Assets are normally depreciated in bulk as detailed in the Asset Bulk Depreciation Process section but it may be necessary to depreciate an individual Asset before it is revalued, as detailed in the Revaluation section, or disposed, as detailed in the Disposal section.

Individual Assets can be depreciated via the AM Depreciation form, which can be accessed by clicking on the  button on the Main tab of the AM Asset Maintenance form, as detailed in the Amending Assets section.

button on the Main tab of the AM Asset Maintenance form, as detailed in the Amending Assets section.

Where the Status of the Asset is set to  , clicking on the

, clicking on the  button will allow you to create a new Depreciation transaction.

button will allow you to create a new Depreciation transaction.

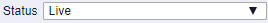

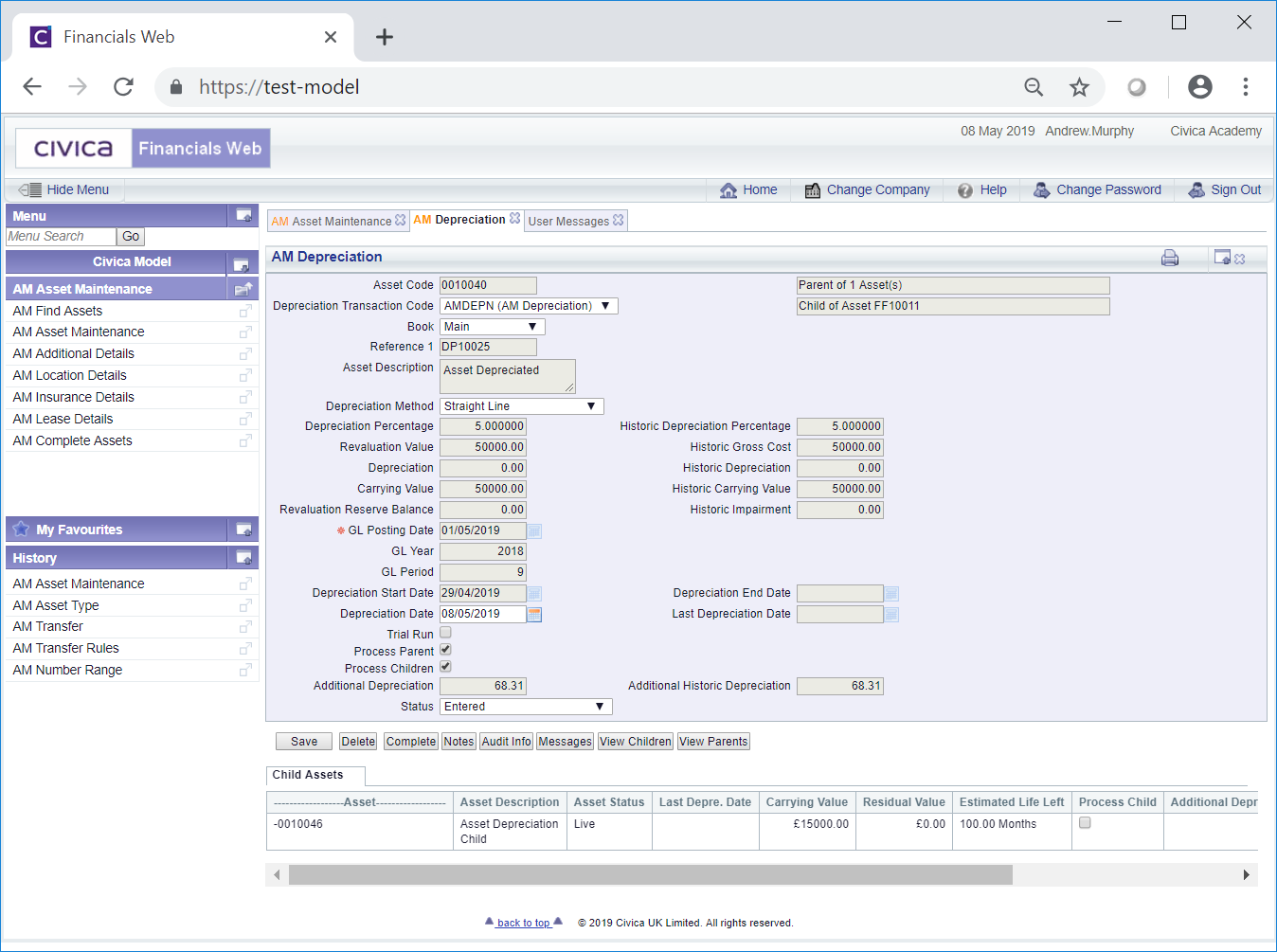

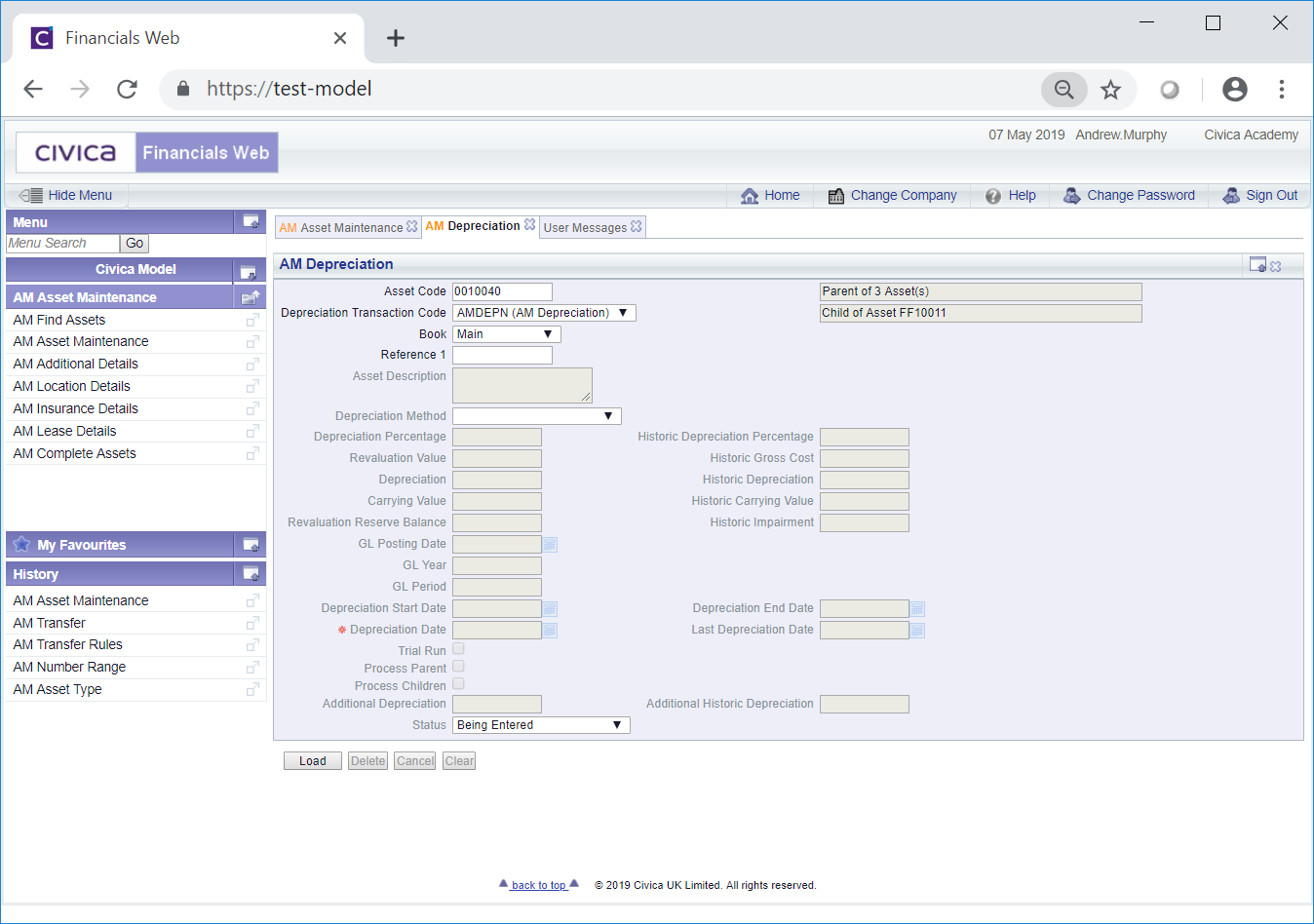

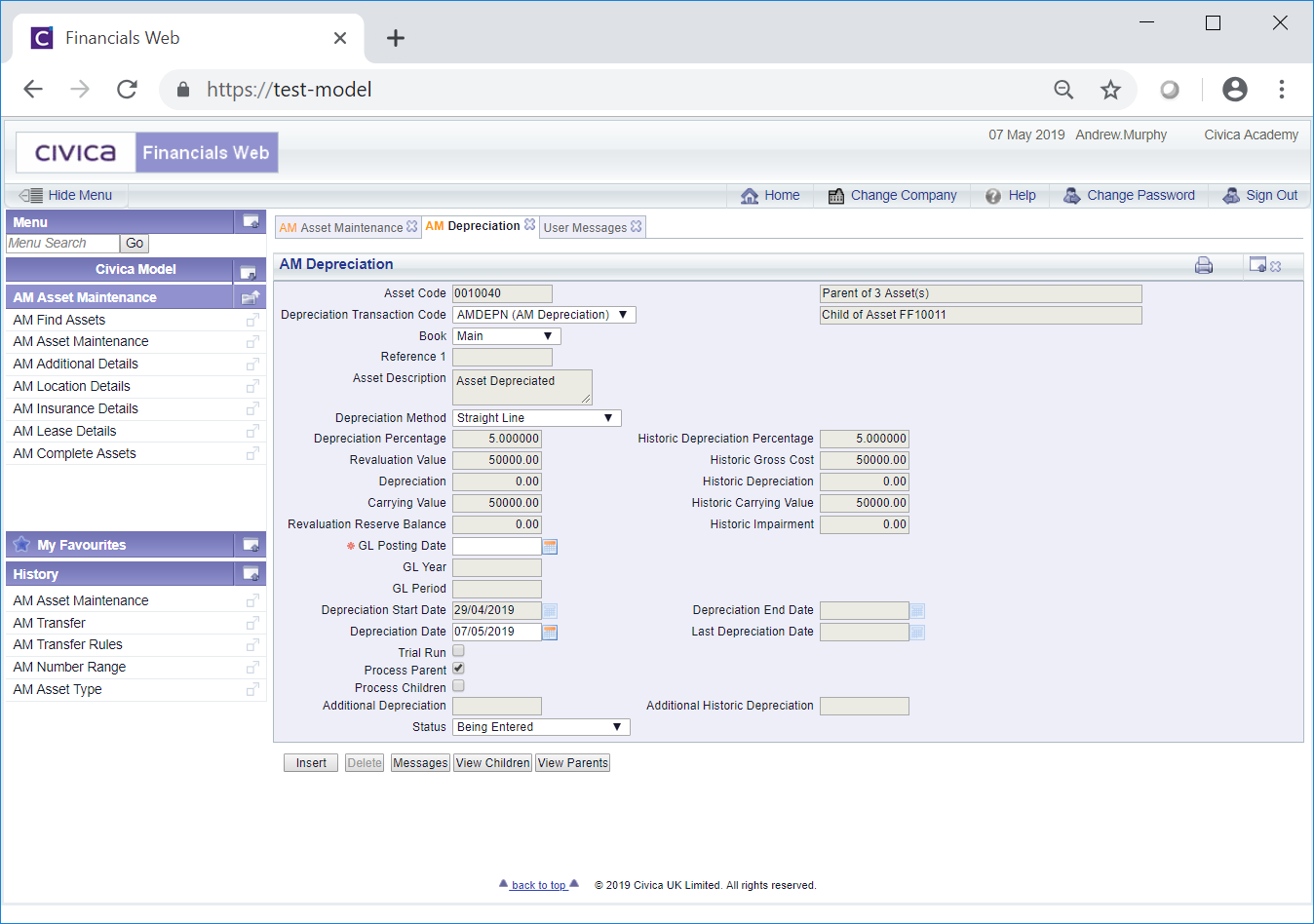

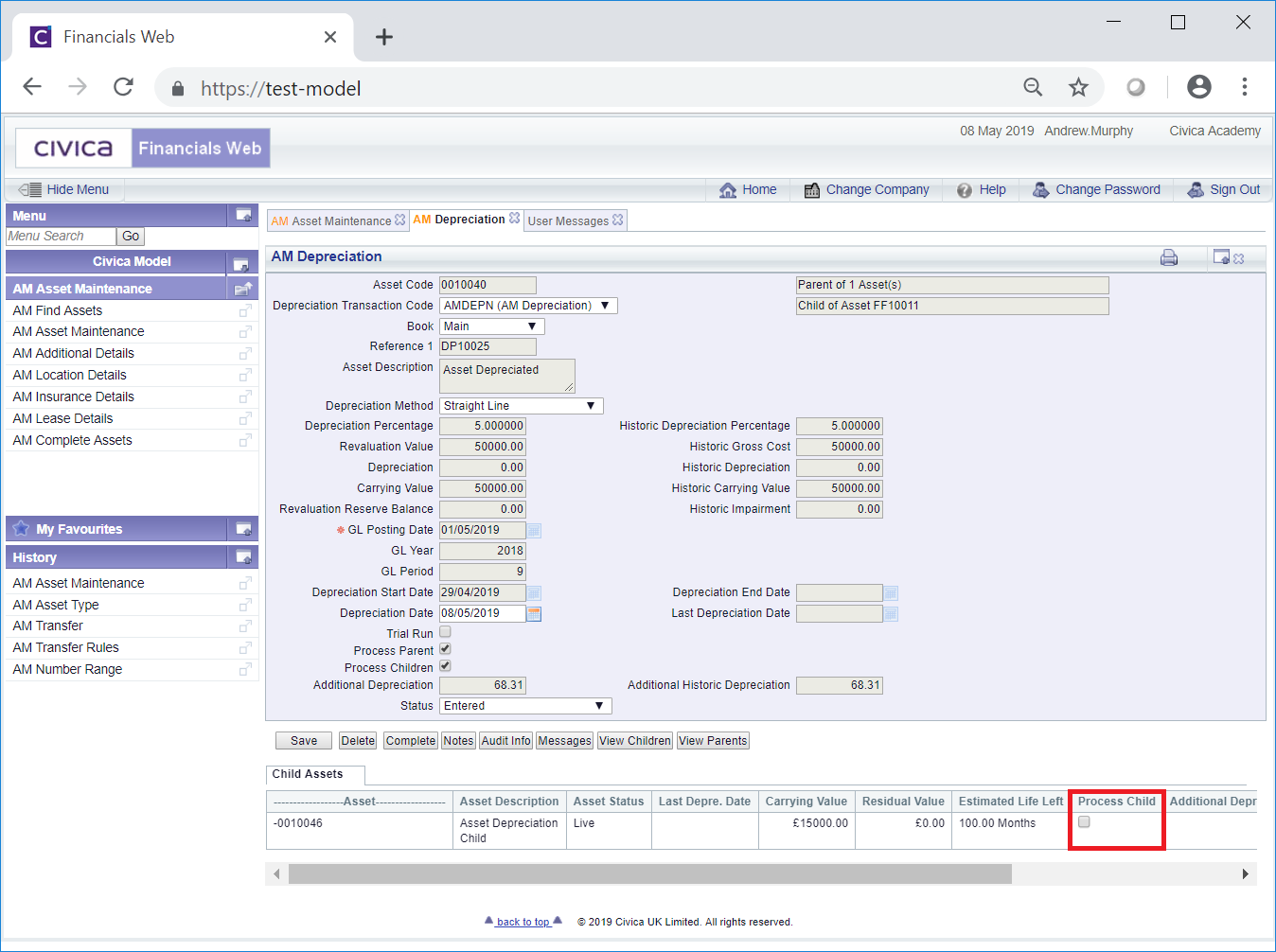

The AM Depreciation form will open:

