To view and/or amend a VAT Recode adjustment to a VAT Return click on the  button on the GL VAT Return Header form, as detailed in the Viewing/ Amending Adjustments section.

button on the GL VAT Return Header form, as detailed in the Viewing/ Amending Adjustments section.

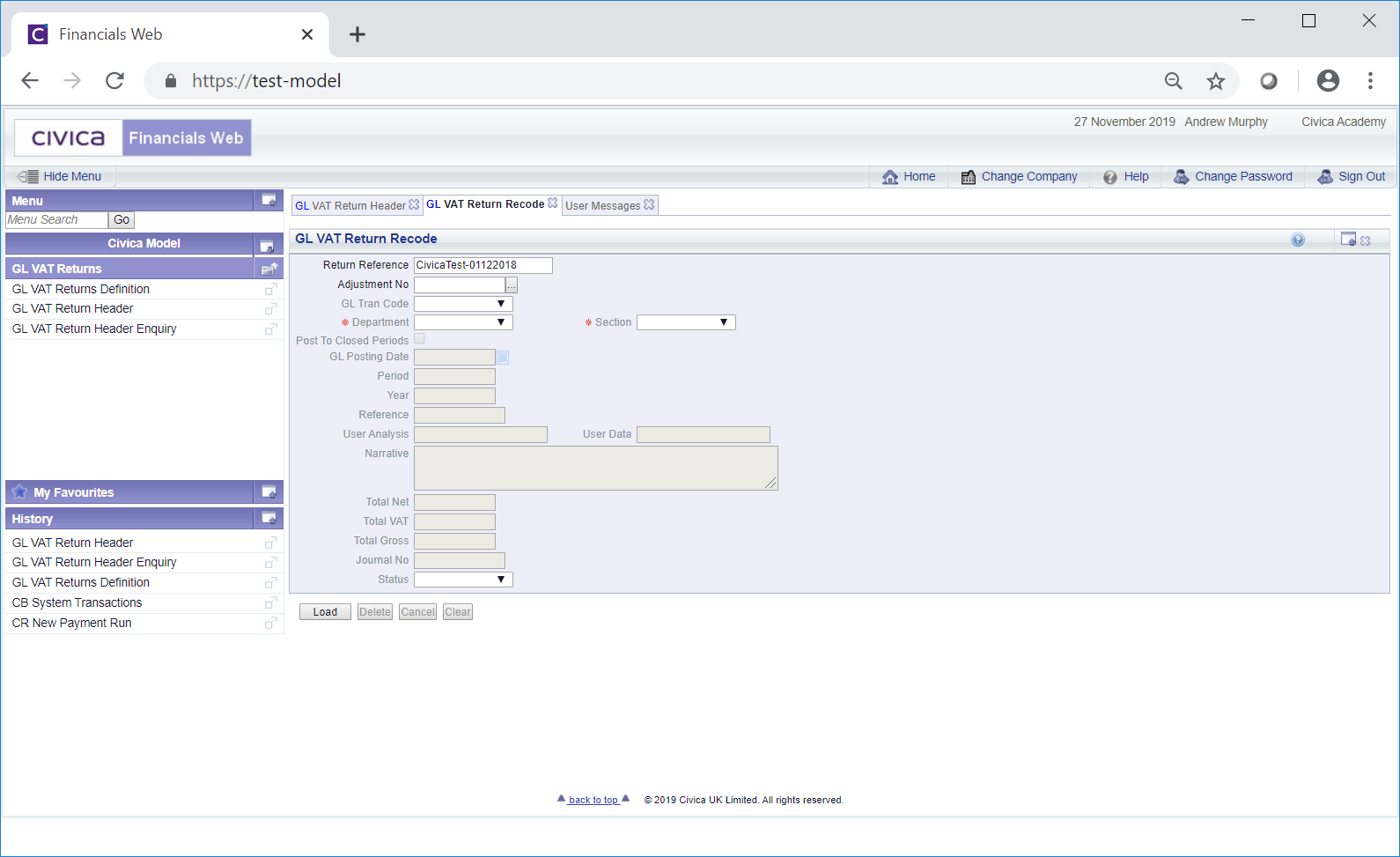

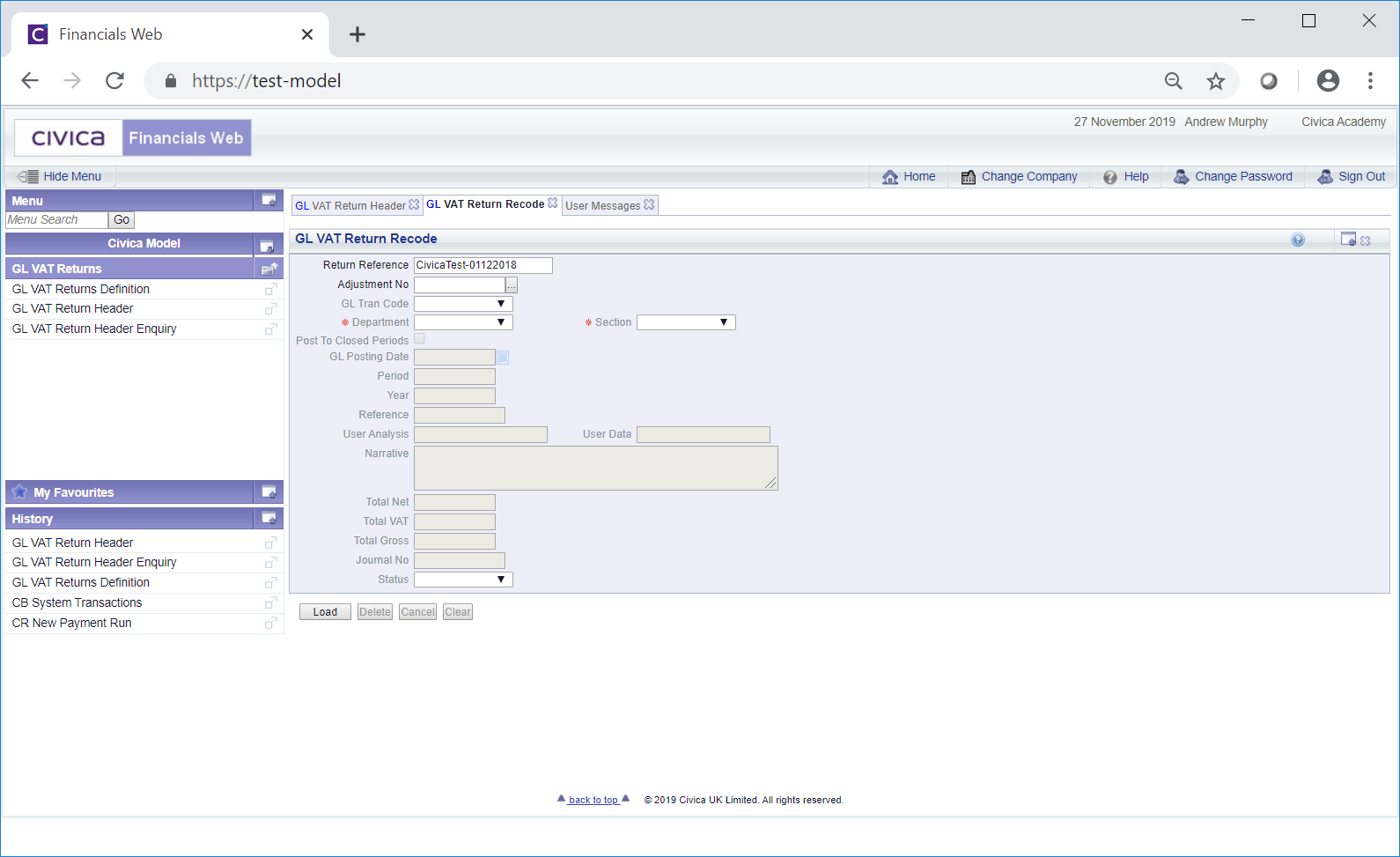

The GL VAT Return Recode form will open:

In the Adjustment No field, add the Adjustment number for the VAT Recode adjustment

Alternatively click on the Find Amendment button to the right of this field,  , and the GL Find VAT Return Adjustment form will open, allowing you to search for and select the required VAT Recode adjustment. This form is further detailed in the Find Adjustment section.

, and the GL Find VAT Return Adjustment form will open, allowing you to search for and select the required VAT Recode adjustment. This form is further detailed in the Find Adjustment section.

