Sundry Invoices can be created via the CR Sundry Invoice form.

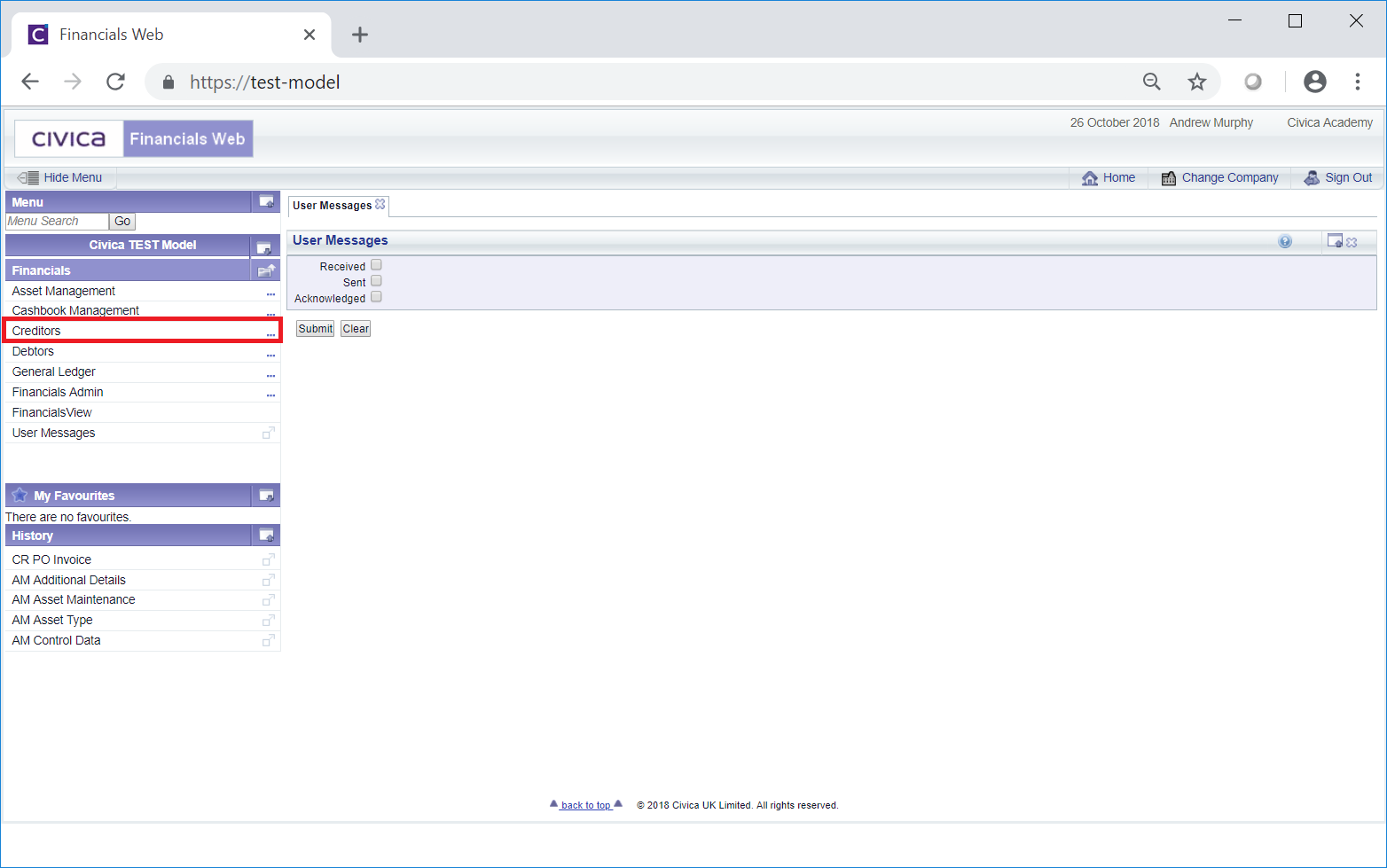

This form can be accessed from the Financials menu by selecting the Creditors menu option:

