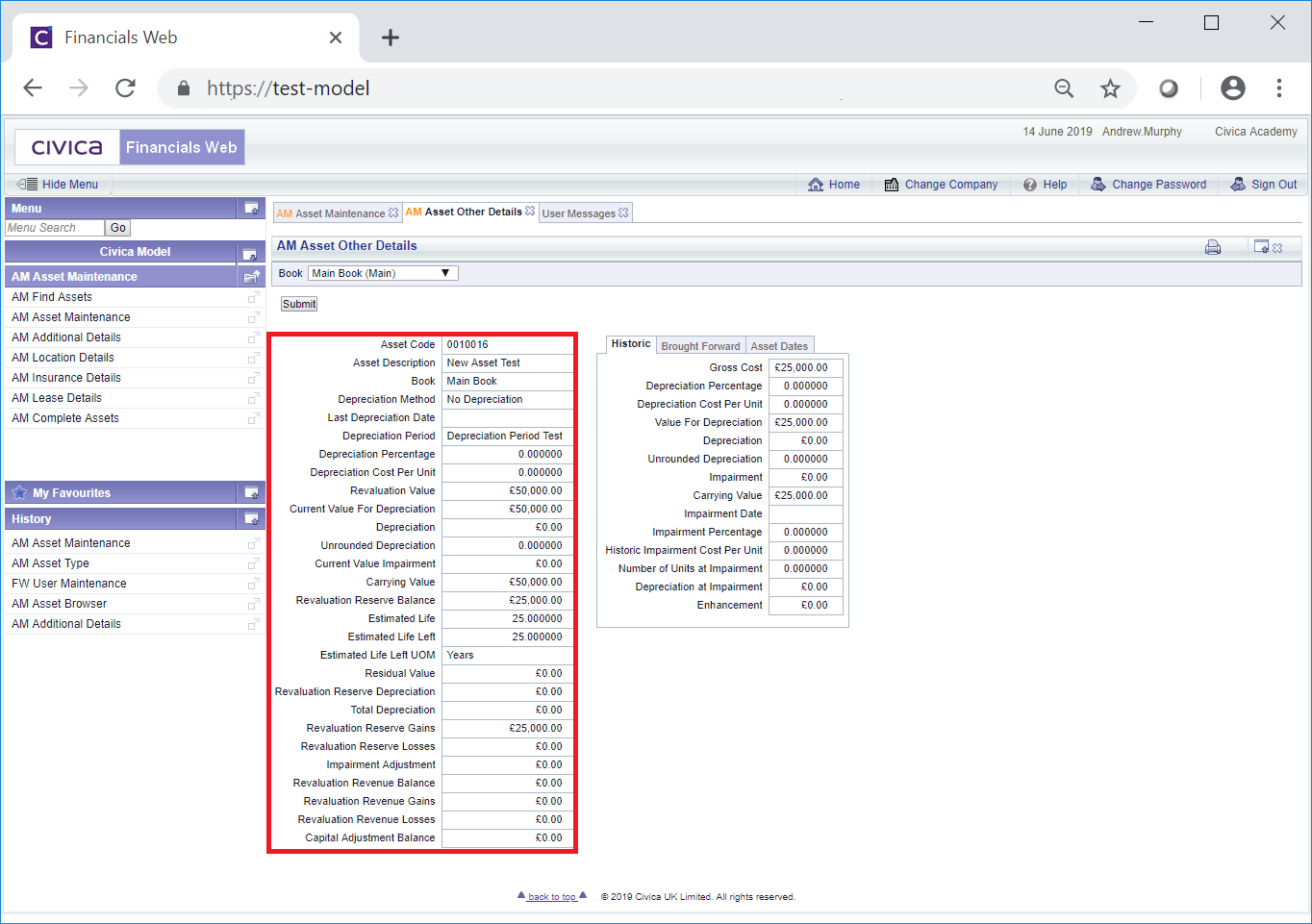

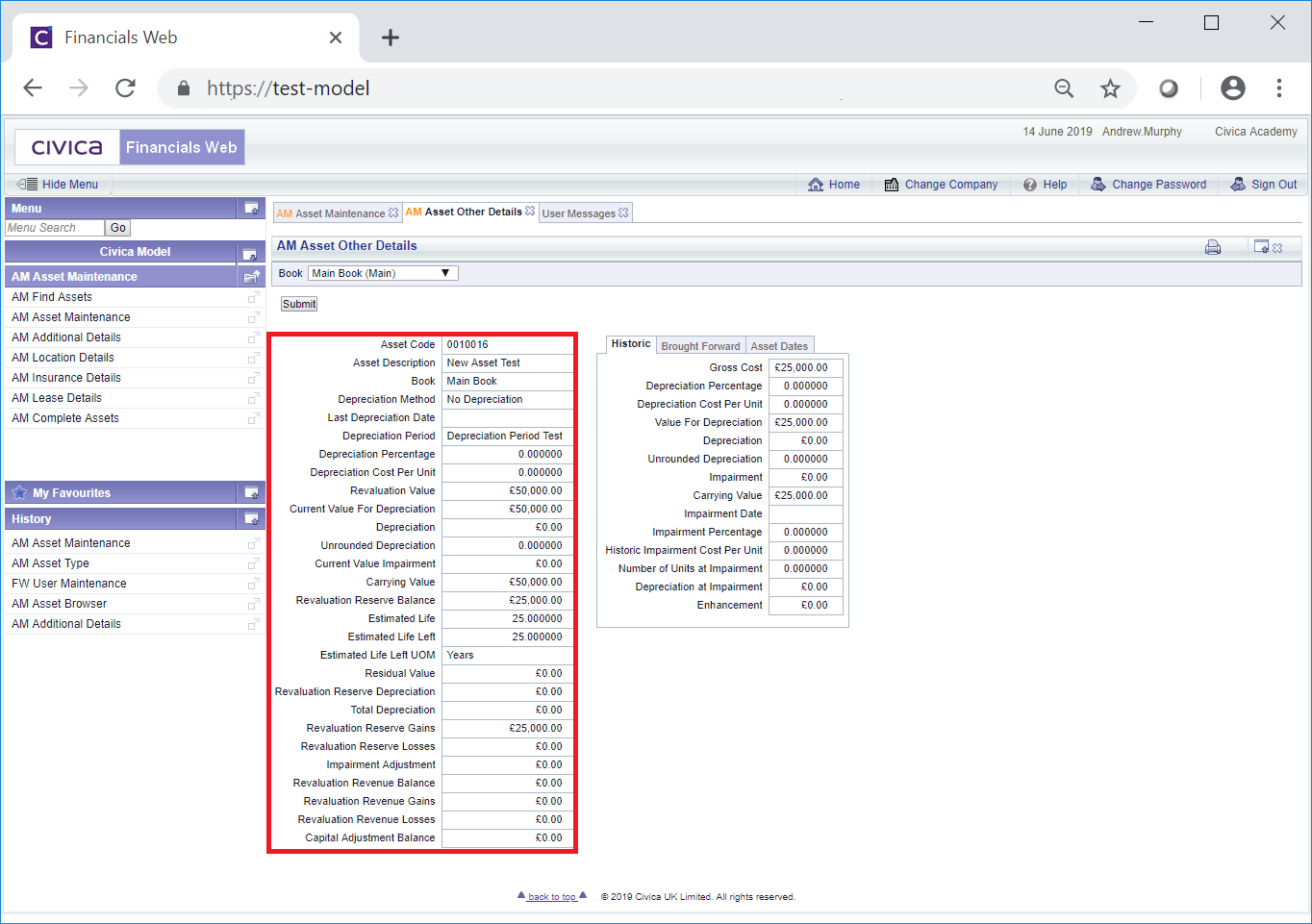

The main fields of the Asset Book are displayed on the left of the screen:

These are:

- Asset Code: This field will display the code of the Asset.

- Asset Description: This field will display the description of the Asset.

- Book: This field will display the name of the Asset Book selected in the Book drop-down field at the top of the screen. This will normally be Main Book.

- Depreciation Method: This field will display the Depreciation Method for the Asset as set on the Asset Book.

- Last Depreciation Date: Where the Asset has been depreciated, this field will display the date that the Asset was depreciated up to (and including this date). Where the Asset has not yet been depreciated this field will be blank.

- Depreciation Period: This field will display the Depreciation Period for the Asset as set on the Asset Book.

- Depreciation Percentage: This field will display the percentage that the Asset will be or has been depreciated by. This can be set directly from the Asset Book where the percentage to be used has been provided as an overriding depreciation percentage.

