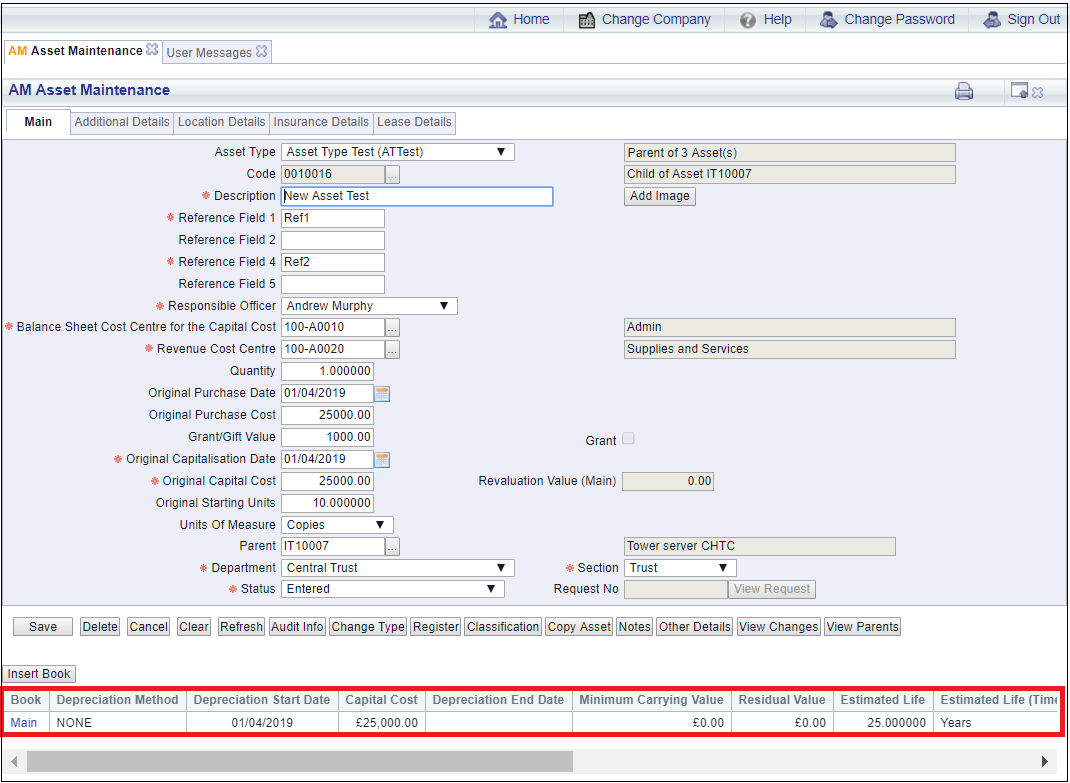

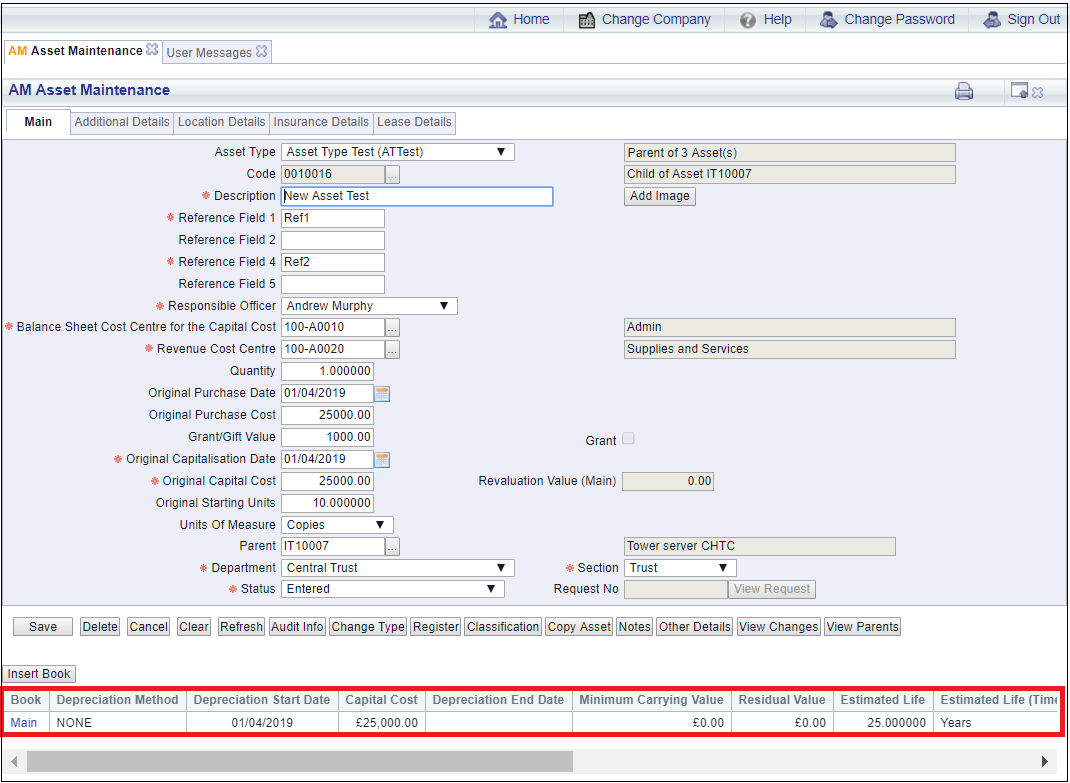

When creating an Assert clicking on the  button on the Main tab of the AM Asset Maintenance form, as detailed in the Creating Assets section, will allow you to insert an Asset Book into the Asset.

button on the Main tab of the AM Asset Maintenance form, as detailed in the Creating Assets section, will allow you to insert an Asset Book into the Asset.

When amending an Asset this button may also be available on the Main tab of the AM Asset Maintenance form, as detailed in the Amending Assets section.

Please note: The Main Asset Book will be required to be inserted. Further Asset Books can be inserted but only if this had been configured with agreement from your organisation.