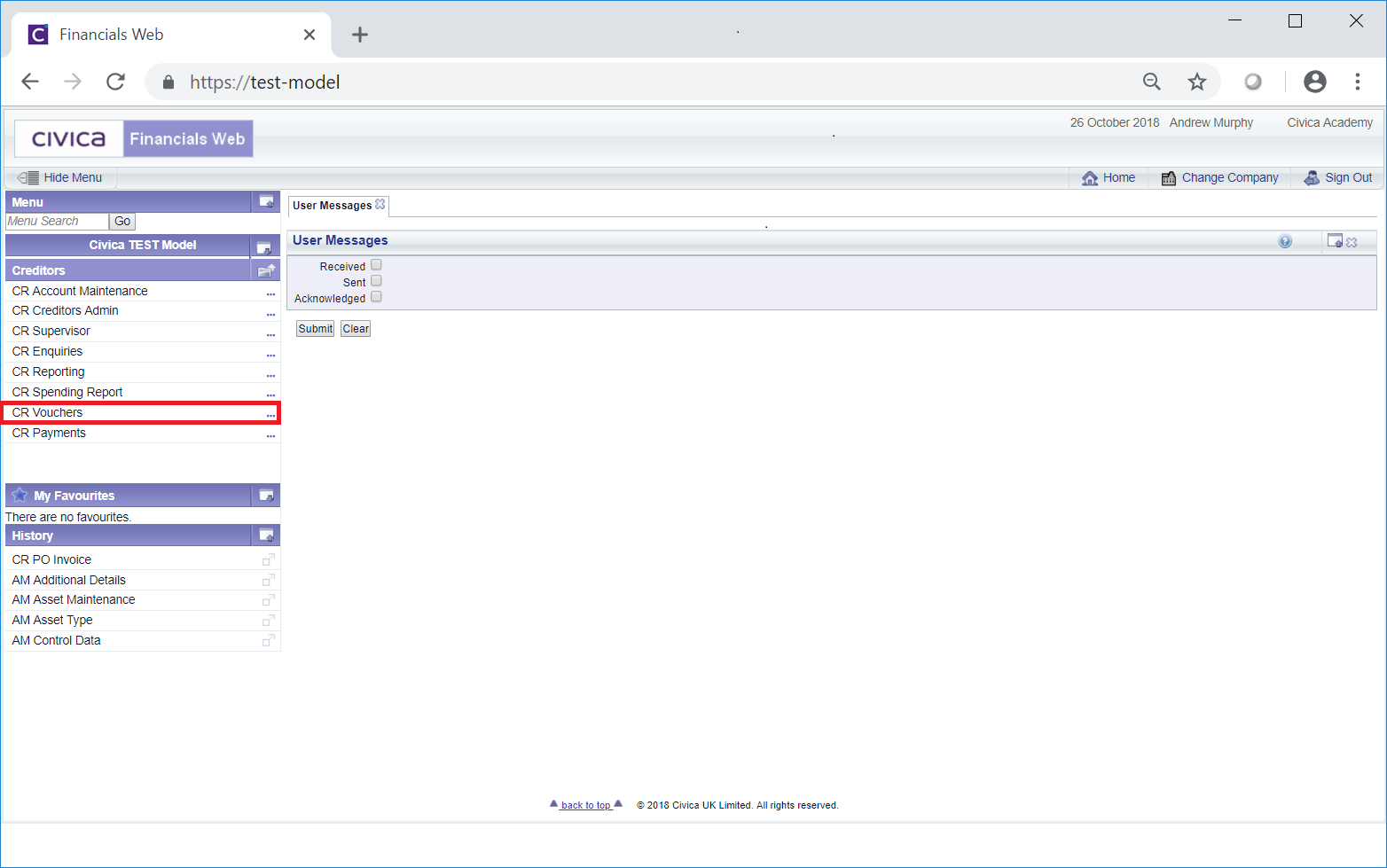

Then the CR Vouchers menu option:

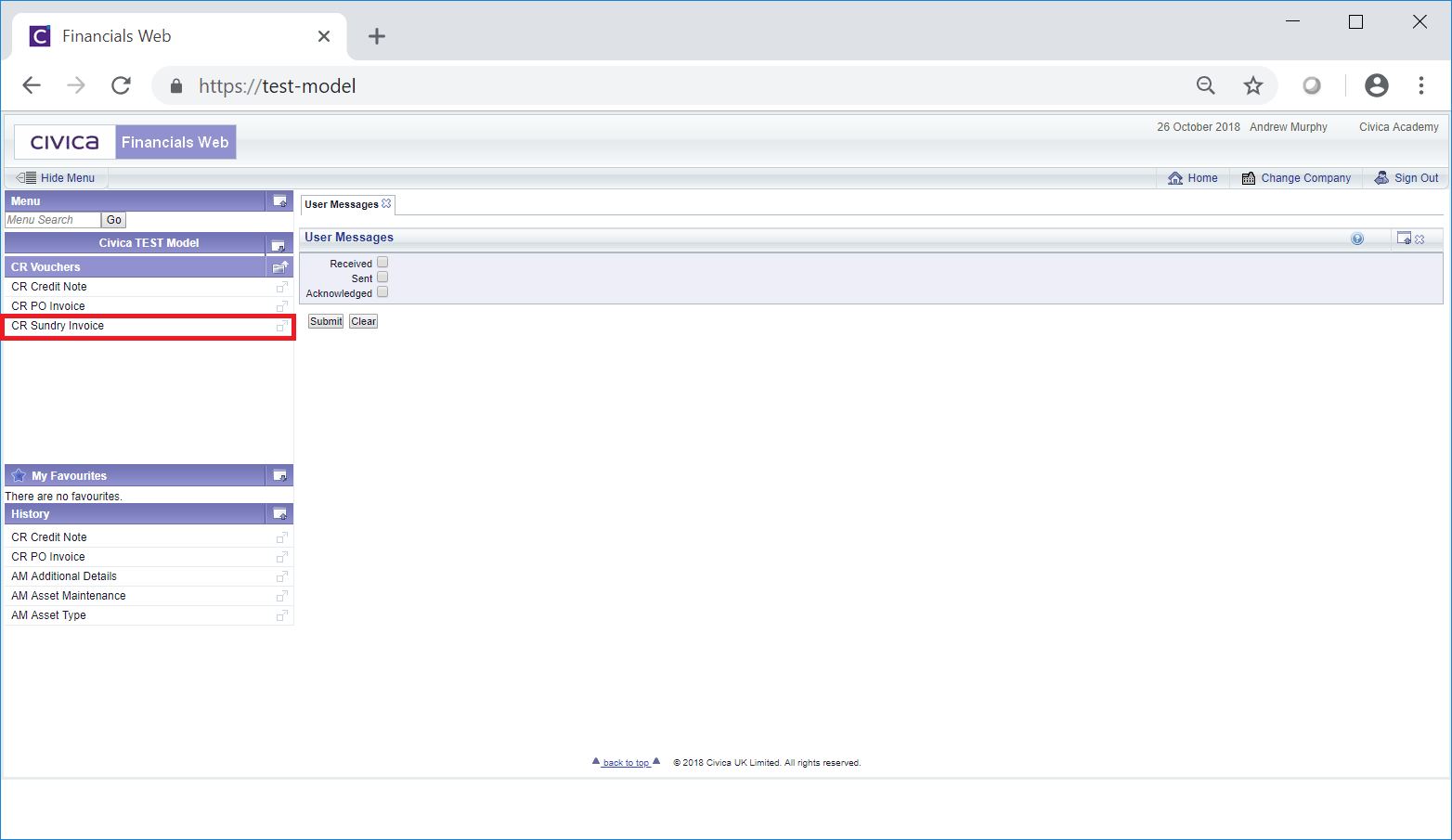

Then the CR Sundry Invoice option:

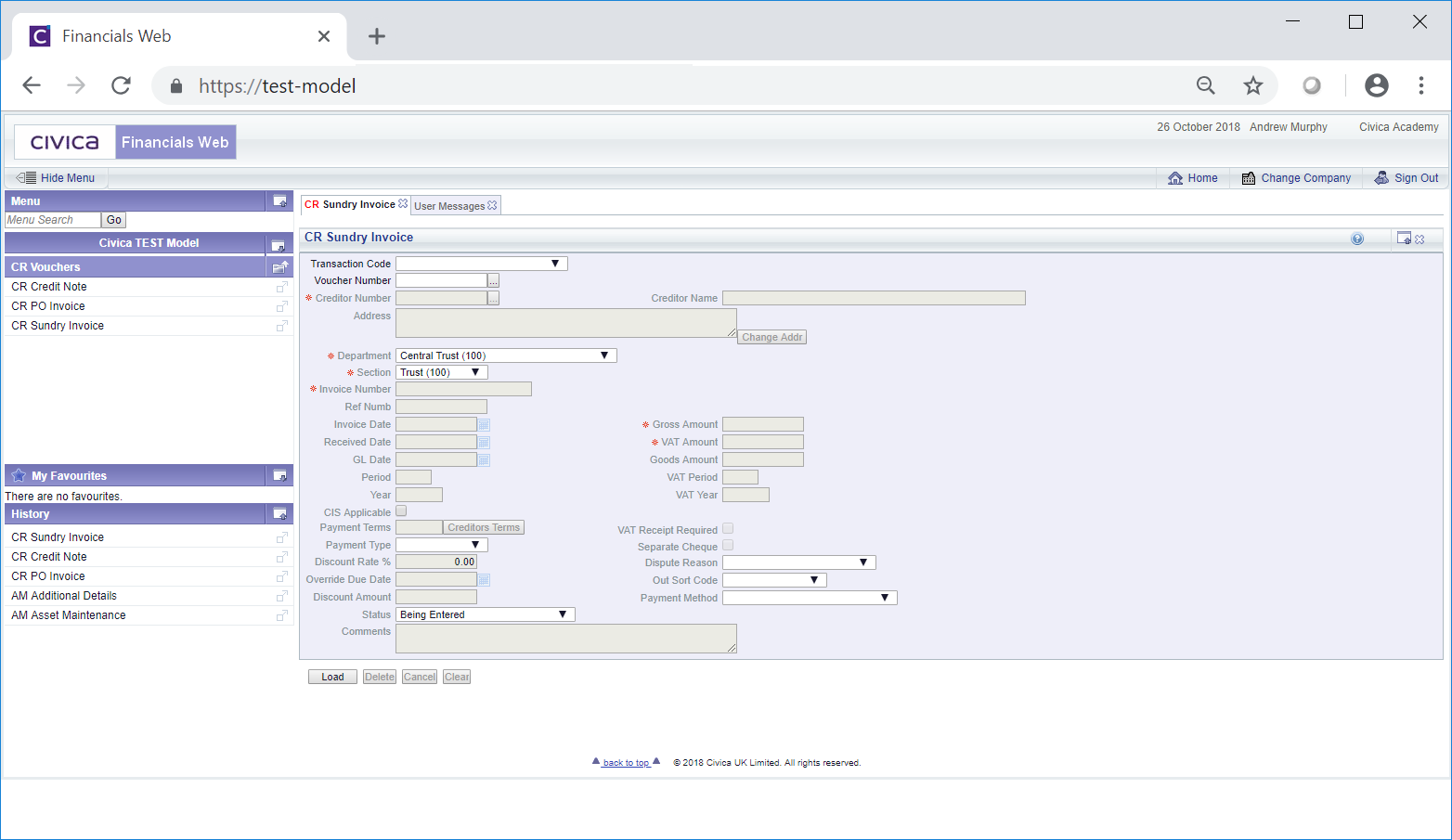

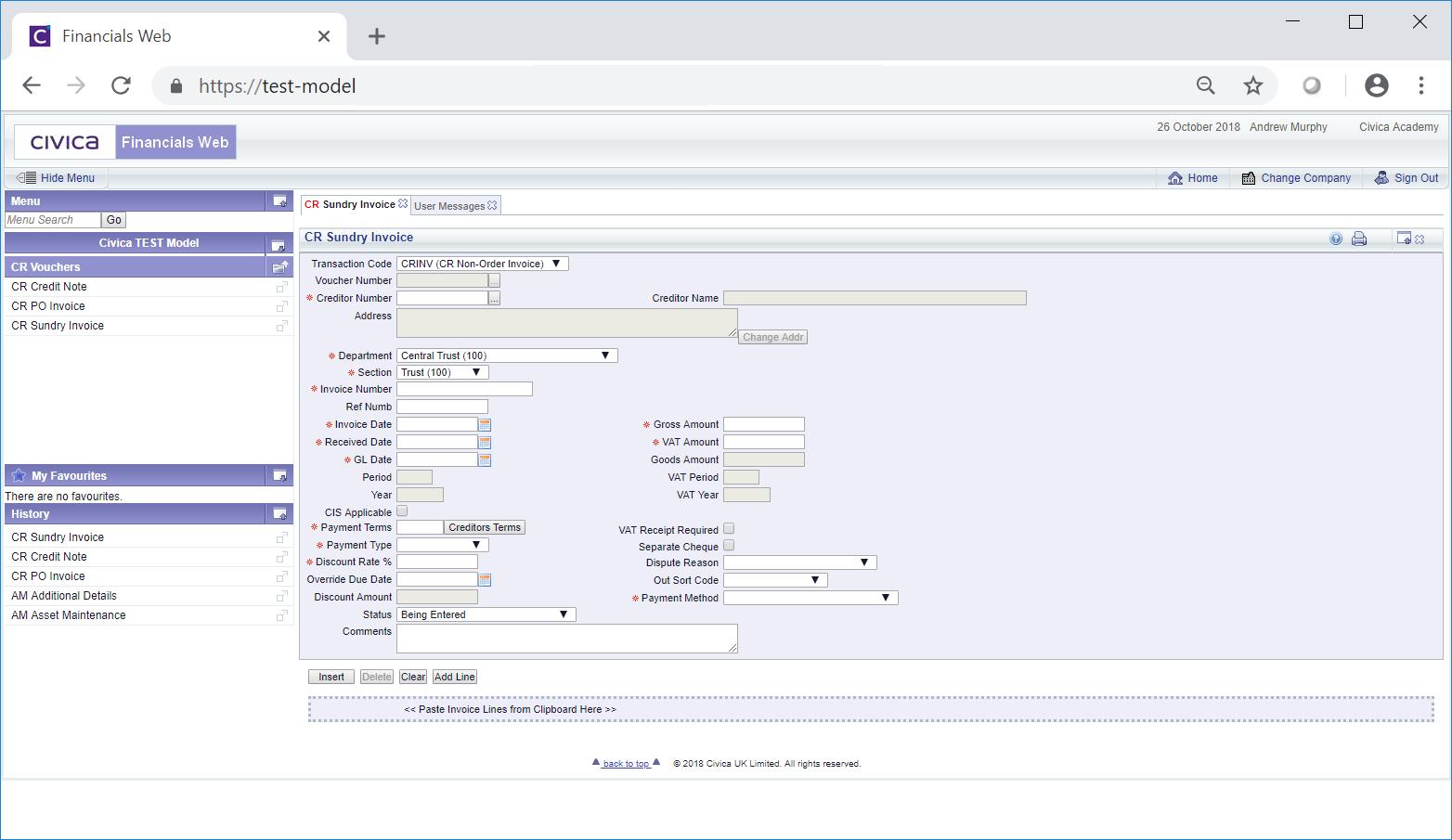

The CR Sundry Invoice form will then be displayed:

To create a new Sundry Invoice select the relevant option from the Transaction Code field and click on the ![]() button.

button.

Please Note: Where you have opted to auto generated Voucher Numbers, one will be created automatically. Otherwise you will need to add the Voucher Number before clicking on the ![]() button:

button:

Add details to the fields as required (mandatory fields are notated with a red asterisk *).