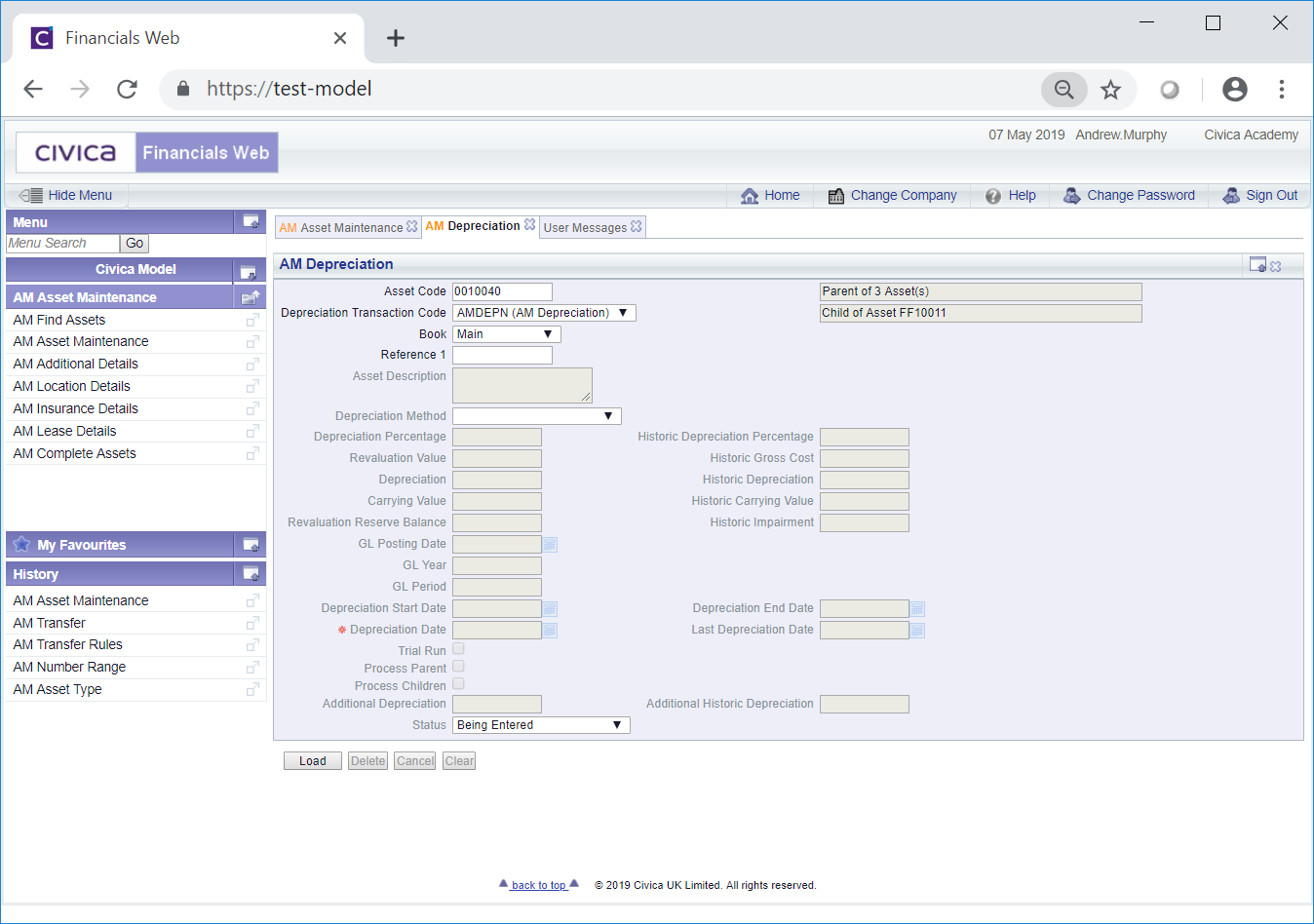

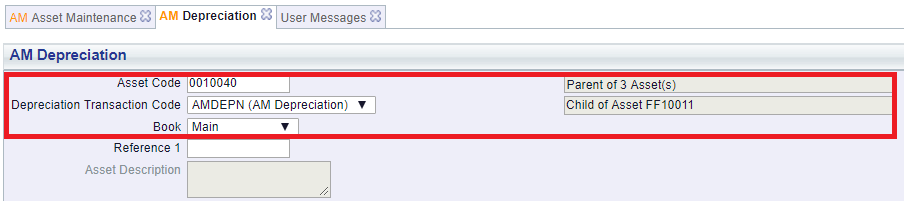

The first few fields on the form will be populated from the Asset on the AM Asset Maintenance form where the  button was selected:

button was selected:

A unique transaction reference will need to be added to the Reference 1 field where these are not automatically generated. Where these are generated automatically this field can be left blank. Please note: this field may have a different label dependent on your configuration.