It can also be set or changed by a Revaluation transaction, as detailed in the Revaluation section, a Relife transaction, as detailed in the Relife section, or by a Depreciation transaction as detailed in the Depreciation section.

- Depreciation Cost Per Unit: Where the Depreciation Method for the Asset, as detailed in the Depreciation Method field above, is Units of Use, this field will show the current depreciation cost per unit.

- Revaluation Value: This field will display either the amount in the Original Capital Cost field for the Asset on the AM Asset Maintenance form, or an amended amount following a Revaluation transaction. Revaluation transactions are further detailed in the Revaluation section.

The amount in this field will also be displayed in the Revaluation Value (Main) field on the Asset Maintenance form

- Current Value for Depreciation: This field will display the value of the Assert that is currently being used for the depreciation calculations. The amount in this field will be the same as the amount as in the Revaluation Value field, detailed immediately above but where the Depreciation Method for the Asset, as detailed in the Depreciation Method field above, is one of the Declining Balance depreciations methods, the amount will be reduced at the start of each financial year.

- Depreciation: This field will display the accumulated Depreciation amount for the Asset, rounded to two decimal places, since it was set to a status of

. If it has not been depreciated yet the amount will be set to zero. It will be also be set to zero where the Asset is revalued, i.e. following a Revaluation transaction, which is further detailed in the Revaluation section.

. If it has not been depreciated yet the amount will be set to zero. It will be also be set to zero where the Asset is revalued, i.e. following a Revaluation transaction, which is further detailed in the Revaluation section.

- Unrounded Depreciation: This field will display the amount in the Depreciation field, detailed immediately above, but it will be rounded to six decimal points to mitigate rounding issues.

- Current Value Impairment: This field can be ignored as Impairments cannot currently be recorded in FinancialsLIVE other than as a Revaluation transaction, as detailed in the Revaluation section. The amount in this field will always be zero.

- Carrying Value: The amount displayed in this field is the Carrying Value of the Asset Book, sometimes known as the Net Book Value.

It will be the amount in the Revaluation Value field, less the amount in the Current Value Impairment field (which will always be zero), less the amount in the Depreciation field, all detailed above.

- Revaluation Reserve Balance: The amount displayed in this field is the balance on the Revaluation Reserve account for the Asset Book and will be affected by Revaluation Gains and Losses following a Revaluation transaction, which is further detailed in the Revaluation section.

It will be the amount in the Revaluation Reserve Gains field, less the amount in the Revaluation Reserve Losses field, less the amount in the Revaluation Reserve Depreciation field, all detailed further below.

- Estimated Life: This field will be displayed where the Depreciation Method field, as detailed above, displays a different depreciation method other than Units of Use. It will display an estimated amount for the entire lifetime of the Asset, i.e. from the date in the Depreciation Start Date field on the Asset (as detailed on the Grid at the bottom of the AM Asset Maintenance form), and is used in conjunction with the time period, e.g. Months or Years, in the Estimated Life Left UOM field detailed below.

This field will be initially be set to the amount in the Estimated Life field on the Asset Book (as detailed on the Grid at the bottom of the AM Asset Maintenance form). This amount can be amended by adding a new Estimated Life Left amount in a Revaluation or Relife transaction - this will recalculate the Estimated Life amount from the date in the Depreciation Start Date field on the Asset Book.

The Estimated Life on the AM Asset Other Details form and on the Grid at the bottom of the AM Asset Maintenance form will be set to the new amount.

Revaluation transactions are further detailed in the Revaluation section and Relife transactions are further detailed in the Relife section.

- Estimated Life Left: This field will be displayed where the Depreciation Method field, as detailed above, displays a different depreciation method other than Units of Use. It will display an estimated amount for the remaining lifetime of the Asset and is used in conjunction with the time period, e.g. months or year, in the Estimated Life Left UOM field detailed below.

This field will initially have the same amount as in the Estimated Life field, detailed immediately above, and will be recalculated when the Asset is depreciated, which is further detailed in the Depreciation section.

It can also be changed by a Revaluation transaction, which is further detailed in the Revaluation section, and a Relife transaction, which are further detailed in the Relife section.

- Estimated Life Left UOM: This Unit of Measure field will be displayed where the Depreciation Method field, as detailed above, displays a different depreciation method other than Units of Use and will be set to a time period, e.g. Months or Years. This field is used in conjunction with the Estimated Life and Estimated Life Left fields detailed immediately above.