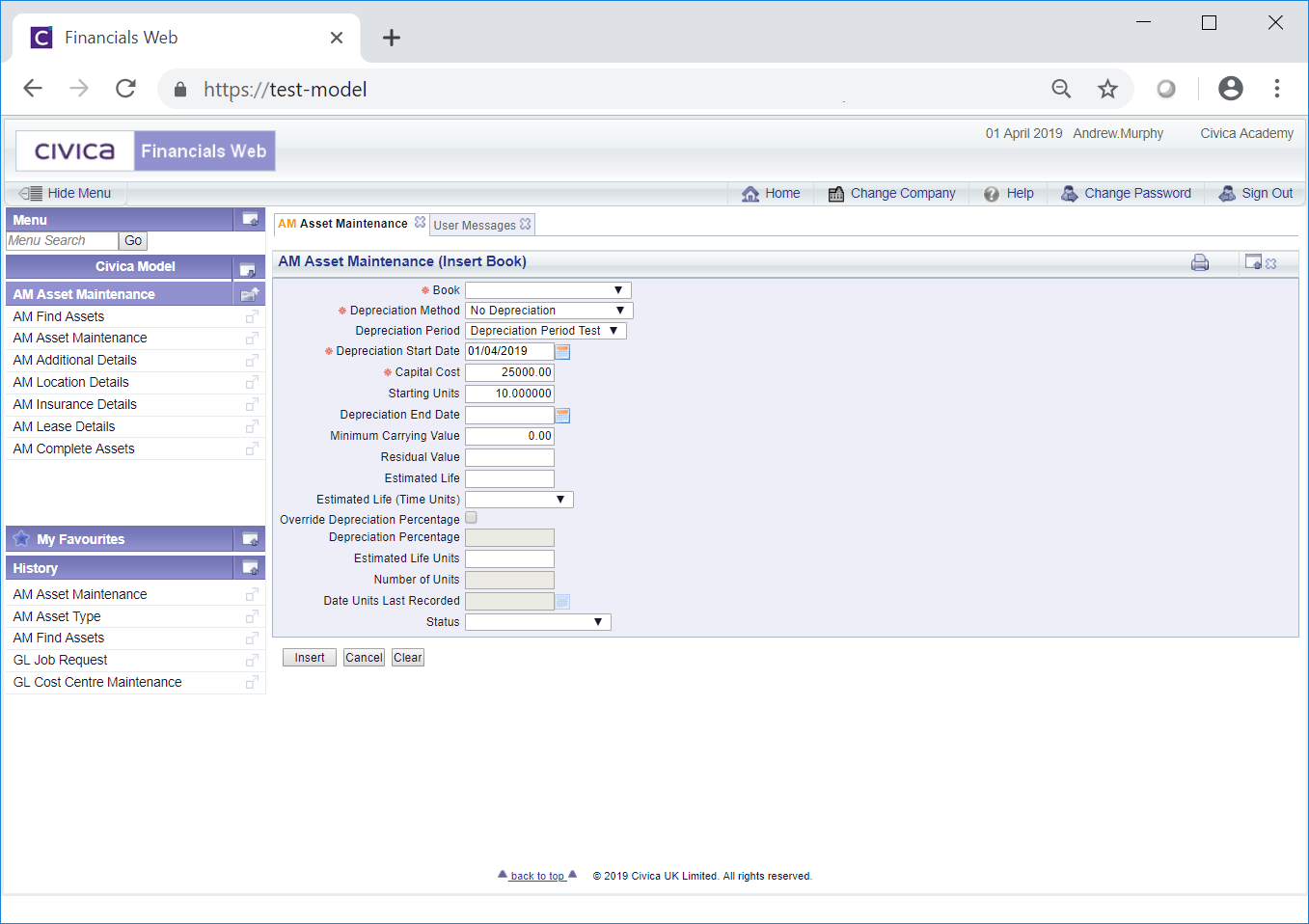

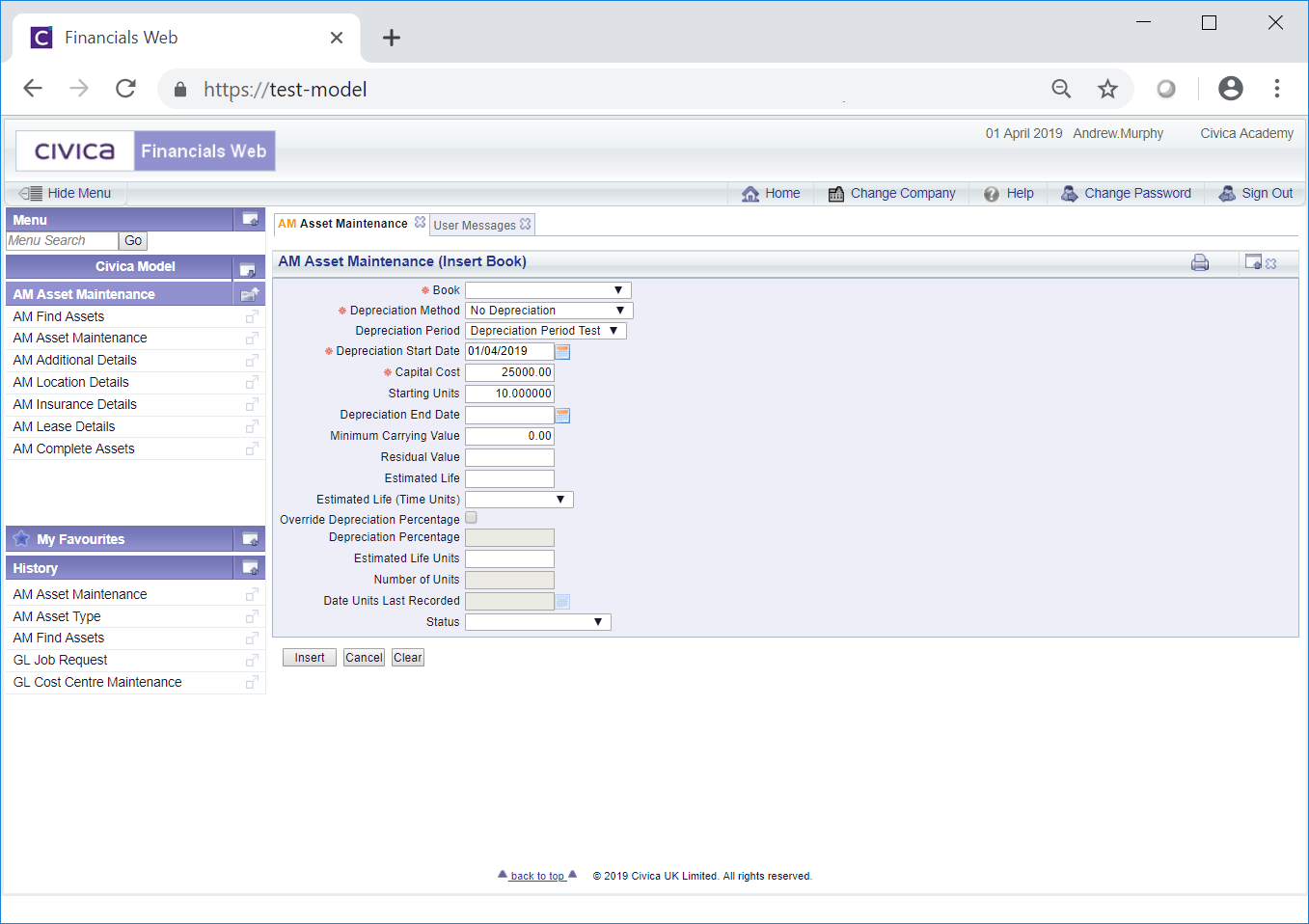

The AM Asset Maintenance (Insert Book) form will open:

The fields available on this form are as follows (mandatory fields are notated with a red asterisk *):

- Book: Select the relevant Asset Book from this drop-down field.