Click on the  button:

button:

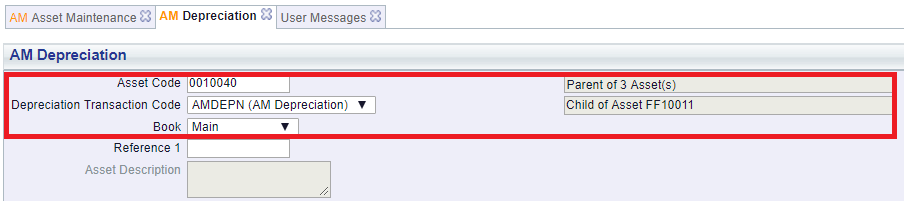

The following fields are displayed (mandatory fields are notated with a red asterisk *):

- Asset Code: This field will display the code of the Asset to be depreciated and cannot be changed.

- Depreciation Transaction Code: This field will display the transaction code for the Depreciation transaction and cannot be changed.

- Book: This field will default to Main Asset Book of the Asset but can be changed where the Asset has more than one Asset Book by selecting the relevant option from the drop-down list.

- Reference 1: This field will contain the reference for the transaction where it has been manually added. Where it is to be automatically generated this field will be blank. The details in this field cannot be changed. Please note: this field may have a different label dependent on your configuration.

- Asset Description: This field will contain the description of the Asset to be depreciated and cannot be changed.

- Depreciation Method: This field will default to the option in the Depreciation Method field from the Asset Book that is displayed in the Book field detailed above and cannot be changed. This can be found on the Grid at the bottom of the AM Asset Maintenance form of the Asset.

- Depreciation Percentage: This field will default to the amount in the Depreciation Percentage field from the Asset Book that is displayed in the Book field detailed above and cannot be changed. This can be found on the Grid at the bottom of the AM Asset Maintenance form of the Asset.

- Revaluation Value: This field will default to the amount in the Revaluation Value field from the Asset Book displayed in the Book field detailed above and cannot be changed. This amount can be found on the AM Asset Other Details screen that can be accessed by clicking on the

button on the new Asset on the AM Asset Maintenance form.

button on the new Asset on the AM Asset Maintenance form.

This amount will initially be the same as the amount on the Original Capital Cost field on the AM Asset Maintenance form for the Asset but will be changed where the Asset is revalued. Revaluing Assets is further detailed in the Revaluation section.

- Depreciation: This field will default to the amount on the Depreciation field on the Asset Book displayed in the Book field detailed above and cannot be changed. This amount can be found on the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- Carrying Value: This field will default to amount in the Carrying Value field on the Asset Book displayed in the Book field detailed above and cannot be changed. This amount can be found on the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- Revaluation Reserve Balance: This field will default to the amount in the Revaluation Reserve Balance field on the Asset Book displayed in the Book field detailed above and cannot be changed. This amount can be found on the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form .

button on the Asset on the AM Asset Maintenance form .

- Historic Depreciation Percentage: This field will default to the Historic Depreciation Percentage on the Asset Book displayed in the Book field detailed above and cannot be changed. This percentage can be found in the Depreciation Percentage field on the Historic tab of the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- Historic Gross Cost: This field will default to the Historic Gross Cost amount on the Asset Book displayed in the Book field detailed above and cannot be changed. This amount can be found in the Gross Cost field on the Historic tab of the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- Historic Depreciation: This field will default to the Historic Depreciation amount on the Asset Book displayed in the Book field detailed above and cannot be changed. This amount can be found in the Depreciation field on the Historic tab of the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- Historic Carrying Value: This field will default to the Historic Carrying Value amount on the Asset Book displayed in the Book field detailed above and cannot be changed. This amount can be found in the Carrying Value field on the Historic tab of the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- Historic Impairment: This field will default to the Historic Impairment amount on the Asset Book displayed in the Book field detailed above and cannot be changed. This amount can be found in Impairment field on the Historic tab of the AM Asset Other Details screen that can be accessed by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

- GL Posting Date: Add the date that the Depreciation transaction is to be posted to the General Ledger.

- GL Year: The Year in this field will be determined by the date added to the GL Posting Date field, as detailed immediately above, and will be populated once the

button is clicked on, as detailed below. You will not be able to change this field directly.

button is clicked on, as detailed below. You will not be able to change this field directly.

- GL Period: The Period in this field will be determined by the date added to the GL Posting Date field, as detailed above, and will be populated once the

button is clicked on, as detailed below. You will not be able to change this field directly.

button is clicked on, as detailed below. You will not be able to change this field directly.

- Depreciation Start Date: This field will display the date in the Depreciation Start Date field on the Asset Book as detailed in the Book field above and cannot be changed. This can be found on the Grid at the bottom of the AM Asset Maintenance form of the Asset.