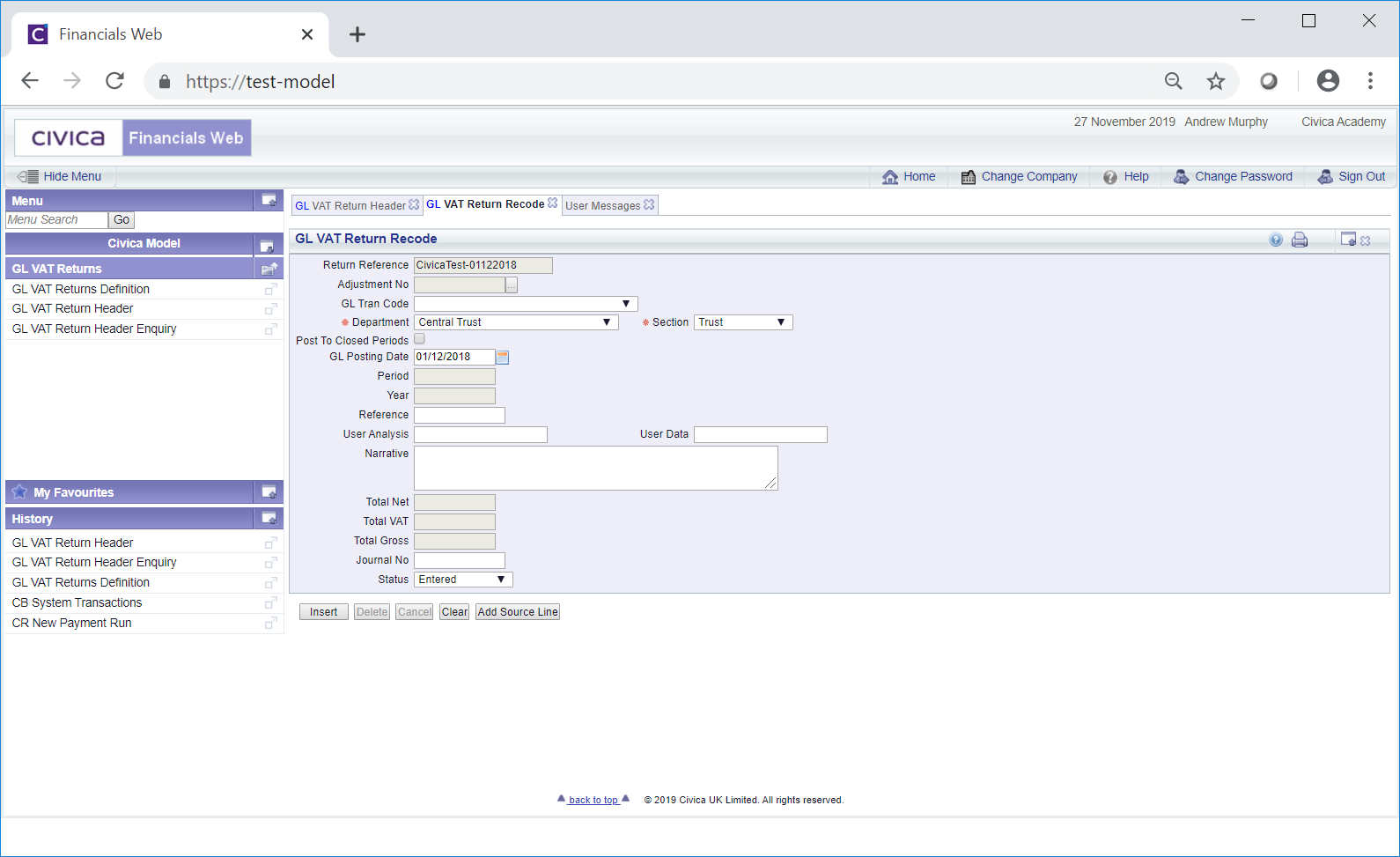

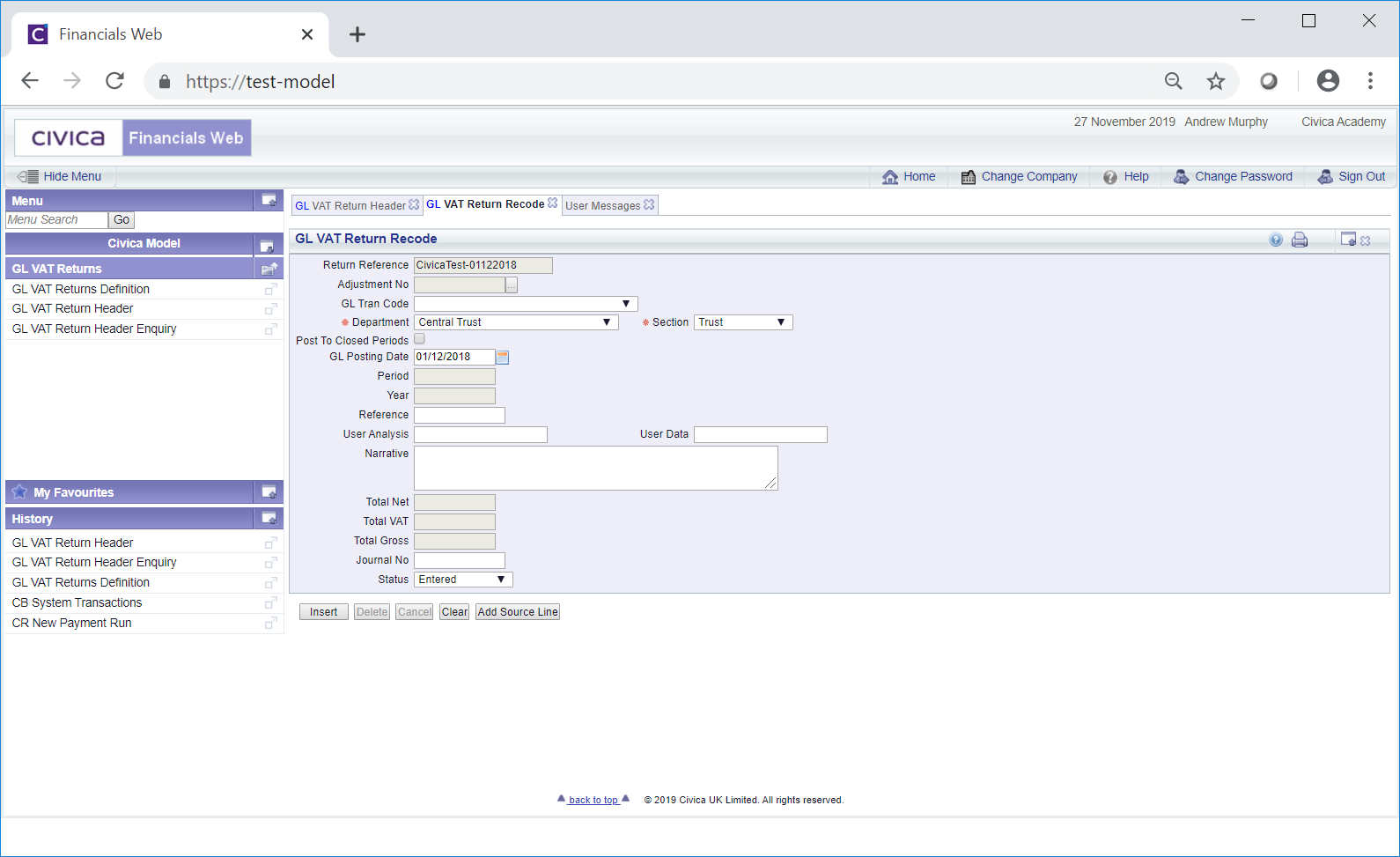

The details of the VAT Recode adjustment will be displayed on the GL VAT Return Recode form:

Please note: Where the VAT Recode adjustment has a Status field of Completed, a Read Only version of the GL VAT Return Recode form will displayed and you will not be able to make any changes to the fields or options on the form or on the Grid at the bottom of the form.

The VAT Recode adjustments on this form will be held against the relevant item in Box 6 or Box 7 on the VAT Return.

Where required GL Journals may have been or can be created for these VAT Recode adjustments that will also update the General Ledger.

The following fields on this form are displayed: (mandatory items are notated with a red asterisk *):

- Return Reference: This Read Only field will display the reference for the VAT Return.

- Adjustment No: This Read Only field will display the reference for the VAT Recode adjustment.

