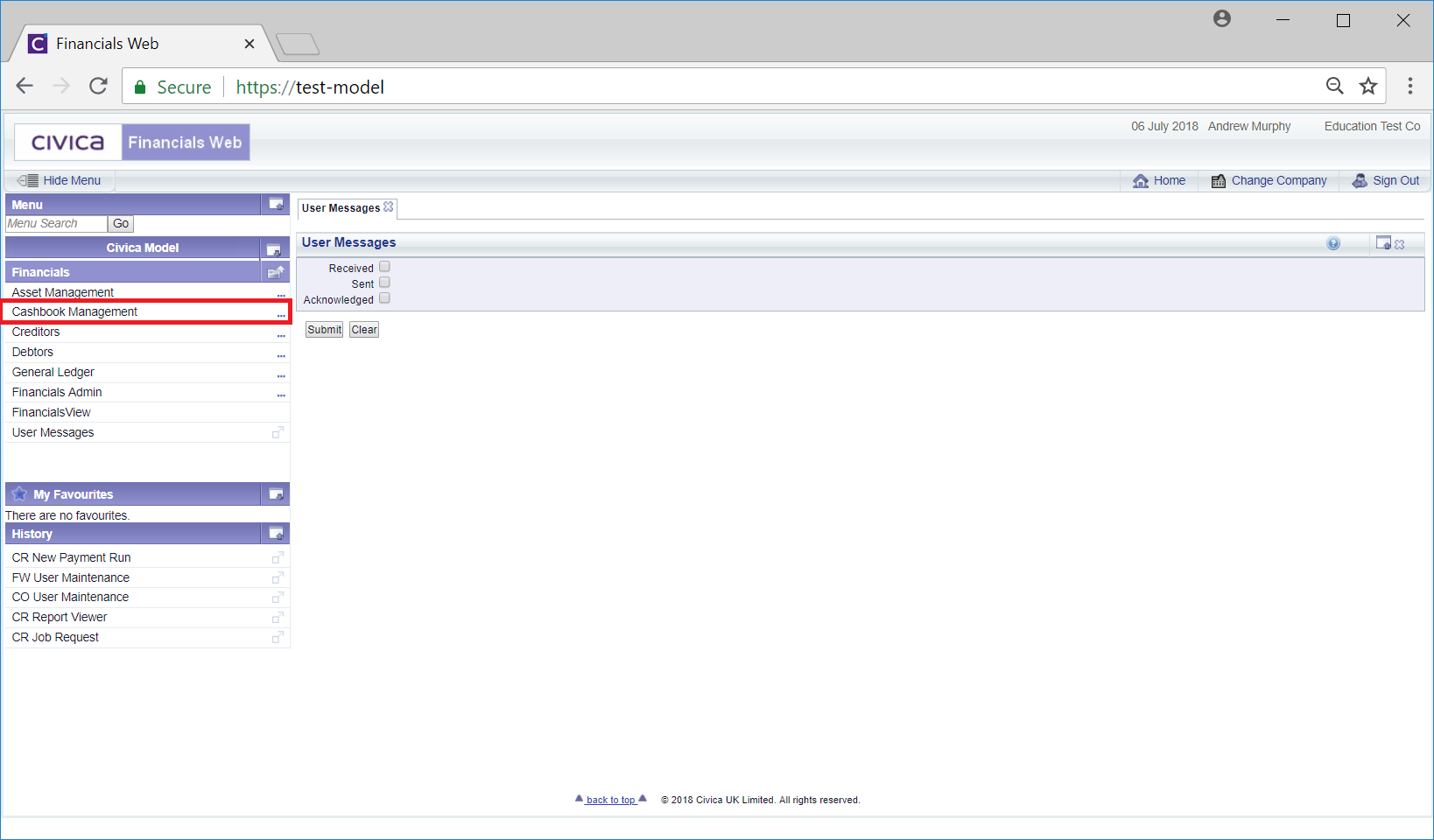

Fund Codes can be viewed and maintained on the CB Fund Code form, which can be accessed by selecting the Cashbook Management option on the Financials menu:

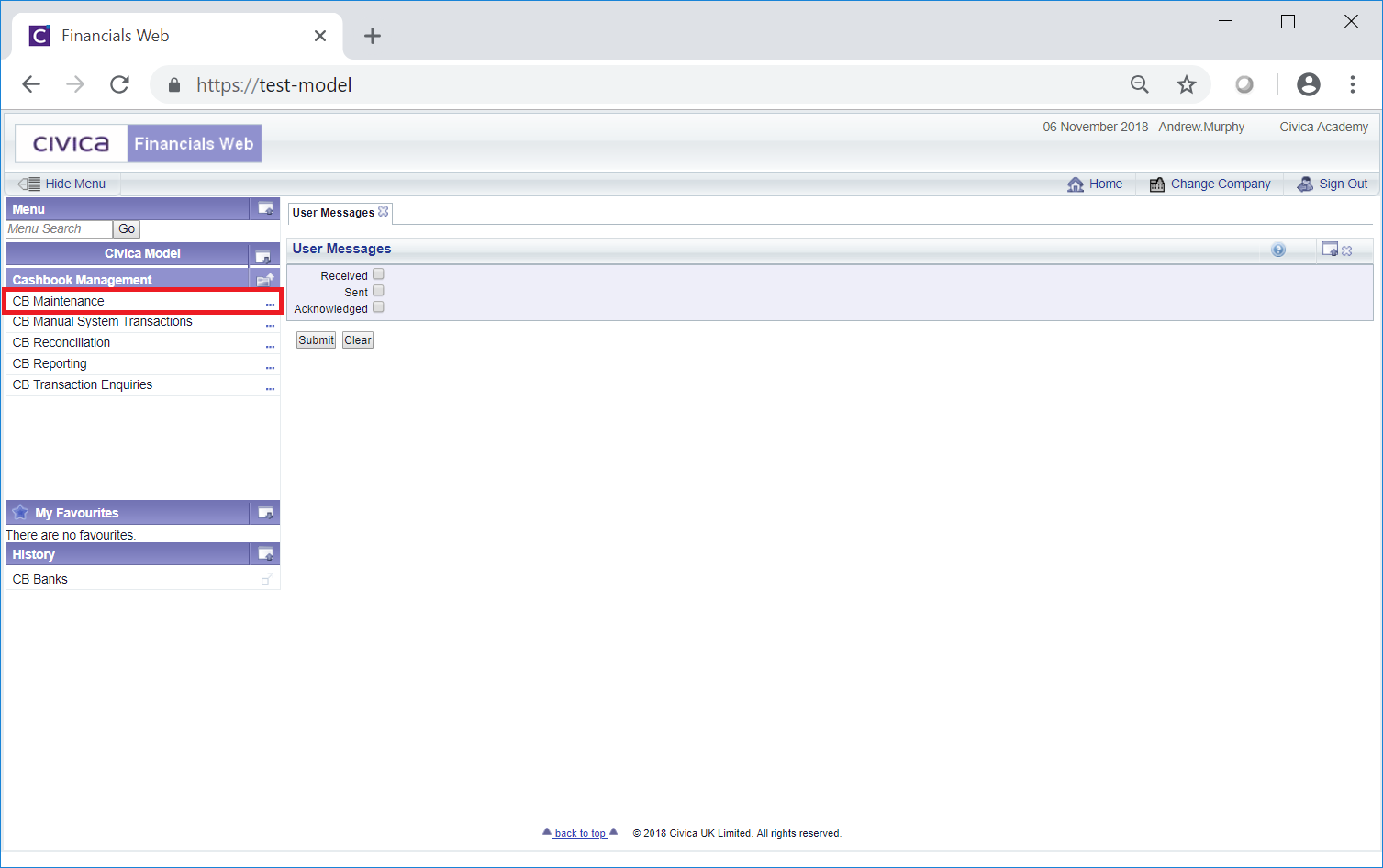

Then the CB Maintenance menu option:

