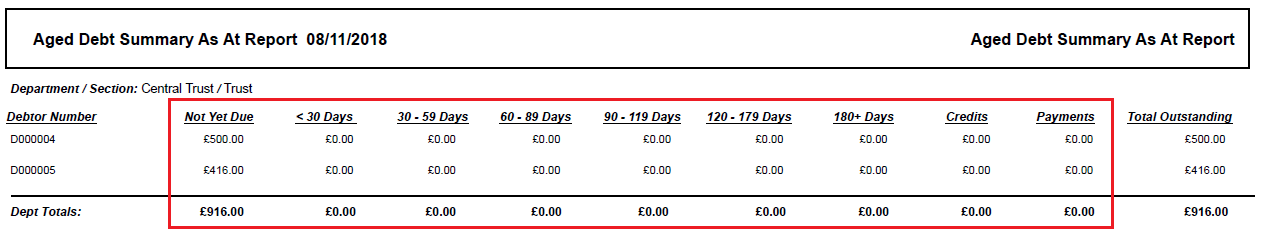

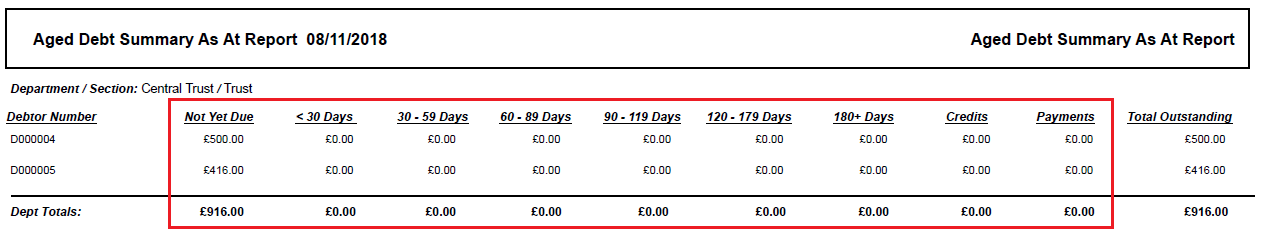

The Aged Debt Analysis As At Report provides an analysis of aged debt per Debtor as at a given date in the past.

There are 5 Overdue Days parameters on the Job Request that defines the overdue days from the 'as at' date that are utilised on the Report. The default values for these parameters are 30, 60, 90, 120 and 180 and these can be changed, if required.

Where the days entered for each of these parameter are left as their default, the following transaction amounts will be displayed in columns on the Report:

- Total of any transaction amounts that are in Credit at the 'as at' date.

- Total of any transaction amounts that are not yet due at the 'as at' date.

- Total of any outstanding transactions where the amount is overdue by less than 30 days from the 'as at' date.

- Total of any outstanding transactions where the amount is overdue by 30 days and up to and including 59 days from the 'as at' date.

- Total of any outstanding transactions where the amount is overdue by 60 days and up to and including 89 day from the 'as at' date.

- Total of any outstanding transactions where the amount is overdue by 90 days and up to and including 119 days from the 'as at' date.

- Total of any outstanding transactions where the amount is overdue by 120 days or more from the 'as at' date.

- Total of payments made by the Debtor at the 'as at' date.

An example of the Report is displayed below:

To run the Report the following options should be added to these fields on the DB Job Request form:

- Report Master: Aged Debt Analysis As At Report

- Report Folder: All Styles

- Report Style: Aged Debt Analysis As At Report

Click on the  button and the following Parameters and Criteria will be displayed in a Grid at the bottom of the form:

button and the following Parameters and Criteria will be displayed in a Grid at the bottom of the form:

Parameters

The Parameters for this Report are as follows:

- As At Date: This field should include the date at which the aged debt will be calculated.

- Overdue Days_1: This field will default to 30 days and can be changed if required.