- Depreciation End Date: This field will display the date in the Depreciation End Date field on the Asset Book as detailed in the Book field above and cannot be changed. Where there is no date on the Depreciation End Date field on the Asset Book this field will be blank. This can be found on the Grid at the bottom of the AM Asset Maintenance form of the Asset.

- Depreciation Date: This field will default to the current Assets Processing Date (normally today's date) and will be the date up to which the depreciation will be calculated (inclusive of this date). The date can be changed, if required.

- Last Depreciation Date: This field will display the date in the Last Depreciation Date field on the Asset Book as detailed in the Book field above and cannot be changed. This date can be found by clicking on the

button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

This will be the date that the Asset was last depreciated up to (and including). The Asset will be depreciated from the day after this date up to and including the date in the Depreciation Date field, detailed immediately above.

Where the date in the Depreciation Date field is after the date in the Depreciation End Date field, the Asset will be depreciated from the date after the date in the Last Depreciation Date field up to and including the date in the Depreciation End Date field.

Where there is no date on the Last Depreciation Date field on the Asset Book this field will be blank, in which case the Asset will be depreciated from the date in the Depreciation Start Date field up to and including the date in the Depreciation Date field. Where the date in the Depreciation Date field is after the date in the Depreciation End Date field, the Asset will be depreciated from the date in the Depreciation Start Date field up to and including the date in the Depreciation End Date field.

- Trial Run: When this option is selected the Depreciation transaction will still be created detailing the changes but no values will be updated on the Asset. This option can be selected or deselected as required.

- Number of Units: This field will only be displayed where the Depreciation Method field, as detailed above, is set to Units of Use. This field will display the amount in the Number of Units field on the Asset Book displayed in the Book field detailed above. This can be found on the Grid at the bottom of the AM Asset Maintenance form of the Asset.

This amount must be changed and must also be greater than the amount in the Last Number of Units field, as detailed immediately below. For example if the Asset is a vehicle with a mileage of 500 when purchased (Starting Units) and an expected life of 200,000 miles (Estimated Life Units), when it is depreciated for the first time, 500 will be in the Last Number of Units field and the current mileage should be added to this field, e.g 1,500 miles. Once depreciated the Last Number of Units field will contain 1,500.

- Last Number of Units: This field will only be displayed where the Depreciation Method field, as detailed above, is set to Units of Use. This field will display the amount in the Last Number of Units field on the Asset Book in the Book field, as detailed above. This can be found on the Grid at the bottom of the AM Asset Maintenance form of the Asset. The amount in this field can not be changed.

Where the Last Number of Units field on the Asset Book is blank, this field will display the same amount as in the Number of Units field, as detailed above.

Depreciation will be calculated for the number of additional units between the amount in the Number of Units field, as detailed immediately above, and the amount in the Last Number of Units field.

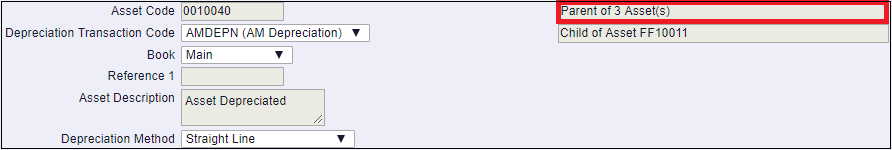

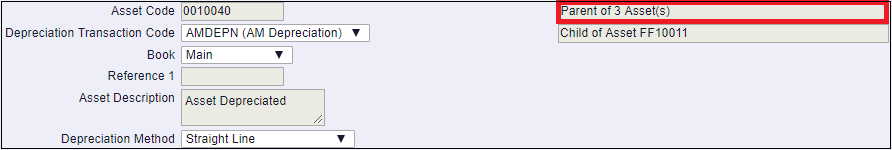

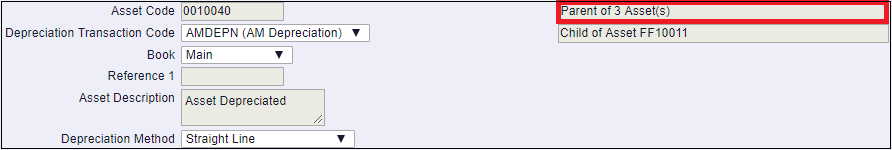

- Process Parent: This option will be available where the Asset has one or more Child Assets, i.e. it is a Parent Asset, and it will be selected by default. Whether the Asset is a Parent Asset will also be detailed at the top of the form:

Please note: the number of Children in this field will not include any Child Assets that have been Disposed or have been Cancelled.

Where this option is selected this Asset, i.e. the Parent Asset, will be depreciated. This option can be deselected where only the Child Assets are to be depreciated - some of the fields and options detailed above will be used when processing Child Assets such as the GL Posting Date and Depreciation Date fields as well as the Trial Run option.

Please also note: Assets with a Depreciation Method specified on the Asset Book of Units of Use will not be able to include any Child Assets for depreciation. The Depreciation Method can be found on the Grid at the bottom of the AM Asset Maintenance form of the Asset.

- Process Children: This option will be available where the Asset has one or more Child Assets, i.e. it is a Parent Asset, but the option will not be selected. Whether the Asset is a Parent Asset will also be detailed at the top of the form:

Please note: the number of Children in this field will not include any Child Assets that have been Disposed or have been Cancelled - only these Child Assets will be processed. In addition Assets with a Depreciation Method specified on the Asset Book of Units of Use will not be able to include any Child Assets for depreciation. The Depreciation Method can be found on the Grid at the bottom of the AM Asset Maintenance form of the Asset.

