required Ledger Code. This form is further detailed in the Ledger Code Search section. Once selected the required Ledger Code will be added to this field.

More blank Lines can added by clicking on the ![]() button. Please ensure that the total of the Goods Amount column equals the amount on the Goods Amount field on the form. Also the total of the amounts in the VAT Amount column in the Grid should equal the amount in the VAT Amount field on the form.

button. Please ensure that the total of the Goods Amount column equals the amount on the Goods Amount field on the form. Also the total of the amounts in the VAT Amount column in the Grid should equal the amount in the VAT Amount field on the form.

New Lines added to the Grid can be removed by clicking on the ![]() button located to the left of the Line.

button located to the left of the Line.

Lines that already exist on the Grid can also be removed by clicking on the ![]() located to the left of the Line.

located to the left of the Line.

Where the status is set to ![]() , clicking on this button will change the status to

, clicking on this button will change the status to  if the full Credit Note amount has not been matched. If it has been matched in full it will change to either

if the full Credit Note amount has not been matched. If it has been matched in full it will change to either ![]() if authorisation is required, or

if authorisation is required, or ![]() if no authorisation is required.

if no authorisation is required.

Where the status is set to ![]() , clicking on this button will change the status to

, clicking on this button will change the status to ![]() if the full Credit Note amount has not been matched. If it has been matched in full it will change to

if the full Credit Note amount has not been matched. If it has been matched in full it will change to ![]() .

.

The following buttons will also be available when the status of the Credit Note is set to ![]() :

:

: Where this button is a enable, an image of the Credit Note will be available. Otherwise it will not be enabled. Clicking on this button when enabled and you will be able to view the image.

: Where this button is a enable, an image of the Credit Note will be available. Otherwise it will not be enabled. Clicking on this button when enabled and you will be able to view the image. . Notes are further detailed in the Notes section.

. Notes are further detailed in the Notes section.