Any transaction where the amount is overdue for less than the number of days in this field, i.e. starting from the date in the As At Date parameter field, will be included in a [Parameter Value] column on the Report. For example where the default value is used, i.e. 30, any transactions with an amount that is overdue by 1 day and up to and including 29 days starting from the date in the As At Date parameter field will be added to a <30 days column.

The value added will also be used in conjunction with the value added to the Overdue Days_2 parameter field, detailed below. Any transaction where the amount is overdue by the value in the Overdue Days_1 parameter, e.g. 30, and up to but not including the value added to the Overdue Days_2 parameter, e.g. 60 will be included in the next column on the Report, e.g. 30 - 59 days. These dates will be from the date in the As At Date parameter field.

- Overdue Days_2: This field will default to 60 days and can be changed if required.

The value added to this field will be used in conjunction with the value added to the Overdue Days_3 parameter field, detailed below. Any transaction where the amount is overdue by the value in the Overdue Days_2 parameter, e.g. 60, and up to but not including the value added to the Overdue Days_3 parameter, e.g. 90, will be included in the next column on the Report, e.g. 60 - 89 days. These dates will be from the date in the As At Date parameter field.

- Overdue Days 3: This field will default to 90 days and can be changed if required.

The value added to this field will be used in conjunction with the value added to the Overdue Days_4 parameter field, detailed below. Any transaction where the amount is overdue by the value in the Overdue Days_3 parameter, e.g. 90, and up to but not including the value added to the Overdue Days_4 parameter, e.g. 120, will be included in the next column on the Report, e.g. 90 - 119 days. These dates will be from the date in the As At Date parameter field.

- Overdue Days 4: This field will default to 120 days and can be changed if required.

Any transaction where the amount is overdue for the number of days that is equal to or greater than the value for this parameter, e.g. 180, will be included in the next column on the Report, e.g. 180+. This will be from the date in the As At Date parameter field.

- Pre Process: This field is used to specify the process that will be run before the report has been produced. For example, setting up temporary tables used by the report. For this Report Style this should be set to @DB_SP_AGED_DEBT_ANALYSIS_REPORT and should not be changed.

- Post Process: This field is used to specify the process that will be run after the report has been produced. For example clearing down temporary tables used by that report. For this Report Style this should be set to @DB_SP_AGED_DEBT_ANALYSIS_REPORT_POST. This should not be changed.

Criteria Fields

The following fields can be added to the Criteria tab and are used to filter the information on the Report:

- Debtor Name: This field will allow you to filter the Debtors using their Name.

- Debtor Number: This field will allow you to filter the Debtors using their Debtor Number.

- Department Code: This field will allow you to filter the Departments using the Department Code.

- First Name: This field will allow you to filter the Debtors using their first name.

- Full Name: This field will allow you to filter the Debtors using their full name.

- Last Name: This field will allow you to filter the Debtors using their Surname.

- Location: This field will allow you to filter the Debtors via their geographic location using their Location code.

- Other Names: This field will allow you to filter the Debtors using their ‘other names’ details.

- Section: This field will allow you to filter the transactions using the Section Code included on the transactions.

- Title: This field will allow you to filter the Debtors using their Title.

- Type of Debtor: This field will allow you to filter the Debtors using their Type, where appropriate, e.g. Trust/School, Students, etc.

- Tax Point Date: This field will allow you to filter the transaction using the date as entered on an invoice/credit note

- Tax Point Period: This field will allow you to filter the transaction using the VAT period the transaction was posted against

- Tax Point Period Desc: This field will allow you to filter the transaction using the Description of the VAT period the transaction was posted against.

- Tax Point Year: This field will allow you to filter the transaction using the VAT year the transaction was posted against.

Adding fields to the Criteria tab and adding conditions to these fields are further detailed in the Criteria tab section.

Click on the  button.

button.

![]() button and the following Parameters and Criteria will be displayed in a Grid at the bottom of the form:

button and the following Parameters and Criteria will be displayed in a Grid at the bottom of the form:![]() button.

button.