These are:

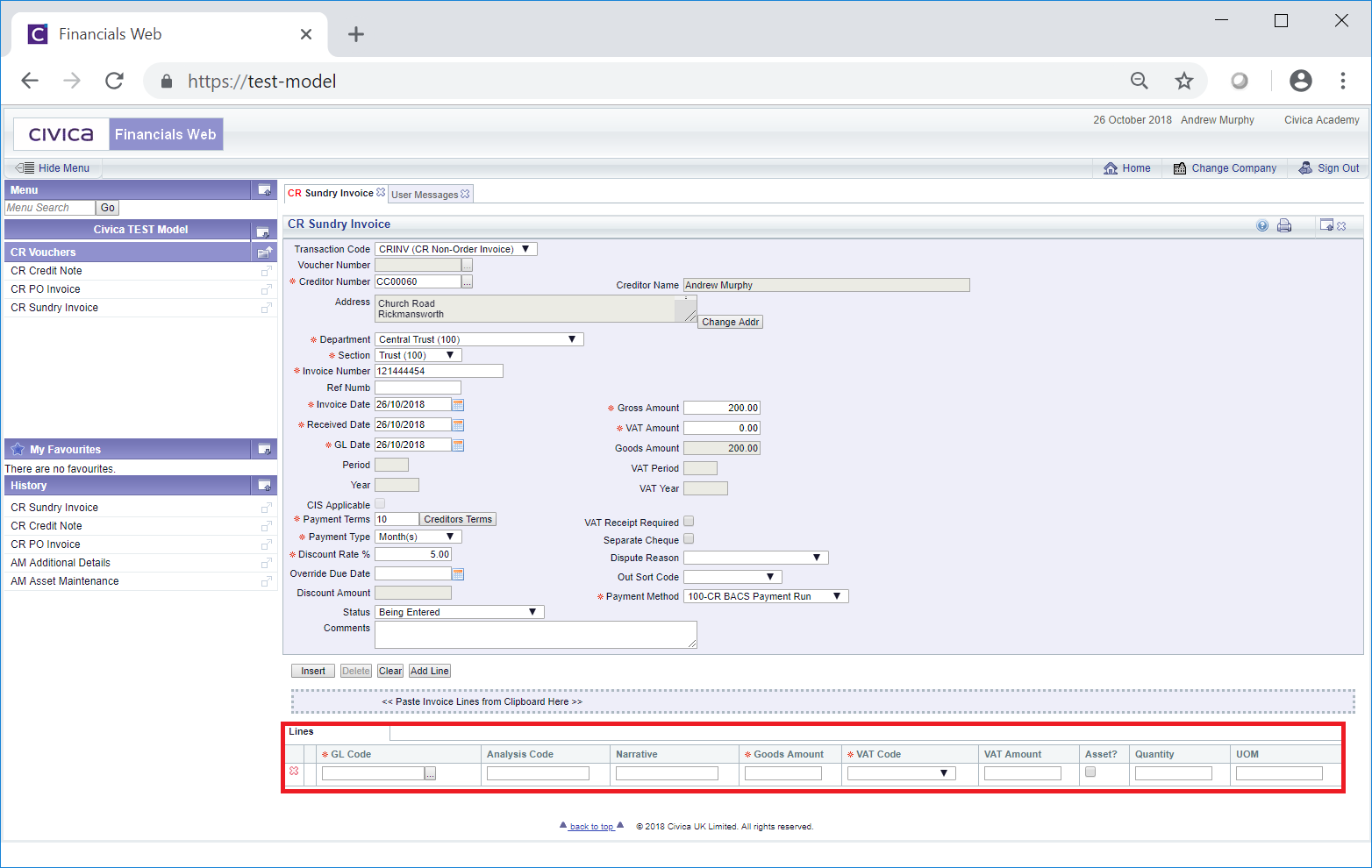

Once the Creditor number is added to this field the name of the Creditor will be added to the Creditor Name field, which cannot be changed.