- GL Trans Code: This field will include a GL Transaction Code where a GL Journal has been or is to be created for the VAT Recode adjustment It can be changed, added or removed where the Status field is set to Entered.

- Department: This field will include the same Department as on the GL VAT Return Header form and should not be changed.

- Section: This field will include the same Section as on the GL VAT Return Header form and should not be changed.

- Post to Closed Periods: This option should not be selected and should not be changed.

- GL Posting Date: This will include the same date as on the Obligation Start Date field on the GL VAT Return Header form and can be changed, if required, where the Status field is set to Entered.

- GL Period: This Read Only field will be populated with the GL Period the transaction has been posted to where the Status field is set to Completed or will be posted to where the status is set to Entered.

- GL Year: This Read Only field will be populated with the required GL Year the transaction has been posted to where the Status is set to Completed or will be posted to where the Status field is set to Entered.

- Reference: Where the Status field is set to Completed and a GL Journal has been created by the VAT Recode, a reference may be included in this field that has been added to the Journal.

Where the Status field is set to Entered and GL Journal is to be created by the VAT Recode adjustment, a Reference can be added to this field that will be included on the GL Journal. Where a GL Journal is not to be created, this field should be left blank.

- User Analysis: Where the Status field is set to Completed and a GL Journal has been created by the VAT Recode adjustment, analysis information may be included in this field that has been added to the Journal.

Where the status is set to Entered and a GL Journal is to be created by the VAT Recode adjustment, analysis information can be added to this field that will be included on the GL Journal. Where a GL Journal is not to be created, this field should be left blank.

- User Data: Where the Status field is set to Completed and a GL Journal has been created by the VAT Recode adjustment, User data information may be included in this field that has been added to the Journal.

Where the status is set to Entered and GL Journal is to be created by the VAT Recode adjustment, User data information can be added to this field that will be included on the GL Journal. Where a GL Journal is not to be created, this field should be left blank.

- Narrative: Where the Status field is set to Completed and a GL Journal has been created by the VAT Recode adjustment, further information may be included in this field that has been added to the Journal.

Where the Status field is set to Entered and a GL Journal is to be created by the VAT Recode adjustment, further information can be added to this field that will be included on the GL Journal. Where a GL Journal is not to be created, this field should be left blank.

- Total Net: Where this Read Only field is populated it will include the sum of the Net Amount fields on the Adjustment Lines tab on the Grid at the bottom of the form.

- Total VAT: Where this Read Only field is populated it will include the sum of the VAT Amount fields on the Adjustment Lines tab on the Grid at the bottom of the form.

- Total Gross: Where this Read Only field is populated it will include the sum of the Gross Amount fields on the Adjustment Lines tab on the Grid at the bottom of the form.

- Journal Number: Where a GL Journal has been created by the VAT Recode adjustment, this field will be populated with the Journal Number, otherwise it will be blank.

- Status: Where this Read Only field is set to Entered, you will be able to make changes to some of the fields on the form, add Lines to the Adjustment Lines tab on the Grid at the bottom of the form by clicking on the

button, as detailed below (where no Grid is displayed clicking on this button will create the Grid), as well as make changes to some fields on any Lines in the Grid, which is further detailed below.

button, as detailed below (where no Grid is displayed clicking on this button will create the Grid), as well as make changes to some fields on any Lines in the Grid, which is further detailed below.

Where this Read Only field is set set to Completed, you will not be able to change anything on the form or to any Lines in the Adjustment Lines tab on the Grid. Some buttons will be available to provide further information on the VAT Recode and these are further detailed below.

Where Lines are displayed in the Adjustment Lines tab on the Grid, it will contain the following details (mandatory items are notated with a red asterisk *):

- Line No: This Read Only field will be populated where the Status field is set to Complete and will display the number of the Line.

- Reason: The Recode option should be included in this field where the Status field is set to Complete. Where the Status field is set to Entered this field should also be set to Recode.

- Narrative: This field may contain further information for the Line and can only be amended, removed, or where the field is blank, added, where the Status field is set to Entered.

- Trans Code: This field may contain transactional information for the Line and can only be amended, removed, or where the field is blank, added, where the Status field is set to Entered.