Where both the Parent and its Children are selected to be depreciated there will be the option to process any Child Asset that has a Status of  at the same time as the Parent is depreciated.

at the same time as the Parent is depreciated.

- Additional Depreciation: This field will be blank and you will not be able to change it. Once the Depreciation transaction is inserted, as detailed below, this field will display the depreciation to date above the Net Book Value of the Asset.

- Historic Additional Depreciation: This field will be blank and you will not be able to change it. Once the Depreciation transaction is inserted, as detailed below, this field will display the accumulated historic depreciation to date above the Net Book Value of the Asset.

- Status: This will be set to

and you will not be able to change this field.

and you will not be able to change this field.

The buttons at the bottom of the form are as follows:

: Clicking on this button will open the AM Asset Depreciation Messages screen allowing you to see any exception conditions when calculating the depreciation.

: Clicking on this button will open the AM Asset Depreciation Messages screen allowing you to see any exception conditions when calculating the depreciation. : This button will be displayed where the Asset is a Parent Asset, i.e. it has one or more Children. Clicking on this button will open the AM Asset's Children form, displaying the Asset's Children. This form is further detailed in the Assets Children section.

: This button will be displayed where the Asset is a Parent Asset, i.e. it has one or more Children. Clicking on this button will open the AM Asset's Children form, displaying the Asset's Children. This form is further detailed in the Assets Children section. : This button will be displayed where the Asset is a Child Asset, i.e. it has a Parent. Clicking on this button will open the AM Asset's Parents form, displaying the Asset's Parents. This form is further detailed in the Assets Parents section.

: This button will be displayed where the Asset is a Child Asset, i.e. it has a Parent. Clicking on this button will open the AM Asset's Parents form, displaying the Asset's Parents. This form is further detailed in the Assets Parents section. : Click on this button to create the Depreciation transaction:

: Click on this button to create the Depreciation transaction:

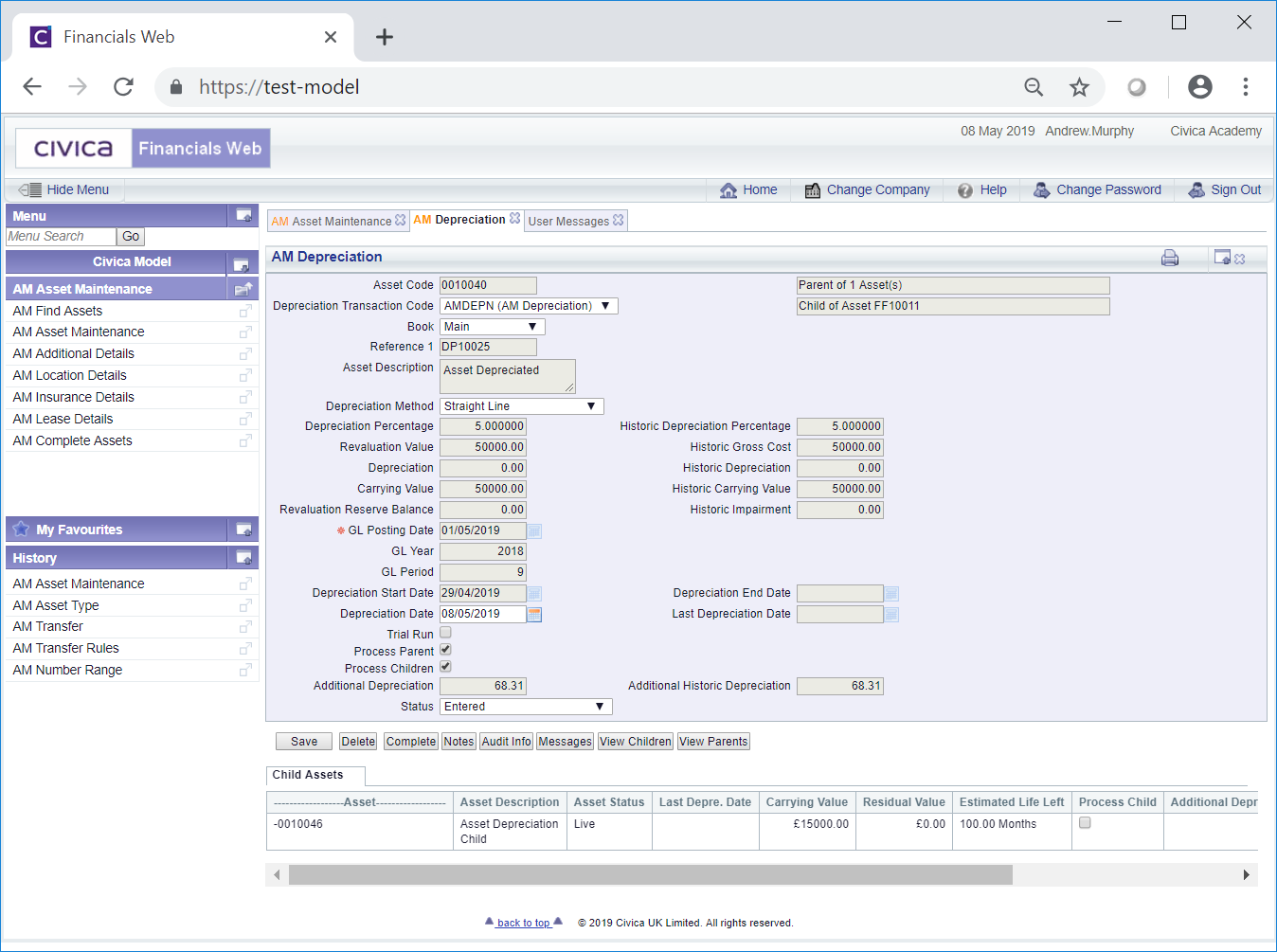

Where the Process Child option has been selected on the form, the Child Assets will be included in a Grid at the bottom of the form.

The same fields as detailed above will still be available and some can be changed, if required.

You will note that the Status of the transaction has now changed to  and that further buttons are now be available at the bottom of the form.

and that further buttons are now be available at the bottom of the form.

These are:

: Click on this button to save any further changes to the fields on the form and to any Grid at the bottom of the form.

: Click on this button to save any further changes to the fields on the form and to any Grid at the bottom of the form. : Click on this button to delete the transaction. A message will be displayed asking for confirmation that the transaction is to be deleted. Please note: the transaction can only be deleted where the status is set to

: Click on this button to delete the transaction. A message will be displayed asking for confirmation that the transaction is to be deleted. Please note: the transaction can only be deleted where the status is set to  .

. : Clicking on this button will allow you to add a note with regard to the Depreciation transaction. This is further detailed in the Notes section.

: Clicking on this button will allow you to add a note with regard to the Depreciation transaction. This is further detailed in the Notes section. : Clicking on this button will open the Audit Info screen, providing audit details of the Depreciation transaction. This is further detailed in the Audit Info section.

: Clicking on this button will open the Audit Info screen, providing audit details of the Depreciation transaction. This is further detailed in the Audit Info section. : Clicking on this button will complete the Depreciation transaction.

: Clicking on this button will complete the Depreciation transaction.

Where the Process Child option has been selected on the form ensure that the Process Child column in the Grid at the bottom of the form is also selected.

Where more than one Line is included in the Grid select this column for each Child that is to be depreciated.

Once the  button has been selected the form will change to a read only version of the AM Depreciation form where no further changes can be made and the Status of the Depreciation transaction will change to

button has been selected the form will change to a read only version of the AM Depreciation form where no further changes can be made and the Status of the Depreciation transaction will change to  . This form is further detailed in the AM Depreciation (Readonly) form section.

. This form is further detailed in the AM Depreciation (Readonly) form section.

button on the Main tab of the AM Asset Maintenance form, as detailed in the Amending Assets section.

button on the Main tab of the AM Asset Maintenance form, as detailed in the Amending Assets section.![]() , clicking on the

, clicking on the  button will allow you to create a new Depreciation transaction.

button will allow you to create a new Depreciation transaction.

button was selected:

button was selected:

![]() button:

button:

button on the new Asset on the AM Asset Maintenance form.

button on the new Asset on the AM Asset Maintenance form. button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form. button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form. button on the Asset on the AM Asset Maintenance form .

button on the Asset on the AM Asset Maintenance form . button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form. button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form. button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form. button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form. button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form. button on the Asset on the AM Asset Maintenance form.

button on the Asset on the AM Asset Maintenance form.

![]() at the same time as the Parent is depreciated.

at the same time as the Parent is depreciated. : Clicking on this button will open the AM Asset Depreciation Messages screen allowing you to see any exception conditions when calculating the depreciation.

: Clicking on this button will open the AM Asset Depreciation Messages screen allowing you to see any exception conditions when calculating the depreciation. : This button will be displayed where the Asset is a Parent Asset, i.e. it has one or more Children. Clicking on this button will open the AM Asset's Children form, displaying the Asset's Children. This form is further detailed in the Assets Children section.

: This button will be displayed where the Asset is a Parent Asset, i.e. it has one or more Children. Clicking on this button will open the AM Asset's Children form, displaying the Asset's Children. This form is further detailed in the Assets Children section. : This button will be displayed where the Asset is a Child Asset, i.e. it has a Parent. Clicking on this button will open the AM Asset's Parents form, displaying the Asset's Parents. This form is further detailed in the Assets Parents section.

: This button will be displayed where the Asset is a Child Asset, i.e. it has a Parent. Clicking on this button will open the AM Asset's Parents form, displaying the Asset's Parents. This form is further detailed in the Assets Parents section.

![]() and that further buttons are now be available at the bottom of the form.

and that further buttons are now be available at the bottom of the form.

![]() button has been selected the form will change to a read only version of the AM Depreciation form where no further changes can be made and the Status of the Depreciation transaction will change to

button has been selected the form will change to a read only version of the AM Depreciation form where no further changes can be made and the Status of the Depreciation transaction will change to ![]() . This form is further detailed in the AM Depreciation (Readonly) form section.

. This form is further detailed in the AM Depreciation (Readonly) form section.