The Address field will also be populated from the Main address on the Creditor record, which is further detailed in the Maintain Creditor Addresses section. This can be changed by clicking on the  button located at the bottom right hand corner of the Address field. This will open the CR Find Creditor Addresses screen that will list all the Addresses that are on the Creditor record. Selecting a different Address on this form will replace the details in the Address field with the selected address details. This form is further detailed in the Find Creditor Addresses section.

button located at the bottom right hand corner of the Address field. This will open the CR Find Creditor Addresses screen that will list all the Addresses that are on the Creditor record. Selecting a different Address on this form will replace the details in the Address field with the selected address details. This form is further detailed in the Find Creditor Addresses section.

Please note: when adding details to the Gross Amount field and the VAT Amount field, the Goods Amount field on the form will be updated with the net amount.

These terms can be changed by clicking on the ![]() button to the right of the Payment Terms field. This will open the CR Find Creditor Payment Terms screen, which will display all the Payment Terms that are on the Creditor record. Selecting a different Payment Term on this screen will replace the details in these three fields with the selected term details. This form is further detailed in the Find Creditor Payment Terms section.

button to the right of the Payment Terms field. This will open the CR Find Creditor Payment Terms screen, which will display all the Payment Terms that are on the Creditor record. Selecting a different Payment Term on this screen will replace the details in these three fields with the selected term details. This form is further detailed in the Find Creditor Payment Terms section.

Alternatively the details in each of these fields can be amended by clicking into the field and typing in the required details.

Please note: the option added to this field will be used when processing the payment for the Invoice, which is further detailed in the Creditor Payments section.

The options available will be dependant on the set up of your organisation. Organisations that have responsibility for school/academies, e,g a Trust, will have payment method options for the Trust, which will be denoted with a Department of 100, and payment method options for each school/academy, which will be denoted with subsequent Department numbers, e.g, 101, 102, 103 etc.

There will also be separate options for both BACS and Cheque payments. For example BACS payment methods for the Trust will include 100-CRBACS. BACS payments for individual schools/academies in the Trust will include 101-CRBACS, 102-CRBACS, 103-CBACS etc. Cheque payment methods for the Trust will include100-CRCHQ and for individual schools/academies in the Trust will include 101-CRCHQ, 102-CRCHQ, 103-CRCHQ etc.

If the Invoice is to be paid from the Trust, the option selected in the Payment Method field should include the Trust department number, e.g. 100-CRBACS for BACS payments or 100-CRCHQ for Cheques. If the Invoice is to be paid from an individual school/academy, the option selected should include that school/academy Department number, e.g. for BACS payments 101-CRBACS, 102-CRBACS, 103-CBACS etc, or for Cheque payments 101-CRCHQ, 102-CRCHQ, 103-CRCHQ etc.

Ensure that the correct option is selected in this field.