- Reference 1: This field may contain reference information for the Line and can only be amended, removed, or where the field is blank, added, where the Status field is set to Entered

- Reference 2: This field may contain a second reference information for the Line and can only be amended, removed, or where the field is blank, added, where the Status field is set to Entered

- Date: This field will include the GL Date from the VAT Return transaction and can only be amended where the Status field is set to Entered

- Input/Output: This Read Only field will include one of the following:

- Input: This will be displayed where the Line is from Creditors.

- Output: This will be displayed where the Line is from Debtors.

- Net Amount: This Read Only field will be display the net amount of the transaction.

- VAT Code: A new VAT Code for the transaction will be included in this field. Where the Status field is set to Entered this can be changed, removed, or where the field is blank a Code can be added from the drop-down list.

- VAT Amount: A VAT Amount may be included in this field that will adjust the amounts in Box 6 or 7 on the VAT Return. Where the Status field is set to Entered, this amount can be changed or removed, or where the field is blank an amount can be added.

Where this field is blank when the VAT Recode is completed, a calculated amount will be added that will be the amount in the Gross Amount field less the amount determined by the code in the VAT Code field.

- Gross Amount: Where this Read Only field includes an amount, it will be equal to the amount in the Net Amount field plus the amount in the VAT Amount field.

- GL Journal?: Where this option is selected and the Status field is set to Complete a GL Journal would have been created by the VAT Recode adjustment.

Where the Status field is set to Entered this option can be selected or deselected. Where the Adjustment Line is to amend the VAT Return and create a GL Journal, this option should be selected. Where the VAT Recode adjustment is to only amend the VAT Return, this option should not be selected.

Please note: Where this option is selected, also ensure that the relevant GL Transaction Code has been added to the GL Trans Code field on the form.

- VAT GL Code: Where the GL Journal option, as detailed immediately above, is selected and the Status field is set to Complete, a GL Ledger Code will be included in this field for the VAT Amount included in the VAT Recode adjustment.

Where the Status field is set to Entered and the GL Journal option, as detailed immediately above, is selected, a GL Ledger Code is required in this field for the VAT Amount included in the VAT Recode adjustment. This field may already be populated but can be changed or where the field is blank one added by clicking in this field and adding the relevant Ledger Code.

Alternatively clicking on the Find Ledger button located to the right of this field,  , will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

, will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

- I/E Code: Where the GL Journal option, as detailed above, is selected and the Status field is set to Complete, a GL Ledger Code is required in this field for the Net Amount included in the VAT Recode adjustment.

Where the Status field is set to Entered and the GL Journal option, as detailed above, is selected a GL Ledger Code is required in this field for the Net Amount included in the VAT Recode adjustment. This field may already be populated but can be changed or where the field is blank one added by clicking in this field and adding the relevant Ledger Code.

Alternatively clicking on the Find Ledger button located to the right of this field,  , will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

, will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

- EU Generated VAT: Please ignore this field.

- Original Net Amount: This Read Only field will display the original net amount on the Line in the VAT Return.

- Original VAT Type: This Read Only field will display the original VAT type on the Line in the VAT Return.

- Original VAT Amount: This Read Only field will display the original VAT amount on the Line in the VAT Return.

- Boxes populated: Where the Status field is set to Complete this field will show the Boxes on the VAT Return that have been updated by the Adjustment Line.

Where the status is set to Entered the Lines can be removed from the Adjustment Lines tab by clicking on the  button to the left of the required Line. A message will be displayed asking for confirmation that the Line is to be removed.

button to the left of the required Line. A message will be displayed asking for confirmation that the Line is to be removed.

The following buttons will be displayed:

: This button will only be enabled where the Status field is set to Entered. Click on this button to save any changes made to the fields and options on the form or to the Adjustment Line tab on the Grid.

: This button will only be enabled where the Status field is set to Entered. Click on this button to save any changes made to the fields and options on the form or to the Adjustment Line tab on the Grid. : This button will only be enabled where the Status field is set to Entered. Click on this button to delete the VAT Recode adjustment. A message will be displayed asking for confirmation that it is to be deleted.

: This button will only be enabled where the Status field is set to Entered. Click on this button to delete the VAT Recode adjustment. A message will be displayed asking for confirmation that it is to be deleted. : Clicking on this button will clear all the fields and options on the form - these will revert back to their default values - and remove the Grid from the bottom of the form. The initial GL VAT Return Recode form will be displayed, where you can create a new VAT Recode adjustment or view an existing one. Any unsaved changes will be lost.