The time period can be changed by a Revaluation transaction, which is further detailed in the Revaluation section, and a Relife transaction, which are further detailed in the Relife section.

- Last Number of Units: This field will only be displayed where the Depreciation Method field, as detailed above, is set to Units of Use. It will display the amount that was in the Number of Units field on the Asset (as detailed on the Grid at the bottom of the AM Asset Maintenance form) just before it was last depreciated. Depreciating Assets is further detailed in the Depreciation section.

Where the Asset has not yet been depreciated it will display the amount in the Number of Units field on the Asset.

- Estimated Life (Units): This field will only be displayed where the Depreciation Method field, as detailed above, is set to Units of Use. It will display an estimated amount in terms of Units for the entire lifetime of the Asset, i.e. from the date in the Depreciation Start Date field on the Asset (as detailed on the Grid at the bottom of the AM Asset Maintenance form), and is used in conjunction with the Units of Measure field, e.g. Kilometres, Metres, Miles etc., on the AM Asset Maintenance form.

This field will initially to be set to the amount in the Estimated Life Units field on the Asset Book (as detailed on the Grid at the bottom of the AM Asset Maintenance form).

- Estimated Life Left (Units): This field will only be displayed where the Depreciation Method field, as detailed above, is set to Units of Use. It will display the an estimated amount in terms of Units for the remaining lifetime of the Asset. It will be set to the amount n the Estimated Life Units field on the Asset (as detailed on the Grid at the bottom of the AM Asset Maintenance form).

This amount will be recalculated where the Asset is depreciated - the calculation will take into account the amount in the Number of Units field on the Asset (as detailed on the Grid at the bottom of the AM Asset Maintenance form).

- Residual Value: This field will display a residual value for the Asset. It will be set to the same amount as on the Residual Value field on the Asset (as detailed on the Grid at the bottom of the AM Asset Maintenance form).

The amount can be changed by a Revaluation transaction, which is further detailed in the Revaluation section, and a Relife transaction, which are further detailed in the Relife section.

- Revaluation Reserve Depreciation: The amount on this field will be the accumulated depreciation of the Asset that is included in the Revaluation Reserve Balance, reducing this balance.

- Total Depreciation: The amount in this field will be the total accumulated depreciation of the Asset over the life of the Asset, i.e. it will not be set to zero where the Asset is revalued. Revaluations are further detailed in the Revaluation section.

- Revaluation Reserve Gains: This field will include an accumulated amount for increases to the value of the Asset due to revaluations. These will be included in the Revaluation Reserve Balance field. Revaluations are further detailed in the Revaluation section.

- Revaluation Reserve Losses: This field will include an accumulated amount for decreases to the value of the Asset due to revaluations. These will be included in the Revaluation Reserve Balance. Revaluations are further detailed in the Revaluation section.

- Impairment Adjustment: Please ignore this field as impairments are not currently being used.

- Revaluation Revenue Balance: This field will include an accumulated amount for all postings to the Revenue accounts for Revaluation Impairments and Impairment Reversals for the Asset. The amount will be equal to the amount in the Revaluation Revenue Gains field less the amount in the Revaluation Revenue Losses field, both detailed immediately below.

- Revaluation Revenue Gains: This field would normally display the accumulated value of Impairment and Impairment Reversal postings to the Revenues accounts due to increases in the value of the Asset (gains) following Revaluations of the Asset. As Impairments are not currently being used this field can be ignored.

- Revaluation Revenue Losses: This field would normally display the accumulated value of Impairment and Impairment Reversal postings to the Revenues accounts due to decreases in the value of the Asset (losses) following Revaluations of the Asset. As Impairments are not currently being used this field can be ignored.

- Capital Adjustment Balance: This field would normally display the accumulated value of Impairment postings to the Capital Adjustment Balance accounts. As Impairments are not currently being used this field can be ignored.

. If it has not been depreciated yet the amount will be set to zero. It will be also be set to zero where the Asset is revalued, i.e. following a Revaluation transaction, which is further detailed in the Revaluation section.

. If it has not been depreciated yet the amount will be set to zero. It will be also be set to zero where the Asset is revalued, i.e. following a Revaluation transaction, which is further detailed in the Revaluation section.