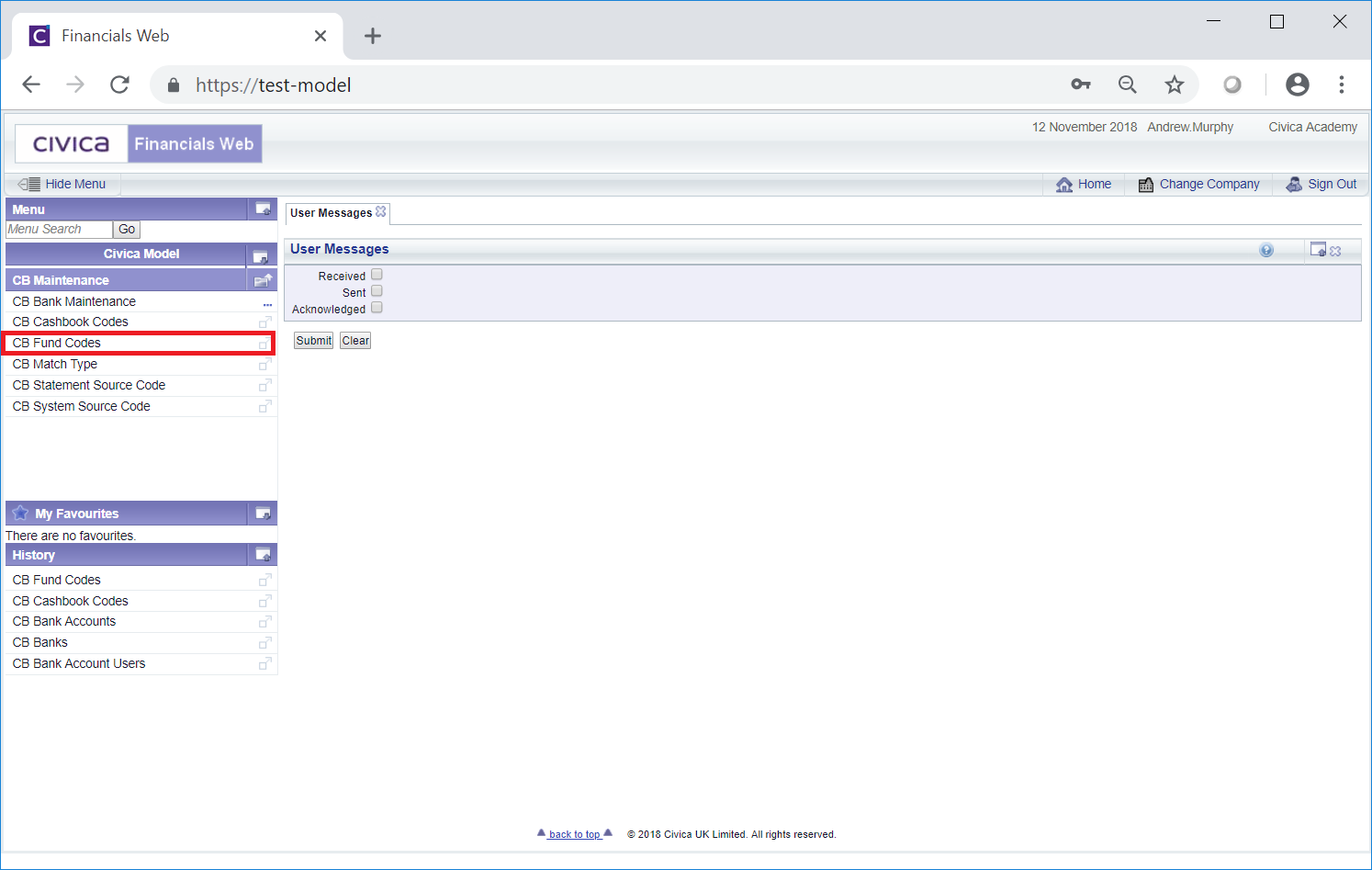

Then the CB Fund Codes menu option:

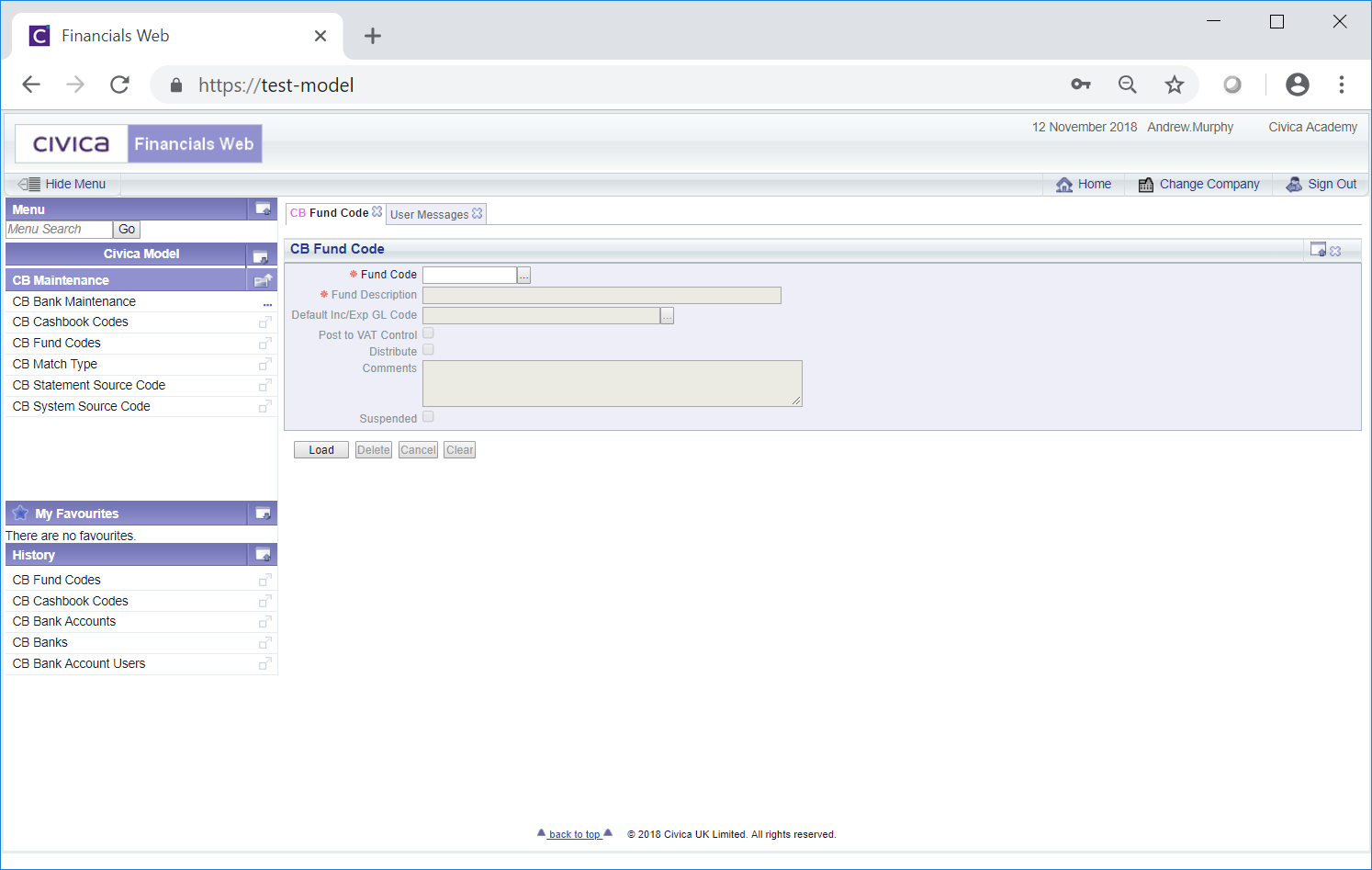

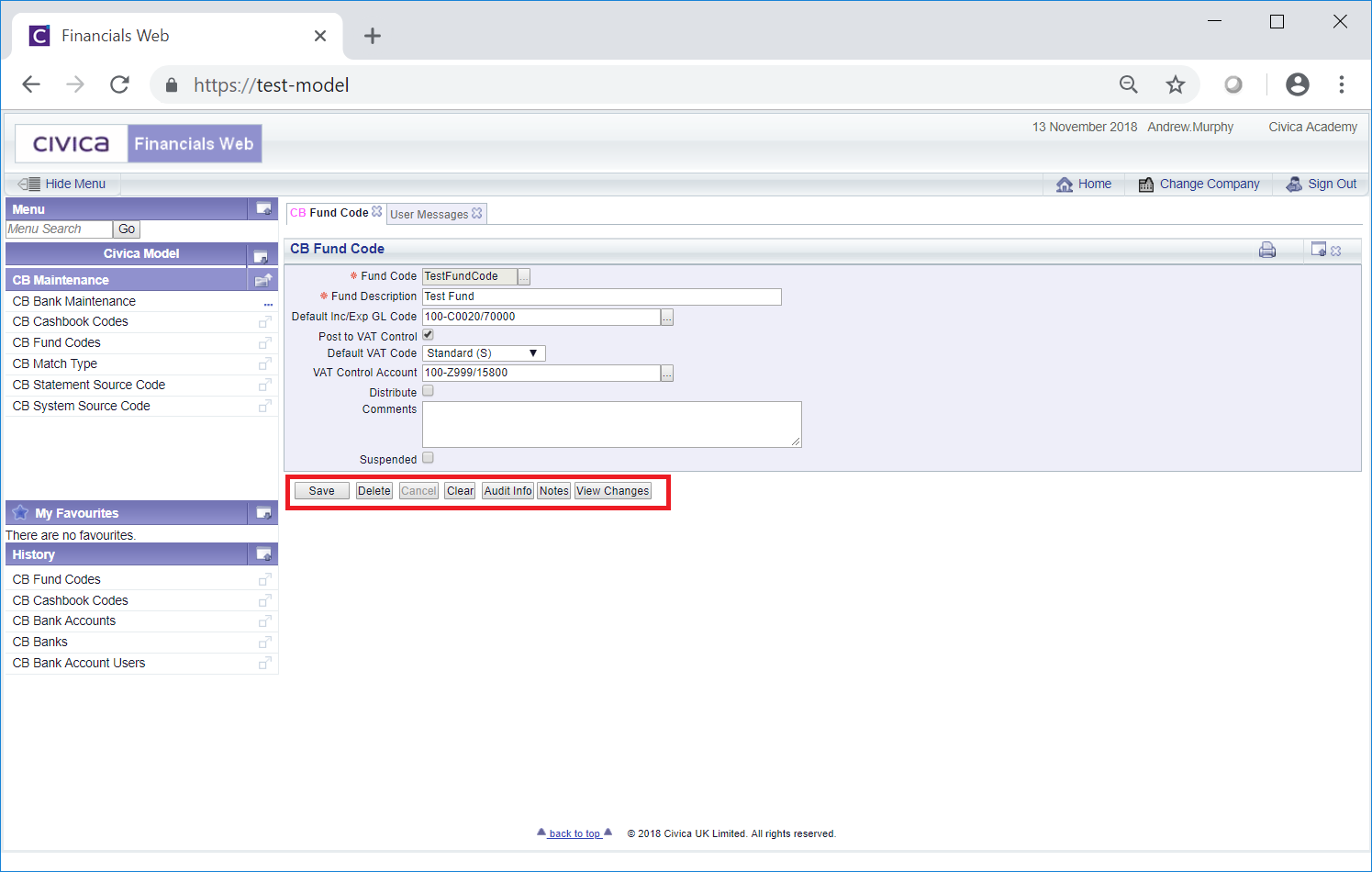

The CB Fund Code form will open:

Add the code of the required Fund Code to the Fund Code field click on the  button. The details of the Fund Code will be loaded onto the form.

button. The details of the Fund Code will be loaded onto the form.