- Depreciation Method: The default option in this field will be defined by the option selected in the Depreciation Method field on the Asset Type that has been added to the Asset Type field on the Main tab of the AM Asset Maintenance form. Asset Types are further detailed in the Asset Types section.

The option in this field can be changed, if required, by selecting a different option from the drop-down list.

- Depreciation Period: The default option in this field will be defined by the option selected in the Depreciation Period field on the Asset Type that has been added to the Asset Type field on the Main tab of the AM Asset Maintenance form. Asset Types are further detailed in the Asset Types section.

The option in this field can be changed, if required, by selecting a different option from the drop-down list. These options are defined as detailed in the Depreciation Period section of Asset Admin.

- Depreciation Start Date: The field should include that date that the Asset will be initially depreciated from. It will default either to:

- The date added to the Original Capitalisation Date field on the Main tab of the AM Asset Maintenance form, or

- The 1 April of the following year where the Do Not Depreciate in Year of Acquisition is set in the configuration.

The date can be changed if required.

- Capital Cost: The amount in this field will default to the amount added to the Original Cost field on the Main tab of the AM Asset Maintenance form. The amount can be changed if required. Once the Asset book is inserted the amount in this field will be added to the Revaluation Value (Main) field on the AM Asset Maintenance form.

- Starting Units: The amount in this field will default to the amount added to the Original Starting Units field on the Main tab of the AM Asset Maintenance form. The amount can be changed if required.

- Depreciation End Date: Add a date to this field to specify the date that depreciation will end, if required.

- Minimum Carrying Value: This field will define the amount below which the Asset will not be depreciated. The amount in this field will be the amount in the Minimum Carrying Value field on the Asset Type that has been added to the Asset Type field on the Main tab of the AM Asset Maintenance form. Asset Types are further detailed in the Asset Types section. The amount in the Minimum Carrying Value field can be amended, as required.

- Residual Value: An estimated amount for the residual value of the Asset can be added this field, if required.

- Estimated Life: If the option in the Depreciation Method field, as detailed above, is set to Units of Use, this field will not be required. Otherwise add the time period amount over which the asset is to be depreciated - the time period, e.g. months or years, is defined in the Estimated Life (Time Units) field, as detailed immediately below.

- Estimated Life (Time Units): Select the relevant time period, e.g. month or year, from this drop-down field where an amount has been added to the Estimated Life field, detailed immediately above.

- Override Depreciation Percentage: Select this tick box to override the Depreciation Percentage. This option will only be available where the Depreciation Method field, as detailed above, is set to either Straight Line, Fixed Declining Balance or Double Declining Balance.

- Depreciation Percentage: This field will only be available where the Override Depreciation Percentage option, as detailed immediately above, has been selected. Where available add the required Depreciation Percentage Amount for the Asset to this field.

- Estimated Life Units: This field is only required where the Depreciation Method field, as detailed above, is set to Units of Use and it should specify the estimated life of the Asset in terms of the Units of Measure as detailed on the Units of Measure field on the Main tab of the AM Asset Maintenance form. When creating an Asset is should include the amount in the Starting Units field detailed above.

- Number of Units: Once the Asset Book is inserted the amount in this field will default to the amount in the Starting Units field, as detailed above. It specifies the current reading for the Number of Units of the Asset and is maintained when the Asset is depreciated.

- Dates Units Last Recorded: This field will be blank and will not be currently be available as it specifies the date that the Number of Units was lasted entered for the Asset Book and is maintained by the system.

The following buttons are available:

If you are amending an Asset you will be returned to the Main tab of the AM Asset Maintenance form, as detailed in the Amending Assets section.

The Asset Book will not be inserted into the Asset.

: Clicking on the button will close the form and any changes will be lost. The original version of the AM Asset Maintenance form will open allowing you to create or search for an Asset.

: Clicking on the button will close the form and any changes will be lost. The original version of the AM Asset Maintenance form will open allowing you to create or search for an Asset. : Click on this button to insert the Asset Book into the Asset. The form will close and you will be returned to the Main tab on the AM Asset Maintenance form, as detailed in the Creating Assets section if you are creating an Asset,

: Click on this button to insert the Asset Book into the Asset. The form will close and you will be returned to the Main tab on the AM Asset Maintenance form, as detailed in the Creating Assets section if you are creating an Asset,

If you are amending an Asset you will be returned to the Main tab of the AM Asset Maintenance form, as detailed in the Amending Assets section.

The Asset Book will be added to a Grid underneath the  button.

button.

button on the Main tab of the AM Asset Maintenance form, as detailed in the Creating Assets section, will allow you to insert an Asset Book into the Asset.

button on the Main tab of the AM Asset Maintenance form, as detailed in the Creating Assets section, will allow you to insert an Asset Book into the Asset.

![]() button.

button.