: Clicking on this button will clear all the fields and options on the form - these will revert back to their default values - and remove the Grid from the bottom of the form. The initial GL VAT Return Recode form will be displayed, where you can create a new VAT Recode adjustment or view an existing one. Any unsaved changes will be lost. : This button will only be enabled where the Status field is set to Entered. Clicking on this button take you to the GL Find VAT Return Lines for Recode form allowing you to search for and add an item (or Line) to the Adjustment Lines tab on the GL VAT Return Recode form, as detailed above. This form is further detailed in the Find VAT Return Lines section.

: This button will only be enabled where the Status field is set to Entered. Clicking on this button take you to the GL Find VAT Return Lines for Recode form allowing you to search for and add an item (or Line) to the Adjustment Lines tab on the GL VAT Return Recode form, as detailed above. This form is further detailed in the Find VAT Return Lines section. : Clicking on this button will open the Audit Info screen providing audit information on the VAT Recode adjustment. This screen is further detailed on the Audit Info section.

: Clicking on this button will open the Audit Info screen providing audit information on the VAT Recode adjustment. This screen is further detailed on the Audit Info section. : This button will only be enabled where the Status field is set to Entered. Click on this button to complete the VAT Recode adjustment. The form will change to a Read Only version of the form and the status of the VAT Recode adjustment will be set to Complete. As this is a Read Only form, no further changes can be made to the VAT Recode adjustment.

: This button will only be enabled where the Status field is set to Entered. Click on this button to complete the VAT Recode adjustment. The form will change to a Read Only version of the form and the status of the VAT Recode adjustment will be set to Complete. As this is a Read Only form, no further changes can be made to the VAT Recode adjustment. : This button will only be enabled where the Status field is set to Completed and where a GL Journal has been created from the VAT Recode adjustment. Clicking on this button will open the GL Standard Journal (Readonly) screen providing details of the Journal. This screen is further detailed in the Viewing Standard Journals section.

: This button will only be enabled where the Status field is set to Completed and where a GL Journal has been created from the VAT Recode adjustment. Clicking on this button will open the GL Standard Journal (Readonly) screen providing details of the Journal. This screen is further detailed in the Viewing Standard Journals section.

button on the GL VAT Return Header form, as detailed in the Viewing/ Amending Adjustments section.

button on the GL VAT Return Header form, as detailed in the Viewing/ Amending Adjustments section.

, and the GL Find VAT Return Adjustment form will open, allowing you to search for and select the required VAT Recode adjustment. This form is further detailed in the Find Adjustment section.

, and the GL Find VAT Return Adjustment form will open, allowing you to search for and select the required VAT Recode adjustment. This form is further detailed in the Find Adjustment section.

![]() , will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

, will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.![]() , will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section.

, will open the GL Find Ledger Code form, allowing you to search for and select the required Ledger Code. This form is further detailed in the Find Ledger Code section. button to the left of the required Line. A message will be displayed asking for confirmation that the Line is to be removed.

button to the left of the required Line. A message will be displayed asking for confirmation that the Line is to be removed. : This button will only be enabled where the Status field is set to Entered. Clicking on this button take you to the GL Find VAT Return Lines for Recode form allowing you to search for and add an item (or Line) to the Adjustment Lines tab on the GL VAT Return Recode form, as detailed above. This form is further detailed in the Find VAT Return Lines section.

: This button will only be enabled where the Status field is set to Entered. Clicking on this button take you to the GL Find VAT Return Lines for Recode form allowing you to search for and add an item (or Line) to the Adjustment Lines tab on the GL VAT Return Recode form, as detailed above. This form is further detailed in the Find VAT Return Lines section. : This button will only be enabled where the Status field is set to Completed and where a GL Journal has been created from the VAT Recode adjustment. Clicking on this button will open the GL Standard Journal (Readonly) screen providing details of the Journal. This screen is further detailed in the Viewing Standard Journals section.

: This button will only be enabled where the Status field is set to Completed and where a GL Journal has been created from the VAT Recode adjustment. Clicking on this button will open the GL Standard Journal (Readonly) screen providing details of the Journal. This screen is further detailed in the Viewing Standard Journals section.