Alternatively clicking on the Find Fund Code button located to the right of the Fund Code field,  , will open the CB Find Fund Code form allowing you to search for and select the required Fund Code. This form is further detailed in the Find Fund Code section. Once selected the details of the Fund Code will be loaded into the CB Fund Code form.

, will open the CB Find Fund Code form allowing you to search for and select the required Fund Code. This form is further detailed in the Find Fund Code section. Once selected the details of the Fund Code will be loaded into the CB Fund Code form.

Further buttons will also then be available at the bottom of the form:

The following fields and options on the form will be displayed (mandatory items are notated with a red asterisk *):

The GL Code can be changed or a new one added by tying the code into the field. Alternatively clicking on the Find GL Code button located to the right of this field,  , will open the CB Find Ledger Code form allowing you to search for and select the required income or expenditure Ledger Code. This form is further detailed in the Find Ledger Code section. Once selected the Ledger Code will be loaded into this field.

, will open the CB Find Ledger Code form allowing you to search for and select the required income or expenditure Ledger Code. This form is further detailed in the Find Ledger Code section. Once selected the Ledger Code will be loaded into this field.

If this option is selected the following fields will be displayed.

The VAT Code can be changed or a new one added by selecting the required option from this drop-down field.

, will open the CB Find Ledger Code form allowing you to search for and select the required Ledger Code for the Control Account. This form is further detailed in the Find Ledger Code section. Once selected the Ledger Code will be loaded into this field.

, will open the CB Find Ledger Code form allowing you to search for and select the required Ledger Code for the Control Account. This form is further detailed in the Find Ledger Code section. Once selected the Ledger Code will be loaded into this field.The following buttons are also available:

: Click on this button to save any changes made to the form. If changes have been made and you close the form, a message will be displayed stating that changes have not been saved and giving you the opportunity to go back to the form to save the changes.

: Click on this button to save any changes made to the form. If changes have been made and you close the form, a message will be displayed stating that changes have not been saved and giving you the opportunity to go back to the form to save the changes. : Click on this button to delete the Fund Code. A message will be displayed asking for confirmation that the Fund Code is to be deleted.

: Click on this button to delete the Fund Code. A message will be displayed asking for confirmation that the Fund Code is to be deleted.Please note: a Fund Code can only be deleted if it has not been used within any transactions. If it has been used it can be suspended instead, as detailed above.

: Clicking on this button will clear all the details on the form - the initial form will be displayed where you can search for or create a Fund Code. If changes have been made to the form and not saved, a message will be displayed stating that changes have not been saved and giving you the opportunity to go back to the form to save the changes.

: Clicking on this button will clear all the details on the form - the initial form will be displayed where you can search for or create a Fund Code. If changes have been made to the form and not saved, a message will be displayed stating that changes have not been saved and giving you the opportunity to go back to the form to save the changes. : Clicking on this button will open the Audit Info screen providing audit details for the Fund Code. This screen is further detailed in the Audit Info section.

: Clicking on this button will open the Audit Info screen providing audit details for the Fund Code. This screen is further detailed in the Audit Info section. : Clicking on this button will allow you to add a note with regard to the Fund Code. If there is an existing note for the Fund Code the button will be displayed as

: Clicking on this button will allow you to add a note with regard to the Fund Code. If there is an existing note for the Fund Code the button will be displayed as  . Notes are further detailed in the Notes section.

. Notes are further detailed in the Notes section. : Clicking on this button will open the CB Find Changes to Fund Code screen and will detail changes made to the Fund Code. This screen is further detailed in the View Fund Code Changes section.

: Clicking on this button will open the CB Find Changes to Fund Code screen and will detail changes made to the Fund Code. This screen is further detailed in the View Fund Code Changes section.