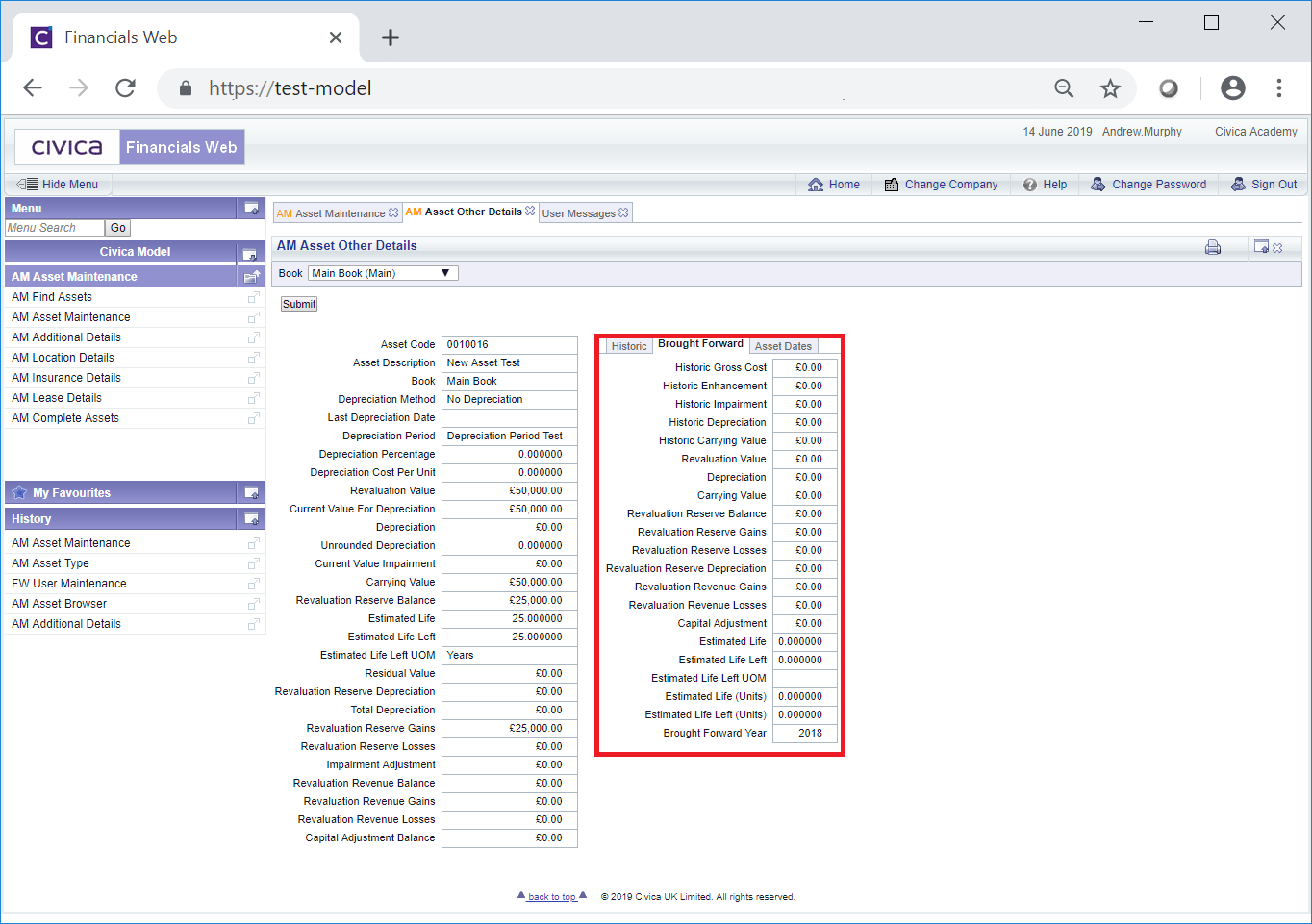

The Brought Forward tab on the AM Asset Other Details screen contains the following details:

These values are brought forward from the previous financial year for information and reporting purposes only.

These details will not change and are as follows:

- Historic Gross Cost: The amount in this field will be the amount that was in the Gross Cost field on the Historic tab at the end of the previous financial year.

- Historic Enhancement: The amount in this field will be the amount that was in the Enhancement field on the Historic tab at the end of the previous financial year.

- Historic Impairment: Please ignore this field as Impairments are not currently being used

- Historic Depreciation: The amount in this field will be the amount that was in the Depreciation field on the Historic tab at the end of the previous financial year.

- Historic Carrying Value: The amount in this field will be the amount that was in the Carrying Value field on the Historic tab at the end of the previous financial year.

- Revaluation Value: The amount in this field will be the amount that was in the Revaluation Value field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section.

- Depreciation: The amount in this field will be the amount that was in the Depreciation field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section.

- Carrying Value: The amount in this field will be the amount that was in the Carrying Value field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section.

- Revaluation Reserve Balance: The amount in this field will be the amount that was in the Revaluation Reserve Balance field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section.

- Revaluation Reserve Gains: The amount in this field will be the amount that was in the Revaluation Reserve Gains field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section.

- Revaluation Reserve Losses: The amount in this field will be the amount that was in the Revaluation Reserve Losses field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section.

- Revaluation Reserve Depreciation: The amount in this field will be the amount that was in the Revaluation Reserve Depreciation field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section.

- Revaluation Revenue Gains: The amount in this field will be the amount that was in the Revaluation Revenues Gains field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section.

- Revaluation Revenue Losses: The amount in this field will be the amount that was in the Revaluation Revenue Losses field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section.

- Capital Adjustment: The amount in this field will be the amount that was in the Capital Adjustment Balance field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section.

- Estimated Life: The amount in this field will be the amount that was in the Estimated Life field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section. Where the Depreciation Method field of the Asset Book includes Units of Use this field will display 0.00.

- Estimated Life Left: The amount in this field will be the amount that was in the Estimated Life Left field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section. Where the Depreciation Method field of the Asset Book includes Units of Use this field will display 0.00.

- Estimated Life Left UOM: The Unit of Measure displayed in this field will be the one that was in the Estimated Life Left UOM field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section. Where the Depreciation Method field of the Asset Book includes Units of Use this field will be blank.

- Estimated Life (Units): The amount in this field will be the amount that was in the Estimated Life (Units) field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section. Where the Depreciation Method field of the Asset Book does not include Units of Use this field will display 0.00.

- Estimated Life Left (Units): The amount in this field will be the amount that was in the Estimated Life Left (Units) field on the AM Asset Other Details screen at the end of the previous financial year. This field is further detailed in the Main fields section. Where the Depreciation Method field of the Asset Book does not include Units of Use this field will display 0.00.

- Brought Forward Year: This field will display the Year that the above details were brought forward from. For example if the current Year is 2019, this field will display 2018.