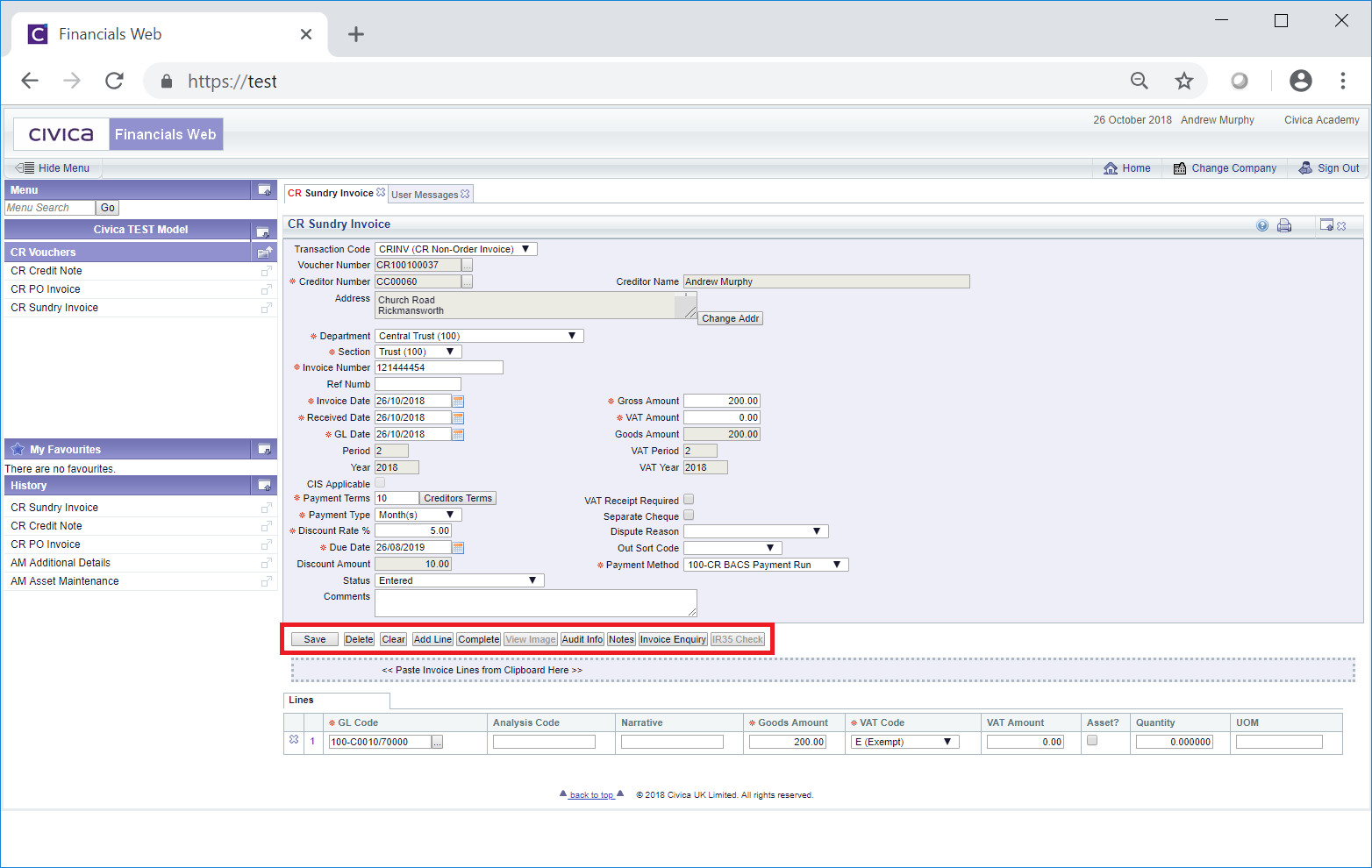

The following buttons are also available:

Add details to the fields in the Line as required (mandatory fields are notated with a red asterisk *).

The required Ledger Code can be added directly into the GL Code column for the Line. Alternatively clicking on the Find Ledger Code button located next to this field: ![]() will open the CR Ledger Code Search form allowing you to search for and select the required Ledger Code. This form is further detailed in the Ledger Code Search section. Once selected the required Ledger Code will be added to this field.

will open the CR Ledger Code Search form allowing you to search for and select the required Ledger Code. This form is further detailed in the Ledger Code Search section. Once selected the required Ledger Code will be added to this field.

Click on this button to add further Lines as required. Please ensure that the total of the Goods Amt. column in the Grid equals the amount in the Goods Amount field in the form and that the total of the VAT Amt. column in the Grid equals the amount in the VAT Amount field in the form.

In addition where the product is an Asset, an Asset Request can be sent to the FinancialsLIVE Asset Management module to create an Asset for it. An Asset Request can be created and sent by selecting the Asset? option on the Line. Creating an Asset in the Asset Management module from an Asset Request is further detailed in the Asset Registration Request section.

Lines on the Grid can be removed by clicking on the ![]() button located at the left of each Line.

button located at the left of each Line.

You will also note that the status of the Invoice has changed from ![]() to

to ![]() .

.

The buttons near the bottom of the form are:

button located at the left of each Line.

button located at the left of each Line. : Where this button is a enable, an image of the Purchase Order will be available. Otherwise it will not be enabled. Clicking on this button when enabled and you will be able to view the image.

: Where this button is a enable, an image of the Purchase Order will be available. Otherwise it will not be enabled. Clicking on this button when enabled and you will be able to view the image.